Question

What type of trading order might you give to your broker in each of the following circumstances? a. You want to buy shares of Intel

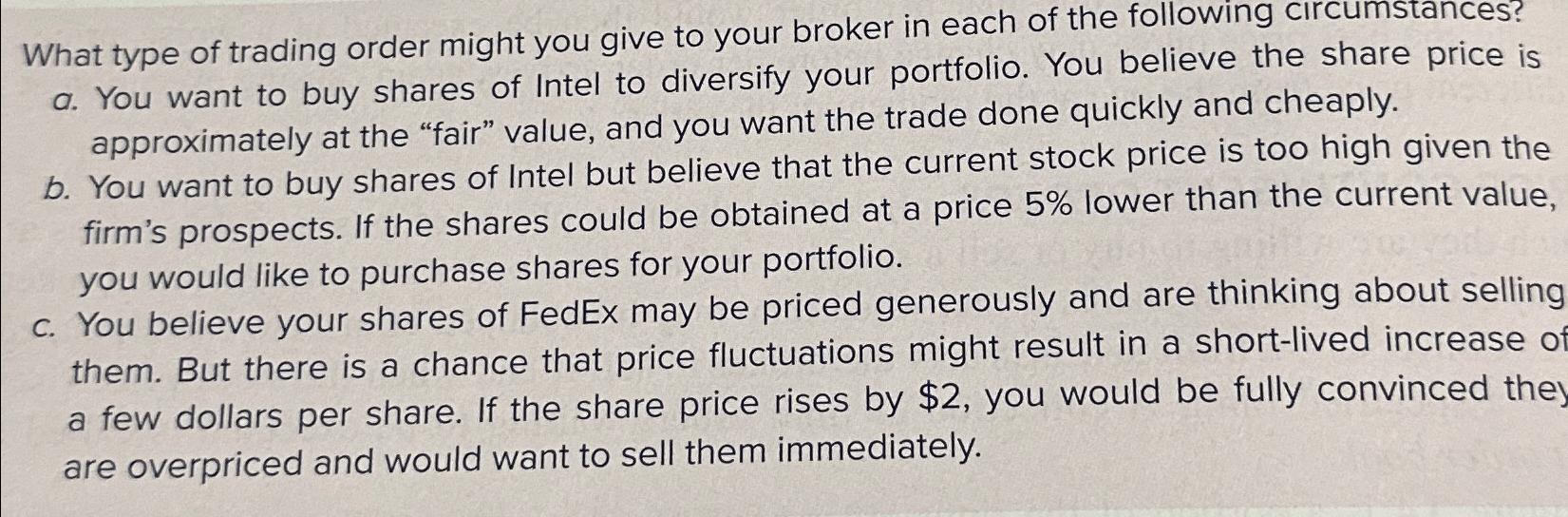

What type of trading order might you give to your broker in each of the following circumstances?\ a. You want to buy shares of Intel to diversify your portfolio. You believe the share price is approximately at the "fair" value, and you want the trade done quickly and cheaply.\ b. You want to buy shares of Intel but believe that the current stock price is too high given the firm's prospects. If the shares could be obtained at a price

5%lower than the current value, you would like to purchase shares for your portfolio.\ c. You believe your shares of FedEx may be priced generously and are thinking about selling them. But there is a chance that price fluctuations might result in a short-lived increase o a few dollars per share. If the share price rises by

$2, you would be fully convinced the are overpriced and would want to sell them immediately.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started