Question

What sheet do I record this on the tax return? 12. Paige received a Form 1099-B from her broker for the sale of the following

What sheet do I record this on the tax return?

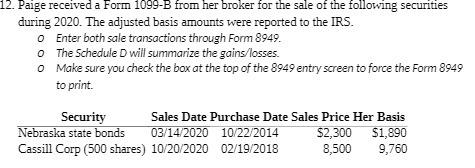

12. Paige received a Form 1099-B from her broker for the sale of the following securities during 2020. The adjusted basis amounts were reported to the IRS. O Enter both sale transactions through Form 8949. o The Schedule D will summarize the gains/losses. o Make sure you check the box at the top of the 8949 entry screen to force the Form 8949 to print. Security Nebraska state bonds Sales Date Purchase Date Sales Price Her Basis 03/14/2020 10/22/2014 $2,300 $1,890 8,500 9,760 Cassill Corp (500 shares) 10/20/2020 02/19/2018

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided you should not re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App