Answered step by step

Verified Expert Solution

Question

1 Approved Answer

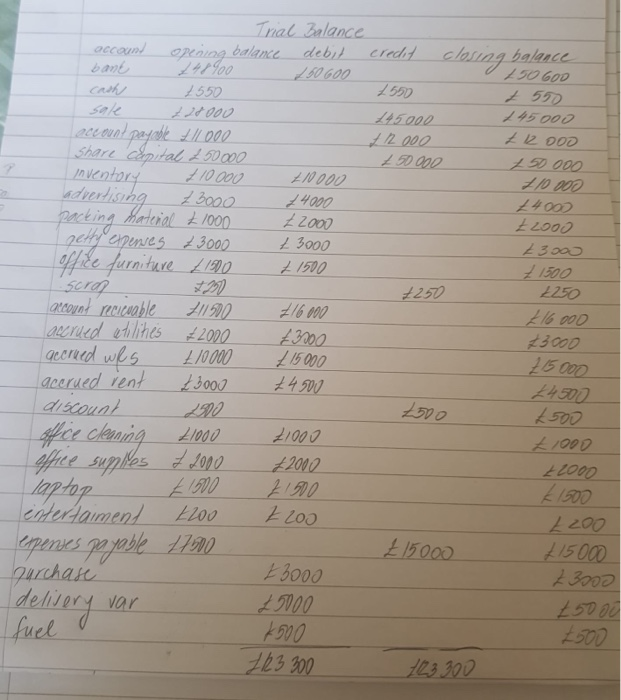

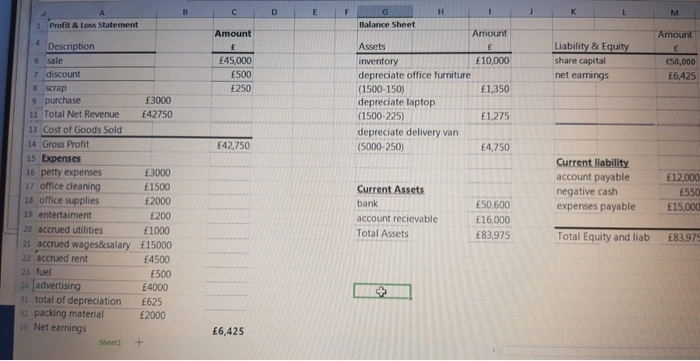

what other informations are need it? they are 2 misstakes one on trial balance where office supplies should be 1500 and on profit and loss

what other informations are need it? they are 2 misstakes one on trial balance where office supplies should be 1500 and on profit and loss account of accrued utilities should be 3000

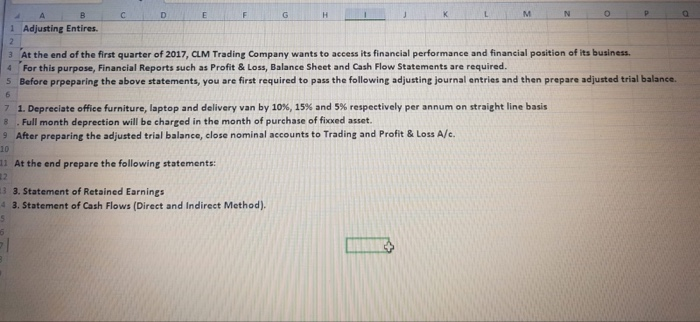

1 Adjusting Entires. At the end of the first quarter of 2017, CLM Trading Company wants to access its financial performance and financial position of its business For this purpose, Financial Reports such as Profit & Loss, Balance Sheet and Cash Flow Statements are required. 5 Before prpeparing the above statements, you are first required to pass the following adjusting journal entries and then prepare adjusted trial balance 7 1. Depreciate office furniture, laptop and delivery van by 10%, 15% and 5% respectively per annum on straight line basis Full month deprection will be charged in the month of purchase of fixed asset. After preparing the adjusted trial balance, close nominal accounts to Trading and Profit & Loss A/e. 11 At the end prepare the following statements: 13. Statement of Retained Earnings 4 3. Statement of Cash Flows (Direct and Indirect Method). 2500 Trial Balance accound opening balance debit bant 47900 0600 cash 550 sale 228000 account payable H/000 Share Capital 250000 inventory 10000 10000 advertising 23000 74000 packing thateral 1000 12000 och penses 3000 3000 office furniture 1500 + 1500 credit closing balance 250 600 52 245.000 145000 12000 L 2000 +0000 20 000 +10000 24002 22000 7257 116000 23000 15000 4500 2250 216.000 23.000 25000 4500 2500 account recicable aucried etilines accrued wRs laccrued rent discount offre cleaning office supplies laptop entertaiment expenses payable purchase delivery var 11500 2000 10000 3000 2900 21000 - 22000 1500 200 4790 21000 22000 1500 Z 200 1000 22000 100 2200 215000 23002 15000 25000 3000 20000 1500 263 300 fuel 123.300 CDE M 1 Profit & Loss Statement Amount Amount 45,000 500 250 Liability & Equity share capital net earnings 50,000 6,425 Balance Sheet Amount Assets inventory 10,000 depreciate office furniture (1500-150) 1,350 depreciate laptop (1500-225) 1.275 depreciate delivery van (5000-250) 4,750 42,750 Description 6 sale 7 discount 8 scrap 9 purchase 3000 11 Total Net Revenue E42750 13 Cost of Goods Sold 14 Gross Profit 15 Expenses 16 petty expenses 3000 17 office cleaning 1500 18 office supplies 2000 19 entertainment E200 20 accrued utilities 1000 21 accrued wages&salary f15000 22 accrued rent 4500 23 fuel 500 24 advertising 4000 31 total of depreciation 625 32 packing material 2000 39 Net earnings Sheet + Current Assets bank account recievable Total Assets Current liability account payable negative cash expenses payable 12,000 550 15,000 50,600 16,000 83.975 Total Equity and liab 83,975 6,425 1 Adjusting Entires. At the end of the first quarter of 2017, CLM Trading Company wants to access its financial performance and financial position of its business For this purpose, Financial Reports such as Profit & Loss, Balance Sheet and Cash Flow Statements are required. 5 Before prpeparing the above statements, you are first required to pass the following adjusting journal entries and then prepare adjusted trial balance 7 1. Depreciate office furniture, laptop and delivery van by 10%, 15% and 5% respectively per annum on straight line basis Full month deprection will be charged in the month of purchase of fixed asset. After preparing the adjusted trial balance, close nominal accounts to Trading and Profit & Loss A/e. 11 At the end prepare the following statements: 13. Statement of Retained Earnings 4 3. Statement of Cash Flows (Direct and Indirect Method). 2500 Trial Balance accound opening balance debit bant 47900 0600 cash 550 sale 228000 account payable H/000 Share Capital 250000 inventory 10000 10000 advertising 23000 74000 packing thateral 1000 12000 och penses 3000 3000 office furniture 1500 + 1500 credit closing balance 250 600 52 245.000 145000 12000 L 2000 +0000 20 000 +10000 24002 22000 7257 116000 23000 15000 4500 2250 216.000 23.000 25000 4500 2500 account recicable aucried etilines accrued wRs laccrued rent discount offre cleaning office supplies laptop entertaiment expenses payable purchase delivery var 11500 2000 10000 3000 2900 21000 - 22000 1500 200 4790 21000 22000 1500 Z 200 1000 22000 100 2200 215000 23002 15000 25000 3000 20000 1500 263 300 fuel 123.300 CDE M 1 Profit & Loss Statement Amount Amount 45,000 500 250 Liability & Equity share capital net earnings 50,000 6,425 Balance Sheet Amount Assets inventory 10,000 depreciate office furniture (1500-150) 1,350 depreciate laptop (1500-225) 1.275 depreciate delivery van (5000-250) 4,750 42,750 Description 6 sale 7 discount 8 scrap 9 purchase 3000 11 Total Net Revenue E42750 13 Cost of Goods Sold 14 Gross Profit 15 Expenses 16 petty expenses 3000 17 office cleaning 1500 18 office supplies 2000 19 entertainment E200 20 accrued utilities 1000 21 accrued wages&salary f15000 22 accrued rent 4500 23 fuel 500 24 advertising 4000 31 total of depreciation 625 32 packing material 2000 39 Net earnings Sheet + Current Assets bank account recievable Total Assets Current liability account payable negative cash expenses payable 12,000 550 15,000 50,600 16,000 83.975 Total Equity and liab 83,975 6,425 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started