Question

What were the last prices of the bonds (listed in the Last Sale column)? Assume that par value of the bond is $1,000. How much

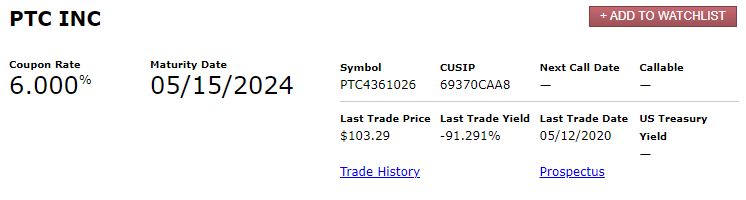

What were the last prices of the bonds (listed in the Last Sale column)? Assume that par value of the bond is $1,000. How much the investor will pay for the bond if he/she purchased the bond at the Price listed in the Last Sale column. Show your work in your project.

Assume that par value of the bond is $1,000. Calculate the annual coupon interest payments. Show your work in your project.

Assume that par value of the bond is $1,000. Calculate the current yield of the bonds. Show your work in your project.

How much is the YTM listed on the website of the bonds (in the Last Sale column - Yield)? (No calculations are required for this question).

Write a 1-2 page of the analysis of the bonds. In your analysis you should answer the following questions. Please explain your answer to each question.

If you are going to buy a bond issued by THE COMPANY, which bond would you choose? Why?

Are these bonds callable? If the bonds that you chose are callable (non-callable), will it change your decision to buy them?

What is the bonds rating? What important information does this analysis provide?

If you are an investor who is looking for a bond to invest in, are you going to buy a bond that you chose?

In Research Project Part 2 you analyzed debt/equity and financial leverage ratios. How do these ratios support your decision to buy these bonds or not?

PTC INCStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started