Question

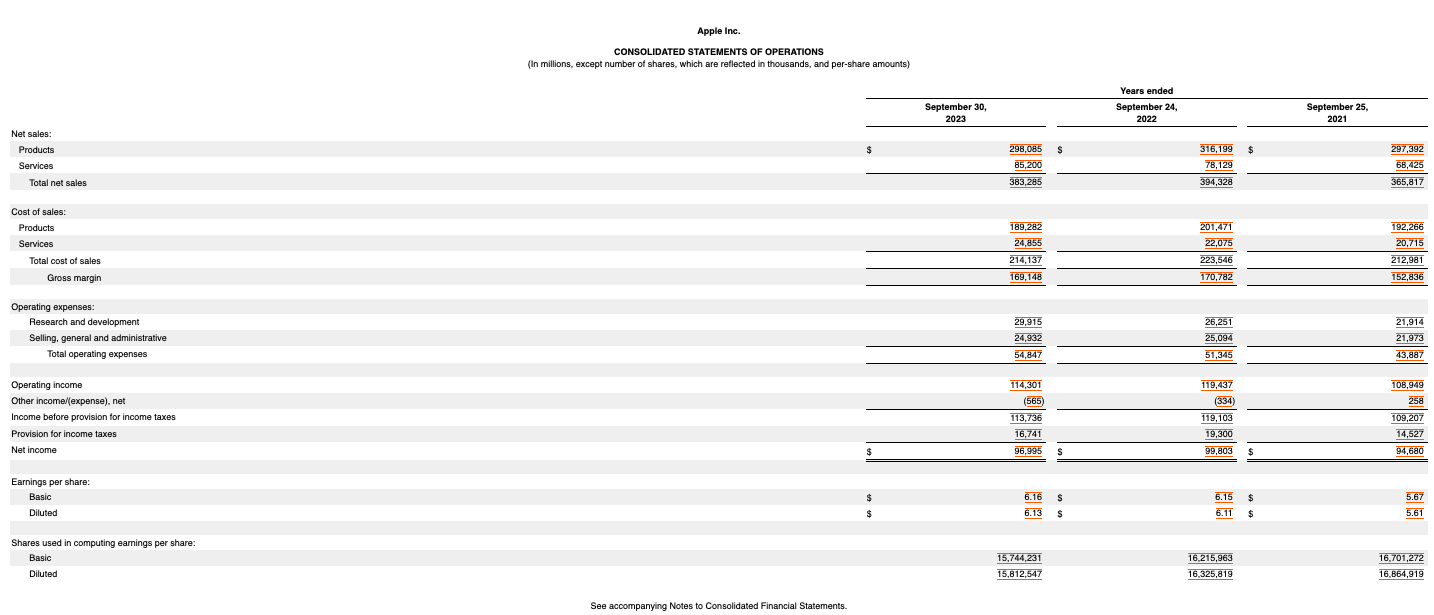

What were net sales (remember to adjust the amounts in the statements as needed - some are in thousands, some in millions)? The Net Sales

- What were net sales (remember to adjust the amounts in the statements as needed - some are in thousands, some in millions)?

The Net Sales for the year of 2023 is $298,085,000,000 The Net Sales for the previous year ending September 29, 2022: $394,328,000

- Were sales up or down compared to the previous year?

The sales were down compared to the previous year since in 2023

- WHY?

According to the Management's Discussion and Analysis of Financial Condition and Results of Operations, net sales decreased compared to the previous year due to a weakness in foreign currencies specifically the US dollar. iPhone net sales decreasing by $4.9 billion compared to 2022 due to less net sales of non- pro iPhone models (SEC, n.d). Additionally, iPad net sales decreased by $10.8 billion because of a lower net sale of laptops. iPad net sales also decreased by $1.0 billion due to lower net sales of iPad mini and iPad Air. Finally, the net sales decreased due to a decrease of 3% of wearables, home, and accessories. Consumers were not pleased about the higher net sales of services, leading to lower net sales of products.

- What was net income (loss) before taxes and interest?

The net income before taxes and interest is $113,736,000,000.

- What was net income (loss) after taxes and interest?

The net income after taxes and interest is $96,995,000,000.

- Was net income greater or less than the previous year?

The net income is less than the previous year.

WHY?

The net income decreased by 3% due to a weakness in foreign currencies relative to the U.S. dollar. This accounted for more than the entire year-over-year decrease in total net sales, which consisted primarily of lower net sales of Mac and iPhone, partially offset by higher net sales of Services (SEC, n.d).

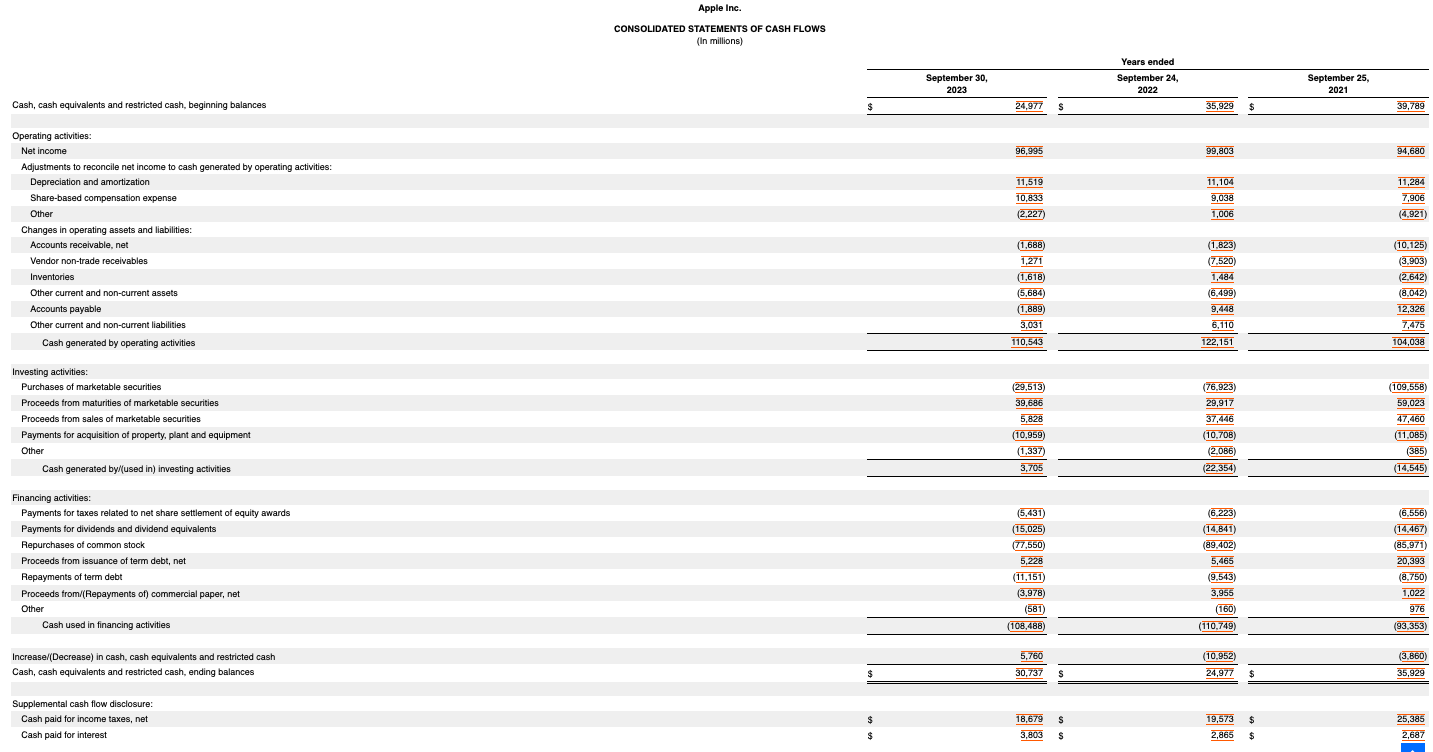

- What was the biggest source of cash flow for the company?

The biggest source of cash flow for the company is Proceeds from maturities of marketable securities $39,686,000,000.

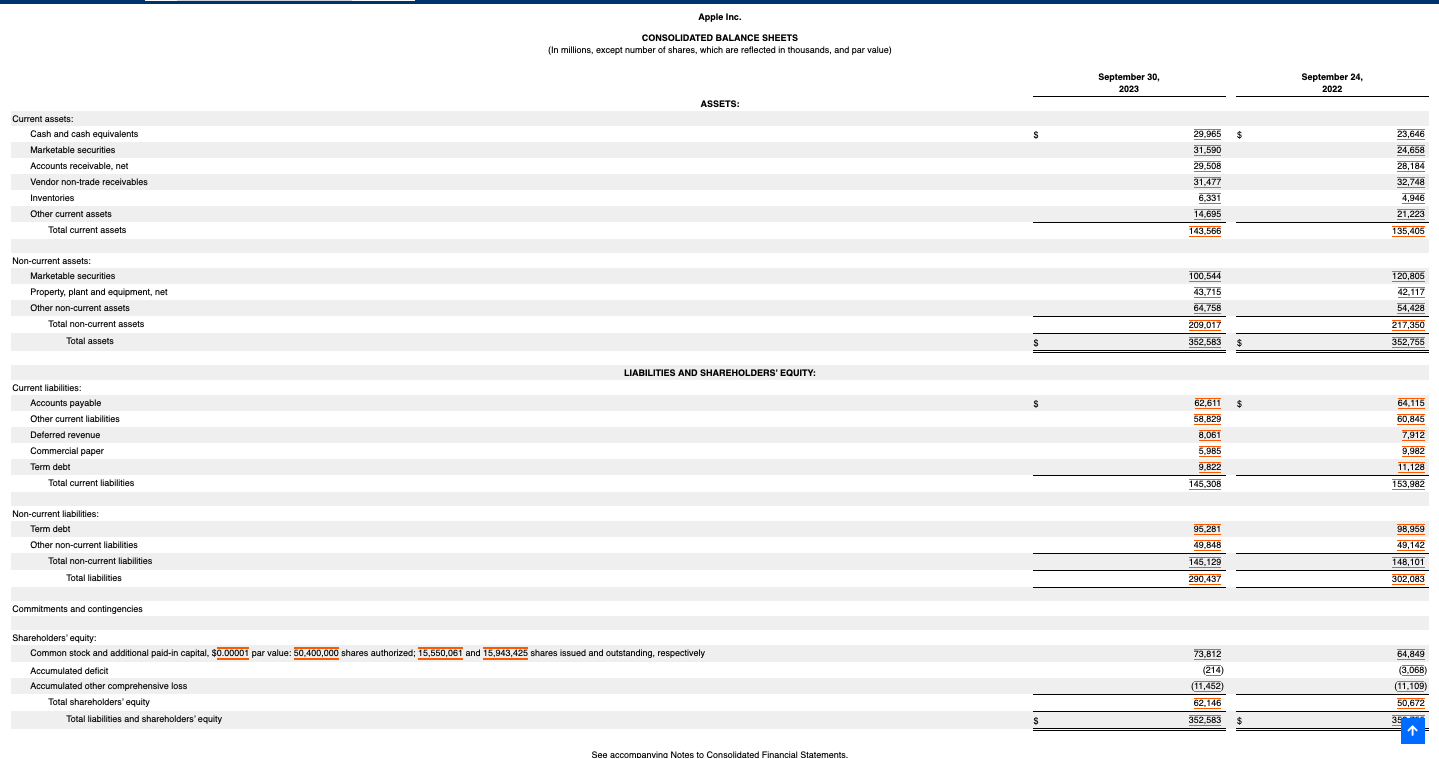

- What were total assets?

The total assets for Apple Inc are $352,583,000,000 (total current assets + Total non-current assets)

- What was the single largest category of assets?

The single largest category of assets was Marketable Securities $100,544,000,000

- What were total liabilities?

The total liabilities was $290,437,000,000 (total current liabilities + Total non-current liabilities)

- What was the single largest liability?

The single largest liability was Term Debt $95,281,000,000

Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Vendor non-trade receivables Inventories Other current assets Total current assets Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares, which are reflected in thousands, and par value) September 30, 2023 ASSETS: September 24, 2022 29,965 23,646 31,590 24,658 29,508 28,184 31,477 32,748 6,331 4,946 14,695 143,566 21,223 135,405 100,544 120,805 43,715 42,117 64,758 54,428 209,017 217,350 352,583 $ 352,755 LIABILITIES AND SHAREHOLDERS' EQUITY: Non-current liabilities: Term debt Other non-current liabilities Total non-current liabilities Total liabilities Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 50,400,000 shares authorized; 15,550,061 and 15,943,425 shares issued and outstanding, respectively Accumulated deficit Accumulated other comprehensive loss Total shareholders' equity Total liabilities and shareholders' equity See accompanying Notes to Consolidated Financial Statements. 62,611 $ 64,115 58,829 60,845 8,061 7,912 5,985 9,982 9,822 11,128 145,308 153,982 95,281 98,959 49,848 49,142 145,129 148,101 290,437 302,083 73,812 64,849 (214) (3,068) (11,452) 62,146 (11,109) 50,672 352,583 35

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started