Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What was the amount of provision for estimated uncollectible accounts for year 2? The Company has established an allowance for doubtful accounts. The allowance for

What was the amount of provision for estimated uncollectible accounts for year 2?

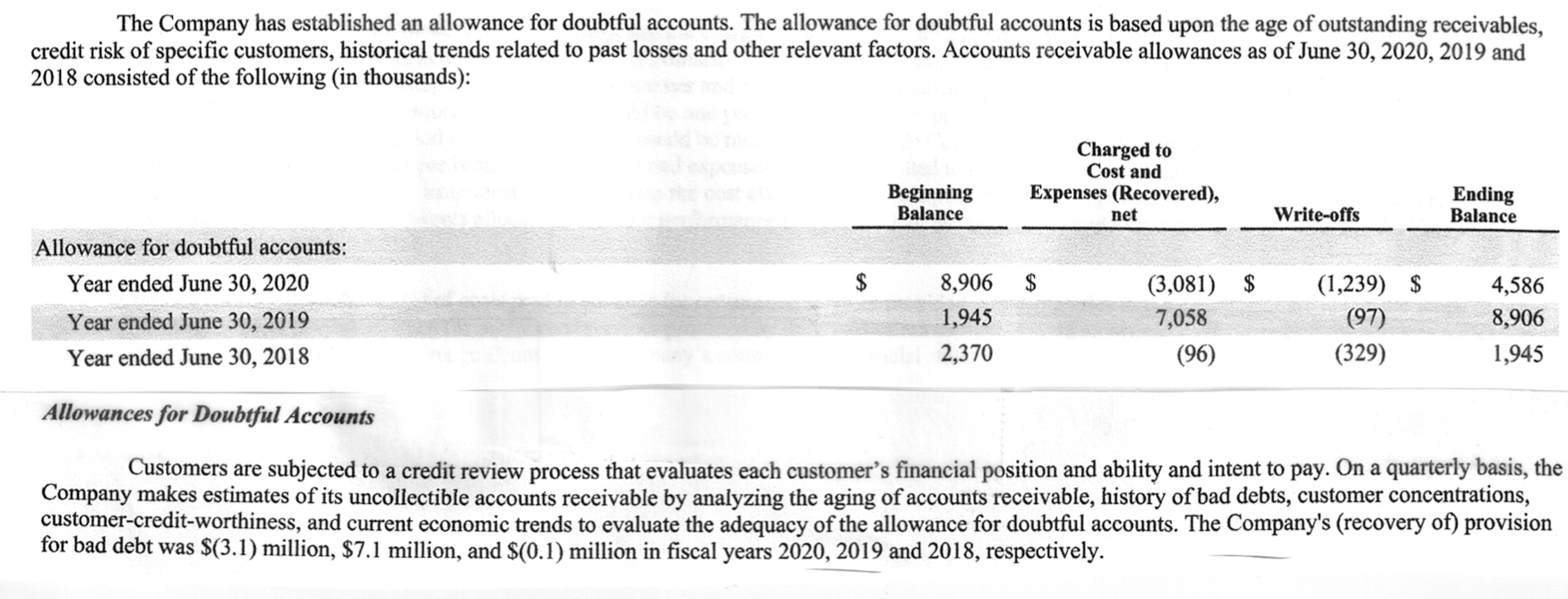

The Company has established an allowance for doubtful accounts. The allowance for doubtful accounts is based upon the age of outstanding receivables, credit risk of specific customers, historical trends related to past losses and other relevant factors. Accounts receivable allowances as of June 30, 2020, 2019 and 2018 consisted of the following (in thousands): Charged to Cost and Expenses (Recovered), Beginning Balance Ending Balance net Write-offs $ $ Allowance for doubtful accounts: Year ended June 30, 2020 Year ended June 30, 2019 Year ended June 30, 2018 8,906 1,945 2,370 (3,081) 7,058 (96) (1,239) $ (97) (329) 4,586 8,906 1,945 Allowances for Doubtful Accounts Customers are subjected to a credit review process that evaluates each customer's financial position and ability and intent to pay. On a quarterly basis, the Company makes estimates of its uncollectible accounts receivable by analyzing the aging of accounts receivable, history of bad debts, customer concentrations, customer-credit-worthiness, and current economic trends to evaluate the adequacy of the allowance for doubtful accounts. The Company's (recovery of) provision for bad debt was $(3.1) million, $7.1 million, and $(0.1) million in fiscal years 2020, 2019 and 2018, respectivelyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started