Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the weighted geometric average return of the equities only, including the small cap mutual fund over the 6 year period, in Jay's investment

What is the weighted geometric average return of the equities only, including the small cap mutual fund over the 6 year period, in Jay's investment portfolio?

A 1.78%

B 8.9%

C 11.23%

D 12.22%

E 15.92%

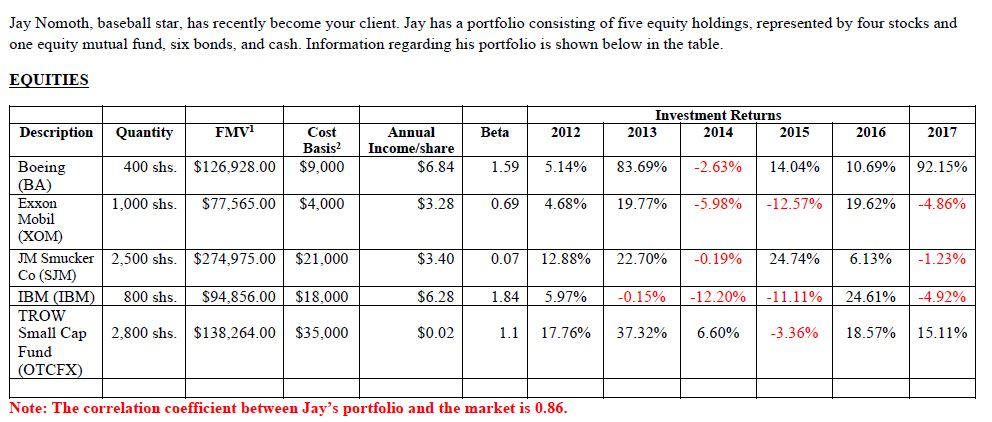

Jay Nomoth, baseball star, has recently become your client. Jay has a portfolio consisting of five equity holdings, represented by four stocks and one equity mutual fund, six bonds, and cash. Information regarding his portfolio is shown below in the table EQUITIES Investnent Returns 2014 DescriptionQuantity 2012 Cost 400 shs126,928.00 $9,000 1,000 shs. $77,565.00 $4,000 FMV Annual Beta 2013 2015 2016 2017 Basis2 Income/share Boeing (BA Exxon Mobil (XOM) JM Smucker2,500 shs. $274,975.00 $21,000 Co (SJM) IBM TROW Small Cap 2,800 shs. $138,264.00 $35,000 Fund OTC $6.84| 1.59| 5.14% | 83.69% | -263% | 14.04% | 10.69% | 92.15% $3.28 | 0.69| 4.68% | 19.77% | -5.98% | -12.57% | 19.62% | -4.86% $3.40 | $6.28 | $0.02 0.07 | 12.88% | 22.70% | -0.19% | 24.74% | 6.13% -1.23% 1.84| 5.97% | -0.15% | -12.20%| -11.11%| 24.61% | -4.92% 1.11 17.76% | 37.32% | 6.60% | -3.36% | 18.57% | 15.11% 800 shs. S94,856.00 $18,000 Note: The correlation coefficient between Jay's portfolio and the market is 0.86Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started