Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What justification does the FASB give for its treatment of unrealized holding gains and losses for available-for-sale securities? FASB requires unrealized holding gains and losses

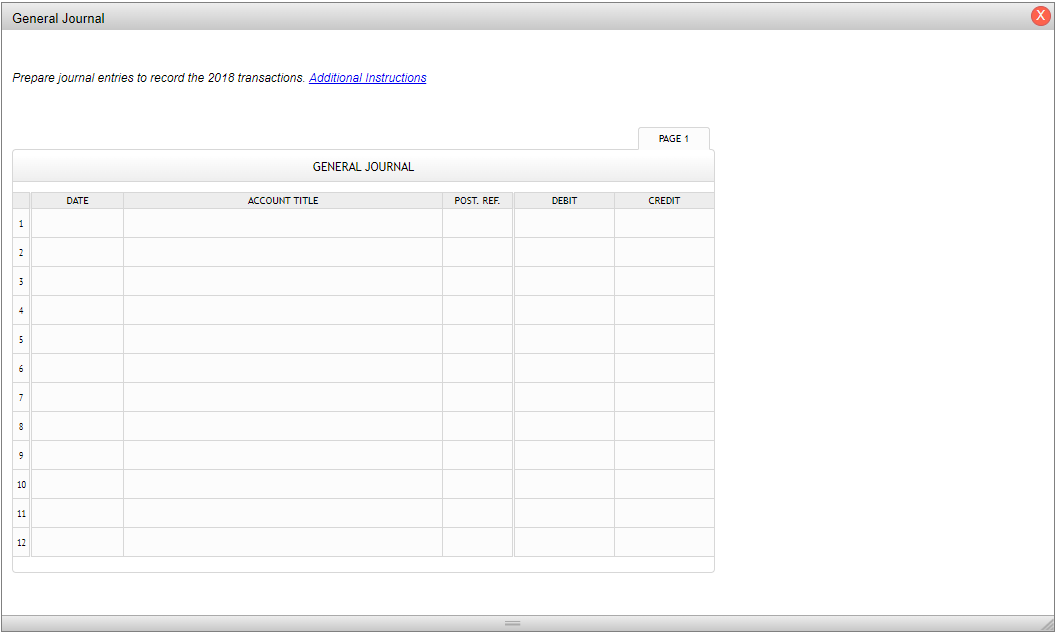

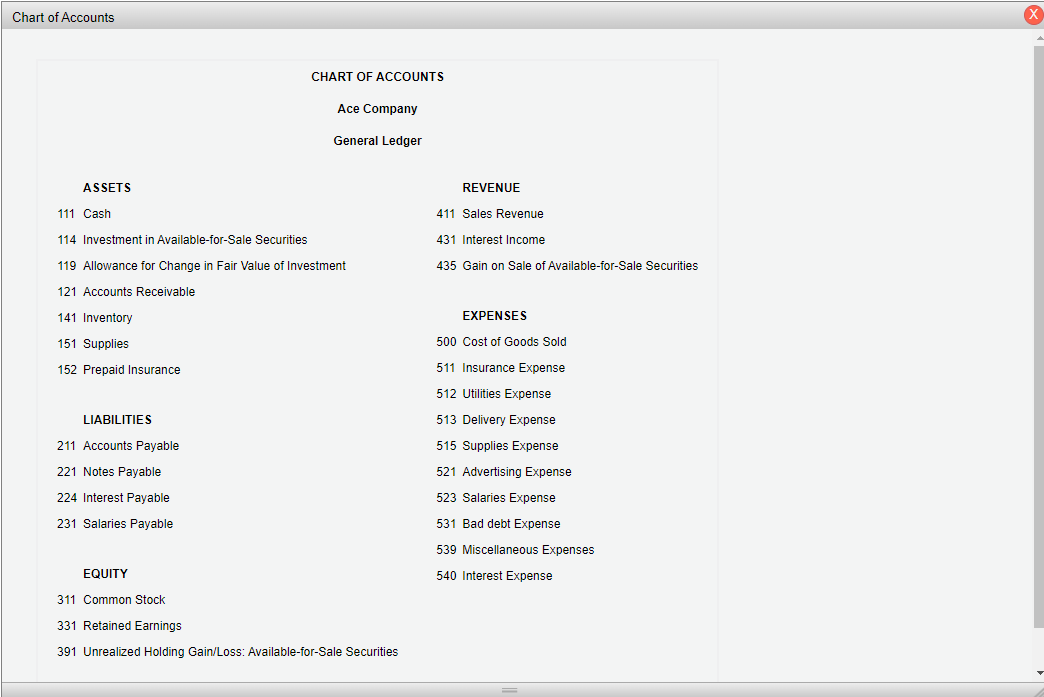

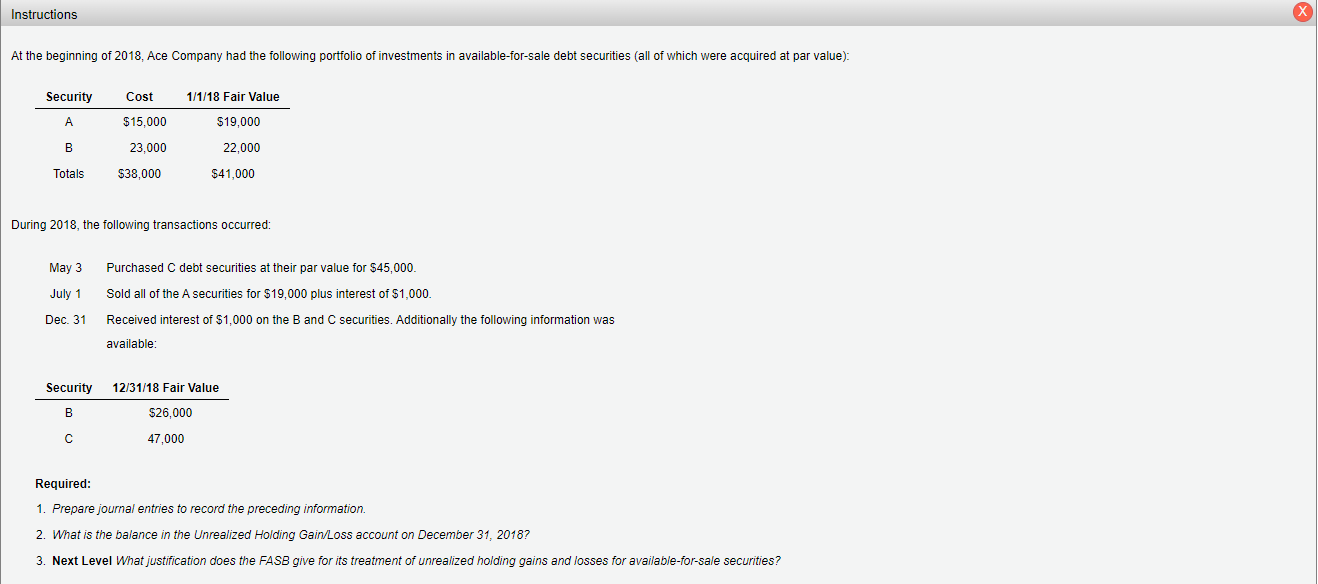

What justification does the FASB give for its treatment of unrealized holding gains and losses for available-for-sale securities? FASB requires unrealized holding gains and losses for available-for-sale securities to be reported as a component of other comprehensive income because: I Reporting unrealized holding gains and losses in income for available-for-sale securities would create unnecessary volatility in a company's reported net income. II The securities are actively managed making the inclusion of gains and losses irrelevant. What is the balance in the Unrealized Holding Gain/Loss account on December 31, 2018? Prepare journal entries to record the 2018 transactions. Chart of Accounts CHART OF ACCOUNTS Ace Company General Ledger ASSETS 111 Cash 114 Investment in Available-for-Sale Securities 119 Allowance for Change in Fair Value of Investment 121 Accounts Receivable 141 Inventory 151 Supplies 152 Prepaid Insurance LIABILITIES 211 Accounts Payable 221 Notes Payable 224 Interest Payable 231 Salaries Payable EQUITY 311 Common Stock 331 Retained Earnings 391 Unrealized Holding Gain/Loss: Available-for-Sale Securities REVENUE 411 Sales Revenue 431 Interest Income 435 Gain on Sale of Available-for-Sale Securities EXPENSES 500 Cost of Goods Sold 511 Insurance Expense 512 Utilities Expense 513 Delivery Expense 515 Supplies Expense 521 Advertising Expense 523 Salaries Expense 531 Bad debt Expense 539 Miscellaneous Expenses 540 Interest Expense During 2018, the following transactions occurred: May 3 Purchased C debt securities at their par value for $45,000. July 1 Sold all of the A securities for $19,000 plus interest of $1,000. Dec. 31 Received interest of $1,000 on the B and C securities. Additionally the following information was available: Required: 1. Prepare journal entries to record the preceding information. 2. What is the balance in the Unrealized Holding Gain/Loss account on December 31,2018? 3. Next Level What justification does the FASB give for its treatment of unrealized holding gains and losses for available-for-sale securities

What justification does the FASB give for its treatment of unrealized holding gains and losses for available-for-sale securities? FASB requires unrealized holding gains and losses for available-for-sale securities to be reported as a component of other comprehensive income because: I Reporting unrealized holding gains and losses in income for available-for-sale securities would create unnecessary volatility in a company's reported net income. II The securities are actively managed making the inclusion of gains and losses irrelevant. What is the balance in the Unrealized Holding Gain/Loss account on December 31, 2018? Prepare journal entries to record the 2018 transactions. Chart of Accounts CHART OF ACCOUNTS Ace Company General Ledger ASSETS 111 Cash 114 Investment in Available-for-Sale Securities 119 Allowance for Change in Fair Value of Investment 121 Accounts Receivable 141 Inventory 151 Supplies 152 Prepaid Insurance LIABILITIES 211 Accounts Payable 221 Notes Payable 224 Interest Payable 231 Salaries Payable EQUITY 311 Common Stock 331 Retained Earnings 391 Unrealized Holding Gain/Loss: Available-for-Sale Securities REVENUE 411 Sales Revenue 431 Interest Income 435 Gain on Sale of Available-for-Sale Securities EXPENSES 500 Cost of Goods Sold 511 Insurance Expense 512 Utilities Expense 513 Delivery Expense 515 Supplies Expense 521 Advertising Expense 523 Salaries Expense 531 Bad debt Expense 539 Miscellaneous Expenses 540 Interest Expense During 2018, the following transactions occurred: May 3 Purchased C debt securities at their par value for $45,000. July 1 Sold all of the A securities for $19,000 plus interest of $1,000. Dec. 31 Received interest of $1,000 on the B and C securities. Additionally the following information was available: Required: 1. Prepare journal entries to record the preceding information. 2. What is the balance in the Unrealized Holding Gain/Loss account on December 31,2018? 3. Next Level What justification does the FASB give for its treatment of unrealized holding gains and losses for available-for-sale securities Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started