Answered step by step

Verified Expert Solution

Question

1 Approved Answer

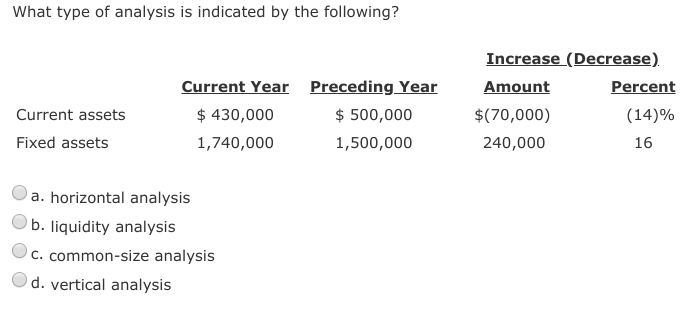

What type of analysis is indicated by the following? Increase (Decrease). Amount Percent $(70,000) (14)% 240,000 16 Current Year Preceding Year $ 430,000 $ 500,000

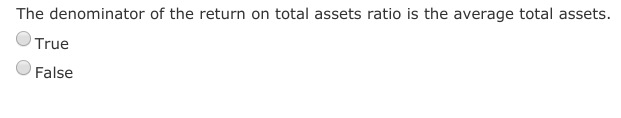

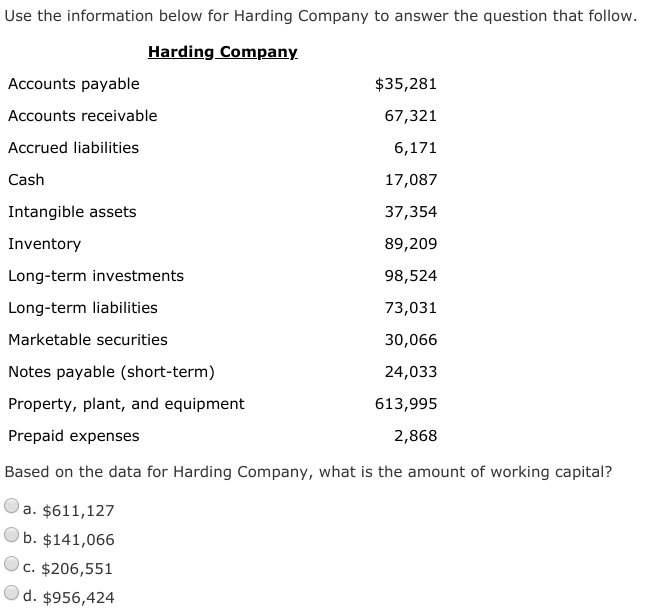

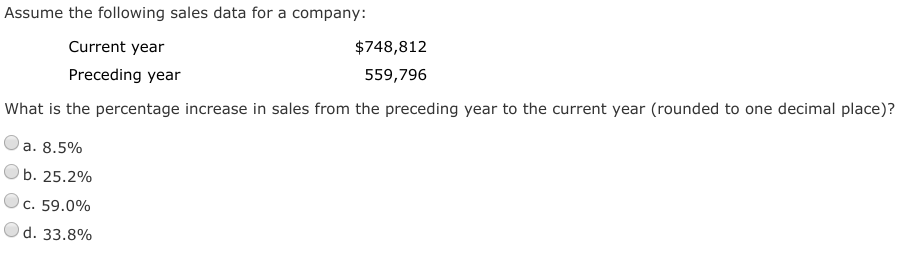

What type of analysis is indicated by the following? Increase (Decrease). Amount Percent $(70,000) (14)% 240,000 16 Current Year Preceding Year $ 430,000 $ 500,000 1,740,000 1,500,000 Current assets Fixed assets a. horizontal analysis b. liquidity analysis C. common-size analysis d. vertical analysis The denominator of the return on total assets ratio is the average total assets. True False Use the information below for Harding Company to answer the question that follow. Harding Company Accounts payable $35,281 Accounts receivable 67,321 Accrued liabilities 6,171 Cash 17,087 37,354 Intangible assets Inventory 89,209 Long-term investments 98,524 Long-term liabilities 73,031 Marketable securities 30,066 Notes payable (short-term) 24,033 Property, plant, and equipment 613,995 Prepaid expenses 2,868 Based on the data for Harding Company, what is the amount of working capital? a. $611,127 b. $141,066 C. $206,551 d. $956,424 Assume the following sales data for a company: Current year $748,812 Preceding year 559,796 What is the percentage increase in sales from the preceding year to the current year (rounded to one decimal place)? a. 8.5% b. 25.2% C. 59.0% d. 33.8%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started