Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is your investment risk appetite, more specifically, risk tolerance? (risk-averse, risk-neutral, or risk seeker) As a Consequence, which investment scenarios will be your

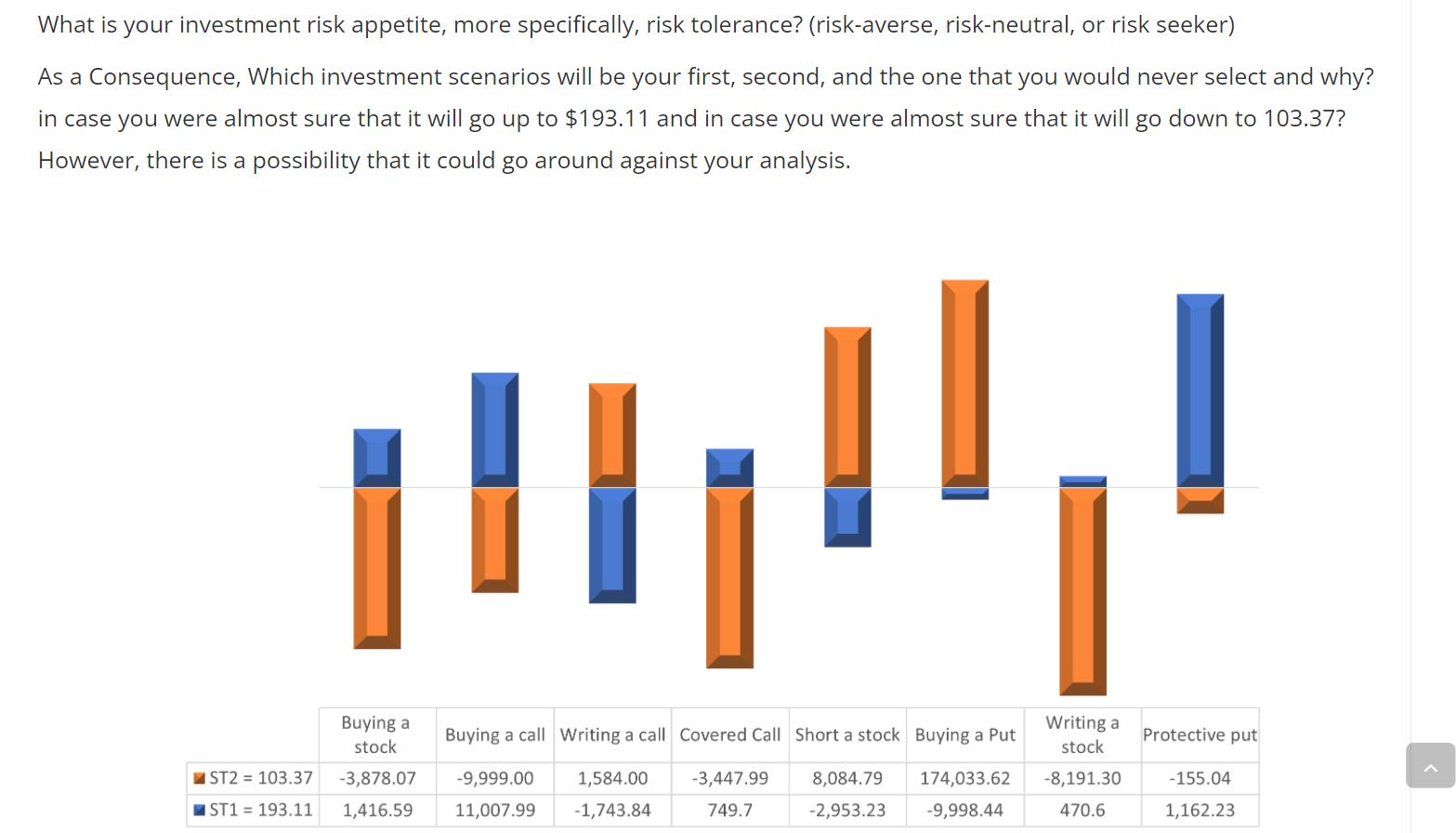

What is your investment risk appetite, more specifically, risk tolerance? (risk-averse, risk-neutral, or risk seeker) As a Consequence, which investment scenarios will be your first, second, and the one that you would never select and why? in case you were almost sure that it will go up to $193.11 and in case you were almost sure that it will go down to 103.37? However, there is a possibility that it could go around against your analysis. -9,999.00 11,007.99 ST2 = 103.37 ST1 193.11 Buying a stock -3,878.07 1,416.59 Buying a call Writing a call Covered Call Short a stock Buying a Put 1,584.00 -1,743.84 -3,447.99 749.7 8,084.79 -2,953.23 174,033.62 -9,998.44 Writing a stock -8,191.30 470.6 Protective put -155.04 1,162.23

Step by Step Solution

There are 3 Steps involved in it

Step: 1

investment risk appetite more specifically risk tolerance riskaverse risk natural or risk seeker Riskunwilling For this situation you could focus on moderate speculations with lower possible returns Y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started