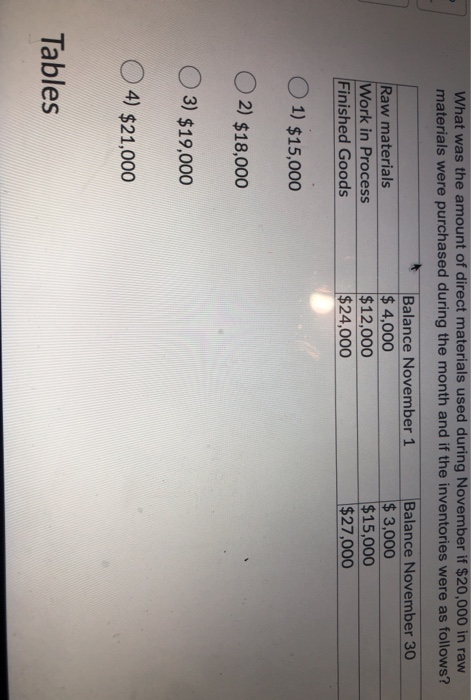

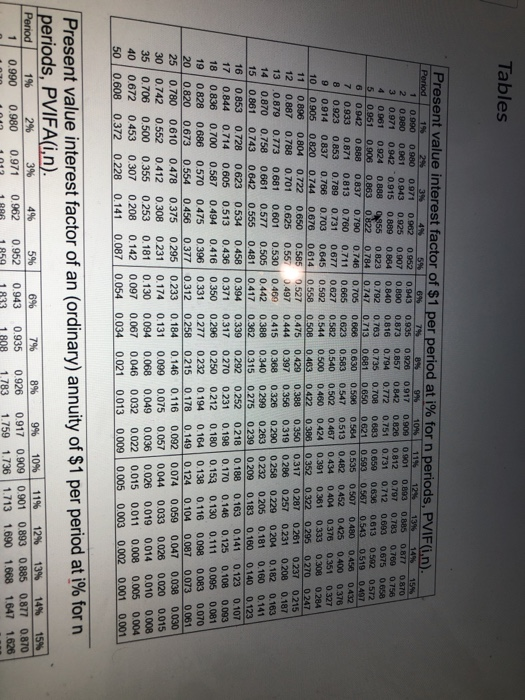

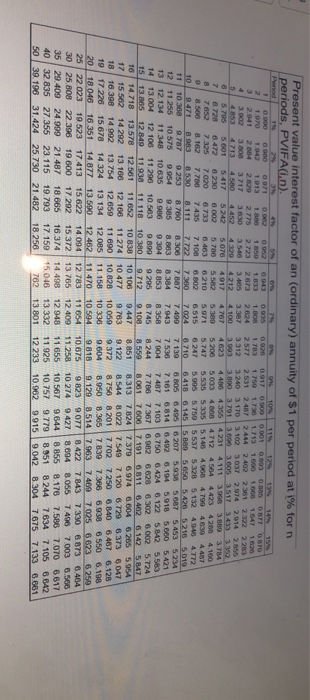

What was the amount of direct materials used during November if $20,000 in raw materials were purchased during the month and if the inventories were as follows? Raw materials Work in Process Finished Goods Balance November 1 $ 4,000 $12,000 $24,000 Balance November 30 $ 3,000 $15,000 $27,000 1) $15,000 2) $18,000 3) $19,000 4) $21,000 Tables Tables Present value interest factor of $1 per period at i% for n periods, PVIF(in). 0.907 Period 19 26 3% 44 696 79 B% 1 1096 996 11% 0.990 1396 0980 0.971 125 15% 0.962 0.952 0.935 0.943 0.920 0.917 2 0.00 0.961 0.900 0001 0.893 0.885 0.943 O 877 0870 0.925 0 000 0.873 0.857 0.971 0842 0.826 0.915 0.812 3 0.797 0.783 0.942 0 TO 0.756 0.889 0.884 0 840 0.816 0.794 0.772 0.751 0.712 0.731 0,693 0.961 0.675 4 0.924 0.888 0658 0955 0.823 0.792 0.763 0.735 0.70B 0683 0.636 5 0.951 0592 0.906 0659 0.863 0613 0.572 0822 0.784 0.747 0.713 0.681 0 650 0.621 0.593 0.567 0.543 0519 0.497 6 0.942 0888 0.837 0.790 0.746 0.705 0.686 0.630 0.596 0.584 0.535 0507 0.480 0455 0.432 7 0.933 0.871 0.813 0.760 0.711 0.665 0623 0.583 0547 0.513 0.482 0.452 0.425 0.400 0376 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0404 0.376 0.351 0.327 9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0460 0.424 0.391 0 361 0 333 0.308 0.284 10 0 905 0.820 0.744 0.676 0.614 0.558 0508 0.463 0.422 0 386 0.352 0.322 0 295 0270 0247 11 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0287 0.261 0.237 0215 12 0.887 0.788 0.701 0.625 0.55 0.497 0.444 0.397 0.356 0.319 0.286 0.257 0.231 0208 0.187 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.258 0.220 0.204 0.182 0.163 14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0 263 0.232 0205 0.181 0.160 0.141 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0275 0.239 0.200 0.183 0.160 0.140 0.123 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 0.141 0.123 0.107 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0270 0231 0.198 0.170 0.146 0.125 0.108 0.093 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 0.111 0.095 0.081 19 0.828 0.686 0.570 0.475 0.396 0 331 0.277 0.232 0.194 0.164 0.138 0.116 0.098 0.083 0.070 20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 0.087 0.073 0061 25 0.780 0.610 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 0.047 0.038 0.030 30 0.742 0.552 0.412 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 0.026 0.020 0.015 35 0.706 0.500 0.355 0.253 0.181 0.130 0.094 0.068 0.049 0.010 0.008 0.036 0.026 0.019 0.014 40 0.672 0.453 0.307 0.011 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0015 0.008 0.005 0.004 0.372 50 0.608 0.228 0.141 0.087 0.054 0.001 0.034 0.021 0.013 0.005 0.003 0.002 0.001 0009 Present value interest factor of an (ordinary) annuity of $1 per period at i% for n periods, PVIFA(i,n). 5% Period 1 1% 0.990 2% 0.980 3% 0.971 4% 0.962 6% 0.943 0.952 7% 0.935 1.808 8% 0.926 1.783 9% 10% 11% 12% 13% 14% 15% 0.917 0.909 0.901 0.893 0.885 0.877 0.870 1.759 1.736 1.713 1.690 1.668 1.647 1.626 859 Present value interest factor of an (ordinary) annuity of $1 per period at 1% forn periods, PVIFA(in). 0.920 0905 1.805 2.624 5242 Period on 0.000 0900 0071 0002 0 052 003 TOPO 1.042 1.013 1.80 1 850 1.833 2.941 2.884 22 2.775 2.723 2 673 4 3.902 300 3.717 3630 3485 4 4.713 4 580 4212 5.795 5.001 5076 4 917 7 6.728 6.472 0.230 6 002 5.786 5582 7.652 7.325 7.020 6.733 6.403 6.210 25.00 8. 182 7.760 7.435 7.108 6.802 TO 8.5.30 8.111 7722 7.300 11 10 358 9.787 9.253 8.700 8 300 7.887 12 11.255 10.575 0.054 9.385 8.803 8.384 13 12.134 11,348 10 035 9.986 9304 8053 14 13.004 12.106 11 296 10.563 9.899 9.295 13 805 12 849 11.938 11 116 10 380 9.712 16 14.718 13.578 12.561 11.652 10 838 10 106 17 15.562 14 292 13 166 12 100 11.274 10 477 18 16.398 14.992 13.754 12.650 11.690 10.828 19 17.228 15.678 14.324 13 134 12.085 11.158 20 18 046 16 351 14.877 1350012462111470 25/ 22.023 19.523 17.413 15.622 14.094 12 783 30 25.808 22 396 19 600 17.292 15.372 13.765 35 29.409 24.999 21.487 18.665 16.374 14.498 40 32 835 27 355 23 115 19.793 17. 159 15 046 50 39.196 31.424 25.730 21.482 18.256 702 4.100 4.767 5.380 5.971 6.515 7024 7.490 7.943 8 358 6.745 9108 9.447 9.783 10.059 10.330 10.594 11 654 12 409 12 948 13 332 13 801 2.577 3 312 3093 4623 5 200 5.747 6 247 6.710 7 130 7530 7 904 8 244 8 559 8.851 9.122 9 372 9.604 9818 10.675 11.258 11 655 11.925 12 233 10 0.017 0 000 0001 OTO 1.750 1.730 1.713 1.800 1.60 1620 2.531 2487 2.444 2.402 2351 2322 2283 3.240 3.170 3.102 3 OST 2 974 2014 2015 3 890 3.791 3 000 3.605 3517 3433 342 4.400 4 231 3.990 3.BBO 3 TBA 5033 4 BOB 4 712 4564 4200 4.100 5.535 5335 5.146 4 COB 4.790 4.630 44T 5.995 5.750 5.537 5328 5.132 4.0 4.772 6.418 6.145 5 BSD 5650 54265215 5010 6.805 6 207 5.938 5.6BT 5.453 5234 7 161 6.814 6492 6104 5.918 5.000 5421 7.487 7.103 6.750 6.424 6.122 5 B42 5.583 7.786 7367 6 982 6.628 6302 6002 5724 8.061 7006 7191 6811 6.462 6 142 5 BAT 8.313 7.824 7.379 6974 6.804 625 5954 3.544 B022 7.549 7.120 6.729 6373 6047 8.756 8.2017 702 7250 6.840 6.467 6.128 8.950 8.365 7.830 7.366 6938 6550 6198 9 129 8514 7.963 7419 70255023 0259 9.823 9077 8.422 7.843 7.330 6873 6464 10.274 9.427 8 894 8055 7496 7003 6.506 10 567 9.644 8 855 8.176 7.586 7070 0.617 10.757 9.779 8851 8 244 7.634 7.105 6842 10 962 9.915 9.042 8.304 7.675 7.133 6.661