Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is year 1 operating cash flows: Revenues: Costs: Depreciation: Tax rate: Total FCF: Company A is considering opening a new facility. You were introduced

What is year 1 operating cash flows:

Revenues:

Costs:

Depreciation:

Tax rate:

Total FCF:

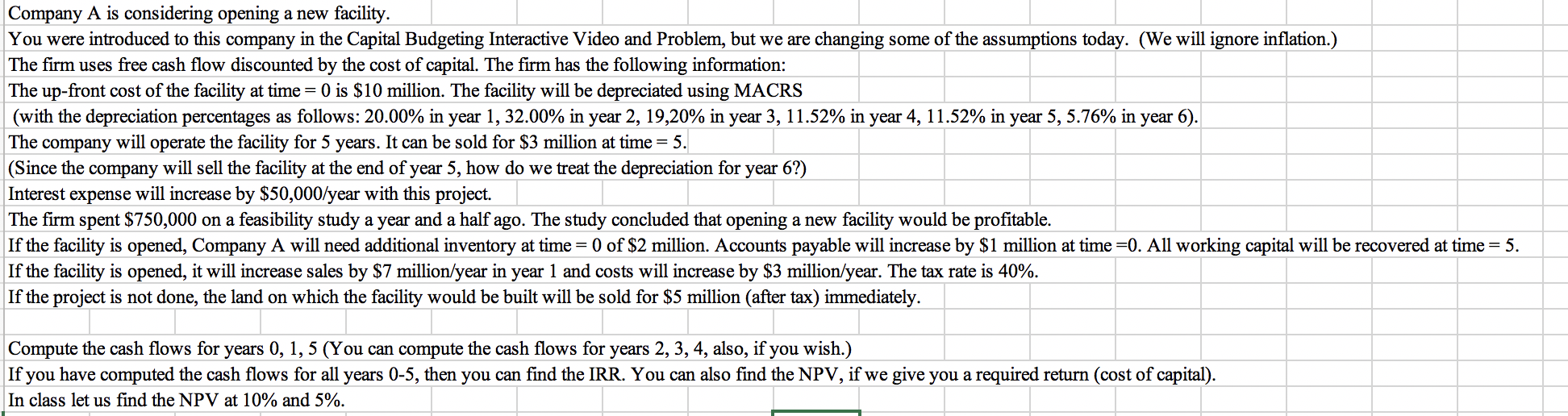

Company A is considering opening a new facility. You were introduced to this company in the Capital Budgeting Interactive Video and Problem, but we are changing some of the assumptions today. (We will ignore inflation.) The firm uses free cash flow discounted by the cost of capital. The firm has the following information: The up-front cost of the facility at time = 0 is $10 million. The facility will be depreciated using MACRS (with the depreciation percentages as follows: 20.00% in year 1, 32.00% in year 2, 19,20% in year 3, 11.52% in year 4, 11.52% in year 5, 5.76% in year 6). The company will operate the facility for 5 years. It can be sold for $3 million at time = 5. (Since the company will sell the facility at the end of year 5, how do we treat the depreciation for year 6?) Interest expense will increase by $50,000/year with this project. The firm spent $750,000 on a feasibility study a year and a half ago. The study concluded that opening a new facility would be profitable. If the facility is opened, Company A will need additional inventory at time = 0 of $2 million. Accounts payable will increase by $1 million at time=0. All working capital will be recovered at time = 5. If the facility is opened, it will increase sales by $7 million/year in year 1 and costs will increase by $3 million/year. The tax rate is 40%. If the project is not done, the land on which the facility would be built will be sold for $5 million (after tax) immediately. Compute the cash flows for years 0, 1, 5 (You can compute the cash flows for years 2, 3, 4, also, if you wish.) If you have computed the cash flows for all years 0-5, then you can find the IRR. You can also find the NPV, if we give you a required return (cost of capital). In class let us find the NPV at 10% and 5%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started