Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what kind of information do you need? Chapter Summary Assignment #4 (Ch 8 & 9) D2L quiz questions will be asked in class based on

what kind of information do you need?

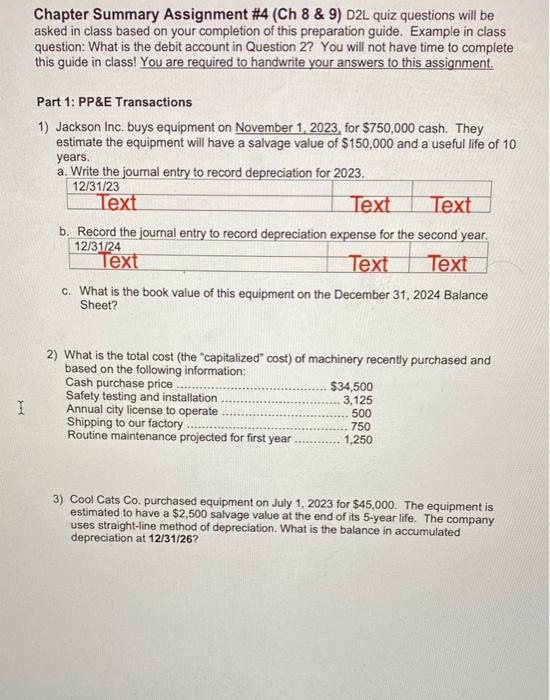

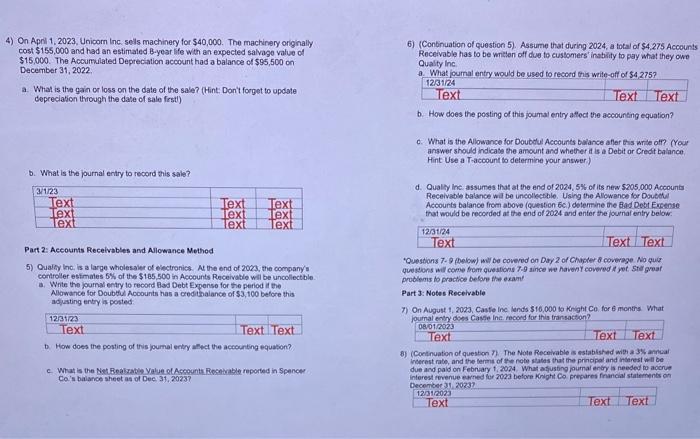

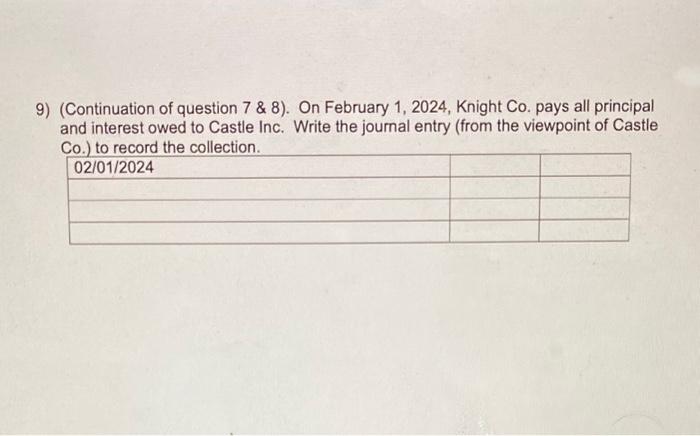

Chapter Summary Assignment \#4 (Ch 8 \& 9) D2L quiz questions will be asked in class based on your completion of this preparation guide. Example in class question: What is the debit account in Question 2? You will not have time to complete this guide in class! You are required to handwrite your answers to this assignment. Part 1: PP\&E Transactions 1) Jackson Inc. buys equipment on November 1, 2023, for $750,000 cash. They estimate the equipment will have a salvage value of $150,000 and a useful life of 10 years. a. Write the joumal entry to record depreciation for 2023 . b. Record the journal entry to record depreciation expense for the second vear. c. What is the book value of this equipment on the December 31, 2024 Balance Sheet? 2) What is the total cost (the "capitalized" cost) of machinery recently purchased and based on the following information: 3) Cool Cats Co. purchased equipment on July 1, 2023 for $45,000. The equipment is estimated to have a $2,500 salvage value at the end of its 5-year life. The company uses straight-line method of depreciation. What is the balance in accumulated depreciation at 12/31/26? 4) On Apnil 1, 2023, Unicom inc sels machinery for $40,000. The machinery originaly cost $155,000 and had an estimated B-year life wth an expected salvage value of 6) (Continuation of puestion 5). Assume that during 2024, a total of $4,275 Accounts $15,000. The Accurrulated Depreciation account had a balance of $95,500 on Recelvable has to be witten off due to customers' inabiliy to pay what they owe Qualty inc. December 31, 2022 . a. What foumal entry would be used to recoed this weite-off of $4,275 ? a. What is the gain or loss on the date of the sale? (Hint: Don't forget to updite depreciation through the date of sale frsti) b. How does the posting of this joumal entry aflect the accounting equation? c. What is the Alowance for Doubolu Accounts balance afler ths write aff? (Your answer should indicase the amount and whether it is a Debit or Crest balance. Hint Use a Taccount to determine your answer.) b. What is the journal entry to record this sale? d. Qualy ine assumes that at the end of 2024, 5% of its new $205,000 Accounts Receivable batance wal be uneolectble. Using the Allowence for Doutete Accounts balance from above (question 6c) dolemine the Bad Dobt Exsense. that would be recorded at the end of 2024 and enter the journaf ently below. Part 2: Aceounts Receivables and Allowance Methed Questions 7.9 Relbw) wil be coverd on Dary 2 or Chister 8 coverage No quiz 5) Oualfy the, is a large wholesaler of electronics. NH the end of 2023, the company's quedions wil come fom que sitons 7.9 aince we havenY covered A jot ste great controler estmales 5% of the $185,500 in Accounts Receivable wil be uncollectble. a. White the journal enty to record Bad Debt Expenso for the period it the problenss to practice before fte exant Alowance for Doubtul Accounts has a condthalance of 53,100 betore this Part J: Notes Receivable adjasting entry is posted: 7) On August 1. 2023, Caste ine lends $16,000 to Kinght Co. for 6 months. What inumal metrid deses, Castale ine mocend for this transacton? b. How does the posting of this poumal entry astat the accounting equasion? 8) (Contnuation of queston 7). The Note Receirable is establshed wign a 35 ambal inerest rate, and the terms of 7 enote stacas that the pmapal and ntenest will be c. What is the Net Bealzable Yalue of Aceounta Fiocticable reported in Spencer due and paid on Febriary 1,2024 . What afusbing pumal enty is needed to acoure Co:s balanos sheet as of Dee 31,20233 ? interest parenue esmed for 2023 betore Koiloth Co presares francial statements on (Continuation of question 7 \& 8). On February 1,2024 , Knight Co. pays all principal and interest owed to Castle Inc. Write the journal entry (from the viewpoint of Castle Ca itn rerard the rollertion Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started