Question

What is wrong here? Tax year 2019. Robert receives a yearly salary of $99,000, plus an annual bonus, from Software INC. The annual bonus is

What is wrong here? Tax year 2019.

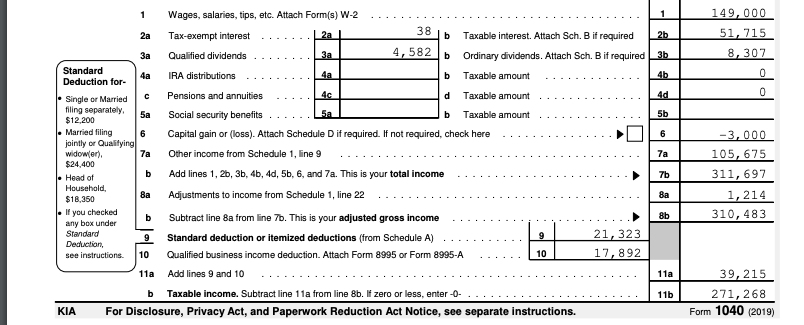

Robert receives a yearly salary of $99,000, plus an annual bonus, from Software INC. The annual bonus is determined in December of each year but not paid until January of the following year. Robert's bonus is $50,000 for 2018 (received in 2019) and $66,000 for 2019 (received in 2020). Robert contributed $20,000 to the plan in 2018-and Software made a matching contribution of $10,000. The company provides an office for Robert's use that is located at Suite 419, 101 Real Boulevard, Dallas, TX. (you need to determine what the total wages on Form W-2 will be based on the numbers noted above-do not calculate Medicare/social security payments.

1 2a 149,000 51, 715 8, 307 0 0 Standard 4a Deduction for- Single or Married filing separately, 5a $12,200 Married filing 6 jointly or Qualifying widower), 7a $24,400 Head of b Household 8a $18,350 If you checked b any box under Standard 9 Deduction see instructions 10 Wages, salaries, tips, etc. Attach Form(s) W-2 1 2a 38 Tax-exempt interest b Taxable interest. Attach Sch. B if required 2b Qualified dividends 4,582 b Ordinary dividends. Attach Sch. Bif required 3b IRA distributions 4a b Taxable amount 4b Pensions and annuities 4c d Taxable amount 4d Social security benefits 5a b Taxable amount 5b Capital gain or loss). Attach Schedule D if required. If not required, check here 6 Other income from Schedule 1, line 9 7a Add lines 1, 26, 35, 46, 40, 55, 6, and 7a. This is your total income 7b Adjustments to income from Schedule 1, line 22 8a -3,000 105, 675 311,697 1,214 310,483 8b 9 Subtract line 8a from line 7b. This is your adjusted gross income Standard deduction or itemized deductions (from Schedule A) Qualified business income deduction. Attach Form 8995 or Form 8995-A Add lines 9 and 10 21,323 17,892 10 11a 11a 11b 39,215 271,268 Form 1040 (2019) b Taxable income. Subtract line 11a from line 8b. If zero or less, enter-O- For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. KIA 1 2a 149,000 51, 715 8, 307 0 0 Standard 4a Deduction for- Single or Married filing separately, 5a $12,200 Married filing 6 jointly or Qualifying widower), 7a $24,400 Head of b Household 8a $18,350 If you checked b any box under Standard 9 Deduction see instructions 10 Wages, salaries, tips, etc. Attach Form(s) W-2 1 2a 38 Tax-exempt interest b Taxable interest. Attach Sch. B if required 2b Qualified dividends 4,582 b Ordinary dividends. Attach Sch. Bif required 3b IRA distributions 4a b Taxable amount 4b Pensions and annuities 4c d Taxable amount 4d Social security benefits 5a b Taxable amount 5b Capital gain or loss). Attach Schedule D if required. If not required, check here 6 Other income from Schedule 1, line 9 7a Add lines 1, 26, 35, 46, 40, 55, 6, and 7a. This is your total income 7b Adjustments to income from Schedule 1, line 22 8a -3,000 105, 675 311,697 1,214 310,483 8b 9 Subtract line 8a from line 7b. This is your adjusted gross income Standard deduction or itemized deductions (from Schedule A) Qualified business income deduction. Attach Form 8995 or Form 8995-A Add lines 9 and 10 21,323 17,892 10 11a 11a 11b 39,215 271,268 Form 1040 (2019) b Taxable income. Subtract line 11a from line 8b. If zero or less, enter-O- For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. KIA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started