what threats do you see for saldo? just a paragraph

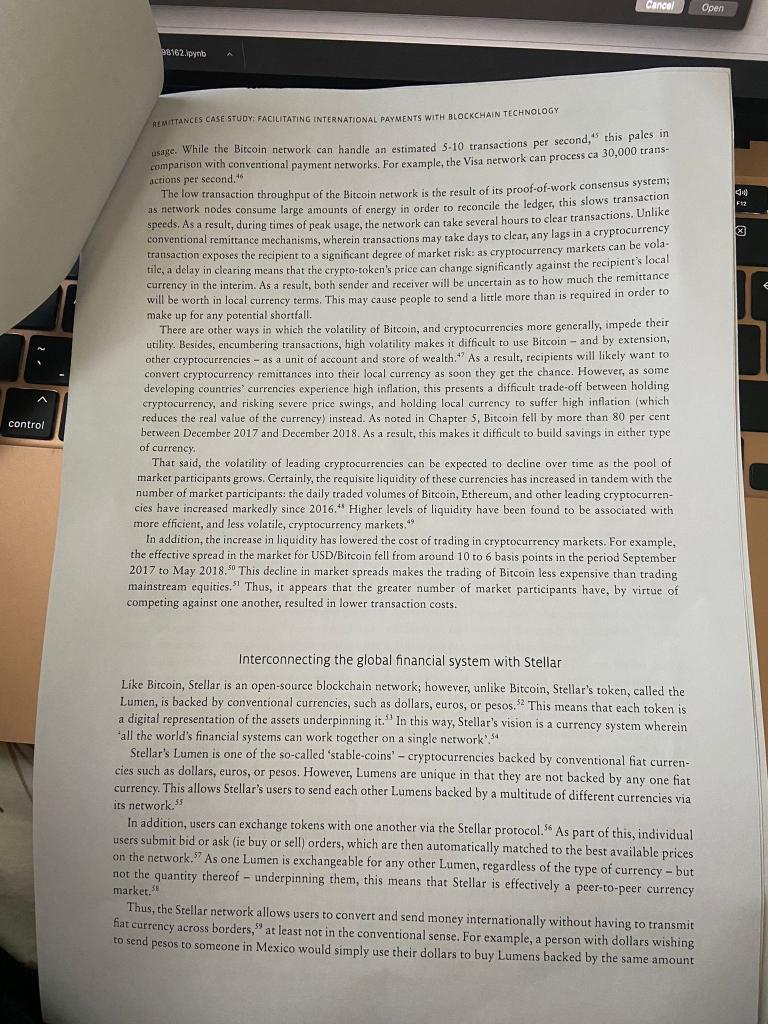

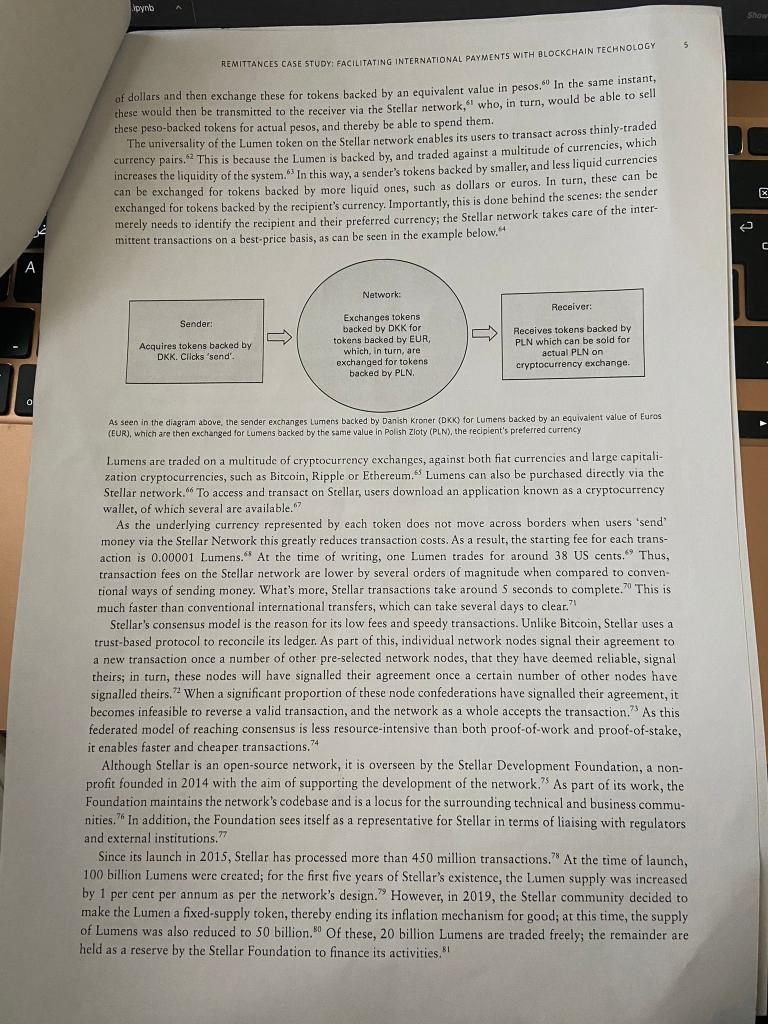

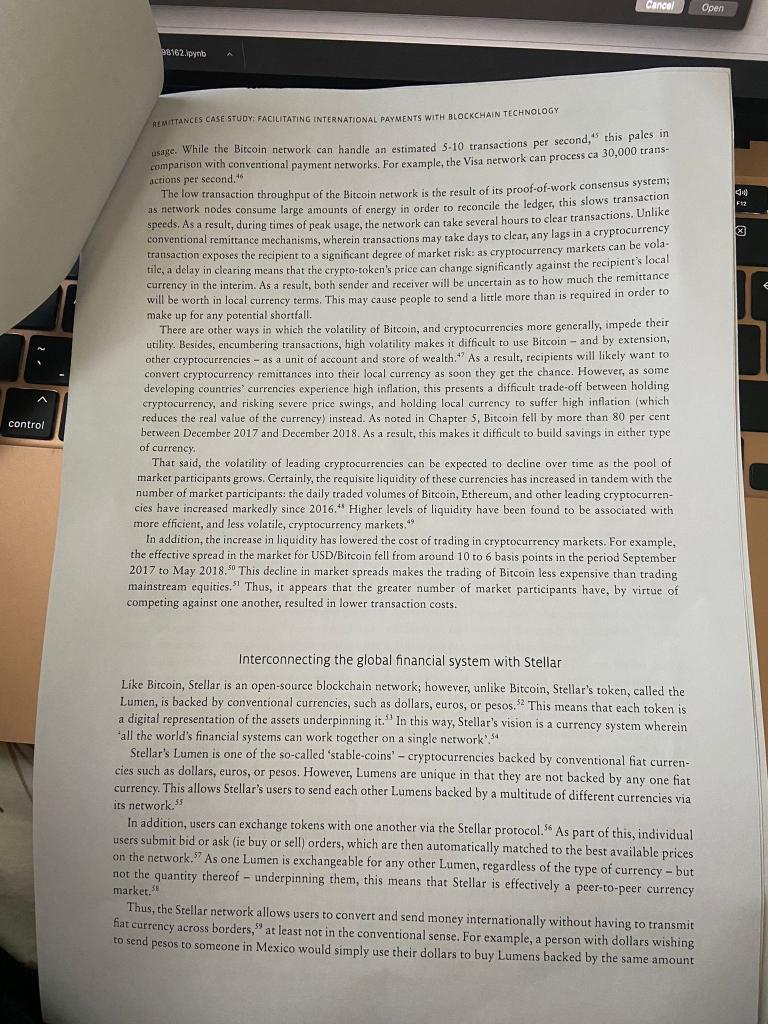

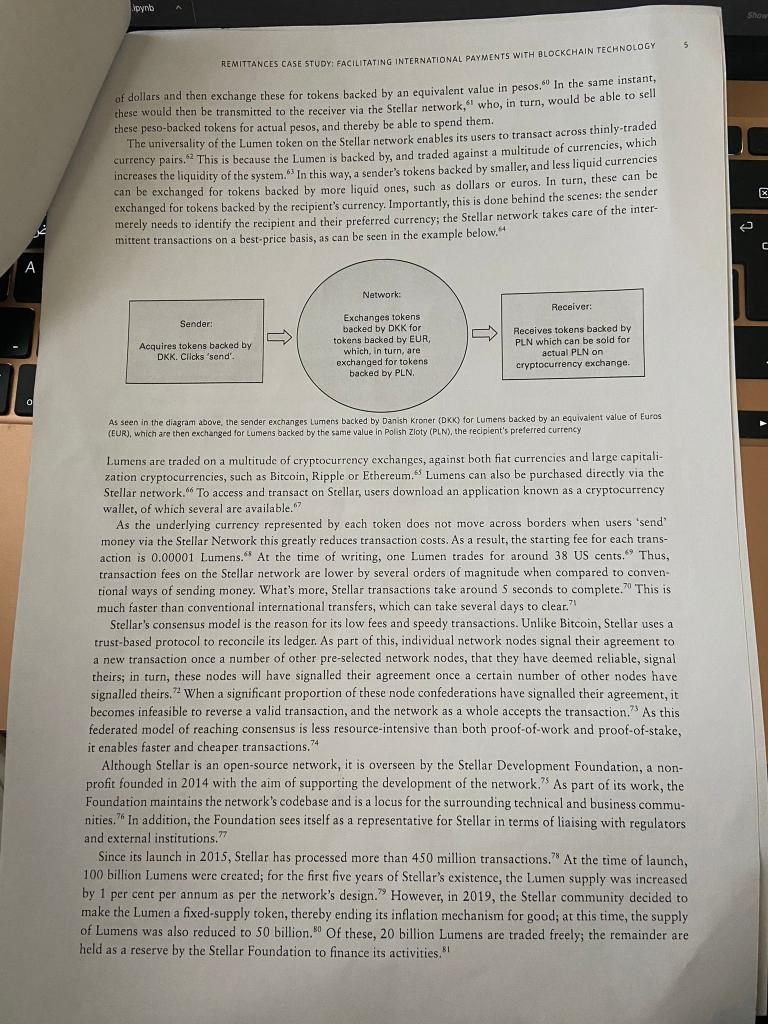

Remittances Case Study Facilitating international payments with blockchain technology LEARNING OBJECTIVES This case study will help you understand: The role of international remittances in developing economies; The challenges faced by migrants sending money back home: How various blockchain solutions can help alleviate these problems. BACKGROUND READING This case study makes reference to material covered in Chapters 1, 2, 3 and 5 of Financial Technology. Introduction In Chapter 1, we saw how Vodafone uses its mobile network and its commercial relationships with a multitude of small merchants to supplement an underdeveloped financial system as part of its M-pesa solution. This has allowed urban dwellers in several African nations to send funds to their friends and family in rural areas. The benefits of this are far reaching: for example, it is estimated that M-pesa has helped lift 2 per cent of Kenyan households out of poverty. While M-pesa succeeded in lowering the cost of sending money within countries, high remittance costs persist for migrant workers who send money across borders. Just as Vodafone leveraged existing networks to make up for lacking financial infrastructure, fintechs use internet-based technologies to lower remittance costs. This case study examines the use of one such technology, blockchain, and its role in facilitating international remittances. Underdeveloped financial systems and financial exclusion In many developing countries there is a tendency for financial institutions to cater to affluent urban dwellers, and in doing so, they overlook rural and lower income populations. This is unlikely to be the result of malice; rather, affluent urban populations are seen as more profitable by the financial sector. With growing middle classes concentrated in urban areas across the developing world, there is little incentive to venture into the hinterlands Meanwhile, underdeveloped and inefficient financial systems put upward pressure on transaction costs in developing economies. Although larger transactions tend to attract lower fees, these can be proportionally higher in developing countries than for similar transactions in developed countries. As a result, financial insti- tutions favour wealthier clients in order to make up for higher costs with an increase in scale. Although some countries have made progress in updating their financial systems, and thereby succeeded in lowering transaction costs, there are others in which progress has been lacking. In these countries, existing financial infrastructure caters mainly to the upper and middle classes, leaving small businesses and large swathes of the general population without adequate access to financial services. In this way, many people in lower income and rural populations find themselves financially excluded, which can be an impediment to economic development in emerging economies. However, it can also represent an opportunity: with an estimated REMITTANCES CASE STUDY: FACILITATING INTERNATIONAL PAYMENTS WITH BLOCKCHAIN TECHNOLOGY billion people who are unbanked', there is a gap in the global financial services market for intrepid fintechs to exploit. Just as underdeveloped financial systems exert costs on transactions within countries, they also hinder inter- national remittances. According to a 2019 estimate, there are 272 million international migrants. Many of these people send money to friends and family back home. The average cost of such remittances in 2020 is an estimated 6.7 per cent of the transaction value. In this way, high transaction costs prevent remittance flows from reaching those that need them the most. However, the digitization of the financial system may help alleviate this situation by lowering transaction costs. Indeed, it appears that it already has: in 2009, the average remittance cost was 9.7 per cent"; thus, the decline to 6.7 per cent in the space of 11 years can be seen as evidence that the international financial system is becoming more efficient at facilitating remittance flows. Given the prevailing socio-technological trends outlined in Financial Technology, it is likely that some of this efficiency will have been driven by technological change. Indeed, such change may facilitate greater financial inclusion. For example, the proportion of people over the age 15 with a financial institution account in Mexico is around 35 per cent;"? meanwhile 70 per cent of the population in Mexico have access to the internet. As a result, there is space for fintechs to enter the financial services market by leveraging the digital connectedness of the Mexican population. A The role of international remittances International remittances play an important role in economic development by funding education, healthcare, and entrepreneurship. Indeed, there is evidence to suggest that remittances contribute to economic growth in developing nations via their positive impact on consumption, savings and investment." In terms of volume, remittances are greater than other transfers between developed and developing nations: they are about double the size of foreign aid flows into developing countries. Moreover, in 2019 remittance flows exceeded foreign direct investment into low- and middle-income countries for the first time.! Over time, remittances appear to increase the flow of money in circulation to a greater degree than bank loans and other financial products do; indeed, remittances may help households build a basis for acquiring financial products. For example, a family could use remittances to save for a down payment on a home loan. In addition, it has been observed that remittances increase the demand for banking services, as recipients need somewhere safe to store their money. In this way, households that receive foreign remittances are more likely to use financial services, because they are incentivized to do so. This induced financial literacy'effect is instru- mental in increasing financial sector development in emerging economies.20 However, in some lower income countries, the effect of remittances on financial sector development is less clear as recipients in these countries may opt to spend their remittances on consumption, as opposed to saving.21 According to the IMF, a significant proportion of remittances are spent on consumption, and thus not saved or invested. Moreover, when remittances are saved or invested, they tend to be put in assets such as land, hous- ing and jewellery, which are less productive to the overall economy.?? Tangible assets such as jewellery are a popular store of value in developing economies in the face of economic uncertainty. This is unsurprising, given that poorer countries tend to have weaker financial institutions.24 Thus, tangible assets are attractive in such countries because their underdeveloped financial systems cause people not to have faith in financial institutions. In this way, the key to making remittances more effective in promoting development may lie in building more robust financial institutions. Unfortunately, remittances can also have deleterious effects on emerging economies. As they are used to supplement household incomes, remittances may increase the lowest wage at which people are willing to work.25 This can lead to wage inflation and a reduction in the competitiveness of recipient countries' exports. In addition, remittances incentivize skilled workers to migrate which can create labour shortages in developing economies. As a result, there is a risk that developing countries get trapped in a cycle of depend ency on emigration-driven remittance flows, wherein remittances incentivize 'brain drain' thereby impeding economic development, which, in turn, incentivizes further emigration. As remittance flows help households absorb economic shocks, they can provide economic stimulus in developing countries during times of crisis. This effect can be magnified by the tendency of emerging market 3 REMITTANCES CASE STUDY: FACILITATING INTERNATIONAL PAYMENTS WITH BLOCKCHAIN TECHNOLOGY 3 currencies to depreciate in response to economic shocks. For example, in 2013 when the Federal Reserve broached a reduction in its economic stimulus programme, financial markets sold off; as part of this so-called "taper tantrum', emerging market currencies depreciated rapidly. In this way, hard currency remittances can quickly become worth more on the ground during times of economic uncertainty, and thereby provide recipi- with greater Th On On one ha fater degree of support. That said, dependency on remittance flows can be a double-edged sword. od one hand remittances provide much-needed support; on the other, they can be volatile, and are prone to flows to ho during crises, just as recipients need them the most. For example, it is estimated that remittance " to low- and middle-income countries fell by 20 per cent in 2020 as a result of the global pandemic." By comparison, in 2009 remittances to low- and middle-income countries fell by 5 per cent in the aftermath of the global financial crisis. As these flows account for an estimated 8.9 per cent of low-income countries' GDPs," it is not hard to see how the dependency on remittances may exacerbate the effects of global economic down- turns in developing countries. Despite reductions in overall remittance flows during times of global economic contraction, the migrants that do keep up their remittances tend to increase the amounts they send back home. For these people, every penny counts. In the words of one Filipino woman living in Taiwan featured in the Asian and Pacific Migration Journal: 'You work abroad for the children left behind, for them to have a better future. Also, you would always consider, I have a family to return to, hence, I should save my money... You will not think about non-essentials. You will not buy things that are not necessary. Whenever you see beautiful things, you will think, oh this is for my child. I buy for my child, for my husband. You will really see to it that your expense will go towards something, you will not just spend it on things that will not count for something." However, as aforementioned, sending money internationally is not cheap. In this regard, one of the biggest impediments to remittances is the lack of transparency in the market, which hinders more competitive pricing as senders are unable to effectively compare prices." In spite of this, developments in web and mobile technol- ogy have facilitated remittance processes to reduce transaction times and costs over the last few decades prior to 2020. As a result, the average cost of sending an international remittance has come down significantly: between 2009 and 2020, this fell by fell by ca 30 per cent.'' The pros and cons of using cryptocurrencies for remittances At first glance, Bitcoin, and cryptocurrencies more generally, appear to remedy the lack of transparency and high transaction costs associated with sending international remittances. Certainly, the openness of blockchain systems addresses the lack of transparency so pervasive in existing remittance processes. In this way, senders can ascertain exactly how much each transaction will cost them, and the recipients of their money. Indeed, it was suggested as early as 2013 - recall that Bitcoin was only launched in 2009 - that Bitcoin was one of the most efficient ways, cost-wise, of transferring money across borders." For most of Bitcoin's history, this has been the case, with transaction fees tending to oscillate between ca 20 cents and a few dollars, albeit with significant spikes along the way, which were driven by price bubbles, most notably in late 2017 and the spring of 2021. Outside periods of speculative run-ups, however, the cost of sending $ 100 using Bitcoin would have been less than the cost of using conventional remittance channels (6.7 per cent as of 2020).^2 Thus, Bitcoin gives senders a low-cost benchmark against which to compare the cost of sending remittances via different channels; in theory, this should help push down prices. In addition to being demonstrably cheaper than conventional remittance channels, crypto currencies like Bitcoin are accessible to anyone with an internet connection. Internet penetration rates are rising throughout the developing world: for example, the proportion of adults who report using the internet or owning a smart- one rose from 34 to 40 per cent in the Philippines between 2013 and 2015. Over the same period, this figure increased from 16 to 22 per cent in India, 33 to 39 per cent in Nigeria, and 41 to 72 per cent in Turkey. With more people online, cryptocurrencies have the potential to increase the flow of money to people in areas that lack conventional financial infrastructure, and thereby lower the cost of sending remittances. However, the rising uptake of some cryptocurrencies may impede their utility. For example, as the Bitcoin network has grown, it has struggled to scale, and transaction speeds have ground to a halt at times of peak Cancel Open 98162.pyno 40 F12 REMITTANCES CASE STUDY: FACILITATING INTERNATIONAL PAYMENTS WITH BLOCKCHAIN TECHNOLOGY usage. While the Bitcoin network can handle an estimated 5-10 transactions per second, this pales in comparison with conventional payment networks. For example, the Visa network can process ca 30,000 trans- actions per second. The low transaction throughput of the Bitcoin network is the result of its proof-of-work consensus system; as network nodes consume large amounts of energy in order to reconcile the ledger, this slows transaction speeds. As a result, during times f peak usage, the network can take several hours to clear transactions. Unlike conventional remittance mechanisms, wherein transactions may take days to clear, any lags in a cryptocurrency transaction exposes the recipient to a significant degree of market risk: as cryptocurrency markets can be vola- tile, a delay in clearing means that the crypto-token's price can change significantly against the recipient's local currency in the interim. As a result, both sender and receiver will be uncertain as to how much the remittance will be worth in local currency terms. This may cause people to send a little more than is required in order to make up for any potential shortfall. There are other ways in which the volatility of Bitcoin, and cryptocurrencies more generally, impede their utility. Besides, encumbering transactions, high volatility makes it difficult to use Bitcoin - and by extension, other cryptocurrencies as a unit of account and store of wealth." As a result, recipients will likely want to convert cryptocurrency remittances into their local currency as soon they get the chance. However, as some developing countries' currencies experience high inflation, this presents a difficult trade-off between holding cryptocurrency, and risking severe price swings, and holding local currency to suffer high inflation (which reduces the real value of the currency) instead. As noted in Chapter 5, Bitcoin fell by more than 80 per cent between December 2017 and December 2018. As a result, this makes it difficult to build savings in either type of currency. That said, the volatility of leading cryptocurrencies can be expected to decline over time as the pool market participants grows. Certainly, the requisite liquidity of these currencies has increased in tandem with the number of market participants: the daily traded volumes of Bitcoin, Ethereum, and other leading cryptocurren- cies have increased markedly since 2016." Higher levels of liquidity have been found to be associated with more efficient, and less volatile, cryptocurrency markers, In addition, the increase in liquidity has lowered the cost of trading in cryptocurrency markets. For example, the effective spread in the market for USD/Bitcoin fell from around 10 to 6 basis points in the period September 2017 to May 2018. This decline in market spreads makes the trading of Bitcoin less expensive than trading mainstream equities. Thus, it appears that the greater number of market participants have, by virtue of competing against one another, resulted in lower transaction costs. control Interconnecting the global financial system with Stellar Like Bitcoin, Stellar is an open-source blockchain network; however, unlike Bitcoin, Stellar's token, called the Lumen, is backed by conventional currencies, such as dollars, euros, or pesos.52 This means that each token is a digital representation of the assets underpinning it." In this way, Stellar's vision is a currency system wherein all the world's financial systems can work together on a single network54 Stellar's Lumen is one of the so-called 'stable-coins' - cryptocurrencies backed by conventional fiat curren- cies such as dollars, euros, or pesos. However, Lumens are unique in that they are not backed by any one fiat currency. This allows Stellar's users to send each other Lumens backed by a multitude of different currencies via its network. In addition, users can exchange tokens with one another via the Stellar protocol. As part of this, individual users submit bid or ask (ie buy or sell) orders, which are then automatically matched to the best available prices on the network." As one Lumen is exchangeable for any other Lumen, regardless of the type of currency - but not the quantity thereof - underpinning them, this means that Stellar is effectively a peer-to-peer currency market. Thus, the Stellar network allows users to convert and send money internationally without having to transmit fiat currency across borders, at least not in the conventional sense. For example, a person with dollars wishing to send pesos to someone in Mexico would simply use their dollars to buy Lumens backed by the same amount Mpyto REMITTANCES CASE STUDY: FACILITATING INTERNATIONAL PAYMENTS WITH BLOCKCHAIN TECHNOLOGY of dollars and then exchange these for tokens backed by an equivalent value in pesos." In the same instant, these would then be transmitted to the receiver via the Stellar network, who, in turn, would be able to sell these peso-backed tokens for actual pesos, and thereby be able to spend them. The universality of the Lumen token on the Stellar nerwork enables its users to transact across thinly-traded currency pairs. This is because the Lumen is backed by, and traded against a multitude of currencies, which increases the liquidity of the system. In this way, a sender's tokens backed by smaller, and less liquid currencies can be exchanged for tokens backed by more liquid ones, such as dollars or euros. In turn, these can be exchanged for tokens backed by the recipient's currency. Importantly, this is done behind the scenes: the sender merely needs to identify the recipient and their preferred currency; the Stellar network takes care of the inter- mittent transactions on a best price basis, as can be seen in the example below." Network Receiver: Sender: Acquires tokens backed by DKK. Clicks 'send' Exchanges tokens backed by DKK for tokens backed by EUR, which, in turn, are exchanged for tokens backed by PLN Receives tokens backed by PLN which can be sold for actual PLN on cryptocurrency exchange As seen in the diagram above, the sender exchanges Lumens backed by Danish Krone (DKK) for Lumens backed by an equivalent value of Euros (EUR), which are then exchanged for Lumens backed by the same value in Polish Zloty (PLN), the recipient's preferred currency Lumens are traded on a multitude of cryptocurrency exchanges, against both fiat currencies and large capitali- zation cryptocurrencies, such as Bitcoin, Ripple or Ethereum." Lumens can also be purchased directly via the Stellar network. To access and transact on Stellar, users download an application known as a cryptocurrency wallet, of which several are available. As the underlying currency represented by each token does not move across borders when users 'send' money via the Stellar Network this greatly reduces transaction costs. As a result, the starting fee for each trans- action is 0.00001 Lumens. At the time of writing, one Lumen trades for around 38 US cents. Thus, ansaction fees on the Stellar network are lower by several orders of magnitude when compared to conven- tional ways of sending money. What's more, Stellar transactions take around 5 seconds to complete. This is much faster than conventional international transfers, which can take several days to clear. Stellar's consensus model is the reason for its low fees and speedy transactions. Unlike Bitcoin, Stellar uses a trust-based protocol to reconcile its ledger. As part of this, individual network nodes signal their agreement to a new transaction once a number of other pre-selected network nodes, that they have deemed reliable, signal theirs; in turn, these nodes will have signalled their agreement once a certain number of other nodes have signalled theirs. When a significant proportion of these node confederations have signalled their agreement, it becomes infeasible to reverse a valid transaction, and the network as a whole accepts the transaction. As this federated model of reaching consensus is less resource-intensive than both proof-of-work and proof-of-stake, it enables faster and cheaper transactions. 74 Although Stellar is an open-source network, it is overseen by the Stellar Development Foundation, a non- profit founded in 2014 with the aim of supporting the development of the network. As part of its work, the Foundation maintains the network's codebase and is a locus for the surrounding technical and business commu- nities. In addition, the Foundation sees itself as a representative for Stellar in terms of liaising with regulators and external institutions.77 Since its launch in 2015, Stellar has processed more than 450 million transactions. At the time of launch, 100 billion Lumens were created; for the first five years of Stellar's existence, the Lumen supply was increased by 1 per cent per annum as per the network's design. However, in 2019, the Stellar community decided to make the Lumen a fixed-supply token, thereby ending its inflation mechanism for good; at this time, the supply of Lumens was also reduced to 50 billion. Of these, 20 billion Lumens are traded freely; the remainder are held as a reserve by the Stellar Foundation to finance its activities. REMITTANCES CASE STUDY: FACILITATING INTERNATIONAL PAYMENTS WITH BLOCKCHAIN TECHNOLOGY CASE Saldo: Facilitating remittances vla utility bills Though different cryptocurrencies may vary in terms of costs and transaction fees, they have one weakness in common: they may be hard for the average consumer to understand as their inner workings are far removed from most people's day-to-day experiences. In this way, Stellar is no different from Bitcoin, in that sending and receiving nas funds puts the user on a learning curve, by way of having to install and run a wallet application. This imposes mental transaction costs such as uncertainty and the hassle of having to engage with something new and unfamilia . One way to address this is to link the underlying cryptocurrency transactions to something familiar or mundane, such as the payment of energy or water bills. This appears to be the strategy of Saldo, a fintech which enables Mexican workers in the US to pay their families'utility bills via Stellar. Rather than engaging with the Stellar network directly, users deposit dollars with Saldo and identify the recipients' utility providers and account numbers via its application. what follows is a transfer that, to the user is immediate, transparent and irreversible." Behind the scenes, Saldo uses the senders' dollars to pay for peso-backed Lumens, which in turn, facilitate payments to the utility providers. Thus, Saldo is facilitating the use of Stellar by linking it to existing infrastructure via its bill payment solution in this way, Saldo is a cogent example of an innovator seeking to reduce the cost of international remittances by focusing on a specific problem (le paying utility bilis) and taking advantage of the efficiencies offered by blockchain technology. Commenting on its use of Stellar, Saldo CEO, Marco Neri said: Z optio . 'Stellar is the network that's very optimized for payments. We don't need complex smart contracts, but we need efficiency, and we need partners. We see Stellar attracting a lot of like-minded companies believing in an open finance infrastructure, Questions If you were an immigrant worker in the USA looking to send money to your relatives in Mexico, what advantages and disadvantages (le strengths and weaknesses) would you see in using the Saldo app? In light of these points, what opportunities and threats do you see for Saldo? Suggested work The aim of this case is to consider the issues surrounding international remittances from a user perspective; in this way, one may build a deeper understanding of the many issues, challenges, and opportunities pertaining to international payments from the ground up. To address the case, groups of 12-20 people could be subdivided into discussion groups consisting of 3-5 participants. These sub-groups could be tasked with addressing differ- ent aspects of the case and then report back to the wider group in the form of a short presentation. As an example, a larger group could be divided into four sub-groups, each tasked with addressing the case question from a different perspective, for example by conducting different parts of a SWOT analysis. References Suri, T and Jack, W The long-run poverty and gender impacts of mobile money, Science, 2016, 354,1288-92 (December) Doi,Y (2010) Financial Inclusion, Poverty Reduction and Economic Growth, World Bank Group, 10 November, www.worldbank.org/enews/opinion/2010/11/10/financialinclusion-poverty-reduction-economic growth 16 Carrick, J (2016) Bitcoin as a complement to emerging market currencies, Emerging Markets Finance and Trade, 52 (10), pp 2321-34 + Chavan. J (2013) Internet banking-benefits and challenges in an emerging economy, International Journal of Research in Business Management, 1, pp 19-26 Larios-Hernandez, GJ Blockchain entrepreneurship opportunity in the practices of the unbanked, Business Horizons, 2017, 60(6), 865-74 (November-December) Remittances Case Study Facilitating international payments with blockchain technology LEARNING OBJECTIVES This case study will help you understand The role of international remittances in developing economies The challenges faced by migrants sending money back home, How various blockchain solutions can help alleviate these problems BACKGROUND READING This case study makes reference to material covered in Chapters 1.2.3 and 5 of Financial Technology. Introduction In Chapter 1, we saw how Vodafone uses its mobile network and its commercial relationships with a multitude of small merchants to supplement an underdeveloped financial system as part of its M-pesa solution. This has allowed urban dwellers in several African nations to send funds to their friends and family in rural areas. The benefits of this are far reaching for example, it is estimated that M-pesa has helped lift 2 per cent of Kenyan households out of poverty. While M-pesa succeeded in lowering the cost of sending money within countries, high remittance costs persist for migrant workers who send money across borders. Just as Vodafone leveraged existing networks to make up for lacking financial infrastructure, fintechs use internet-based technologies to lower remittance costs. This case study examines the use of one such technology, blockchain, and its role in facilitating international remittances, Underdeveloped financial systems and financial exclusion In many developing countries there is a tendency for financial institutions to cater to affluent urban dwellers, and in doing so, they overlook rural and lower income populations. This is unlikely to be the result of malice: rather, affluent urban populations are seen as more profitable by the financial sector. With growing middle classes concentrated in urban areas across the developing world, there is little incentive to venture into the hinterlands. Meanwhile, underdeveloped and inefficient financial systems put upward pressure on transaction costs in developing economies. Although larger transactions tend to attract lower fees, these can be proportionally higher in developing countries than for similar transactions in developed countries. As a result, financial insti- rutions favour wealthier clients in order to make up for higher costs with an increase in scale. Although some countries have made progress in updating their financial systems, and thereby succeeded in lowering transaction costs, there are others in which progress has been lacking. In these countries, existing financial infrastructure caters mainly to the upper and middle classes, leaving small businesses and large swathes of the general population without adequate access to financial services. In this way, many people in lower income and rural populations find themselves financially excluded, which can be an impediment to economic development in emerging economies. However, it can also represent an WANCE CASE STUDY FACILITATING INTERNATIONAL PAYMENTS WITH BLOCKCHAIN TECHNOLOGY opportunity with an estimated 2 billion people who are unbanked, there is a gap in the global financial es market for intrepid fintechs to exploit Just as under developed financial systems exert costs on transactions within countries, they also hinder inter- national remittances. According to a 2019 estimate, there are 272 million international migrants. Many of these people send money to friends and family back home. The average cost of such remittances in 2020 is an estimated 6.7 per cent of the transaction value. In this way, high transaction costs prevent remittance flows from reaching those that need them the most However, the digitization of the financial system may belp alleviate this situation by lowering transaction costs. Indeed, it appears that it already has: in 2009, the average remittance cout was 9.7 per cent's thus, the decline to 6.7 per cent in the space of 11 years can be seen as evidence that the international financial system is becoming more efficient at facilitating retnittance flows. Given the prevailing socio-technological trends outlined in Financial Technology, it is likely that some of this efficiency will have been driven by technological change Indeed, such change may facilitate greater financial inclusion. For example, the proportion of people over the age 15 with a financial institution account in Mexico is around 35 per cent," meanwhile 70 per cent of the population in Mexico have access to the internet. As a result, there is space for fintechs to enter the financial services market by leveraging the digital connectedness of the Mexican population. The role of international remittances International remittances play an important role in economic development by funding education, healthcare and entrepreneurship. Indeed, there is evidence to suggest that remittances contribute to economic growth in developing nations via their positive impact on consumption, savings and investment." In terms of volume, remittances are greater than other transfers between developed and developing nations: they are about double the size of foreign aid flows into developing countries. Moreover, in 2019 remittance flows exceeded foreign direct investment into low and middle-income countries for the first time. Over time, remittances appear to increase the flow of money in circulation to a greater degree than bank loans and other financial products do; indeed, remittances may help households build a basis for acquiring financial products. For example, a family could use remittances to save for a down payment on a home loan In addition, it has been observed that remittances increase the demand for banking services, as recipients need somewhere safe to store their money. In this way, households that receive foreign remittances are more likely to use financial services, because they are incentivized to do so. This induced financial literacy effect is instru mental in increasing financial sector development in emerging economies 20 However, in some lower income countries, the effect of remittances on financial sector development is less clear as recipients in these countries may opt to spend their remittances on consumption, as opposed to saving. According to the IMF, a significant proportion of remittances are spent on consumption, and thus is not saved or invested. Moreover, when remittances are saved or invested, they tend to be put in assets such as land, hous- ing and jewellery, which are less productive to the overall economy. Tangible assets such as jewellery are a popular store of value in developing economies in the face of economic uncertainty. This is unsurprising, given that poorer countries tend to have weaker financial institutions, Thus, tangible assets are attractive in such countries because their underdeveloped financial systems cause people not to have faith in financial institutions. In this way, the key to making remittances more effective in promoting development may lie in building more robust financial institutions. Unfortunately, remittances can also have deleterious effects on emerging economies. As they are used to supplement household incomes, remittances may increase the lowest wage at which people are willing to work. This can lead to wage inflation and a reduction in the competitiveness of recipient countries exports. In addition, remittances incentivize skilled workers to migrate which can create labour shortages in developing economies." As a result, there is a risk that developing countries get trapped in a cycle of depend ency on emigration-driven remittance flows, wherein remittances incentivize 'brain drain' thereby impeding economic development, which in turn, incentivizes further emigration." A remittance flows help households absorb economic shocks, they can provide economic stimulus in developing countries during times of crisis. This effect can be magnified by the tendency of emerging market EMITTANCES CASE STUDY FACILITATING INTERNATIONAL PAYMENTS WITH BLOCKCHAIN TECHNOLOGY currencies to depreciate in response to economic shocks. For example, in 2013 when the Federal Reserve broached a reduction in its economic stimulus programme, financial markets sold off, as part of this so-called "taper tantrum, emerging market currencies depreciated rapidly. In this way, hard currency remittances can quickly become worth more on the ground during times of economic uncertainty, and thereby provide recipe ents with a greater degree of support. That said, dependency on remittance flows can be a double-edged sword. On one hand remittances provide much-needed support on the other, they can be volatile, and are prone to reduction during crises, just as recipients need them the most. For example, it is estimated that remittance Sows to low-and middle-income countries fell by 20 per cent in 2020 as a result of the global pandemic. By comparison, in 2009 remittances to low and middle-income countries fell by 5 per cent in the aftermath of the global financial crisis." As there flows account for an estimated 8.9 per cent of low-income countries' GDP." it is not hard to see how the dependency on remittances may exacerbate the effects of global economic down turns in developing countries Despite reductions in overall remittance flow during times of global economic contraction, the migrants that do keep up their remittances tend to increase the amounts they send back home. For these people, every penny counts. In the words of one Filipino woman living in Taiwan featured in the Asian and Pacific Migration Journal "You work abroad for the children left behind, for them to have a better future. Also, you would always consider, I have a family to return to, hence, I should have my money. You will not think about nos cuentials. You will not buy things that are not necessary. Whenever you see beautiful things, you will think, oh this is for my child. I buy for my child, for my husband. You will really see to it that your expense will go towards something you will not just spend it on things that will not count for something." However, as aforementioned, sending money internationally is not cheap In this regard, one of the biggest impediments to remittances is the lack of transparency in the market, which hinders more competitive pricing as senders are unable to effectively compare prices." In spite of this, developments in web and mobile technol ogy have facilitated remittance processes to reduce transaction times and costs over the last few decades prior to 2020. As a result, the average cost of sending an international remittance has come down significantly between 2009 and 2020, this fell by fell by ca 30 per cent." The pros and cons of using cryptocurrencies for remittances At first glance, Bitcoin, and cryptocurrencies more generally appear to remedy the lack of transparency and high transaction costs associated with sending international remittances. Certainly, the openness of blockchain systems addresses the lack of transparency so pervasive in existing remittance processes. In this way, senders can ascertain exactly how much each transaction will cost them, and the recipients of their money. Indeed, it was suggested as early as 2013 - recall that Bitcoin was only launched in 2009 - that Bitcoin was one of the most efficient ways, cost-wise, of transferring money across borders. For most of Bitcoin's history, this has been the case, with transaction fees tending to oscillate between ca 20 cents and a few dollars, albeit with significant spikes along the way, which were driven by price bubbles, most notably in late 2017 and the spring of 2021." Outside periods of speculative run-ups, however, the cost of sending $ 100 using Bitcoin would have been less than the cost of using conventional remittance channels (6.7 per cent as of 2020). Thus, Bitcoin gives senders a low-cost benchmark against which to compare the cost of sending remittances via different channels: in theory, this should help push down prices. In addition to being demonstrably cheaper than conventional remittance channels, crypto currencies like Bitcoin are accessible to anyone with an internet connection. Internet penetration rates are rising throughout the developing world: for example, the proportion of adults who report using the internet or owning a smart- phone rose from 34 to 40 per cent in the Philippines between 2013 and 2015. Over the same period, this figure increased from 16 to 22 per cent in India, 33 to 39 per cent in Nigeria, and 41 to 72 per cent in Turkey With more people online, cryptocurrencies have the potential to increase the flow of money to people in areas that lack conventional financial infrastructure, and thereby lower the cost of sending remittances However, the rising uptake of some cryptocurrencies may impede their utility. For example, as the Bitcoin network has grown, it has struggled to scale, and transaction speeds have ground to a halt at times of peak IITTANCES CASE STUDE FACILITATING INTERNATIONAL PAYMENTS WITH BLOCKCHAIN TECHNOLOGY wwe. While the Bitcoin network can handle an estimated 5-10 transactions per second this pales in comparison with conventional payment networks. For example, the Visa network can process ca 30,000 trans actions per second The low transaction throughput of the Bitcoin network is the result of its proof of work consensus system a network nodes consume large amounts of energy in order to reconcile the ledger, this slows transaction speed. As a result, during times of peak usage, the network can take several hours to clear transactions. Unlike conventional remittance mechanisms, wherein transactions may take days to clear, any lags in a cryptocurrency transaction exposes the recipient to a significant degree of market riski as cryptocurrency markets can be vola. tile, a delay in clearing means that the crypto-token'w price can change significantly against the recipient local currency in the interim. As a result, both sender and receiver will be uncertain as to how much the remittance will be worth in local currency terms. This may cause people to send a little more than is required in order to make up for any potential shortfall There are other ways in which the volatility of Bitcoin, and cryptocurrencies more generally, impede their utility. Besides, encumbering transactions, high volatility makes it difficult to use Bitcoin - and by extension, other cryptocurrencies - as a unit of account and store of wealth." As a result, recipients will likely want to convert cryptocurrency remittances into their local currency as soon they get the chance. However, as some developing countries' currencies experience high inflation, this presents a difficult trade-off between holding cryptocurrency, and risking severe price swings, and holding local currency to suffer high inflation which reduces the real value of the currency) instead. As noted in Chapter 5. Bitcoin fell by more than 80 per cent between December 2017 and December 2018. As a result, this makes it difficult to build savings in either type of currency That said, the volatility of leading cryptocurrencies can be expected to decline over time as the pool of market participants grows. Certainly, the requisite liquidity of these currencies has increased in tandem with the number of market participants the daily traded volumes of Bitcoin, Ethereum, and other leading cryptocurren- cies have increased markedly since 2016." Higher levels of liquidity have been found to be associated with more efficient, and less volatile, cryptocurrency markets." In addition, the increase in liquidity has lowered the cost of trading in cryptocurrency markets. For example, the effective spread in the market for USD/Bitcoin fell from around 10 to 6 basis points in the period September 2017 to May 2018. This decline in market spreads makes the trading of Bitcoin less expensive than trading mainstream equities." Thus, it appears that the greater number of market participants have, by virtue of competing against one another, resulted in lower transaction costs. Interconnecting the global financial system with Stellar Like Bitcoin, Stellar is an open source blockchain network, however, unlike Bitcoin, Stellar's token, called the Lumen, is backed by conventional currencies, such as dollars, euros, or pesos. This means that each token is a digital representation of the assets underpinning it." In this way, Stellar's vision is a currency system wherein all the world's financial systems can work together on a single network. Stellar' Lumen is one of the so-called 'stable-coins' - cryptocurrencies backed by conventional fiat curren cies such as dollars, euros, or pesos. However, Lumens are unique in that they are not backed by any one fiat currency. This allows Stellar's users to send each other Lumens backed by a multitude of different currencies va its network." In addition, users can exchange tokens with one another via the Stellar protocol." As part of this, individual users submit bid or ask (je buy or sell) orders, which are then automatically matched to the best available prices on the network. As one Lumen is exchangeable for any other Lumen, regardless of the type of currency - but not the quantity thereof - underpinning them, this means that Stellar is effectively a peer-to-peer currency market." Thus, the Stellar network allows users to convert and send money internationally without having to transmit fiat currency across borders," at least not in the conventional sense. For example, a person with dollars wishing to send pesos to someone in Mexico would simply use their dollars to buy Lumens backed by the same amount ATMITTANCES CASE STUDY FACILITATING INTERNATIONAL PAYMENTS WITH BLOCKCHAIN TECHNOLOGY dollars and then exchange these for tokens backed by an equivalent value in pesos." In the same instant, these would then be transmitted to the receiver via the Stellar network, who, in turn, would be able to sell these pese-backed tokens for actual pesos, and thereby be able to spend them. The universality of the Lumen token on the Stellar network enables its users to transact across thinly-traded currency pain. This is because the Lumen is backed by, and traded against a multitude of currencies, which increases the liquidity of the system. In this way, sender tokens backed by smaller, and less liquid currencies can be exchanged for tokens backed by more liquid ones, such as dollars or euros. In turn, these can be exchanged for tokens backed by the recipient"currency. Importantly, this is done behind the scenes the sender merely needs to identity the recipient and their preferred currency: the Stellar network takes care of the inter mittent transactions on a best-price basis, as can be seen in the example below." A Receiver Sender Acores tokens backed by DKK Cend Network Exchanges token backed by DKK Token backed by EUR which in turn are exchanged for bon backed by PLN Receives tokens backed by PLN which can be sold for actual PLNO cryptocurrency exchange O As seen the above, the new Laced by one too for lune baded by an entive of tutos OLURI Othere for Lumens hacked by the une vue in Polah typuthe pretend currency Lumens are traded on a multitude of cryptocurrency exchanges, against oth fiat currencies and large capital ration cryptocurrencies, such as Bitcoin, Ripple or Ethereum. Lumens can also be purchased directly via the Stellar network. To access and transact on Stellar, users download an application known as a cryptocurrency wallet, of which several are available, As the underlying currency represented by each token does not move across borders when users send money via the Stellar Network this greatly reduces transaction costs. As a result, the starting fee for each trans- action is 0.00001 Lumens. At the time of writing. One Lumen trades for around 38 US cents. Thus, transaction fees on the Stellar network are lower by several orders of magnitude when compared to conven tional ways of sending money. What's more, Stellar transactions take around 5 seconds to complete. This is much faster than conventional international transfers, which can take several days to clear." Stellar's consensus model is the reason for its low fees and speedy transactions. Unlike Bitcoin, Stellar uses a trust-based protocol to concile its ledger. As part of this, individual network nodes signal their agreement to a new transaction once a number of other pre-selected network nodes, that they have deemed reliable, signal theirs; in turn, these nodes will have signalled their agreement once a certain number of other nodes have signalled theirs. When a significant proportion of these node confederations have signalled their agreement, it becomes infeasible to reverse a valid transaction, and the network as a whole accepts the transaction. As this federated model of teaching consensus is less resource-intensive than both proof-of-work and proof-of-stake, it enables faster and cheaper transactions." Although Stellar is an open-source network, it is overseen by the Stellar Development Foundation, a non- profit founded in 2014 with the aim of supporting the development of the network. As part of its work, the Foundation maintains the network's codebase and is a locus for the surrounding technical and business commu- nities. In addition, the Foundation sees itself as a representative for Stellar in terms of liaising with regulators and external institutions, Since its launch in 2015, Stellar has processed more than 450 million transactions. At the time of launch, 100 billion Lumens were created, for the first five years of Stellar's existence, the Lumen supply was increased by 1 per cent per annum as per the network's design. However, in 2019, the Stellar community decided to make the Lumen a fixed-supply token, thereby ending its inflation mechanism for good; at this time, the supply of Lumens was also reduced to 50 billion." Of these, 20 billion Lumens are traded freely: the remainder are held as a reserve by the Stellar Foundation to finance its activities." EMITTANCIS CASE STUDY FACILITATING INTERNATIONAL PAYMENTS WITH BLOCKCHAIN TECHNOLOGY CASE Salde; Facilitating remittances via utility bills Though different cryptocurrencies may vary in terms of costs and transaction fees, they have one weakness in common: they may be hard for the average consumer to understand as their inner workings are far removed from most people day-to-day experiences in this way, Stellar is no different from Bitcoin, in that sending and receiving funds puts the user on a learning curve by way of having to install and run a wallet application. This imposes mental transaction costs such as uncertainty and the hassle of having to engage with something new and unfamiliar One way to address that is to link the underlying cryptocurrency transactions to something familiar or mundane. such as the payment of energy or water bills. This appears to be the strategy of Saldo, a fintech which enables Mexican workers in the US to pay their tales utility bills via Stellar. Rather than engaging with the Stellar betwork directly, users deposit dous with Saldo and identify the recipients'utility providers and account numbers its application. What follows is a transfer that, to the user is immediate, transparent and irreversible. Behind the scenes, Saldo uses the senders dolars to pay for peso-backed Lumens, which in turn, facilitate payments to the utility providers." Thus, Saldo i facilitating the use of Stelar by linking it to existing infrastructure via its bill payment solution in this way, Saldo is a cogent example of an innovator seeking to reduce the cost of international remittances by focusing on a specific problem (le paying utility bits and taking advantage of the efficiencies offered by blockchain technology Commenting on its use of Stella Saldo CEO, Marco Ner said Stellar is the network that's very optimeed for payments we don't need complex smart contracts, but we need efficiency, and we need partners we see Stelar attracting a lot of like-minded companies believing in an open finance infrastructure Z Questions if you were an immigrant worker in the USA looking to send money to your relatives in Mexico, what advantages and disadvantages (ie strengths and weaknesses) would you see in using the Saldo app? In Night of these points, what opportunities and threats do you see for Saldo? . Suggested work The aim of this case is to consider the issues surrounding international remittances from a user perspective in this way, one may build a deeper understanding of the many issues, challenges, and opportunities pertaining to international payments from the ground up. To address the case, groups of 12-20 people could be subdivided into discussion groups consisting of 3-5 participants. These sub-groups could be tasked with addressing differ ent aspects of the case and then report back to the wider group in the form of a short presentation. As an example, a larger group could be divided into four sub-groups, each tasked with addressing the case question from a different perspective, for example by conducting different parts of a SWOT analysis. References Sur, T and Jack, W The long run poverty and gender impacts of mobile money, Science, 2016, 354,1288-92 (December Doi,Y (2010) Financial Inclusion, Poverty Reduction and Economic Growth, World Bank Group, 10 November, www.worldbank.org/enewwopinion 2010/11/10/financialinclusion-poverty-reduction-economic growth Carrick. J (2016) Bitcoin as a complement to emerging market currencies, Emerging Markets Finance and Trade, $2110). pp 2321-34 Chavan,/2013) Internet banking-benefits and challenges in an emerging economy, International Journal of Research in Business Management, 1. pp 19-26 Larios Hernandes, GJ Blockchain entrepreneurship opportunity in the practices of the unbanked, Business Horizon 2017, 60(6), 865-74 (November-December) Remittances Case Study Facilitating international payments with blockchain technology LEARNING OBJECTIVES This case study will help you understand: The role of international remittances in developing economies; The challenges faced by migrants sending money back home: How various blockchain solutions can help alleviate these problems. BACKGROUND READING This case study makes reference to material covered in Chapters 1, 2, 3 and 5 of Financial Technology. Introduction In Chapter 1, we saw how Vodafone uses its mobile network and its commercial relationships with a multitude of small merchants to supplement an underdeveloped financial system as part of its M-pesa solution. This has allowed urban dwellers in several African nations to send funds to their friends and family in rural areas. The benefits of this are far reaching: for example, it is estimated that M-pesa has helped lift 2 per cent of Kenyan households out of poverty. While M-pesa succeeded in lowering the cost of sending money within countries, high remittance costs persist for migrant workers who send money across borders. Just as Vodafone leveraged existing networks to make up for lacking financial infrastructure, fintechs use internet-based technologies to lower remittance costs. This case study examines the use of one such technology, blockchain, and its role in facilitating international remittances. Underdeveloped financial systems and financial exclusion In many developing countries there is a tendency for financial institutions to cater to affluent urban dwellers, and in doing so, they overlook rural and lower income populations. This is unlikely to be the result of malice; rather, affluent urban populations are seen as more profitable by the financial sector. With growing middle classes concentrated in urban areas across the developing world, there is little incentive to venture into the hinterlands Meanwhile, underdeveloped and inefficient financial systems put upward pressure on transaction costs in developing economies. Although larger transactions tend to attract lower fees, these can be proportionally higher in developing countries than for similar transactions in developed countries. As a result, financial insti- tutions favour wealthier clients in order to make up for higher costs with an increase in scale. Although some countries have made progress in updating their financial systems, and thereby succeeded in lowering transaction costs, there are others in which progress has been lacking. In these countries, existing financial infrastructure caters mainly to the upper and middle classes, leaving small businesses and large swathes of the general population without adequate access to financial services. In this way, many people in lower income and rural populations find themselves financially excluded, which can be an impediment to economic development in emerging economies. However, it can also represent an opportunity: with an estimated REMITTANCES CASE STUDY: FACILITATING INTERNATIONAL PAYMENTS WITH BLOCKCHAIN TECHNOLOGY billion people who are unbanked', there is a gap in the global financial services market for intrepid fintechs to exploit. Just as underdeveloped financial systems exert costs on transactions within countries, they also hinder inter- national remittances. According to a 2019 estimate, there are 272 million international migrants. Many of these people send money to friends and family back home. The average cost of such remittances in 2020 is an estimated 6.7 per cent of the transaction value. In this way, high transaction costs prevent remittance flows from reaching those that need them the most. However, the digitization of the financial system may help alleviate this situation by lowering transaction costs. Indeed, it appears that it already has: in 2009, the average remittance cost was 9.7 per cent"; thus, the decline to 6.7 per cent in the space of 11 years can be seen as evidence that the international financial system is becoming more efficient at facilitating remittance flows. Given the prevailing socio-technological trends outlined in Financial Technology, it is likely that some of this efficiency will have been driven by technological change. Indeed, such change may facilitate greater financial inclusion. For example, the proportion of people over the age 15 with a financial institution account in Mexico is around 35 per cent;"? meanwhile 70 per cent of the population in Mexico have access to the internet. As a result, there is space for fintechs to enter the financial services market by leveraging the digital connectedness of the Mexican population. A The role of international remittances International remittances play an important role in economic development by funding education, healthcare, and entrepreneurship. Indeed, there is evidence to suggest that remittances contribute to economic growth in developing nations via their positive impact on consumption, savings and investment." In terms of volume, remittances are greater than other transfers between developed and developing nations: they are about double the size of foreign aid flows into developing countries. Moreover, in 2019 remittance flows exceeded foreign direct investment into low- and middle-income countries for the first time.! Over time, remittances appear to increase the flow of money in circulation to a greater degree than bank loans and other financial products do; indeed, remittances may help households build a basis for acquiring financial products. For example, a family could use remittances to save for a down payment on a home loan. In addition, it has been observed that remittances increase the demand for banking services, as recipients need somewhere safe to store their money. In this way, households that receive foreign remittances are more likely to use financial services, because they are incentivized to do so. This induced financial literacy'effect is instru- mental in increasing financial sector development in emerging economies.20 However, in some lower income countries, the effect of remittances on financial sector development is less clear as recipients in these countries may opt to spend their remittances on consumption, as opposed to saving.21 According to the IMF, a significant proportion of remittances are spent on consumption, and thus not saved or invested. Moreover, when remittances are saved or invested, they tend to be put in assets such as land, hous- ing and jewellery, which are less productive to the overall economy.?? Tangible assets such as jewellery are a popular store of value in developing economies in the face of economic uncertainty. This is unsurprising, given that poorer countries tend to have weaker financial institutions.24 Thus, tangible assets are attractive in such countries because their underdeveloped financial systems cause people not to have faith in financial institutions. In this way, the key to making remittances more effective in promoting development may lie in building more robust financial institutions. Unfortunately, remittances can also have deleterious effects on emerging economies. As they are used to supplement household incomes, remittances may increase the lowest wage at which people are willing to work.25 This can lead to wage inflation and a reduction in the competitiveness of recipient countries' exports. In addition, remittances incentivize skilled workers to migrate which can create labour shortages in developing economies. As a result, there is a risk that developing countries get trapped in a cycle of depend ency on emigration-driven remittance flows, wherein remittances incentivize 'brain drain' thereby impeding economic development, which, in turn, incentivizes further emigration. As remittance flows help households absorb economic shocks, they can provide economic stimulus in developing countries during times of crisis. This effect can be magnified by the tendency of emerging market 3 REMITTANCES CASE STUDY: FACILITATING INTERNATIONAL PAYMENTS WITH BLOCKCHAIN TECHNOLOGY 3 currencies to depreciate in response to economic shocks. For example, in 2013 when the Federal Reserve broached a reduction in its economic stimulus programme, financial markets sold off; as part of this so-called "taper tantrum', emerging market currencies depreciated rapidly. In this way, hard currency remittances can quickly become worth more on the ground during times of economic uncertainty, and thereby provide recipi- with greater Th On On one ha fater degree of support. That said, dependency on remittance flows can be a double-edged sword. od one hand remittances provide much-needed support; on the other, they can be volatile, and are prone to flows to ho during crises, just as recipients need them the most. For example, it is estimated that remittance " to low- and middle-income countries fell by 20 per cent in 2020 as a result of the global pandemic." By comparison, in 2009 remittances to low- and middle-income countries fell by 5 per cent in the aftermath of the global financial crisis. As these flows account for an estimated 8.9 per cent of low-income countries' GDPs," it is not hard to see how the dependency on remittances may exacerbate the effects of global economic down- turns in developing countries. Despite reductions in overall remittance flows during times of global economic contraction, the migrants that do keep up their remittances tend to increase the amounts they send back home. For these people, every penny counts. In the words of one Filipino woman living in Taiwan featured in the Asian and Pacific Migration Journal: 'You work abroad for the children left behind, for them to have a better future. Also, you would always consider, I have a family to return to, hence, I should save my money... You will not think about non-essentials. You will not buy things that are not necessary. Whenever you see beautiful things, you will think, oh this is for my child. I buy for my child, for my husband. You will really see to it that your expense will go towards something, you will not just spend it on things that will not count for something." However, as aforementioned, sending money internationally is not cheap. In this regard, one of the biggest impediments to remittances is the lack of transparency in the market, which hinders more competitive pricing as senders are unable to effectively compare prices." In spite of this, developments in web and mobile technol- ogy have facilitated remittance processes to reduce transaction times and costs over the last few decades prior to 2020. As a result, the average cost of sending an international remittance has come down significantly: between 2009 and 2020, this fell by fell by ca 30 per cent.'' The pros and cons of using cryptocurrencies for remittances At first glance, Bitcoin, and cryptocurrencies more generally, appear to remedy the lack of trans