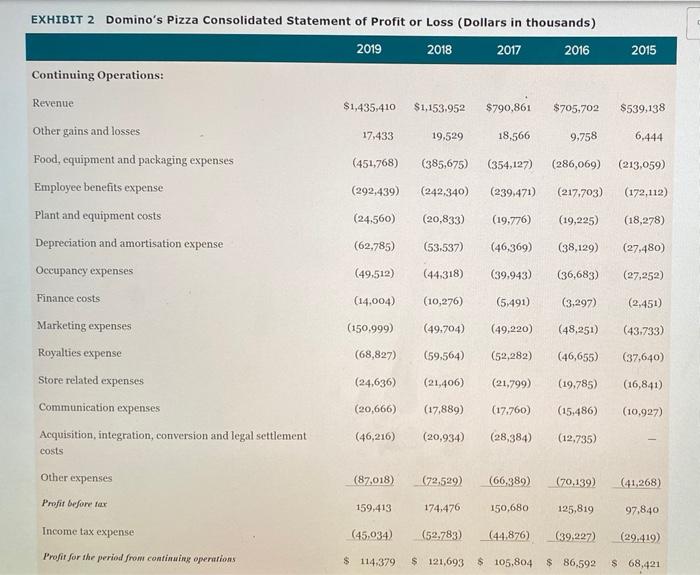

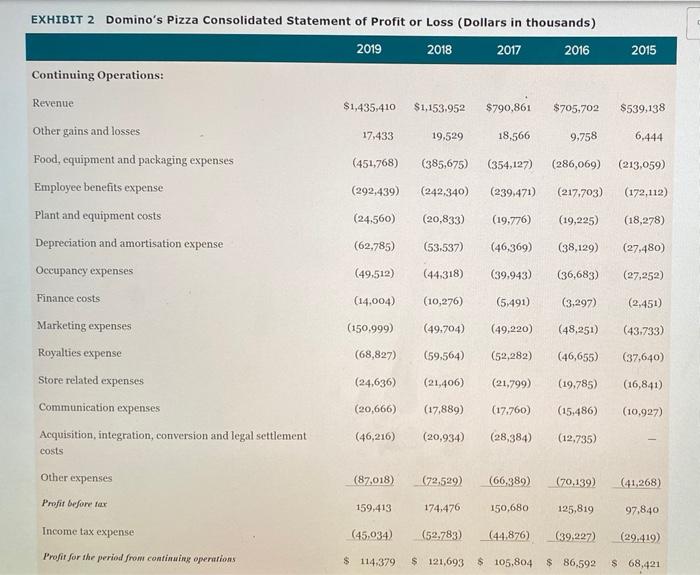

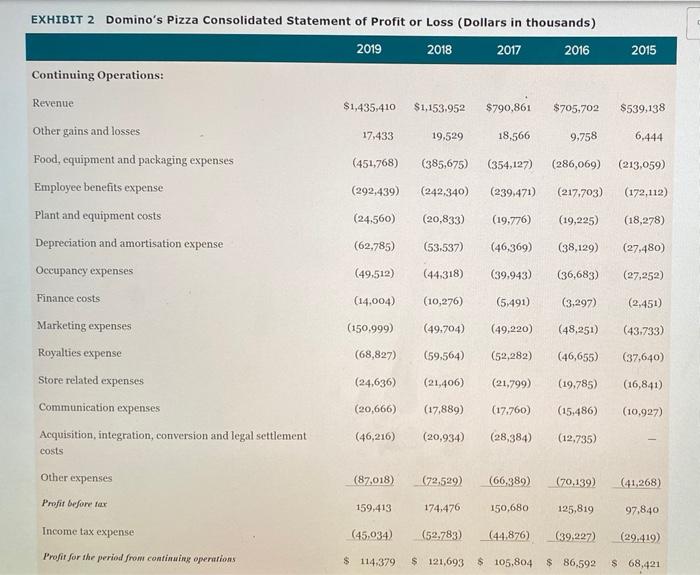

what is your assessment of domino's financial performance over the 2017-2019 period? (use the financial ratios in the Appendix of the text as a guide in doing your financial analysis.)

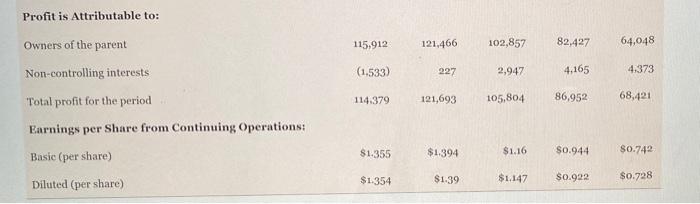

EXHIBIT 2 Domino's Pizza Consolidated Statement of Profit or Loss (Dollars in thousands) 2019 2018 2017 2016 Continuing Operations: 2015 Revenue $1,435,410 $1,153.952 $790,861 $705.702 $539,138 Other gains and losses 17,433 19.529 18,566 9.758 6,444 Food, equipment and packaging expenses (451,768) (385,675) (354,127) (286,069) (213,059) Employee benefits expense (292,439) (242 340) (239,471) (217,703) (172,112) Plant and equipment costs (24,560) (20,833) (19.776) (19,225) (18,278) Depreciation and amortisation expense (62,785) (53,537) (46,369) (38,129) (27,480) Occupancy expenses (49,512) (44.318) (39.943) (36,683) (27,252) Finance costs (14,004) (10,276) (5,491) (3,297) (2,451) Marketing expenses (150.999) (49.704) (49,220) (48,251) (43.733) Royalties expense (68,827) (59,564) (52,282) (46,655) (37,640) Store related expenses (24,636) (21,406) (21,799) (19,785) (16,841) Communication expenses (20,666) (17,889) (17.760) (15,486) (10,927) Acquisition, integration, conversion and legal settlement costs (46,216) (20,934) (28,384) (12,735) other expenses (87,018) (72,529) (66,389) (70,139) (41,268) Profit before for 159.413 174,476 150,680 125,819 97,840 Income tax expense (45,034) (52.783) (44,876) (39.227) (29.419) Profit for the period from continuing operations $ 114.379 $ 121,693 $ 105,804 $ 86,592 $ 68,421 Profit is Attributable to: Owners of the parent 115,912 121,466 102,857 82,427 64,048 Non-controlling interests (1,533) 227 2,947 4,165 4.373 114.379 Total profit for the period 121,693 105,804 86,952 68,421 Earnings per Share from Continuing Operations: $1.355 $1.394 $1.16 $0.944 Basic (per share) $0.742 $1.354 $1.39 $1,147 $0.922 $0.728 Diluted (per share) EXHIBIT 2 Domino's Pizza Consolidated Statement of Profit or Loss (Dollars in thousands) 2019 2018 2017 2016 Continuing Operations: 2015 Revenue $1,435,410 $1,153.952 $790,861 $705.702 $539,138 Other gains and losses 17,433 19.529 18,566 9.758 6,444 Food, equipment and packaging expenses (451,768) (385,675) (354,127) (286,069) (213,059) Employee benefits expense (292,439) (242 340) (239,471) (217,703) (172,112) Plant and equipment costs (24,560) (20,833) (19.776) (19,225) (18,278) Depreciation and amortisation expense (62,785) (53,537) (46,369) (38,129) (27,480) Occupancy expenses (49,512) (44.318) (39.943) (36,683) (27,252) Finance costs (14,004) (10,276) (5,491) (3,297) (2,451) Marketing expenses (150.999) (49.704) (49,220) (48,251) (43.733) Royalties expense (68,827) (59,564) (52,282) (46,655) (37,640) Store related expenses (24,636) (21,406) (21,799) (19,785) (16,841) Communication expenses (20,666) (17,889) (17.760) (15,486) (10,927) Acquisition, integration, conversion and legal settlement costs (46,216) (20,934) (28,384) (12,735) other expenses (87,018) (72,529) (66,389) (70,139) (41,268) Profit before for 159.413 174,476 150,680 125,819 97,840 Income tax expense (45,034) (52.783) (44,876) (39.227) (29.419) Profit for the period from continuing operations $ 114.379 $ 121,693 $ 105,804 $ 86,592 $ 68,421 Profit is Attributable to: Owners of the parent 115,912 121,466 102,857 82,427 64,048 Non-controlling interests (1,533) 227 2,947 4,165 4.373 114.379 Total profit for the period 121,693 105,804 86,952 68,421 Earnings per Share from Continuing Operations: $1.355 $1.394 $1.16 $0.944 Basic (per share) $0.742 $1.354 $1.39 $1,147 $0.922 $0.728 Diluted (per share)