Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What should be reported as total current liabilities? 2. What amount should be reported as total noncurrent liabilities? Chertsey Company provided the following information on

What should be reported as total current liabilities?

2. What amount should be reported as total noncurrent liabilities?

2. What amount should be reported as total noncurrent liabilities?

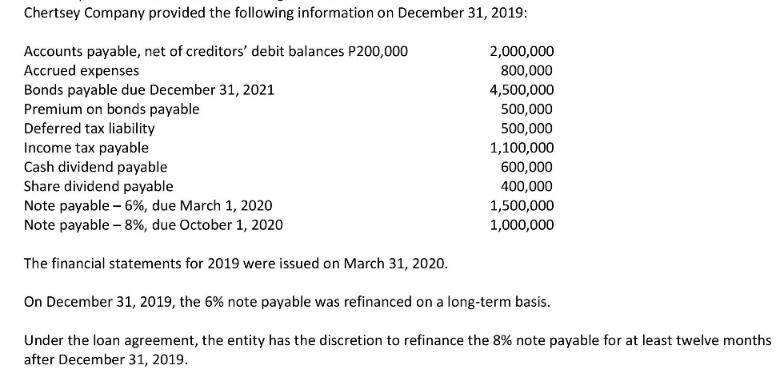

Chertsey Company provided the following information on December 31, 2019: Accounts payable, net of creditors' debit balances P200,000 Accrued expenses Bonds payable due December 31, 2021 Premium on bonds payable Deferred tax liability Income tax payable Cash dividend payable 2,000,000 800,000 4,500,000 500,000 500,000 1,100,000 600,000 400,000 1,500,000 1,000,000 Share dividend payable Note payable - 6%, due March 1, 2020 Note payable - 8%, due October 1, 2020 The financial statements for 2019 were issued on March 31, 2020. On December 31, 2019, the 6% note payable was refinanced on a long-term basis. Under the loan agreement, the entity has the discretion to refinance the 8% note payable for at least twelve months after December 31, 2019.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The total current liabilities are P2200000 This is the sum of the following Accounts payable net ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started