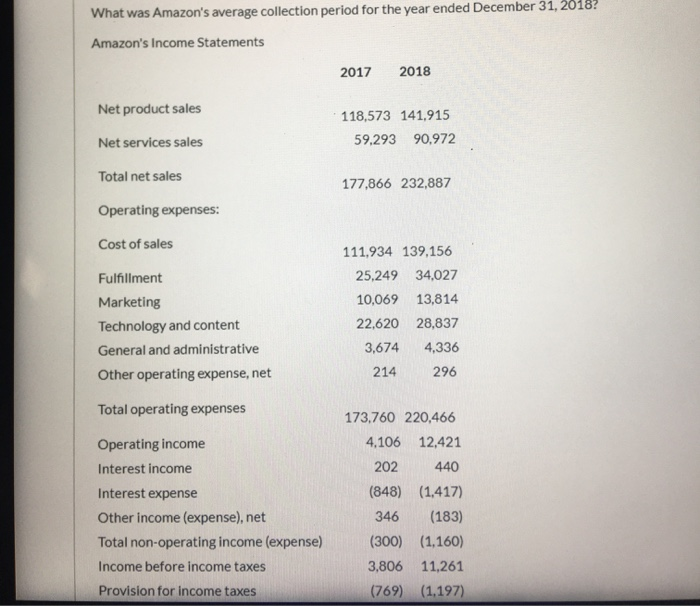

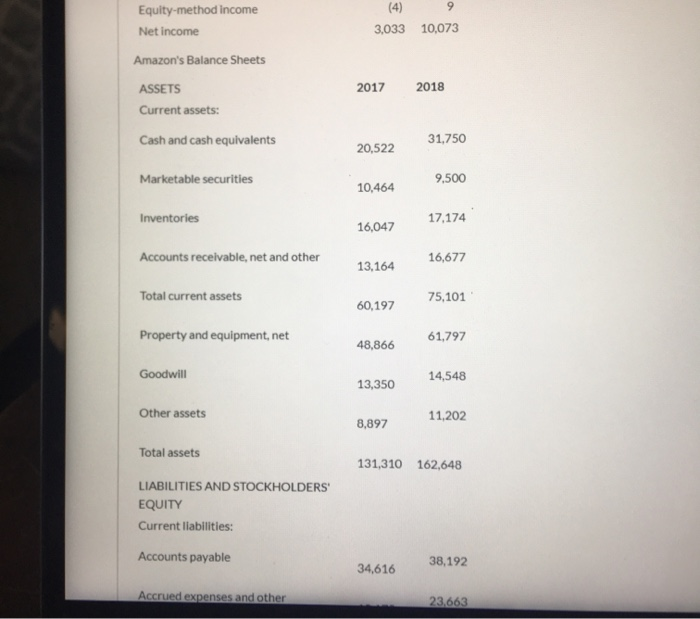

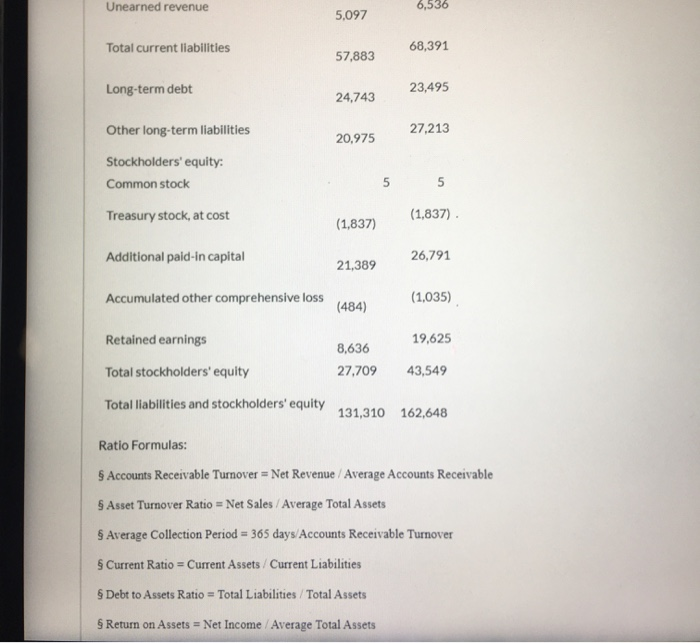

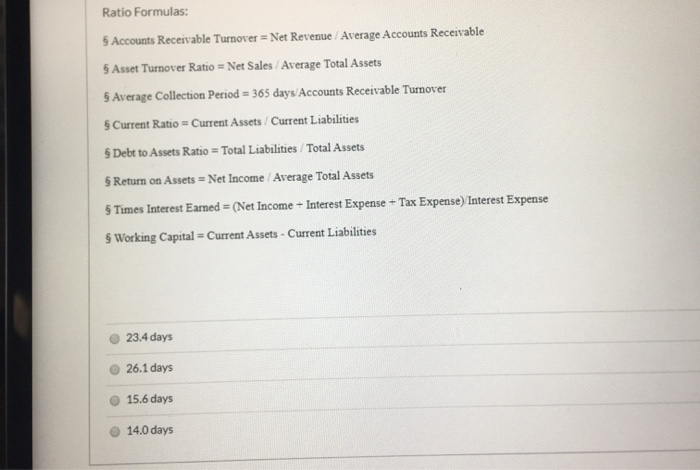

What was Amazon's average collection period for the year ended December 31, 2018? Amazon's Income Statements 2017 2018 Net product sales 118,573 141,915 59,293 90,972 Net services sales Total net sales 177,866 232,887 Operating expenses: Cost of sales Fulfillment Marketing Technology and content General and administrative Other operating expense, net 111.934 139,156 25,249 34,027 10,069 13,814 22,620 28,837 3,674 4,336 214 296 Total operating expenses Operating income Interest income Interest expense Other income (expense), net Total non-operating income (expense) Income before income taxes Provision for income taxes 173.760 220,466 4,106 12,421 202440 (848) (1.417) 346 (183) (300) (1,160) 3,806 11,261 (769) (1,197) Equity-method income Net income (4) 9 3,033 10,073 Amazon's Balance Sheets 2017 2018 ASSETS Current assets: Cash and cash equivalents 31,750 20,522 Marketable securities 9,500 10,464 Inventories 17,174 16,047 Accounts receivable, net and other 16,677 13,164 Total current assets 75,101 60,197 Property and equipment, net 61,797 48,866 Goodwill 14,548 13,350 Other assets 11,202 8,897 Total assets 131,310 162,648 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable 38,192 34,616 Accrued expenses and other 23,663 Unearned revenue 6,536 5,097 Total current liabilities 68,391 57,883 Long-term debt 23,495 24,743 Other long-term liabilities 27,213 20,975 Stockholders' equity: Common stock 5 Treasury stock, at cost (1,837) (1,837) Additional paid-in capital 26,791 21,389 Accumulated other comprehensive loss (1,035) (484) Retained earnings 19,625 8,636 27,709 Total stockholders' equity 43,549 Total liabilities and stockholders' equity olders equity 131,310 162,648 Ratio Formulas: 5 Accounts Receivable Turnover = Net Revenue Average Accounts Receivable SAsset Turnover Ratio = Net Sales Average Total Assets S Average Collection Period = 365 days/Accounts Receivable Turnover Current Ratio = Current Assets Current Liabilities Debt to Assets Ratio = Total Liabilities/Total Assets Return on Assets = Net Income Average Total Assets Ratio Formulas: Accounts Receivable Turnover = Net Revenue Average Accounts Receivable 5 Asset Turnover Ratio = Net Sales Average Total Assets 5 Average Collection Period = 365 days Accounts Receivable Turnover Current Ratio = Current Assets Current Liabilities 5 Debt to Assets Ratio = Total Liabilities/Total Assets Return on Assets = Net Income Average Total Assets Times Interest Earned = (Net Income - Interest Expense + Tax Expense) Interest Expense 5 Working Capital - Current Assets - Current Liabilities 23.4 days 26.1 days 15.6 days 14.0 days