Question

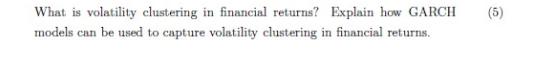

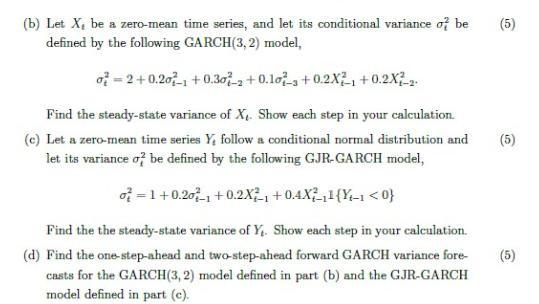

What is volatility clustering in financial returns? Explain how GARCH models can be used to capture volatility clustering in financial returns. (5) (b) Let

What is volatility clustering in financial returns? Explain how GARCH models can be used to capture volatility clustering in financial returns. (5) (b) Let X, be a zero-mean time series, and let its conditional variance of be defined by the following GARCH (3, 2) model, o=2+0.201 +0.30-2 +0.10+ 0.2X +0.2X2-2 Find the steady-state variance of X. Show each step in your calculation. (c) Let a zero-mean time series Y, follow a conditional normal distribution and let its variance of be defined by the following GJR-GARCH model, o=1+0.201 +0.2X1+0.4X11(Y-1

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Volatility clustering refers to the tendency for large changes in a financial time series returns ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials of MIS

Authors: Kenneth C. Laudon, Jane P. Laudon

12th edition

134238249, 978-0134238241

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App