- What was the case study digital approach

- What is the current news for JP Morgan/Chase?Are they dabbling or have they taken steps to truly enter the the digital scene. Use other sources such as text found on social media etc

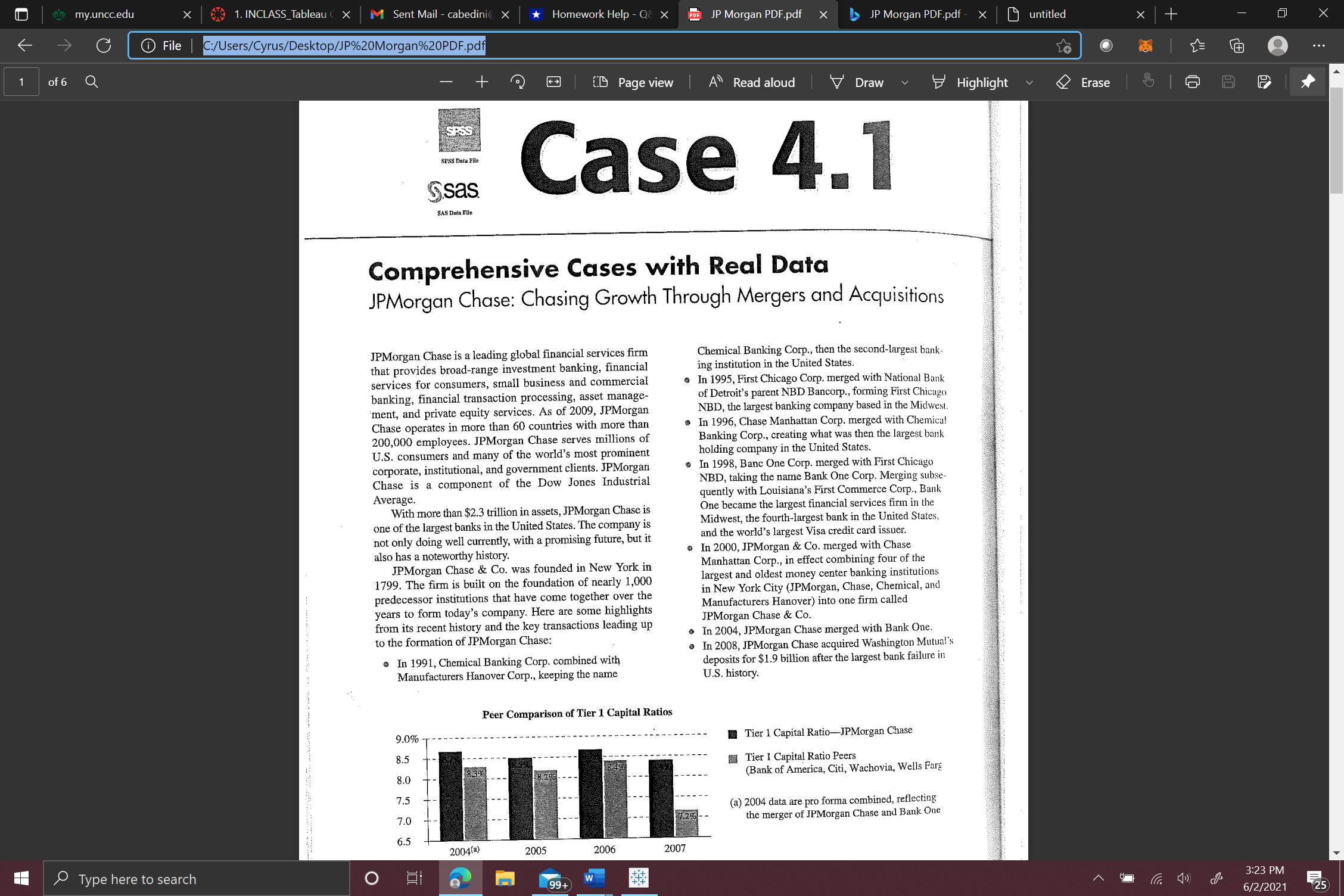

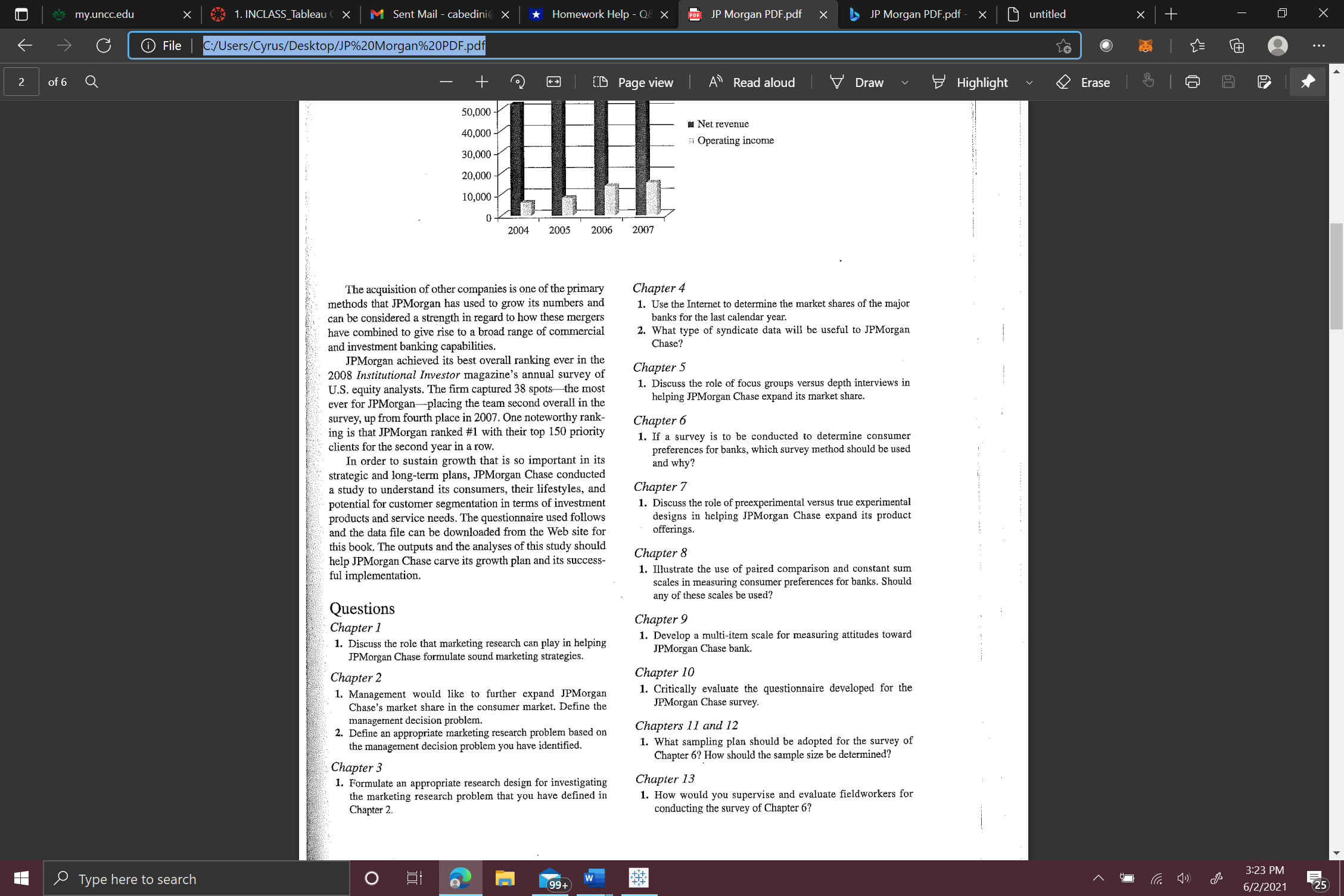

my.uncc.edu x 1. INCLASS_Tableau ( X M Sent Mail - cabedini( X *Homework Help - Q& X PDE JP Morgan PDF.pdf x JP Morgan PDF.pdf - x untitled X X C File C:/Users/Cyrus/Desktop/JP%20Morgan%20PDF.pdf O . . of 6 Q + CD Page view A Read aloud Draw Highlight Erase H P SPSS SPSS Data File Ssas Case 4.1 SAS Data File Comprehensive Cases with Real Data JPMorgan Chase: Chasing Growth Through Mergers and Acquisitions JPMorgan Chase is a leading global financial services firm Chemical Banking Corp., then the second-largest bank- that provides broad-range investment banking, financial ing institution in the United States. services for consumers, small business and commercial In 1995, First Chicago Corp. merged with National Bank banking, financial transaction processing, asset manage- of Detroit's parent NBD Bancorp., forming First Chicago ment, and private equity services. As of 2009, JPMorgan NBD, the largest banking company based in the Midwest. Chase operates in more than 60 countries with more than In 1996, Chase Manhattan Corp. merged with Chemical 200,000 employees. JPMorgan Chase serves millions of Banking Corp., creating what was then the largest bank U.S. consumers and many of the world's most prominent holding company in the United States. corporate, institutional, and government clients. JPMorgan In 1998, Banc One Corp. merged with First Chicago Chase is a component of the Dow Jones Industrial NBD, taking the name Bank One Corp. Merging subse- Average. quently with Louisiana's First Commerce Corp., Bank With more than $2.3 trillion in assets, JPMorgan Chase is One became the largest financial services firm in the one of the largest banks in the United Midwest, the fourth-largest bank in the United States not only doing well currently, with a promising future, but it and the world's largest Visa credit card issuer. also has a noteworthy history. In 2000, JPMorgan & Co. merged with Chase JPMorgan Chase & Co. was founded in New York in Manhattan Corp., in effect combining four of the 1799. The firm is built on the foundation of nearly 1,000 largest and oldest money center banking institutions predecessor institutions that have come together over the in New York City (JPMorgan, Chase, Chemical, and years to form today's company. Here are some highlights Manufacturers Hanover) into one firm called from its recent history and the key transactions leading up JPMorgan Chase & Co to the formation of JPMorgan Chase In 2004, JPMorgan Chase merged with Bank One. In 2008, JPMorgan Chase acquired Washington Mutual's In 1991, Chemical Banking Corp. combined with deposits for $1.9 billion after the largest bank failure in Manufacturers Hanover Corp., keeping the name U.S. history. Peer Comparison of Tier 1 Capital Ratios 9.0% T - Tier 1 Capital Ratio-JPMorgan Chase 8.5 Tier 1 Capital Ratio Peers 8.0 (Bank of America, Citi, Wachovia, Wells Farg 7.5 (a) 2004 data are pro forma combined, reflecting 7.0 the merger of JPMorgan Chase and Bank One 6.5 2004(a) 2005 2006 2007 Type here to search O 1994 w 3:23 PM 6/2/2021m w u m: edu \\ G) File U Type here to se rm jainleai \\ ' . \"(Mall' *ietli' \\ 2004 1005 2006 The acquisition of other companies is one of the primary methods that JPMorgan has used to grow its numbers and can be considered a strength in regard to how these mergers have combined to give rise to a broad range of commercial and investment banking capabilities. J'PMorgan achieved its best overall ranking ever in the ' ' 2008 Institutional Investor magazine's annual survey of US. equity analysis. The firm captured 38 spotsthe most ever for IPMorganplacing the team second overall in the survey, up {mm fourth place in 2W7. One noteworthy rank ing is that JPMorgan ranked #1 with their top 150 priority clients for the second year in a row. In order to sustain growth that is so important in its ~ strategic and long-term plans, JPMorgnn Chase conducted a study to understand its consumers, their lifestyles, and potential for customer segmentation in terms of investment products and service needs The questionnaire used follows and the data file can be downloaded from the Web site for this book. The outputs and the analyses of this study should help J'PMorgan Chase carve its growth plan and its success- ful implementation. Questions Chapter I 1. Discuss the role that marketing research can play in helping IPMurgsn Chase formulate sound murketing strategies. Chapter 2 1. Management would like to further Expand IPMorgnn Chase's market share in the consumer market. Dene the management decision problem. 2. Dene an nppa'uyriahe marketing research problem based on the management decision problem you have identied. . C hapreri !. Formulate an appropriate research design for investigating the marketing research problem that you have dened in 1! Homer ni Helpr \\ JP Morgan PDF.pdf \\ A' Read aloud V Draw I Net revenue . Operating income 2007 Chapter 4 1. Use the Internet to determine the marloet shares of the major banks for the last calendar year. 2. What type of syndicate data will be useful to JPMorgan Chase? Chapter 5 1. Discuss the role of focus groups versus depth interviews in helping Morgan Chase expand its market share. Chapter 6 I. If a survey is to he conducted to determine consumer preferences for banks, which survey method should be used and why? Chapter 7 1. Discuss the role ofpreexperimental versus true experimental designs in helping JPMorgnn Chris: expand its pruduct offerings. Chapter 8 1. Illustrate the use of paired comparison and constant sum scales in measuring consumer preferences for hanks. Should any of these scales he used? Chapter 9 1. Develop r multidiem scale for measuring attitudes toward JPMorgan Chase bank. Chapter 10 1. Critically evaluate the questionnaire developed for the IPMargan Chase survey. Chapters 11 and 12 1. What sampling plan should be Adopted for the survey of Chapter 6'2VHow should the sample size be determined? Chapter 13 1. How would you supervise and evaluate fieldworkers for conducting the survey of Chapter 67 JP Morgan not will \\ '3' Highlig [\"1 untitled Li; F' M ('21 Fas