- What should be the appropriate classification of margin loans under IFRS 9?

- What would be the extent of applicability of these three classifications with regard to margin loan receivables?

- Possible to segregate financial statement effect of IFRS 9 implementation on margin financing-related items?

- Any room for accounting manipulation in classification and ECL assessment of margin loan assets?

- Other financial metrics or analytical tools that Suginami Bank could use in order to better manage the credit risk presented by margin loan assets?

- Is IFRS 9 favourable to the financial performance of a securities margin financing business or otherwise?

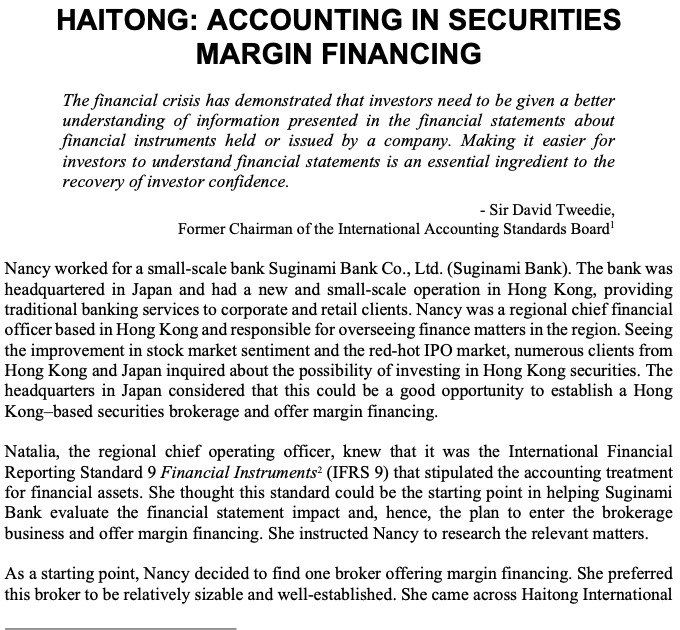

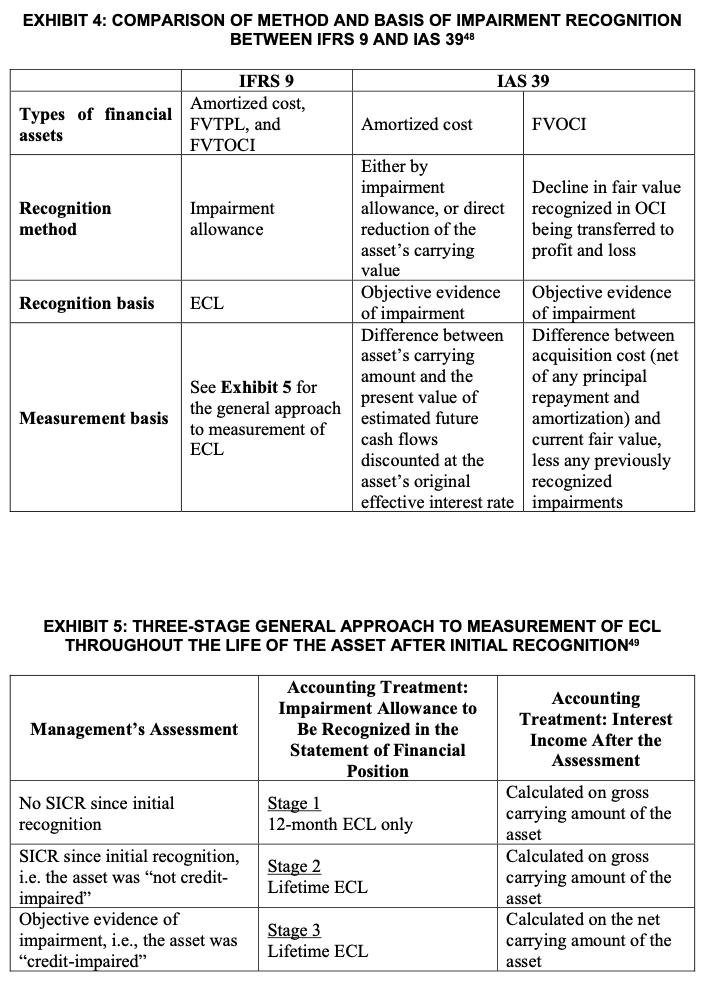

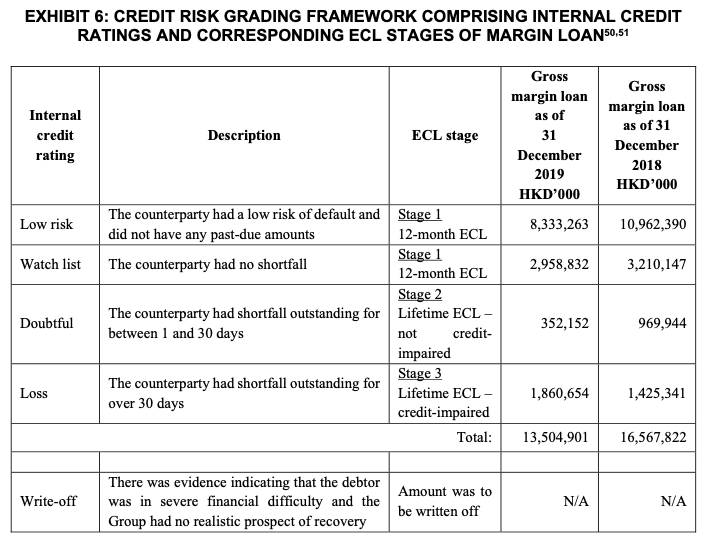

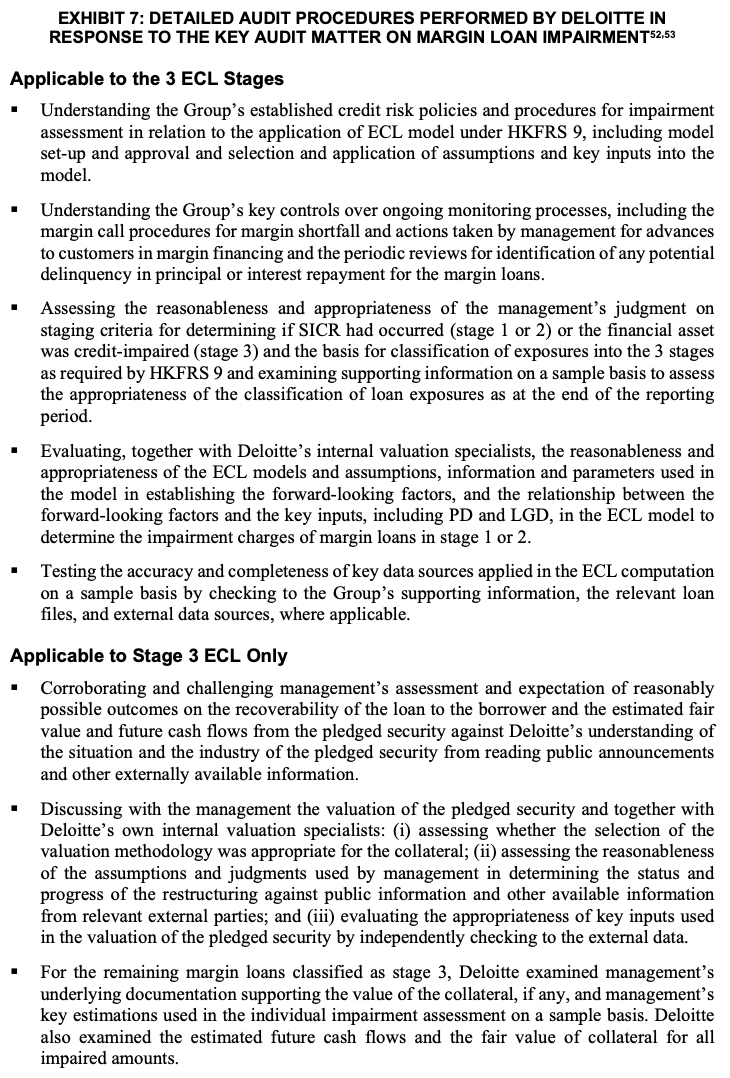

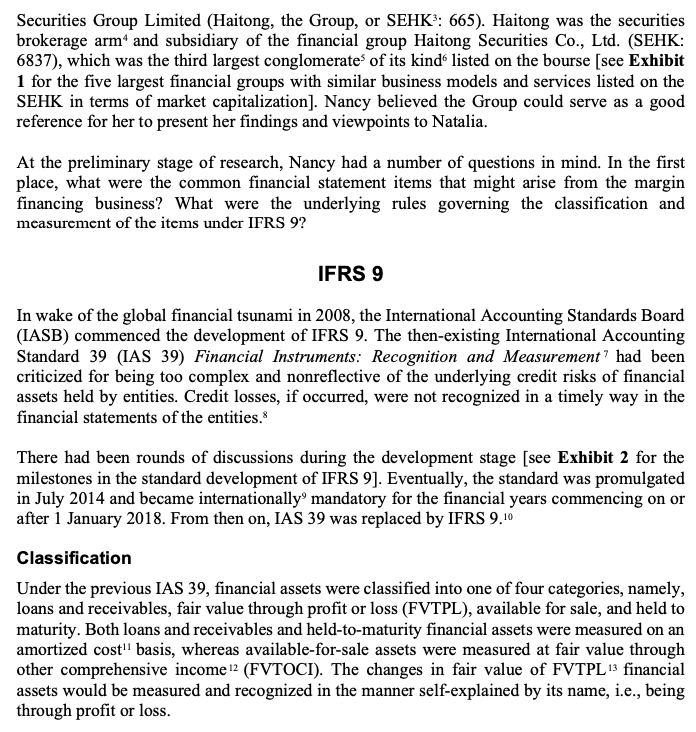

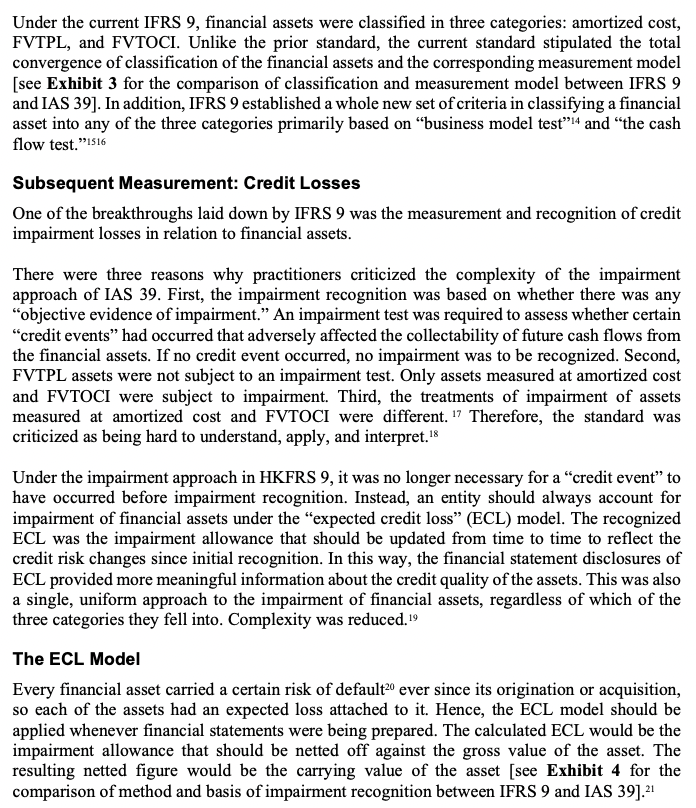

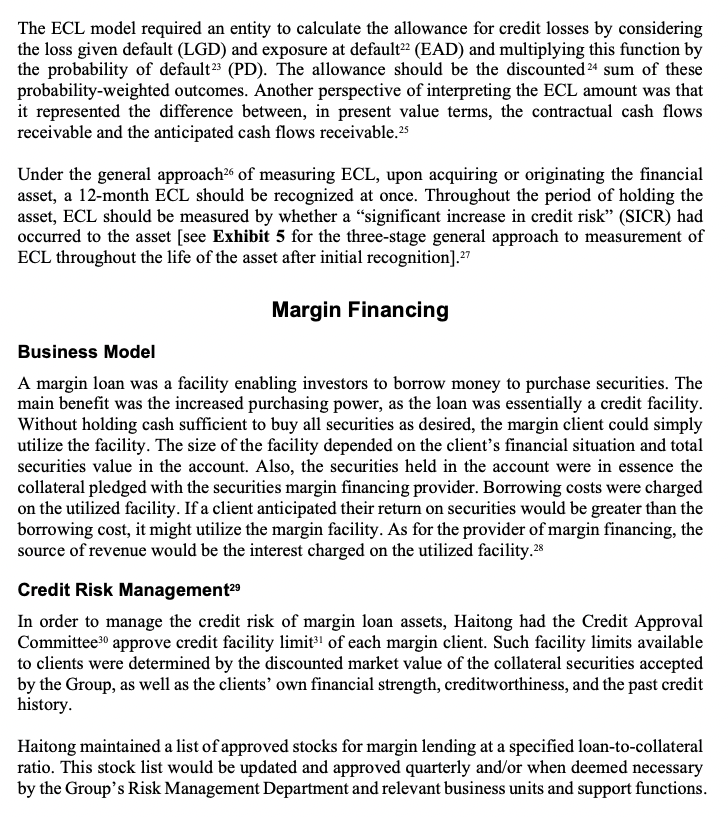

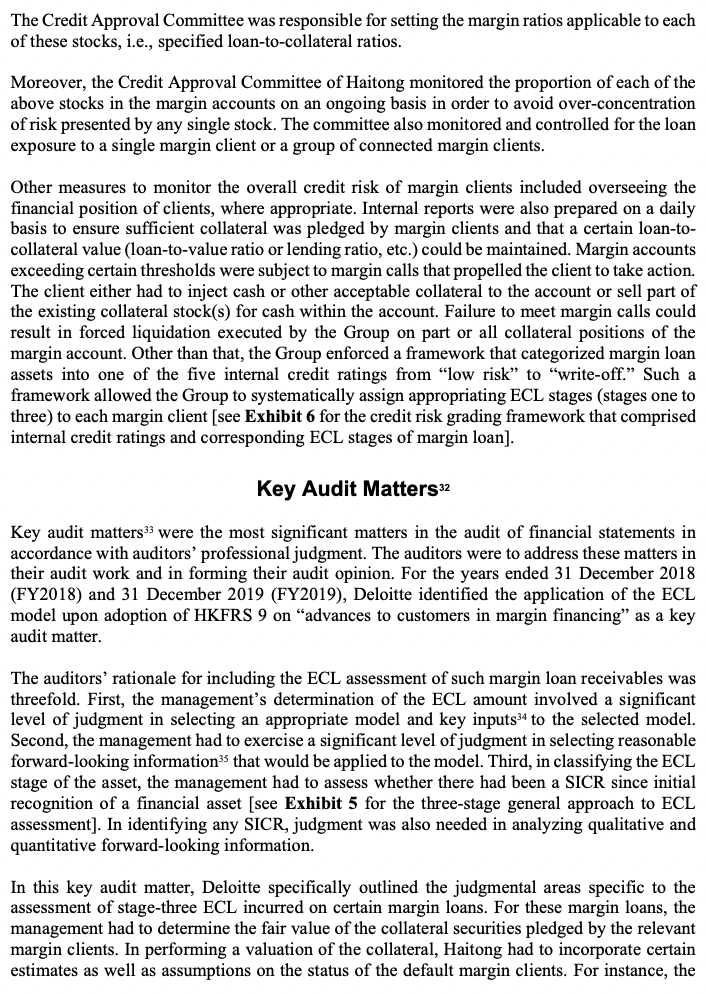

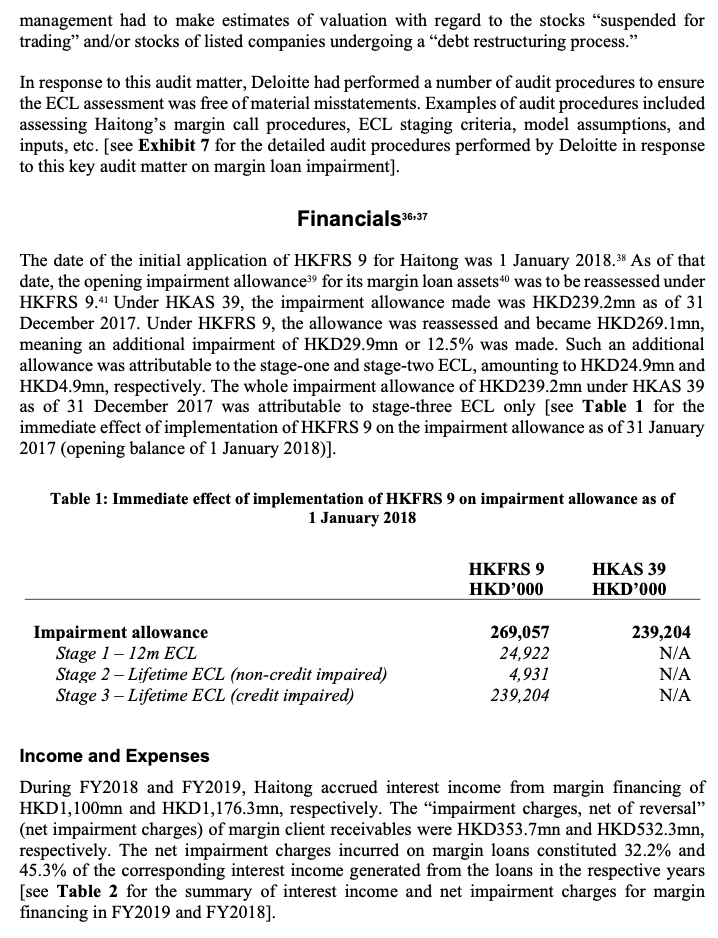

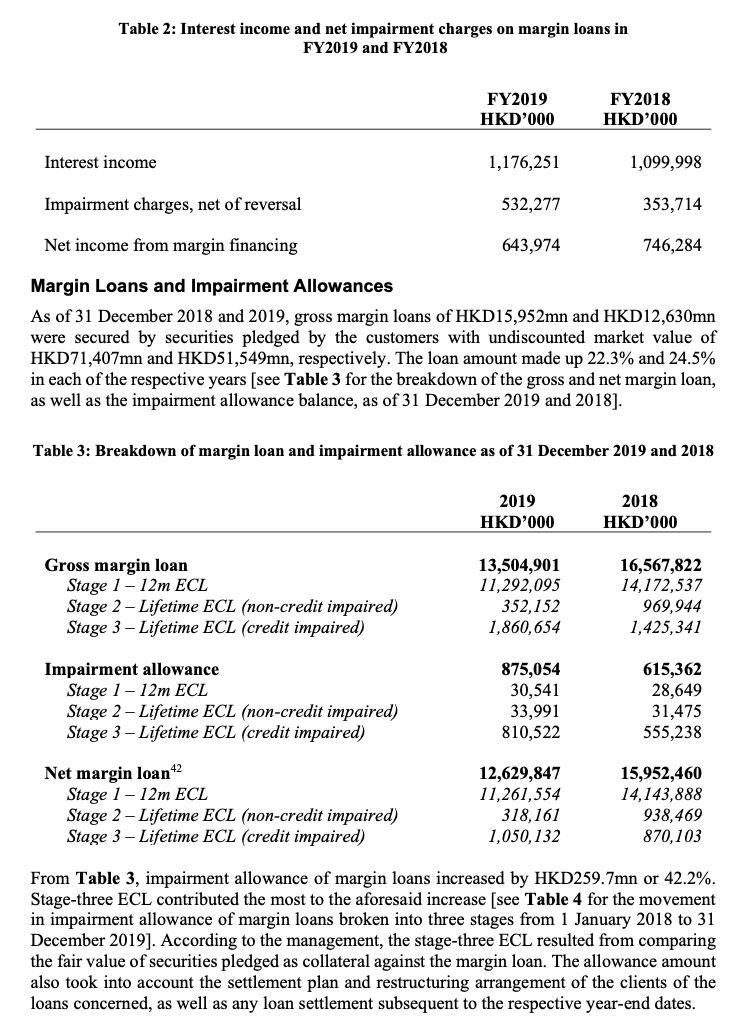

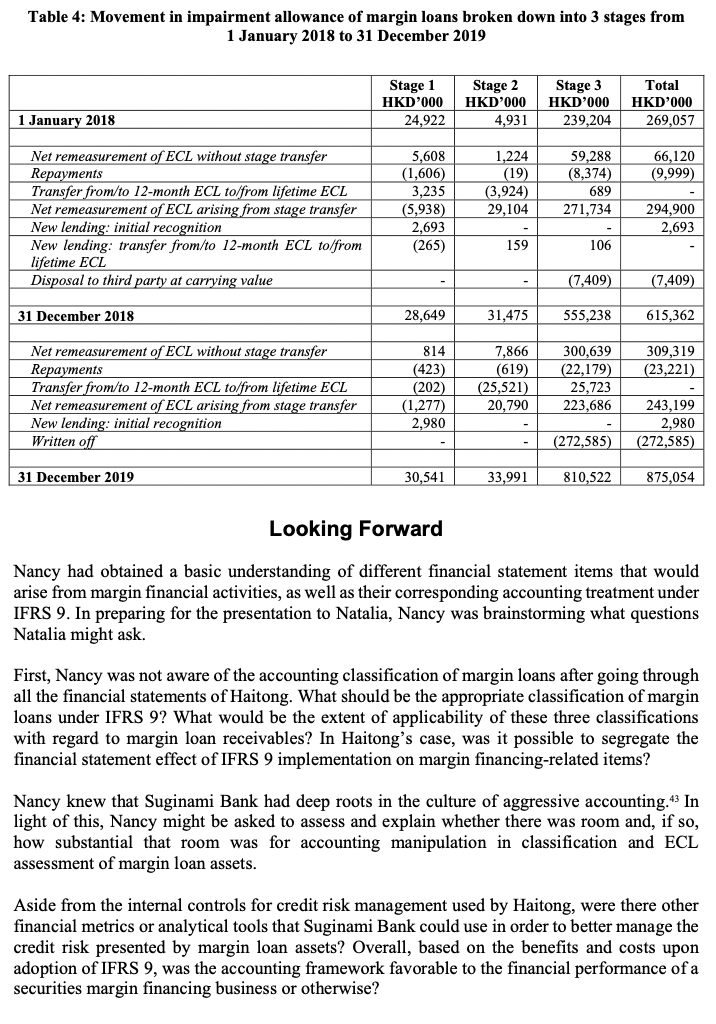

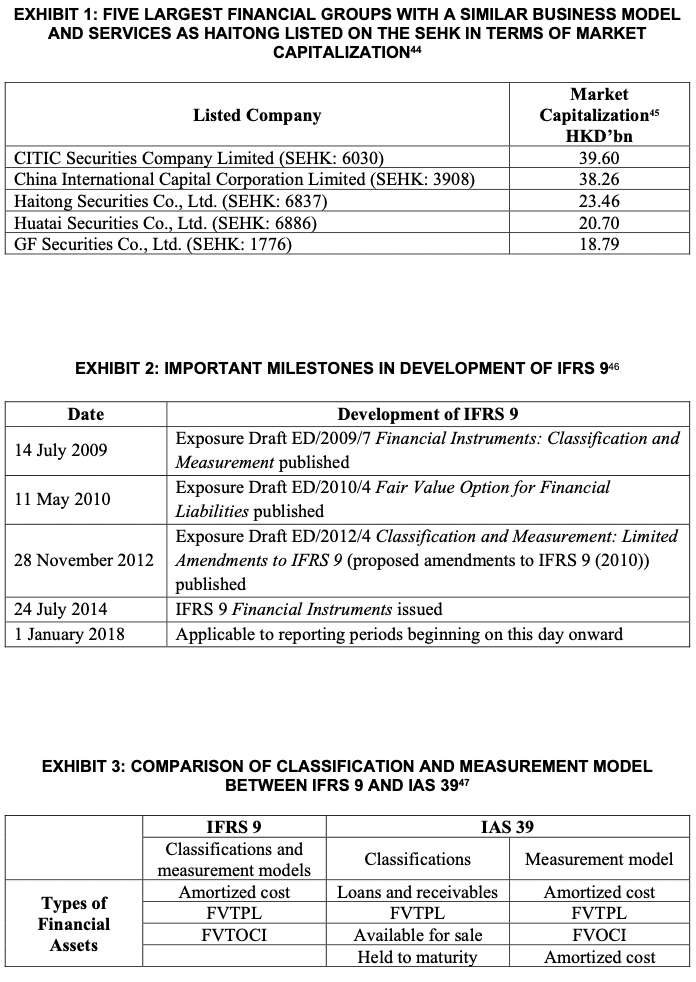

HAITONG: ACCOUNTING IN SECURITIES MARGIN FINANCING The financial crisis has demonstrated that investors need to be given a better understanding of information presented in the financial statements about financial instruments held or issued by a company. Making it easier for investors to understand financial statements is an essential ingredient to the recovery of investor confidence. - Sir David Tweedie, Former Chairman of the International Accounting Standards Board Nancy worked for a small-scale bank Suginami Bank Co., Ltd. (Suginami Bank). The bank was headquartered in Japan and had a new and small-scale operation in Hong Kong, providing traditional banking services to corporate and retail clients. Nancy was a regional chief financial officer based in Hong Kong and responsible for overseeing finance matters in the region. Seeing the improvement in stock market sentiment and the red-hot IPO market, numerous clients from Hong Kong and Japan inquired about the possibility of investing in Hong Kong securities. The headquarters in Japan considered that this could be a good opportunity to establish a Hong Kong-based securities brokerage and offer margin financing. Natalia, the regional chief operating officer, knew that it was the International Financial Reporting Standard 9 Financial Instruments (IFRS 9) that stipulated the accounting treatment for financial assets. She thought this standard could be the starting point in helping Suginami Bank evaluate the financial statement impact and, hence, the plan to enter the brokerage business and offer margin financing. She instructed Nancy to research the relevant matters. As a starting point, Nancy decided to find one broker offering margin financing. She preferred this broker to be relatively sizable and well-established. She came across Haitong InternationalEXHIBIT 4: COMPARISON OF METHOD AND BASIS OF IMPAIRMENT RECOGNITION BETWEEN IFRS 9 AND IAS 3948 IFRS 9 IAS 39 Types of financial Amortized cost, FVTPL, and Amortized cost FVOCI assets FVTOCI Either by impairment Decline in fair value Recognition Impairment allowance, or direct recognized in OCI method allowance reduction of the being transferred to asset's carrying profit and loss value Recognition basis ECL Objective evidence Objective evidence of impairment of impairment Difference between Difference between asset's carrying acquisition cost (net See Exhibit 5 for amount and the of any principal present value of repayment and Measurement basis the general approach estimated future to measurement of amortization) and ECL cash flows current fair value, discounted at the less any previously asset's original recognized effective interest rate impairments EXHIBIT 5: THREE-STAGE GENERAL APPROACH TO MEASUREMENT OF ECL THROUGHOUT THE LIFE OF THE ASSET AFTER INITIAL RECOGNITION" Accounting Treatment: Impairment Allowance to Accounting Management's Assessment Be Recognized in the Treatment: Interest Statement of Financial Income After the Position Assessment No SICR since initial Stage 1 Calculated on gross recognition 12-month ECL only carrying amount of the asset SICR since initial recognition, Stage 2 Calculated on gross i.e. the asset was "not credit- Lifetime ECL carrying amount of the impaired' asset Objective evidence of Calculated on the net impairment, i.e., the asset was Stage 3 carrying amount of the "credit-impaired" Lifetime ECL assetEXHIBIT 6: CREDIT RISK GRADING FRAMEWORK COMPRISING INTERNAL CREDIT RATINGS AND CORRESPONDING ECL STAGES OF MARGIN LOAN50,51 Gross Gross margin loan Internal margin loan as of as of 31 credit Description ECL stage 31 December rating December 2018 2019 HKD'000 HKD'000 Low risk The counterparty had a low risk of default and Stage 1 8,333,263 10,962,390 did not have any past-due amounts 12-month ECL Watch list Stage 1 The counterparty had no shortfall 12-month ECL 2,958,832 3,210,147 Stage 2 Lifetime ECL - Doubtful The counterparty had shortfall outstanding for 352,152 969,944 between 1 and 30 days not credit- impaired Stage 3 Loss The counterparty had shortfall outstanding for Lifetime ECL - 1,860,654 1,425,341 over 30 days credit-impaired Total: 13,504,901 16,567,822 There was evidence indicating that the debtor Write-off Amount was to was in severe financial difficulty and the N/A N/A be written off Group had no realistic prospect of recoveryEXHIBIT 7: DETAILED AUDIT PROCEDURES PERFORMED BY DELOITI'E IN RESPONSE TO THE KEY AUDIT MATTER ON MARGIN LOAN IMPAIRMENT'\" Applicable to the 3 ECL Stages Understanding the Group's established credit risk policies and procedures for impairment assessment in relation to the application of ECL model under HKFRS 9, including model set-up and approval and selection and application of assumptions and key inputs into the model. Understanding the Group's key controls over ongoing monitoring processes, including the margin call procedures for margin shortfall and actions taken by management for advances to customers in margin nancing and the periodic reviews for identication of any potential delinquency in principal or interest repayment for the margin loans. Assessing the reasonableness and appropriateness of the management's judgment on staging criteria for determining if SICR had occurred (stage 1 or 2) or the nancial asset was credit-impaired (stage 3) and the basis for classication of exposures into the 3 stages as required by I-IKFRS 9 and examining supporting information on a sample basis to assess the appropriateness of the classication of loan exposures as at the end of the reporting period. Evaluating, together with Deloitte's internal valuation specialists, the reasonableness and appropriateness of the ECL models and assumptions, information and parameters used in the model in establishing the forward-looking factors, and the relationship between the forward-looking factors and the key inputs, including PD and LGD, in the ECL model to determine the impairment charges of margin loans in stage 1 or 2. Testing the accuracy and completeness of key data sources applied in the ECL computation on a sample basis by checking to the Group's supporting information, the relevant loan les, and external data sources, where applicable. Applicable to Stage 3 ECL Only Corroborating and challenging management's assessment and expectation of reasonably possible outcomes on the recoverability of the loan to the borrower and the estimated fair value and future cash ows from the pledged security against Deloitte's understanding of the situation and the industry of the pledged security from reading public announcements and other externally available information. Discussing with the management the valuation of the pledged security and together with Deloitte's own internal valuation specialists: (i) assessing whether the selection of the valuation methodology was appropriate for the collateral; (ii) assessing the reasonableness of the assumptions and judgments used by management in determining the status and progress of the restructuring against public information and other available information from relevant external parties; and (iii) evaluating the appropriateness of key inputs used in the valuation of the pledged security by independently checking to the external data. For the remaining margin loans classied as stage 3, Deloitte examined management's underlying documentation supporting the value of the collateral, if any, and management' s key estimations used in the individual impairment assessment on a sample basis. Deloitte also examined the estimated future cash ows and the fair value of collateral for all impaired amounts. Securities Group Limited (Haitong, the Group, or SEHK : 665). Haitong was the securities brokerage arm* and subsidiary of the financial group Haitong Securities Co., Ltd. (SEHK: 6837), which was the third largest conglomerates of its kind listed on the bourse [see Exhibit 1 for the five largest financial groups with similar business models and services listed on the SEHK in terms of market capitalization]. Nancy believed the Group could serve as a good reference for her to present her findings and viewpoints to Natalia. At the preliminary stage of research, Nancy had a number of questions in mind. In the first place, what were the common financial statement items that might arise from the margin financing business? What were the underlying rules governing the classification and measurement of the items under IFRS 9? IFRS 9 In wake of the global financial tsunami in 2008, the International Accounting Standards Board (IASB) commenced the development of IFRS 9. The then-existing International Accounting Standard 39 (IAS 39) Financial Instruments: Recognition and Measurement had been criticized for being too complex and nonreflective of the underlying credit risks of financial assets held by entities. Credit losses, if occurred, were not recognized in a timely way in the financial statements of the entities. There had been rounds of discussions during the development stage [see Exhibit 2 for the milestones in the standard development of IFRS 9]. Eventually, the standard was promulgated in July 2014 and became internationally" mandatory for the financial years commencing on or after 1 January 2018. From then on, IAS 39 was replaced by IFRS 9.10 Classification Under the previous IAS 39, financial assets were classified into one of four categories, namely, loans and receivables, fair value through profit or loss (FVTPL), available for sale, and held to maturity. Both loans and receivables and held-to-maturity financial assets were measured on an amortized cost" basis, whereas available-for-sale assets were measured at fair value through other comprehensive income" (FVTOCI). The changes in fair value of FVTPL 's financial assets would be measured and recognized in the manner self-explained by its name, i.e., being through profit or loss.Under the current IFRS 9, nancial assets were classied in three categories: amortized cost, FV'I'PL, and FVTOCI. Unlike the prior standard, the current standard stipulated the total convergence of classication of the financial assets and the corresponding measurement model [see Exhibit 3 for the comparison of classication and measurement model between IFRS 9 and [AS 39]. In addition, IFRS 9 established awhole new set of criteria in classifying a nancial asset into any of the three categories primarily based on \"business model test\"" and \"the cash flow test. ""15 Subsequent Measurement: Credlt Losses One of the breakthroughs laid down by IFRS 9 was the measurement and recognition of credit impairment losses in relation to nancial assets. There were three reasons why practitioners criticized the complexity of the impairment approach of [AS 39. First, the impairment recognition was based on whether there was any \"objective evidence of impairment.\" An impairment test was required to assess whether certain \"credit events\" had occurred that adversely affected the collectability of future cash ows from the nancial assets. If no credit event occurred, no impairment was to be recognized. Second, FVTPL assets were not subject to an impairment test. Only assets measured at amortized cost and FVTOCI were subject to impairment Third, the treatments of impairment of assets measured at amortized cost and FVTOCI were different. \" Therefore, the standard was criticized as being hard to understand, apply, and interpret.'8 Under the impairment approach in HKFRS 9, it was no longer necessary for a \"credit even \" to have occurred before impairment recognition. Instead, an entity should always account for impairment of nancial assets under the \"expected credit loss" (ECL) model. The recognized ECL was the impairment allowance that should be updated from time to time to reflect the credit risk changes since initial recognition. In this way, the nancial statement disclosures of ECL provided more meaningful information about the credit quality of the assets. This was also a single, uniform approach to the impairment of nancial assets, regardless of which of the three categories they fell into. Complexity was reduced.[9 The ECL Model Every financial asset carried a certain risk of default\" ever since its origination or acquisition, so each of the assets had an expected loss attached to it. Hence, the ECL model should be applied whenever nancial staternems were being prepared. The calculated ECL would be the impairment allowance that should be netted off against the gross value of the asset. The resulting netted figure would be the carrying value of the asset [see Exhibit 4 for the comparison of method and basis of impairment recognition between IFRS 9 and [AS 39].21 The ECL model required an entity to calculate the allowance for credit losses by considering the loss given default (LGD) and exposure at default" (EAD) and multiplying this function by the probability of default" (PD). The allowance should be the discounted ? sum of these probability-weighted outcomes. Another perspective of interpreting the ECL amount was that it represented the difference between, in present value terms, the contractual cash flows receivable and the anticipated cash flows receivable. 25 Under the general approach" of measuring ECL, upon acquiring or originating the financial asset, a 12-month ECL should be recognized at once. Throughout the period of holding the asset, ECL should be measured by whether a "significant increase in credit risk" (SICR) had occurred to the asset [see Exhibit 5 for the three-stage general approach to measurement of ECL throughout the life of the asset after initial recognition].27 Margin Financing Business Model A margin loan was a facility enabling investors to borrow money to purchase securities. The main benefit was the increased purchasing power, as the loan was essentially a credit facility Without holding cash sufficient to buy all securities as desired, the margin client could simply utilize the facility. The size of the facility depended on the client's financial situation and total securities value in the account. Also, the securities held in the account were in essence the collateral pledged with the securities margin financing provider. Borrowing costs were charged on the utilized facility. If a client anticipated their return on securities would be greater than the borrowing cost, it might utilize the margin facility. As for the provider of margin financing, the source of revenue would be the interest charged on the utilized facility.28 Credit Risk Management29 In order to manage the credit risk of margin loan assets, Haitong had the Credit Approval Committee" approve credit facility limit? of each margin client. Such facility limits available to clients were determined by the discounted market value of the collateral securities accepted by the Group, as well as the clients' own financial strength, creditworthiness, and the past credit history. Haitong maintained a list of approved stocks for margin lending at a specified loan-to-collateral ratio. This stock list would be updated and approved quarterly and/or when deemed necessary by the Group's Risk Management Department and relevant business units and support functions.The Credit Approval Committee was responsible for setting the margin ratios applicable to each of these stocks, i.e., specied loan-to-collateral ratios. Moreover, the Credit Approval Committee of Haitong monitored the proportion of each of the above stocks in the margin accounts on an ongoing basis in order to avoid over-concentration of risk presented by any single stock. The committee also monitored and controlled for the loan exposure to a single margin client or a group of connected margin clients. Other measures to monitor the overall credit risk of margin clients included overseeing the nancial position of clients, where appropriate. Internal reports were also prepared on a daily basis to ensure sufcient collateral was pledged by margin clients and that a certain loan-to- collateral value (loan-to-value ratio or lending ratio, etc.) could be maintained. Margin accounts exceeding certain thresholds were subject to margin calls that propelled the client to take action The client either had to inject cash or other acceptable collateral to the account or sell part of the existing collateral stock(s) for cash within the account. Failure to meet margin calls could result in forced liquidation executed by the Group on part or all collateral positions of the margin account. Other than that, the Group enforced a framework that categorized margin loan assets into one of the ve internal credit ratings from \"low risk\" to 'vrite-off.\" Such a framework allowed the Group to systematically assign appropriating ECL stages (stages one to three) to each margin client [see Exhibit 6 for the credit risk grading framework that comprised internal credit ratings and corresponding ECL stages of margin loan]. Kay Audlt |'1.llatters=2 Key audit matters\" were the most signicant matters in the audit of nancial statements in accordance with auditors' professional judgment. The auditors were to address these matters in their audit work and in forming their audit opinion. For the years ended 31 December 2018 (FY2018) and 31 December 2019 (FY 2019'), Deloitte identied the application of the ECL model upon adoption of HKFRS 9 on \"advances to customers in margin nancing\" as a key audit matter. The auditors' rationale for including the ECL assessment of such margin loan receivables was threefold. First, the management's determination of the ECL amount involved a signicant level of judgment in selecting an appropriate model and key inputs\" to the selected model. Second, the managementhad to exercise a signicant level of judgment in selecting reasonable forward-looking information35 that would he applied to the model. Third, in classifying the ECL stage of the asset, the management had to assess whether there had been a SICR since initial recognition of a nancial asset [see Exhibit 5 for the three-stage general approach to ECL assessment]. In identifying any SICR, judgment was also needed in analyzing qualitative and quantitative forward-looking information. In this key audit matter, Deloitte specically outlined the judgmental areas specic to the assessment of stage-three ECL incurred on certain margin loans. For these margin loans, the management had to determine the fair value of the collateral securities pledged by the relevant margin clients. In performing a valuation of the collateral, Haitong had to incorporate certain estimates as well as assumptions on the status of the default margin clients. For instance, the management had to make estimates of valuation with regard to the stocks "suspended for trading" and/or stocks of listed companies undergoing a "debt restructuring process." In response to this audit matter, Deloitte had performed a number of audit procedures to ensure the ECL assessment was free of material misstatements. Examples of audit procedures included assessing Haitong's margin call procedures, ECL staging criteria, model assumptions, and inputs, etc. [see Exhibit 7 for the detailed audit procedures performed by Deloitte in response to this key audit matter on margin loan impairment]. Financials 36-37 The date of the initial application of HKFRS 9 for Haitong was 1 January 2018." As of that date, the opening impairment allowance's for its margin loan assets* was to be reassessed under HKFRS 9." Under HKAS 39, the impairment allowance made was HKD239.2mn as of 31 December 2017. Under HKFRS 9, the allowance was reassessed and became HKD269.1mn, meaning an additional impairment of HKD29.9mn or 12.5% was made. Such an additional allowance was attributable to the stage-one and stage-two ECL, amounting to HKD24.9mn and HKD4.9mn, respectively. The whole impairment allowance of HKD239.2mn under HKAS 39 as of 31 December 2017 was attributable to stage-three ECL only [see Table 1 for the immediate effect of implementation of HKFRS 9 on the impairment allowance as of 31 January 2017 (opening balance of 1 January 2018)]. Table 1: Immediate effect of implementation of HKFRS 9 on impairment allowance as of 1 January 2018 HKFRS 9 HKAS 39 HKD'000 HKD'000 Impairment allowance 269,057 239,204 Stage 1 - 12m ECL 24,922 N/A Stage 2 - Lifetime ECL (non-credit impaired) 4,931 N/A Stage 3 - Lifetime ECL (credit impaired) 239,204 N/A Income and Expenses During FY2018 and FY2019, Haitong accrued interest income from margin financing of HKD1, 100mn and HKD1,176.3mn, respectively. The "impairment charges, net of reversal" (net impairment charges) of margin client receivables were HKD353.7mn and HKD532.3mn, respectively. The net impairment charges incurred on margin loans constituted 32.2% and 45.3% of the corresponding interest income generated from the loans in the respective years [see Table 2 for the summary of interest income and net impairment charges for margin financing in FY2019 and FY2018].Table 2: Interest income and net impairment charges on margin loans in FY2019 and FY2018 FY2019 FY2018 HKD'000 HKD'000 Interest income 1,176,251 1,099,998 Impairment charges, net of reversal 532,277 353,714 Net income from margin financing 643,974 746,284 Margin Loans and Impairment Allowances As of 31 December 2018 and 2019, gross margin loans of HKD15,952mn and HKD12,630mn were secured by securities pledged by the customers with undiscounted market value of HKD71,407mn and HKD51,549mn, respectively. The loan amount made up 22.3% and 24.5% in each of the respective years [see Table 3 for the breakdown of the gross and net margin loan, as well as the impairment allowance balance, as of 31 December 2019 and 2018]. Table 3: Breakdown of margin loan and impairment allowance as of 31 December 2019 and 2018 2019 2018 HKD'000 HKD'000 Gross margin loan 13,504,901 16,567,822 Stage 1 - 12m ECL 11,292,095 14,172,537 Stage 2 - Lifetime ECL (non-credit impaired) 352,152 969,944 Stage 3 - Lifetime ECL (credit impaired) 1,860,654 1,425,341 Impairment allowance 875,054 615,362 Stage 1 - 12m ECL 30,541 28,649 Stage 2 - Lifetime ECL (non-credit impaired) 33,991 31,475 Stage 3 - Lifetime ECL (credit impaired) 810,522 555,238 Net margin loan42 12,629,847 15,952,460 Stage 1 - 12m ECL 11,261,554 14,143,888 Stage 2 - Lifetime ECL (non-credit impaired) 318,161 938,469 Stage 3 - Lifetime ECL (credit impaired) 1,050, 132 870,103 From Table 3, impairment allowance of margin loans increased by HKD259.7mn or 42.2%. Stage-three ECL contributed the most to the aforesaid increase [see Table 4 for the movement in impairment allowance of margin loans broken into three stages from 1 January 2018 to 31 December 2019]. According to the management, the stage-three ECL resulted from comparing the fair value of securities pledged as collateral against the margin loan. The allowance amount also took into account the settlement plan and restructuring arrangement of the clients of the loans concerned, as well as any loan settlement subsequent to the respective year-end dates.Table 4: Movement in impairment allowance of margin loans broken down into 3 stages from 1 January 2018 to 31 December 2019 Stage 1 Stage 2 Stage 3 Total HKD'000 HKD'000 HKD'000 HKD'000 1 January 2018 24,922 4,931 239,204 269,057 Net remeasurement of ECL without stage transfer 5,608 1,224 59,288 66,120 Repayments (1,606) (19) (8,374) (9,999) Transfer from/to 12-month ECL to/from lifetime ECL 3,235 (3,924) 689 Net remeasurement of ECL arising from stage transfer (5,938) 29,104 271,734 294,900 New lending: initial recognition 2,693 2,693 New lending: transfer from/to 12-month ECL to/from (265) 159 106 lifetime ECL Disposal to third party at carrying value (7,409) (7,409) 31 December 2018 28,649 31,475 555,238 615,362 Net remeasurement of ECL without stage transfer 814 7,866 300,639 309,319 Repayments (423) (619) (22,179) (23,221) Transfer from/to 12-month ECL to/from lifetime ECL (202) 25,521) 25,723 Net remeasurement of ECL arising from stage transfer (1,277) 20,790 223,686 243,199 New lending: initial recognition 2,980 2,980 Written off (272,585) (272,585) 31 December 2019 30,541 33,991 810,522 875,054 Looking Forward Nancy had obtained a basic understanding of different financial statement items that would arise from margin financial activities, as well as their corresponding accounting treatment under IFRS 9. In preparing for the presentation to Natalia, Nancy was brainstorming what questions Natalia might ask. First, Nancy was not aware of the accounting classification of margin loans after going through all the financial statements of Haitong. What should be the appropriate classification of margin loans under IFRS 9? What would be the extent of applicability of these three classifications with regard to margin loan receivables? In Haitong's case, was it possible to segregate the financial statement effect of IFRS 9 implementation on margin financing-related items? Nancy knew that Suginami Bank had deep roots in the culture of aggressive accounting." In light of this, Nancy might be asked to assess and explain whether there was room and, if so, how substantial that room was for accounting manipulation in classification and ECL assessment of margin loan assets. Aside from the internal controls for credit risk management used by Haitong, were there other financial metrics or analytical tools that Suginami Bank could use in order to better manage the credit risk presented by margin loan assets? Overall, based on the benefits and costs upon adoption of IFRS 9, was the accounting framework favorable to the financial performance of a securities margin financing business or otherwise?EXHIBIT 1: FIVE LARGEST FINANCIAL GROUPS WITH A SIMILAR BUSINESS MODEL AND SERVICES AS HAITONG LISTED ON THE SEHK IN TERMS OF MARKET CAPITALIZATION44 Market Listed Company Capitalization45 HKD'bn CITIC Securities Company Limited (SEHK: 6030) 39.60 China International Capital Corporation Limited (SEHK: 3908) 38.26 Haitong Securities Co., Ltd. (SEHK: 6837) 23.46 Huatai Securities Co., Ltd. (SEHK: 6886) 20.70 GF Securities Co., Ltd. (SEHK: 1776) 18.79 EXHIBIT 2: IMPORTANT MILESTONES IN DEVELOPMENT OF IFRS 946 Date Development of IFRS 9 14 July 2009 Exposure Draft ED/2009/7 Financial Instruments: Classification and Measurement published 11 May 2010 Exposure Draft ED/2010/4 Fair Value Option for Financial Liabilities published Exposure Draft ED/2012/4 Classification and Measurement: Limited 28 November 2012 Amendments to IFRS 9 (proposed amendments to IFRS 9 (2010)) published 24 July 2014 IFRS 9 Financial Instruments issued 1 January 2018 Applicable to reporting periods beginning on this day onward EXHIBIT 3: COMPARISON OF CLASSIFICATION AND MEASUREMENT MODEL BETWEEN IFRS 9 AND IAS 3947 IFRS 9 IAS 39 Classifications and Classifications measurement models Measurement model Types of Amortized cost Loans and receivables Amortized cost Financial FVTPL FVTPL FVTPL FVTOCI Assets Available for sale FVOCI Held to maturity Amortized cost