Answered step by step

Verified Expert Solution

Question

1 Approved Answer

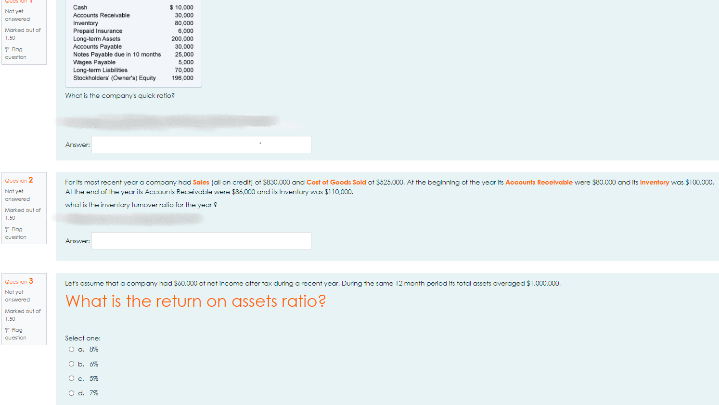

what the correct answer? question 1 ? question 2 ? question 3 ? C Marked out $19.000 A Receivable 30.000 wy 2009 Papadimance 0.000 Long-term

what the correct answer? question 1 ? question 2 ? question 3 ?

C Marked out $19.000 A Receivable 30.000 wy 2009 Papadimance 0.000 Long-term ases 200,000 Kocounts Payable 30.000 Notes Payable due in 10 months 25.000 5.000 Long-term Labs Stockholes (Ower's Equity 190.000 What is the company's Quick rotor Com 70.000 For its most recent year o comoonry hod Sales loll on credit of SUSC.00 on Cost of Goods Sold of Ss25.000. At the beginning of the vocrite Accounts Receivable were 300.000 and its inventory wo: $100.000, Al di Sanribs PH. W $25,000 condilomiy $10,000. walic Itiky Hras Party Marked out of Lot's come thot a company od 800.000 ot net ircome cherox during a recent year. During the come 12 month period its rotalouets overogod $1.000.000 Mulyat What is the return on assets ratio? Select one O c. C Marked out $19.000 A Receivable 30.000 wy 2009 Papadimance 0.000 Long-term ases 200,000 Kocounts Payable 30.000 Notes Payable due in 10 months 25.000 5.000 Long-term Labs Stockholes (Ower's Equity 190.000 What is the company's Quick rotor Com 70.000 For its most recent year o comoonry hod Sales loll on credit of SUSC.00 on Cost of Goods Sold of Ss25.000. At the beginning of the vocrite Accounts Receivable were 300.000 and its inventory wo: $100.000, Al di Sanribs PH. W $25,000 condilomiy $10,000. walic Itiky Hras Party Marked out of Lot's come thot a company od 800.000 ot net ircome cherox during a recent year. During the come 12 month period its rotalouets overogod $1.000.000 Mulyat What is the return on assets ratio? Select one O c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started