What was the effective tax rate in 2018?

| |

| | | 20.1%.radio button unchecked1 of 3 | | Higher than the year before.radio button unchecked2 of 3 | | 25.8%.radio button unchecked3 of 3 | |

What is the primary reason that net deferred tax assets declined in 2018 and later?

| |

| | | Deferred tax assets began to exceed deferred tax liabilities in 2018.radio button unchecked1 of 3 | | Deferred tax liabilities began to exceed deferred tax assets in 2018.radio button unchecked2 of 3 | | Due to the 2018 statutory tax rate reduction, remeasurement of deferred tax assets and liabilities reflect smaller future deductible and taxable amounts, respectively.radio button unchecked3 of 3 | |

How would you explain the primary reason that the effective tax rate in 2018 did not decline to the levels of 2019 and later?

| |

| | | Deferred tax liabilities were less than deferred tax assets after remeasurement pursuant to the 2018 statutory tax rate reduction.radio button unchecked1 of 3 | | Deferred tax assets were higher than deferred tax liabilities after remeasurement pursuant to the 2018 statutory tax rate reduction.radio button unchecked2 of 3 | | It took time for tax expense to adjust to the new tax law. | |

What is the likely reason that income tax expense in 2018 was higher than in 2019 although income before taxes was higher in 2019?

| |

| | | Income tax expense is higher when income before taxes is lower.radio button unchecked1 of 3 | | The company debited Income tax expense and credited Deferred tax assets after remeasuring the liability due to the 2018 tax rate reduction.radio button unchecked2 of 3 | | The company debited Income tax expense and credited Deferred tax liabilities after remeasuring the liability due to the 2018 tax rate reduction.radio button unchecked3 of 3 | |

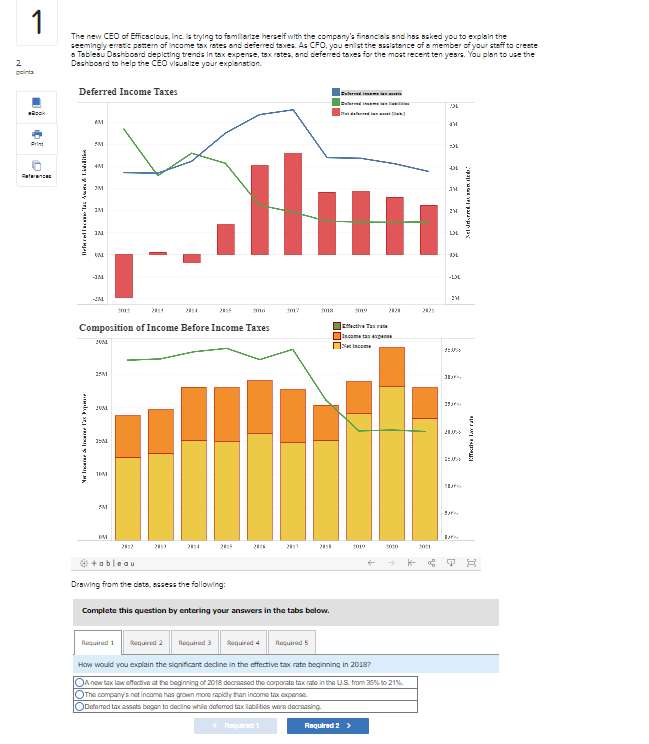

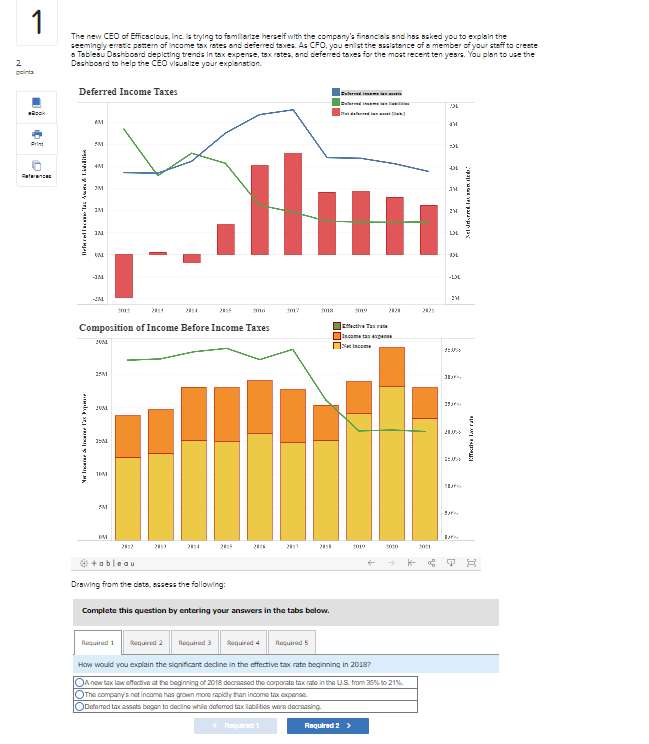

1 The new CEO of Efficscious, Inc. is trying to familiarize herself with the company's financials and has asked you to explain the seemingly errstic pattern of income tax rates and deferred taxes. As CFO, you enlist the sssistance of a member of your staff to create Tablesu Dashboard depleting trends in tax expense, taxistes, and deferred taxes for the most recent ten years. You plan to use the Dashboard to help the CEO visualize your explanation 2. Deferred Income Taxes L AM 3M SM 2.5L 4M -DL .74 llevarlas I.Wit Hot IM 2 Nel Jarra IN LOL W OL -JN -DL IN 2 2020 Composition of Income Before Income Taxes the Tas Income 19 Ir 201. 351 Welce Scene 12 Iecara lay rate S. 10M 11. SM IM 2012 2011 2015 2016 2011 2015 10 +ableau Drawing from the data assess the following: Complete this question by entering your answers in the tabs below. Paduired 1 Rouquired 2 Racuired 3 quired 4 Required How would you explain the significant decline in the effective tax rate beginning in 2018? OA now tax law offective at the beginning of 2018 decreased the corporate tax rate in the US from 35,00 21% The companys not income has grown more rapidly than income tax expense. ODeferred to as began to decline while inferred tax liabilities were decreasing.

1 The new CEO of Efficscious, Inc. is trying to familiarize herself with the company's financials and has asked you to explain the seemingly errstic pattern of income tax rates and deferred taxes. As CFO, you enlist the sssistance of a member of your staff to create Tablesu Dashboard depleting trends in tax expense, taxistes, and deferred taxes for the most recent ten years. You plan to use the Dashboard to help the CEO visualize your explanation 2. Deferred Income Taxes L AM 3M SM 2.5L 4M -DL .74 llevarlas I.Wit Hot IM 2 Nel Jarra IN LOL W OL -JN -DL IN 2 2020 Composition of Income Before Income Taxes the Tas Income 19 Ir 201. 351 Welce Scene 12 Iecara lay rate S. 10M 11. SM IM 2012 2011 2015 2016 2011 2015 10 +ableau Drawing from the data assess the following: Complete this question by entering your answers in the tabs below. Paduired 1 Rouquired 2 Racuired 3 quired 4 Required How would you explain the significant decline in the effective tax rate beginning in 2018? OA now tax law offective at the beginning of 2018 decreased the corporate tax rate in the US from 35,00 21% The companys not income has grown more rapidly than income tax expense. ODeferred to as began to decline while inferred tax liabilities were decreasing.