Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the yield to maturity for the bonds? What is the cost of preferred stock? What is the rate of equity? What is the

What is the yield to maturity for the bonds?

What is the cost of preferred stock?

What is the rate of equity?

What is the after tax cost of debt?

What is the market value of the debt in dollars?

What is the market value of the firm?

What is the weighted cost of equity?

What is the WACC?

What is the weighted average flotation cost?

What is the amount raised?

What is the total flotation cost?

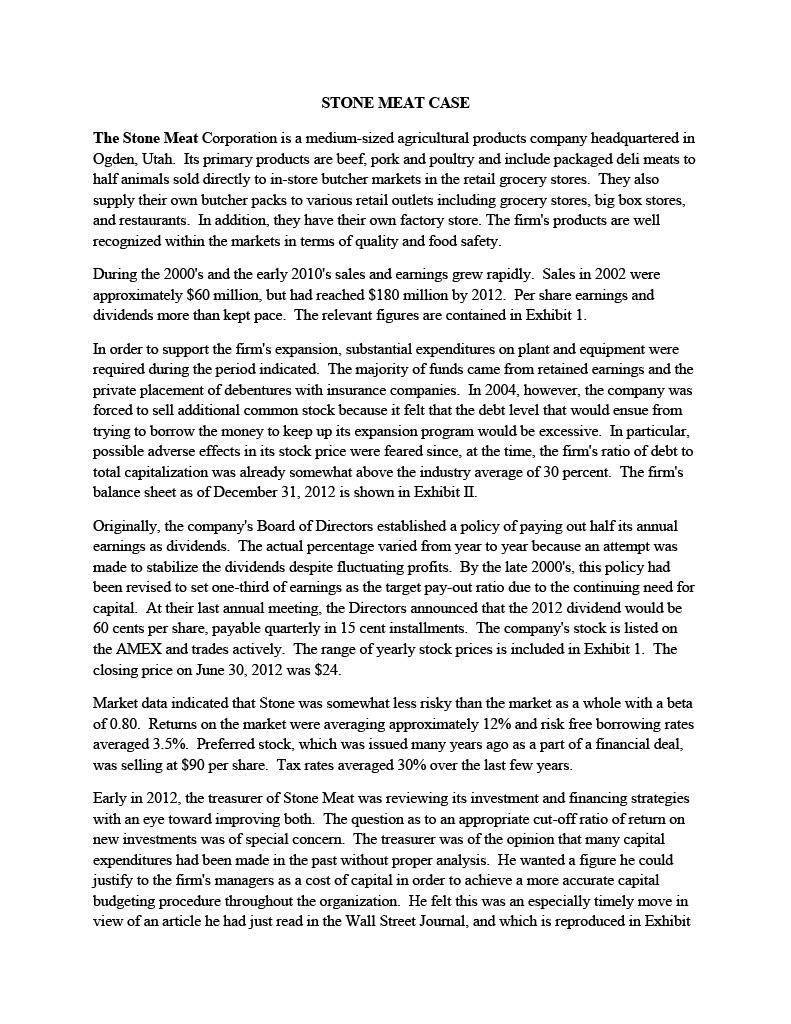

STONE MEAT CASE The Stone Meat Corporation is a medium-sized agricultural products company headquartered in Ogden, Utah. Its primary products are beef, pork and poultry and include packaged deli meats to half animals sold directly to in-store butcher markets in the retail grocery stores. They also supply their own butcher packs to various retail outlets including grocery stores, big box stores, and restaurants. In addition, they have their own factory store. The firm's products are well recognized within the markets in terms of quality and food safety. During the 2000's and the early 2010's sales and earnings grew rapidly. Sales in 2002 were approximately $60 million, but had reached $180 million by 2012. Per share earnings and dividends more than kept pace. The relevant figures are contained in Exhibit 1. In order to support the firm's expansion, substantial expenditures on plant and equipment were required during the period indicated. The majority of funds came from retained earnings and the private placement of debentures with insurance companies. In 2004, however, the company was forced to sell additional common stock because it felt that the debt level that would ensue from trying to borrow the money to keep up its expansion program would be excessive. In particular, possible adverse effects in its stock price were feared since, at the time, the firm's ratio of debt to total capitalization was already somewhat above the industry average of 30 percent. The firm's balance sheet as of December 31, 2012 is shown in Exhibit II. Originally, the company's Board of Directors established a policy of paying out half its annual earnings as dividends. The actual percentage varied from year to year because an attempt was made to stabilize the dividends despite fluctuating profits. By the late 2000 's, this policy had been revised to set one-third of earnings as the target pay-out ratio due to the continuing need for capital. At their last annual meeting, the Directors announced that the 2012 dividend would be 60 cents per share, payable quarterly in 15 cent installments. The company's stock is listed on the AMEX and trades actively. The range of yearly stock prices is included in Exhibit 1 . The closing price on June 30,2012 was $24. Market data indicated that Stone was somewhat less risky than the market as a whole with a beta of 0.80 . Returns on the market were averaging approximately 12% and risk free borrowing rates averaged 3.5\%. Preferred stock, which was issued many years ago as a part of a financial deal, was selling at $90 per share. Tax rates averaged 30% over the last few years. Early in 2012, the treasurer of Stone Meat was reviewing its investment and financing strategies with an eye toward improving both. The question as to an appropriate cut-off ratio of return on new investments was of special concern. The treasurer was of the opinion that many capital expenditures had been made in the past without proper analysis. He wanted a figure he could justify to the firm's managers as a cost of capital in order to achieve a more accurate capital budgeting procedure throughout the organization. He felt this was an especially timely move in view of an article he had just read in the Wall Street Journal, and which is reproduced in Exhibit Il1. Stone Meat's own long-range planning group had forecast a trend similar to the one indicated in the WSJ. Kansas (AP) - The ConAgra Corporation, in a recent annual meeting announcement, forecast a trailing off of sales in its meat processing division. That division, which had been growing at a rate equivalent to three times the CPI growth rate throughout the 2000's and early 2010 's, may be hit by decreases in household expenditures as the effects of the most recent financial crisis are still lingering for the decimated middle class. Retail outlets such as restaurants and grocery stores are reporting that sales of beef and pork products are declining in response to price pressures. Disease that swept through beef and pork herds, are also having a telling effect. Other sources close to the industry confirm the ConAgra prognosis. They estimate the best forecasts that their economists can come up with indicate a decline of about five percent in the growth rate which had been experienced in the last 12 to 15 years. ConAgra is curtailing several plant expansions in its meat processing division which were on the drawing board for the mid-2010's." We are moderately pessimistic," a company spokesman indicated, "and are going to adopt a wait and see attitude for the next year or so." STONE MEAT CASE The Stone Meat Corporation is a medium-sized agricultural products company headquartered in Ogden, Utah. Its primary products are beef, pork and poultry and include packaged deli meats to half animals sold directly to in-store butcher markets in the retail grocery stores. They also supply their own butcher packs to various retail outlets including grocery stores, big box stores, and restaurants. In addition, they have their own factory store. The firm's products are well recognized within the markets in terms of quality and food safety. During the 2000's and the early 2010's sales and earnings grew rapidly. Sales in 2002 were approximately $60 million, but had reached $180 million by 2012. Per share earnings and dividends more than kept pace. The relevant figures are contained in Exhibit 1. In order to support the firm's expansion, substantial expenditures on plant and equipment were required during the period indicated. The majority of funds came from retained earnings and the private placement of debentures with insurance companies. In 2004, however, the company was forced to sell additional common stock because it felt that the debt level that would ensue from trying to borrow the money to keep up its expansion program would be excessive. In particular, possible adverse effects in its stock price were feared since, at the time, the firm's ratio of debt to total capitalization was already somewhat above the industry average of 30 percent. The firm's balance sheet as of December 31, 2012 is shown in Exhibit II. Originally, the company's Board of Directors established a policy of paying out half its annual earnings as dividends. The actual percentage varied from year to year because an attempt was made to stabilize the dividends despite fluctuating profits. By the late 2000 's, this policy had been revised to set one-third of earnings as the target pay-out ratio due to the continuing need for capital. At their last annual meeting, the Directors announced that the 2012 dividend would be 60 cents per share, payable quarterly in 15 cent installments. The company's stock is listed on the AMEX and trades actively. The range of yearly stock prices is included in Exhibit 1 . The closing price on June 30,2012 was $24. Market data indicated that Stone was somewhat less risky than the market as a whole with a beta of 0.80 . Returns on the market were averaging approximately 12% and risk free borrowing rates averaged 3.5\%. Preferred stock, which was issued many years ago as a part of a financial deal, was selling at $90 per share. Tax rates averaged 30% over the last few years. Early in 2012, the treasurer of Stone Meat was reviewing its investment and financing strategies with an eye toward improving both. The question as to an appropriate cut-off ratio of return on new investments was of special concern. The treasurer was of the opinion that many capital expenditures had been made in the past without proper analysis. He wanted a figure he could justify to the firm's managers as a cost of capital in order to achieve a more accurate capital budgeting procedure throughout the organization. He felt this was an especially timely move in view of an article he had just read in the Wall Street Journal, and which is reproduced in Exhibit Il1. Stone Meat's own long-range planning group had forecast a trend similar to the one indicated in the WSJ. Kansas (AP) - The ConAgra Corporation, in a recent annual meeting announcement, forecast a trailing off of sales in its meat processing division. That division, which had been growing at a rate equivalent to three times the CPI growth rate throughout the 2000's and early 2010 's, may be hit by decreases in household expenditures as the effects of the most recent financial crisis are still lingering for the decimated middle class. Retail outlets such as restaurants and grocery stores are reporting that sales of beef and pork products are declining in response to price pressures. Disease that swept through beef and pork herds, are also having a telling effect. Other sources close to the industry confirm the ConAgra prognosis. They estimate the best forecasts that their economists can come up with indicate a decline of about five percent in the growth rate which had been experienced in the last 12 to 15 years. ConAgra is curtailing several plant expansions in its meat processing division which were on the drawing board for the mid-2010's." We are moderately pessimistic," a company spokesman indicated, "and are going to adopt a wait and see attitude for the next year or so

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started