Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What other information you need? these are all information I have in my question. Also, Chegg is charging me almost $30 monthly for expert answer,

What other information you need? these are all information I have in my question.

Also, Chegg is charging me almost $30 monthly for expert answer, why I have to pay extra for answers now?!

| Q1 | ||

| Sky watcher Case from Lento case book | ||

| Prepare the Statement of Cash Flows | ||

| Interpret the findings for each component of the statement |

v

I need help with preparing the cash flow statement, with explanation of calculation and Interpret the findings for each component of the statement in the structure of a memo please

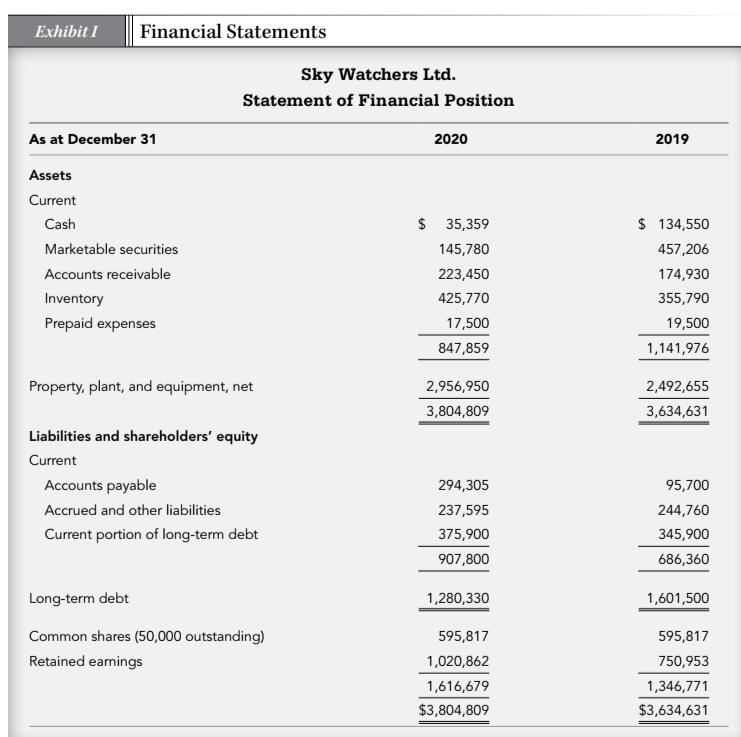

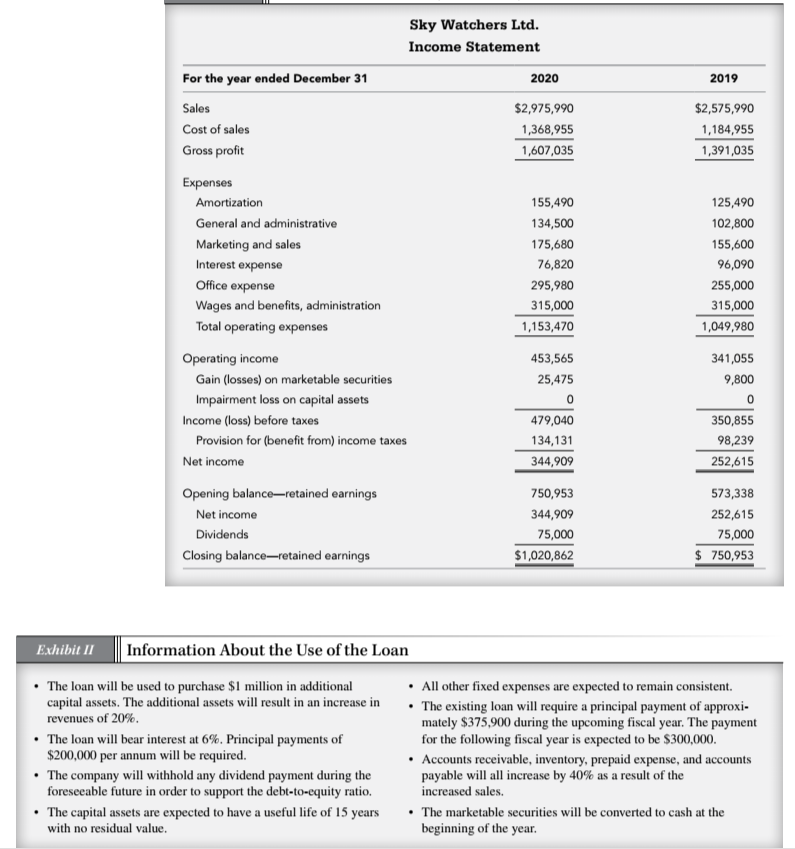

\begin{tabular}{|c|c|c|c|c|} \hline Exhibit I & \multicolumn{4}{|c|}{ Financial Statements } \\ \hline \multicolumn{5}{|c|}{\begin{tabular}{c} Sky Watchers Ltd. \\ Statement of Financial Position \end{tabular}} \\ \hline As at Decer & r 31 & 2020 & & 2019 \\ \hline \multicolumn{5}{|l|}{ Assets } \\ \hline \multicolumn{5}{|l|}{ Current } \\ \hline Cash & & $35,359 & $ & 134,550 \\ \hline Marketab & curities & 145,780 & & 457,206 \\ \hline Accounts & ivable & 223,450 & & 174,930 \\ \hline Inventory & & 425,770 & & 355,790 \\ \hline \multirow{2}{*}{\multicolumn{2}{|c|}{ Prepaid expenses }} & 17,500 & & 19,500 \\ \hline & & 847,859 & & 1,141,976 \\ \hline \multirow{2}{*}{\multicolumn{2}{|c|}{ Property, plant, and equipment, net }} & 2,956,950 & & 2,492,655 \\ \hline & & 3,804,809 & & 3,634,631 \\ \hline \multicolumn{5}{|c|}{ Liabilities and shareholders' equity } \\ \hline \multicolumn{5}{|l|}{ Current } \\ \hline \multicolumn{2}{|c|}{ Accounts payable } & 294,305 & & 95,700 \\ \hline \multicolumn{2}{|c|}{ Accrued and other liabilities } & 237,595 & & 244,760 \\ \hline \multirow{2}{*}{\multicolumn{2}{|c|}{ Current portion of long-term debt }} & 375,900 & & 345,900 \\ \hline & & 907,800 & & 686,360 \\ \hline \multicolumn{2}{|c|}{ Long-term debt } & 1,280,330 & & 1,601,500 \\ \hline \multicolumn{2}{|c|}{ Common shares (50,000 outstanding) } & 595,817 & & 595,817 \\ \hline \multicolumn{2}{|c|}{ Retained earnings } & 1,020,862 & & 750,953 \\ \hline & & 1,616,679 & & 1,346,771 \\ \hline & & $3,804,809 & & 3,634,631 \\ \hline \end{tabular} Sky Watchers Ltd. Income Statement \begin{tabular}{|c|c|c|} \hline For the year ended December 31 & 2020 & 2019 \\ \hline Sales & $2,975,990 & $2,575,990 \\ \hline Cost of sales & 1,368,955 & 1,184,955 \\ \hline Gross profit & 1,607,035 & 1,391,035 \\ \hline \multicolumn{3}{|l|}{ Expenses } \\ \hline Amortization & 155,490 & 125,490 \\ \hline General and administrative & 134,500 & 102,800 \\ \hline Marketing and sales & 175,680 & 155,600 \\ \hline Interest expense & 76,820 & 96,090 \\ \hline Office expense & 295,980 & 255,000 \\ \hline Wages and benefits, administration & 315,000 & 315,000 \\ \hline Total operating expenses & 1,153,470 & 1,049,980 \\ \hline Operating income & 453,565 & 341,055 \\ \hline Gain (losses) on marketable securities & 25,475 & 9,800 \\ \hline Impairment loss on capital assets & 0 & 0 \\ \hline Income (loss) before taxes & 479,040 & 350,855 \\ \hline Provision for (benefit from) income taxes & 134,131 & 98,239 \\ \hline Net income & 344,909 & 252,615 \\ \hline Opening balance-retained earnings & 750,953 & 573,338 \\ \hline Net income & 344,909 & 252,615 \\ \hline Dividends & 75,000 & 75,000 \\ \hline Closing balance-retained earnings & $1,020,862 & $750,953 \\ \hline \end{tabular} Exhibit II 1 Information About the Use of the Loan - The loan will be used to purchase $1 million in additional capital assets. The additional assets will result in an increase in revenues of 20%. - The loan will bear interest at 6%. Principal payments of $200,000 per annum will be required. - The company will withhold any dividend payment during the foreseeable future in order to support the debt-to-equity ratio. - The capital assets are expected to have a useful life of 15 years with no residual value. - All other fixed expenses are expected to remain consistent. - The existing loan will require a principal payment of approximately $375,900 during the upcoming fiscal year. The payment for the following fiscal year is expected to be $300,000. - Accounts receivable, inventory, prepaid expense, and accounts payable will all increase by 40% as a result of the increased sales. - The marketable securities will be converted to cash at the beginning of the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started