Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Laila Company developed a new machine for manufacturing baseballs and is patented. The related costs at the beginning of the year are: Purchase of

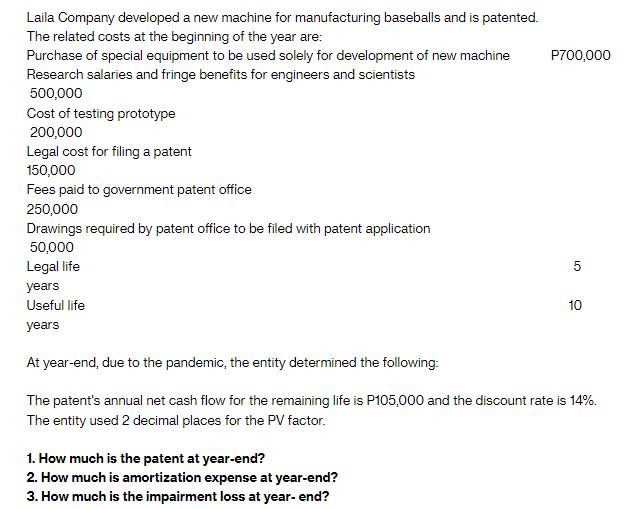

Laila Company developed a new machine for manufacturing baseballs and is patented. The related costs at the beginning of the year are: Purchase of special equipment to be used solely for development of new machine Research salaries and fringe benefits for engineers and scientists 500,000 Cost of testing prototype 200,000 P700,000 Legal cost for filing a patent 150,000 Fees paid to government patent office 250,000 Drawings required by patent office to be filed with patent application 50,000 Legal life years Useful life years At year-end, due to the pandemic, the entity determined the following: The patent's annual net cash flow for the remaining life is P105,000 and the discount rate is 14%. The entity used 2 decimal places for the PV factor. 1. How much is the patent at year-end? 2. How much is amortization expense at year-end? 3. How much is the impairment loss at year-end? 31 10

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the various values at yearend for the patent we need to consider the following information Initial costs Purchase of special equipment P7...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started