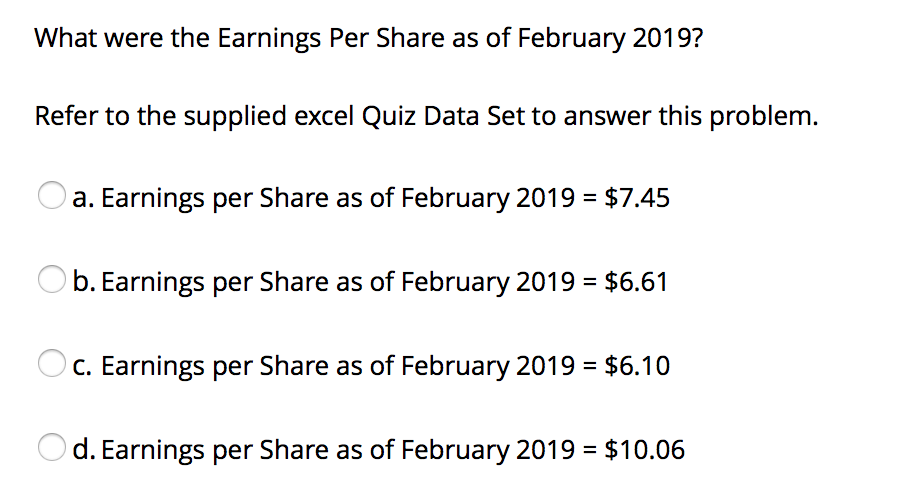

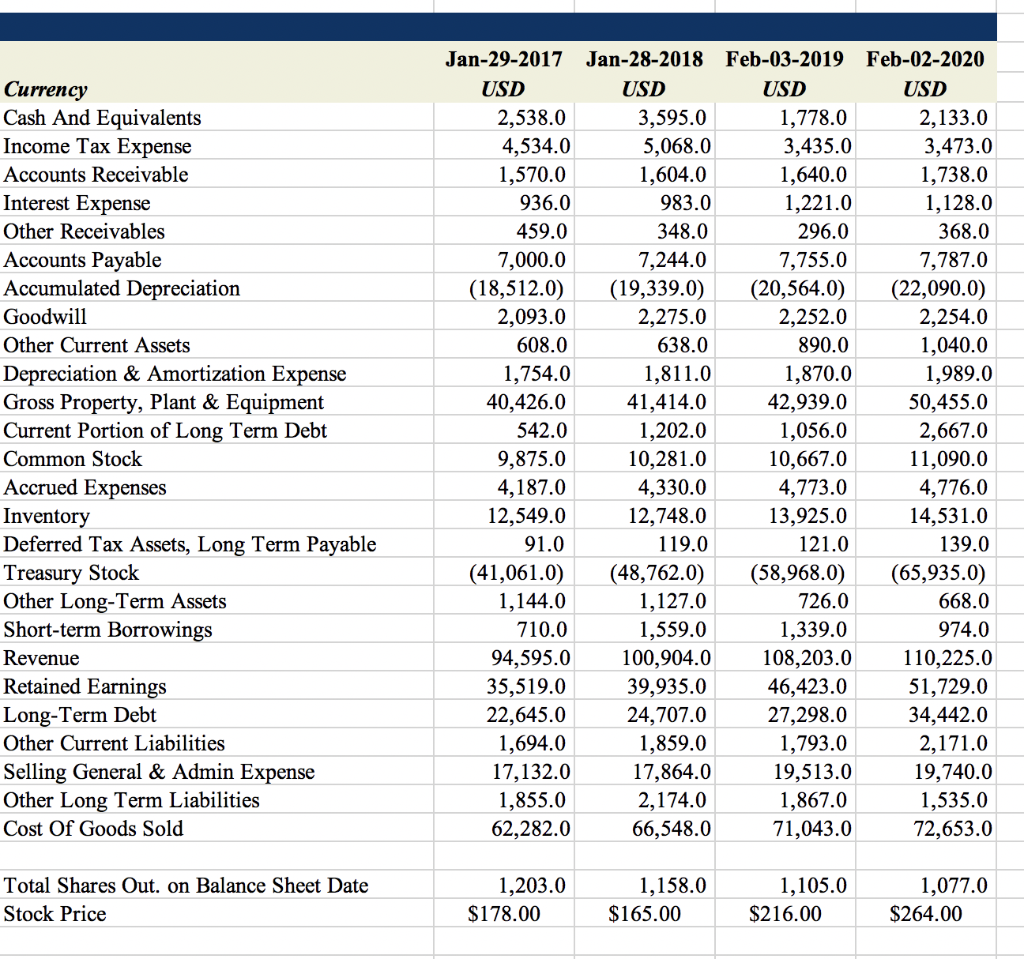

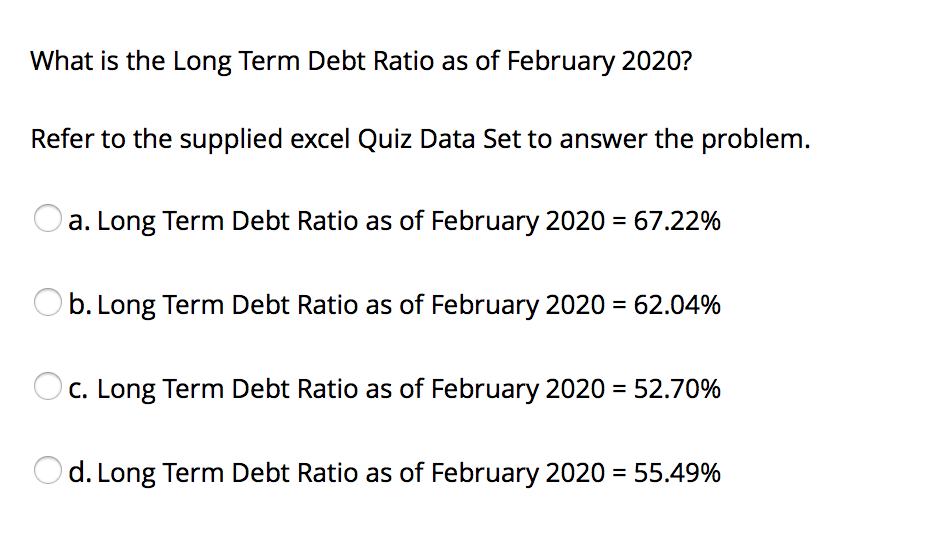

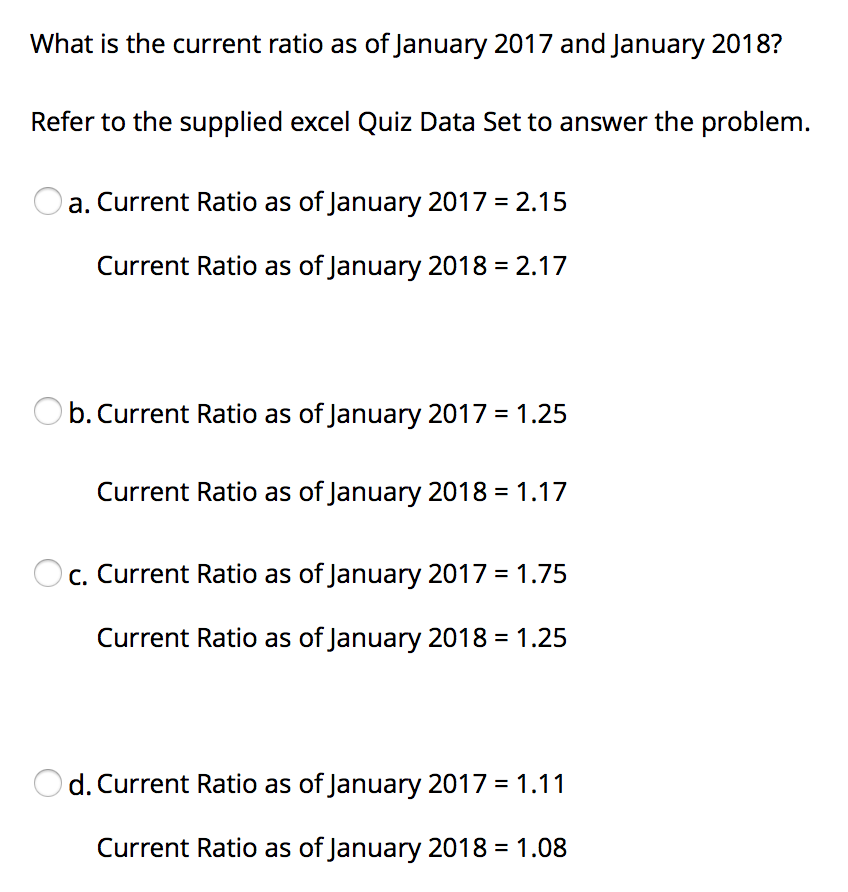

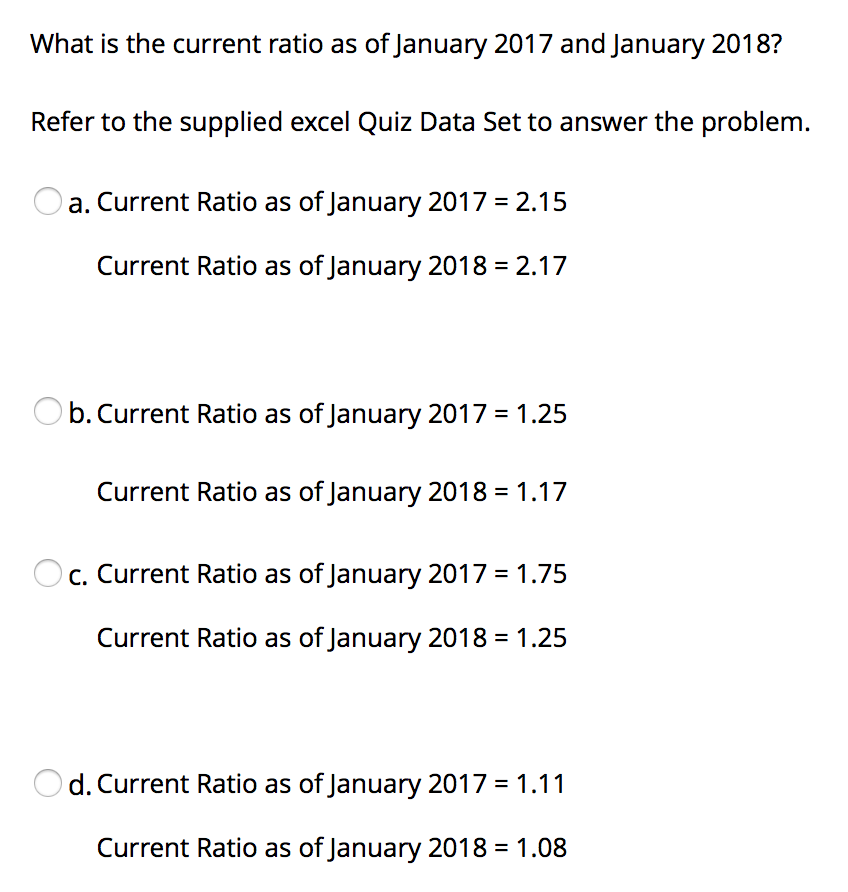

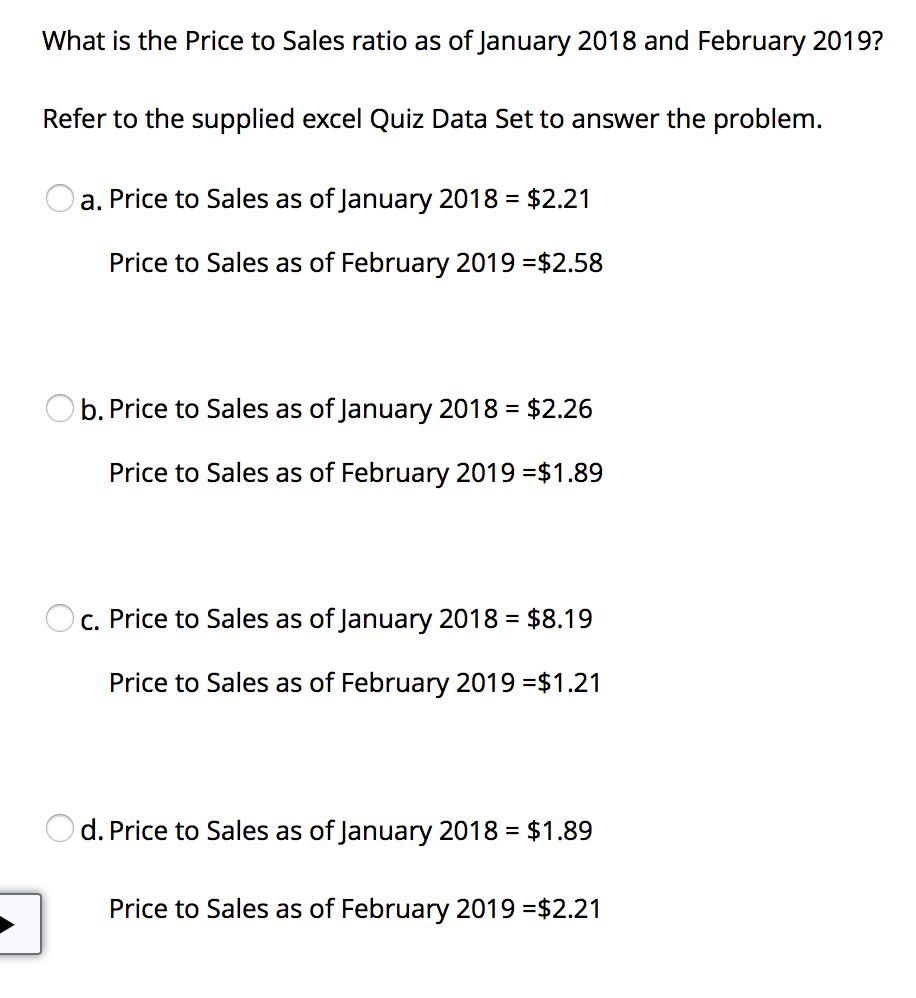

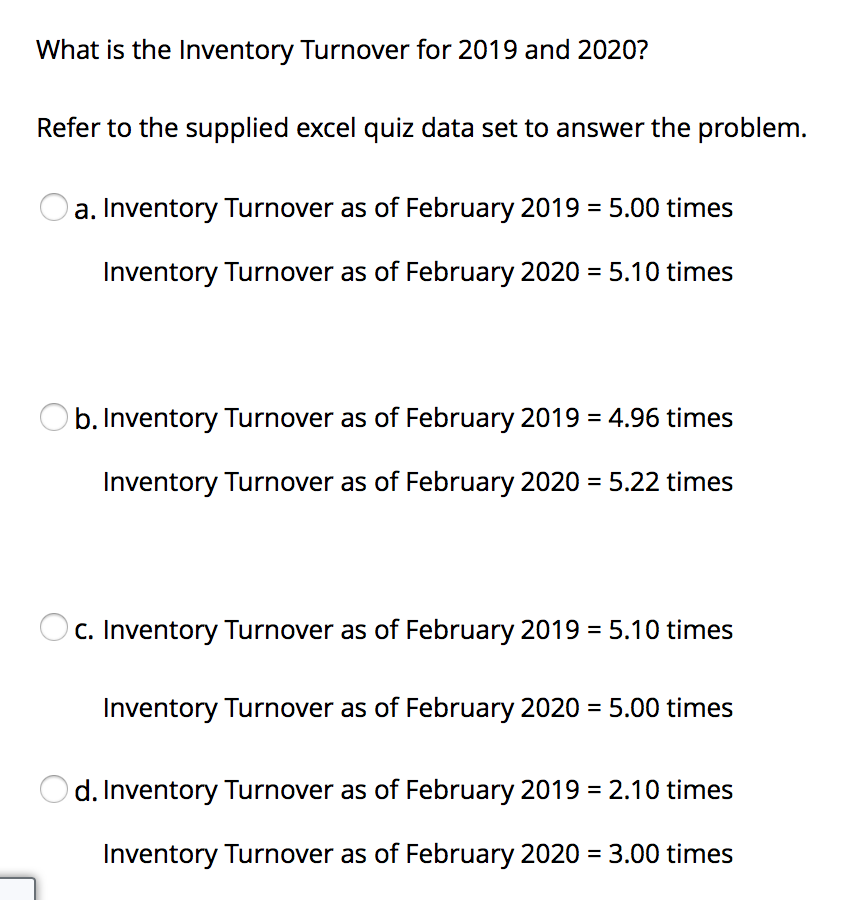

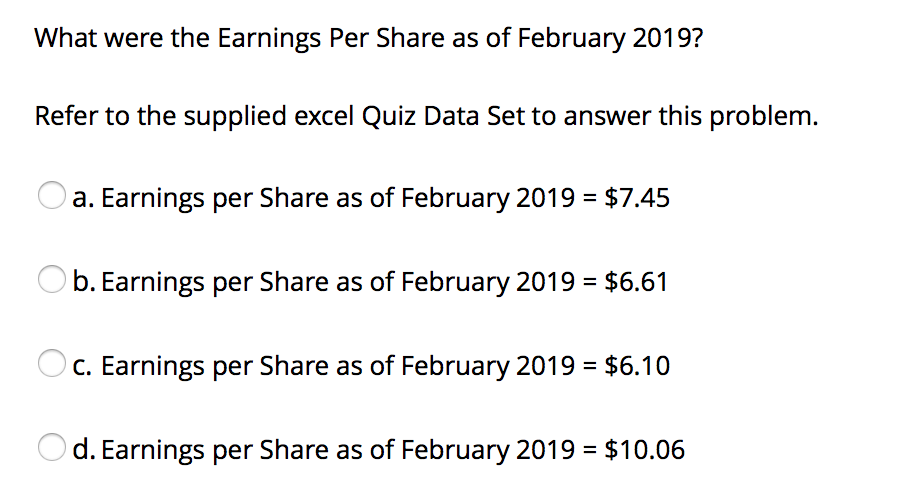

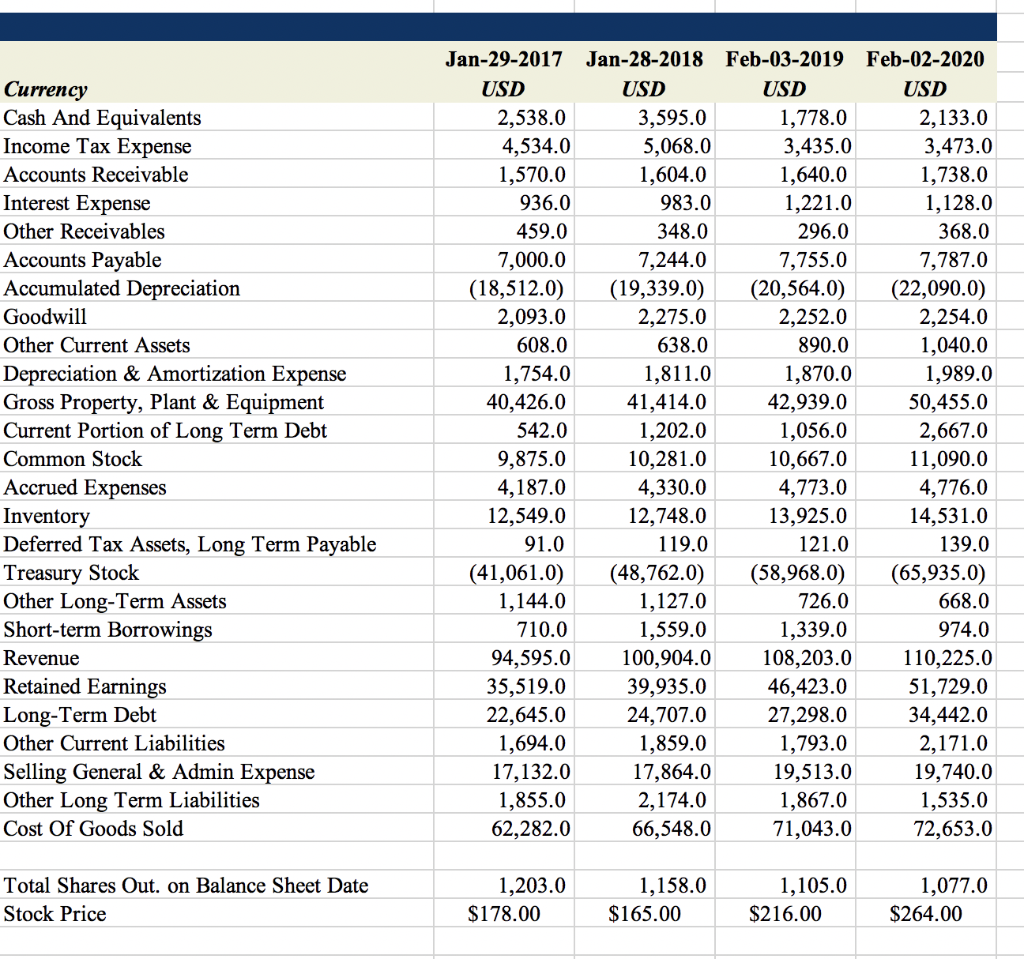

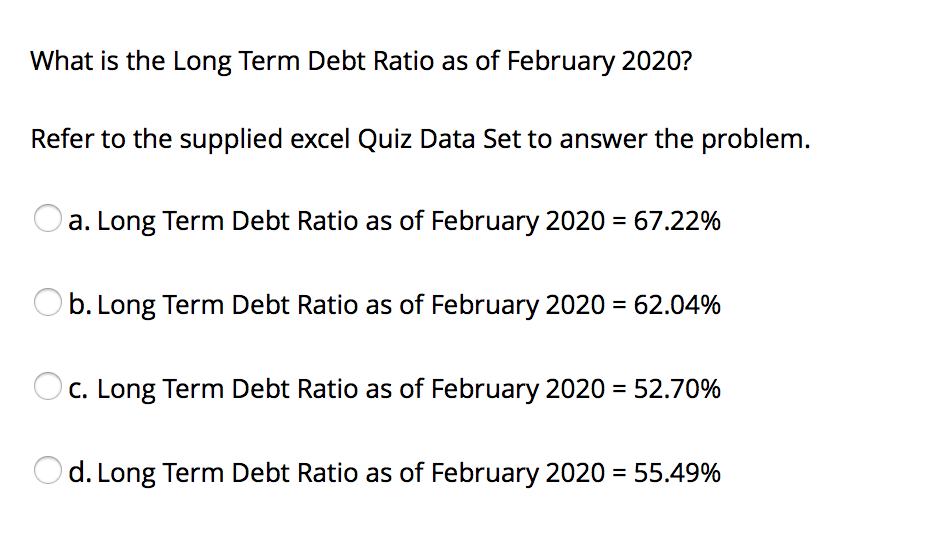

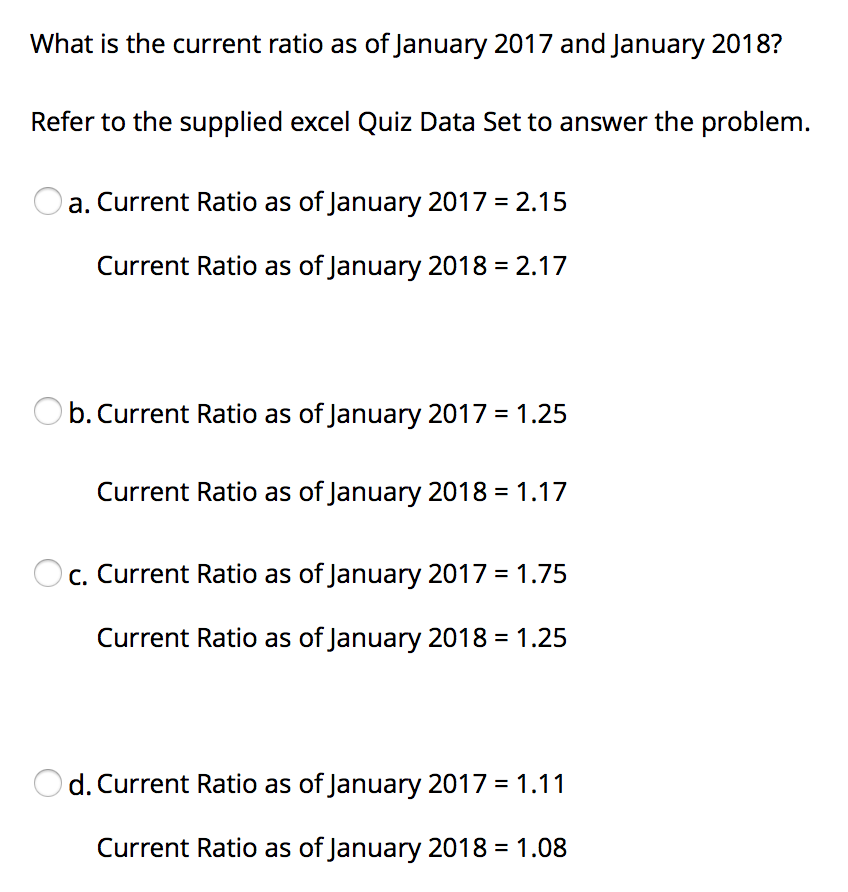

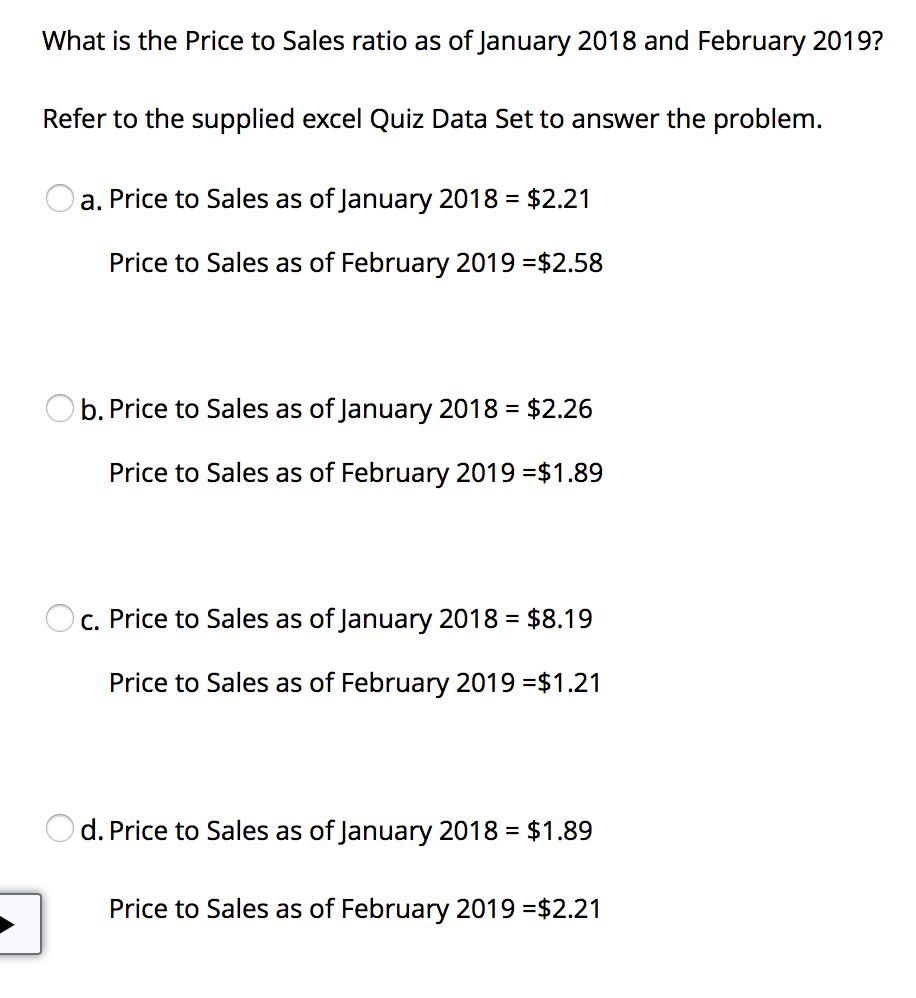

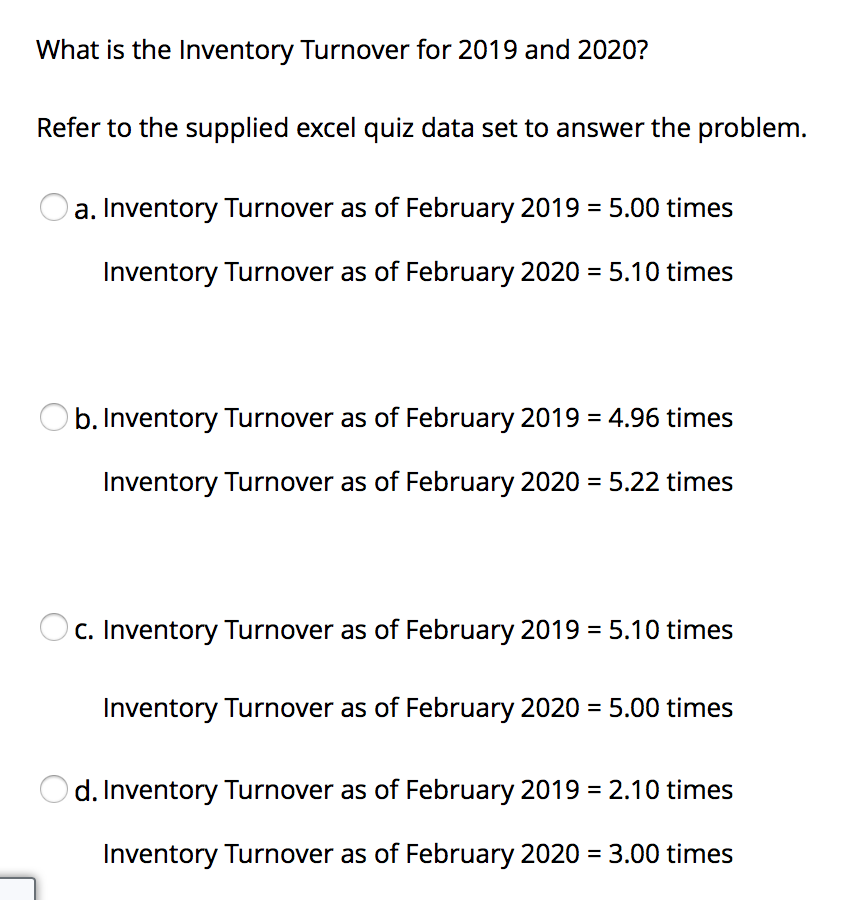

What were the Earnings Per Share as of February 2019? Refer to the supplied excel Quiz Data Set to answer this problem. a. Earnings per Share as of February 2019 = $7.45 b. Earnings per Share as of February 2019 = $6.61 Oc. Earnings per Share as of February 2019 = $6.10 O d. Earnings per Share as of February 2019 = $10.06 Currency Cash And Equivalents Income Tax Expense Accounts Receivable Interest Expense Other Receivables Accounts Payable Accumulated Depreciation Goodwill Other Current Assets Depreciation & Amortization Expense Gross Property, Plant & Equipment Current Portion of Long Term Debt Common Stock Accrued Expenses Inventory Deferred Tax Assets, Long Term Payable Treasury Stock Other Long-Term Assets Short-term Borrowings Revenue Retained Earnings Long-Term Debt Other Current Liabilities Selling General & Admin Expense Other Long Term Liabilities Cost Of Goods Sold Jan-29-2017 USD 2,538.0 4,534.0 1,570.0 936.0 459.0 7,000.0 (18,512.0) 2,093.0 608.0 1,754.0 40,426.0 542.0 9,875.0 4,187.0 12,549.0 91.0 (41,061.0) 1,144.0 710.0 94,595.0 35,519.0 22,645.0 1,694.0 17,132.0 1,855.0 62,282.0 Jan-28-2018 USD 3,595.0 5,068.0 1,604.0 983.0 348.0 7,244.0 (19,339.0) 2,275.0 638.0 1,811.0 41,414.0 1,202.0 10,281.0 4,330.0 12,748.0 119.0 (48,762.0) 1,127.0 1,559.0 100,904.0 39,935.0 24,707.0 1,859.0 17,864.0 2,174.0 66,548.0 Feb-03-2019 USD 1,778.0 3,435.0 1,640.0 1,221.0 296.0 7,755.0 (20,564.0) 2,252.0 890.0 1,870.0 42,939.0 1,056.0 10,667.0 4,773.0 13,925.0 121.0 (58,968.0) 726.0 1,339.0 108,203.0 46,423.0 27,298.0 1,793.0 19,513.0 1,867.0 71,043.0 Feb-02-2020 USD 2,133.0 3,473.0 1,738.0 1,128.0 368.0 7,787.0 (22,090.0) 2,254.0 1,040.0 1,989.0 50,455.0 2,667.0 11,090.0 4,776.0 14,531.0 139.0 (65,935.0) 668.0 974.0 110,225.0 51,729.0 34,442.0 2,171.0 19,740.0 1,535.0 72,653.0 Total Shares Out. on Balance Sheet Date Stock Price 1,203.0 $178.00 1,158.0 $165.00 1,105.0 $216.00 1,077.0 $264.00 What is the Long Term Debt Ratio as of February 2020? Refer to the supplied excel Quiz Data Set to answer the problem. a. Long Term Debt Ratio as of February 2020 = 67.22% O b. Long Term Debt Ratio as of February 2020 = 62.04% C. Long Term Debt Ratio as of February 2020 = 52.70% O d. Long Term Debt Ratio as of February 2020 = 55.49% What is the current ratio as of January 2017 and January 2018? Refer to the supplied excel Quiz Data Set to answer the problem. a. Current Ratio as of January 2017 = 2.15 Current Ratio as of January 2018 = 2.17 O b. Current Ratio as of January 2017 = 1.25 Current Ratio as of January 2018 = 1.17 C. Current Ratio as of January 2017 = 1.75 Current Ratio as of January 2018 = 1.25 Od. Current Ratio as of January 2017 = 1.11 Current Ratio as of January 2018 = 1.08 What is the current ratio as of January 2017 and January 2018? Refer to the supplied excel Quiz Data Set to answer the problem. a. Current Ratio as of January 2017 = 2.15 Current Ratio as of January 2018 = 2.17 O b. Current Ratio as of January 2017 = 1.25 Current Ratio as of January 2018 = 1.17 C. Current Ratio as of January 2017 = 1.75 Current Ratio as of January 2018 = 1.25 Od. Current Ratio as of January 2017 = 1.11 Current Ratio as of January 2018 = 1.08 What is the Price to Sales ratio as of January 2018 and February 2019? Refer to the supplied excel Quiz Data Set to answer the problem. a. Price to Sales as of January 2018 = $2.21 Price to Sales as of February 2019 =$2.58 b. Price to Sales as of January 2018 = $2.26 Price to Sales as of February 2019 =$1.89 O c. Price to Sales as of January 2018 = $8.19 Price to Sales as of February 2019 =$1.21 Od. Price to Sales as of January 2018 = $1.89 Price to Sales as of February 2019 =$2.21 What is the Inventory Turnover for 2019 and 2020? Refer to the supplied excel quiz data set to answer the problem. a. Inventory Turnover as of February 2019 = 5.00 times Inventory Turnover as of February 2020 = 5.10 times O b. Inventory Turnover as of February 2019 = 4.96 times Inventory Turnover as of February 2020 = 5.22 times O c. Inventory Turnover as of February 2019 = 5.10 times Inventory Turnover as of February 2020 = 5.00 times d. Inventory Turnover as of February 2019 = 2.10 times Inventory Turnover as of February 2020 = 3.00 times