Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What was the cost of the completed jobs for 2020? 2. Compute for the amount of direct materials issues to production during 2020. 3. What

What was the cost of the completed jobs for 2020?

2. Compute for the amount of direct materials issues to production during 2020.

3. What is the operating income (loss) for 2020 assuming the under or overapplied overhead is closed to cost of goods sold?

4. What is the operating income (loss) for 2020 assuming the under or overapplied overhead is prorated to the related accounts?

2. Compute for the amount of direct materials issues to production during 2020.

3. What is the operating income (loss) for 2020 assuming the under or overapplied overhead is closed to cost of goods sold?

4. What is the operating income (loss) for 2020 assuming the under or overapplied overhead is prorated to the related accounts?

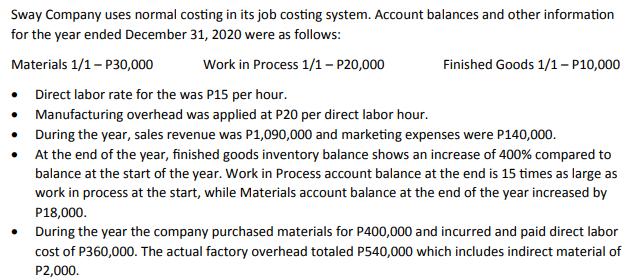

Sway Company uses normal costing in its job costing system. Account balances and other information for the year ended December 31, 2020 were as follows: Materials 1/1 - P30,000 Work in Process 1/1 - P20,000 Finished Goods 1/1 - P10,000 Direct labor rate for the was P15 per hour. Manufacturing overhead was applied at P20 per direct labor hour. During the year, sales revenue was P1,090,000 and marketing expenses were P140,000. At the end of the year, finished goods inventory balance shows an increase of 400% compared to balance at the start of the year. Work in Process account balance at the end is 15 times as large as work in process at the start, while Materials account balance at the end of the year increased by P18,000. During the year the company purchased materials for P400,000 and incurred and paid direct labor cost of P360,000. The actual factory overhead totaled P540,000 which includes indirect material of P2,000.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Cost of Completed Jobs for 2020 To calculate the cost of completed jobs we need to calculate the manufacturing costs for the jobs that were complete...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started