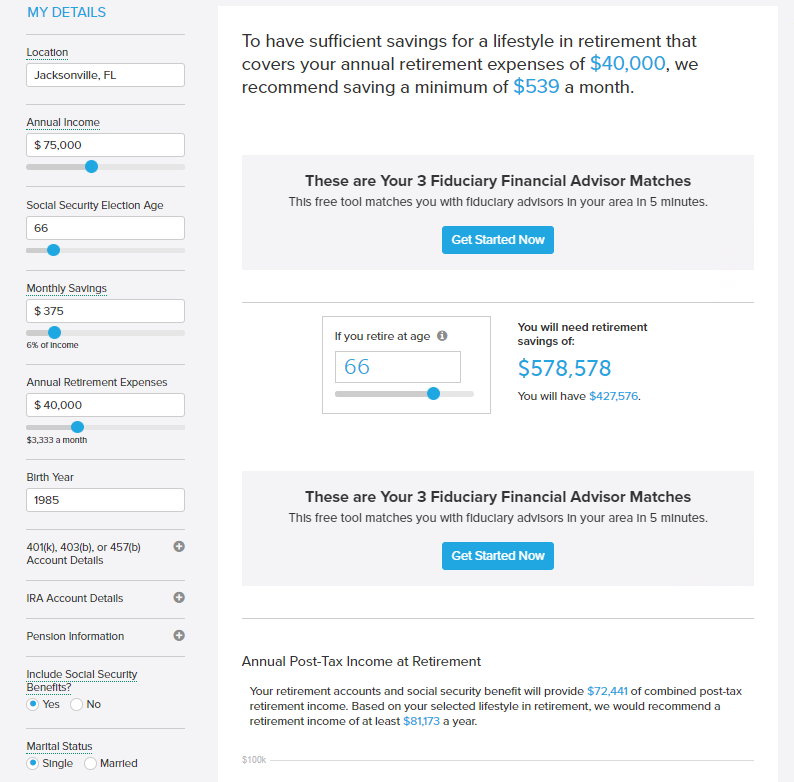

What math formulas are being used to solve this retirement calculator?

Given that a person:

-makes an annual income of $75,000

-has a Social Security Election Age of 66

-Monthly Savings of $375

-Annual retirement expenses of $40,000

-was born in 1985

-marital status is single

-AND they want to include social security benefits in this calculation.

I need to know the actual math equations and what steps were taken to get the answer: "We recommend saving a minimum of $539 a month". I also need to know why this person would need a retirement savings of $578,578 but only has $427,576. How is this calculated?

MY DETAILS Location To have sufficient savings for a lifestyle in retirement that covers your annual retirement expenses of $40,000, we recommend saving a minimum of $539 a month. Jacksonville, FL Annual Income $ 75,000 These are Your 3 Fiduciary Financial Advisor Matches This free tool matches you with fiduciary advisors in your area in 5 minutes. Social Security Election Age 66 Get Started Now Monthly Savings $375 If you retire at age 6 6% of income 66 You will need retirement savings of: $578,578 You will have $427,576. Annual Retirement Expenses $ 40,000 $3,333 a month Birth Year 1985 These are Your 3 Fiduciary Financial Advisor Matches This free tool matches you with fiduciary advisors in your area in 5 minutes. 401(k), 403(b), or 457(b) Account Details + Get Started Now IRA Account Details + Pension Information + Include Social Security Benefits? Yes No Annual Post-Tax Income at Retirement Your retirement accounts and social security benefit will provide $72,441 of combined post-tax retirement income. Based on your selected lifestyle in retirement, we would recommend a retirement income of at least $81,173 a year. Marital Status Single Married $100K MY DETAILS Location To have sufficient savings for a lifestyle in retirement that covers your annual retirement expenses of $40,000, we recommend saving a minimum of $539 a month. Jacksonville, FL Annual Income $ 75,000 These are Your 3 Fiduciary Financial Advisor Matches This free tool matches you with fiduciary advisors in your area in 5 minutes. Social Security Election Age 66 Get Started Now Monthly Savings $375 If you retire at age 6 6% of income 66 You will need retirement savings of: $578,578 You will have $427,576. Annual Retirement Expenses $ 40,000 $3,333 a month Birth Year 1985 These are Your 3 Fiduciary Financial Advisor Matches This free tool matches you with fiduciary advisors in your area in 5 minutes. 401(k), 403(b), or 457(b) Account Details + Get Started Now IRA Account Details + Pension Information + Include Social Security Benefits? Yes No Annual Post-Tax Income at Retirement Your retirement accounts and social security benefit will provide $72,441 of combined post-tax retirement income. Based on your selected lifestyle in retirement, we would recommend a retirement income of at least $81,173 a year. Marital Status Single Married $100K