Answered step by step

Verified Expert Solution

Question

1 Approved Answer

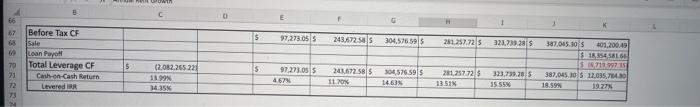

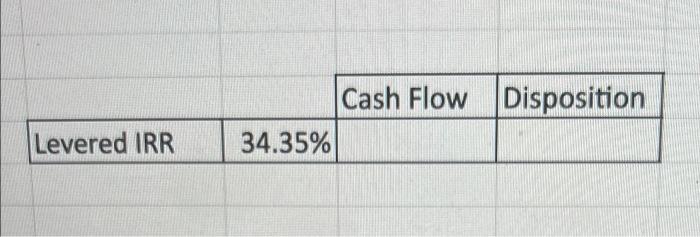

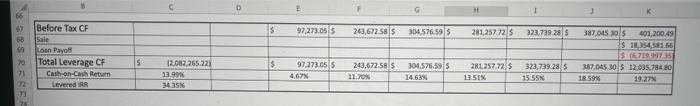

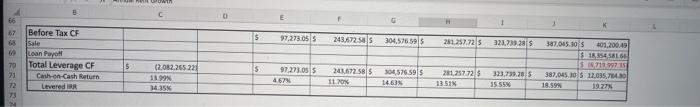

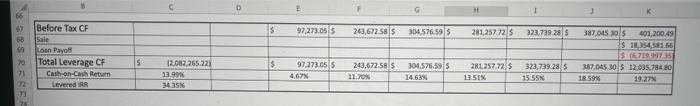

what % of the levered irr is coming from cash flows and what % is coming from the sale of the property WD C 99

what % of the levered irr is coming from cash flows and what % is coming from the sale of the property

WD C 99 $ 97,273.05 S 68 5 243,672.50 S 304,576.59 $ 289,252.725 32.733.2015 Before Tax CF Sale Loan Payott Total Leverage CF Cash on-Cash Return Levered 5 79 21 72 73 (2.082.265221 18.99 387,045.305 101,200.49 11 SESILO 5.1997.15 387,045,30 $ 12.035,76430 18.599 10 5 97.273.05 4.67 243,672.58S 11. 20% 304,576.59 $ 14.63% 281,25772 13 SIN 323,739.2015 15 55% NSE TE NEGE Cash Flow Disposition 34.35% Levered IRR F 1 1 3 K 66 S 97,273,055 243,672.585 304,576 595 281,257.7215 323,739.286 68 , Before Tax CF Sale Loan Pavol Total Leverage CF Cash on-Cash Return Levered RA 387,015.05 401,200.49 S 1,354 381.66 169 17:15 387,045 30 5 12.035.784 80 1 59% 19.27 5 12.082,265.221 13.99 5 97,273.05 5 4.67% 243,672.58 5 304.576.595 14.6 281.257.72 $ 13. SIX 70 71 72 13 24 323,739.285 1555 WD C 99 $ 97,273.05 S 68 5 243,672.50 S 304,576.59 $ 289,252.725 32.733.2015 Before Tax CF Sale Loan Payott Total Leverage CF Cash on-Cash Return Levered 5 79 21 72 73 (2.082.265221 18.99 387,045.305 101,200.49 11 SESILO 5.1997.15 387,045,30 $ 12.035,76430 18.599 10 5 97.273.05 4.67 243,672.58S 11. 20% 304,576.59 $ 14.63% 281,25772 13 SIN 323,739.2015 15 55% NSE TE NEGE Cash Flow Disposition 34.35% Levered IRR F 1 1 3 K 66 S 97,273,055 243,672.585 304,576 595 281,257.7215 323,739.286 68 , Before Tax CF Sale Loan Pavol Total Leverage CF Cash on-Cash Return Levered RA 387,015.05 401,200.49 S 1,354 381.66 169 17:15 387,045 30 5 12.035.784 80 1 59% 19.27 5 12.082,265.221 13.99 5 97,273.05 5 4.67% 243,672.58 5 304.576.595 14.6 281.257.72 $ 13. SIX 70 71 72 13 24 323,739.285 1555

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started