Answered step by step

Verified Expert Solution

Question

1 Approved Answer

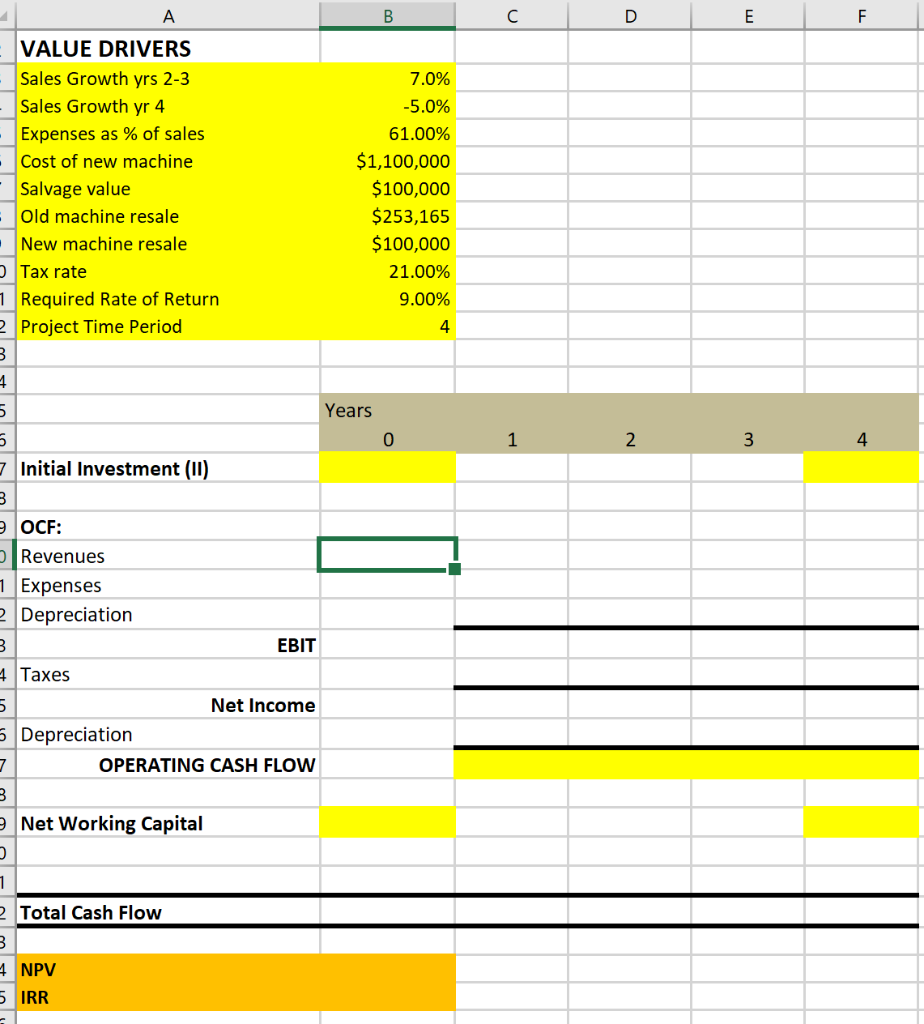

What is the Year 3 Revenue ? DO NOT ENTER A DOLLAR SIGN What is the Year 2 Total Cash Flow? DO NOT ENTER A

What is the Year 3 Revenue? DO NOT ENTER A DOLLAR SIGN

What is the Year 2 Total Cash Flow? DO NOT ENTER A DOLLAR SIGN

What is the IRR of the project based on the revisions from the scenario analysis?

8.4

7.3

7.7

1.9

VALUE DRIVERS Sales Growth yrs 2-3 Sales Growth yr 4 Expenses as % of sales Cost of new machine Salvage value - Old machine resale New machine resale Tax rate 1 Required Rate of Return 2 Project Time Period 7.0% -5.0% 61.00% $1,100,000 $100,000 $253,165 $100,000 21.00% 9.00% 4 UI Years 5 0 1 2 3 4 7 Initial Investment (11) OCF: Revenues 1 Expenses 2 Depreciation EBIT 4 Taxes Net Income 5 Depreciation OPERATING CASH FLOW Net Working Capital 2 Total Cash Flow 3 4 NPV 5 IRR VALUE DRIVERS Sales Growth yrs 2-3 Sales Growth yr 4 Expenses as % of sales Cost of new machine Salvage value - Old machine resale New machine resale Tax rate 1 Required Rate of Return 2 Project Time Period 7.0% -5.0% 61.00% $1,100,000 $100,000 $253,165 $100,000 21.00% 9.00% 4 UI Years 5 0 1 2 3 4 7 Initial Investment (11) OCF: Revenues 1 Expenses 2 Depreciation EBIT 4 Taxes Net Income 5 Depreciation OPERATING CASH FLOW Net Working Capital 2 Total Cash Flow 3 4 NPV 5 IRRStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started