Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what would be the capital gains or losses reported on a tax form schedule D. from the following showing the calculations for each capital gain/loss

what would be the capital gains or losses reported on a tax form schedule D. from the following

showing the calculations for each capital gain/loss what would be shown on the form 8949. that would then be transfered to the schedule d.

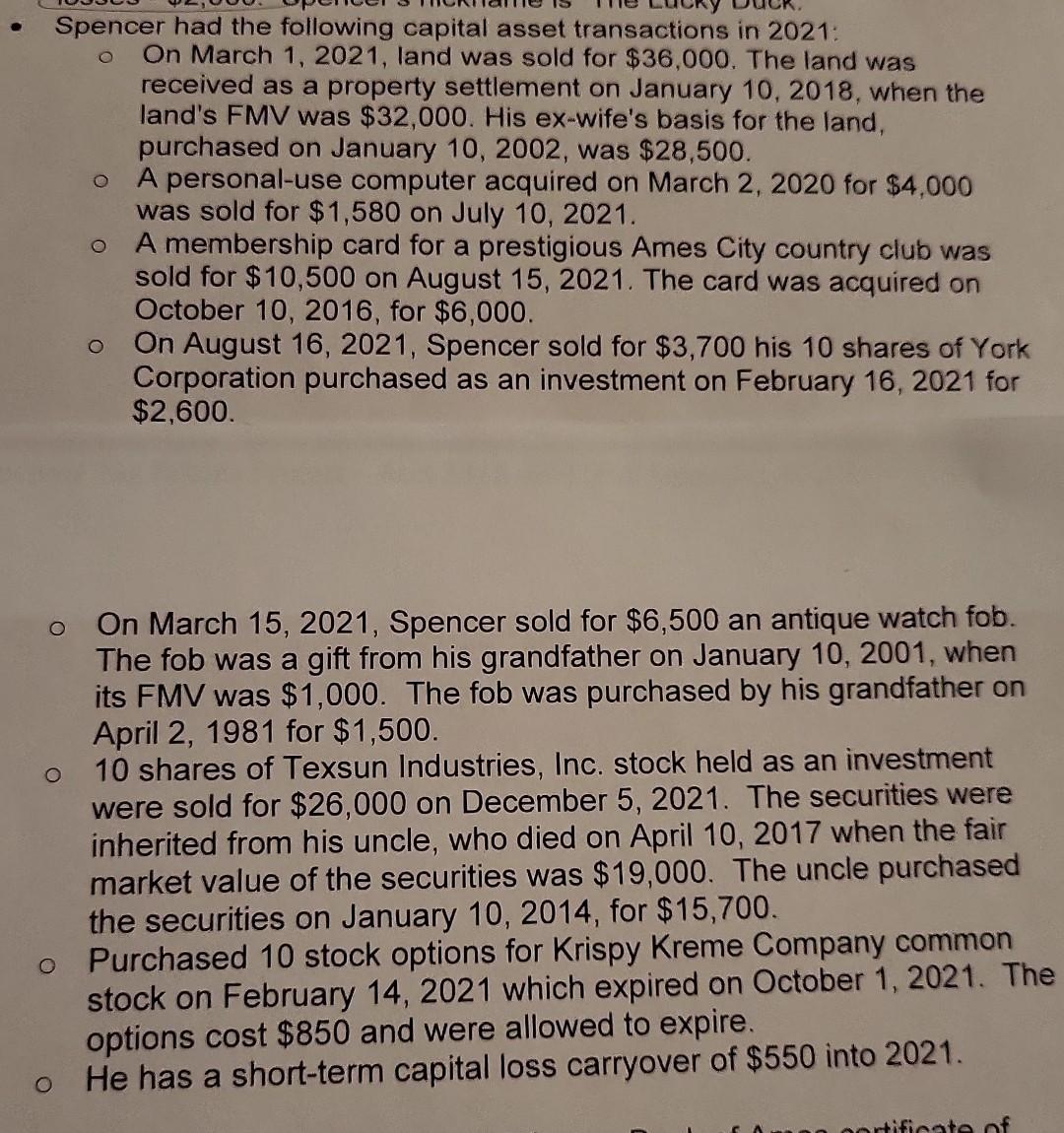

Spencer had the following capital asset transactions in 2021: - On March 1,2021, land was sold for $36,000. The land was received as a property settlement on January 10,2018 , when the land's FMV was $32,000. His ex-wife's basis for the land, purchased on January 10, 2002, was $28,500. - A personal-use computer acquired on March 2, 2020 for $4,000 was sold for $1,580 on July 10,2021. - A membership card for a prestigious Ames City country club was sold for $10,500 on August 15,2021 . The card was acquired on October 10,2016 , for $6,000. - On August 16, 2021, Spencer sold for $3,700 his 10 shares of York Corporation purchased as an investment on February 16, 2021 for $2,600 - On March 15, 2021, Spencer sold for $6,500 an antique watch fob. The fob was a gift from his grandfather on January 10, 2001, when its FMV was $1,000. The fob was purchased by his grandfather on April 2, 1981 for $1,500. - 10 shares of Texsun Industries, Inc. stock held as an investment were sold for $26,000 on December 5,2021 . The securities were inherited from his uncle, who died on April 10, 2017 when the fair market value of the securities was $19,000. The uncle purchased the securities on January 10,2014 , for $15,700. - Purchased 10 stock options for Krispy Kreme Company common stock on February 14, 2021 which expired on October 1, 2021. Th options cost $850 and were allowed to expire. - He has a short-term capital loss carryover of $550 into 2021. Spencer had the following capital asset transactions in 2021: - On March 1,2021, land was sold for $36,000. The land was received as a property settlement on January 10,2018 , when the land's FMV was $32,000. His ex-wife's basis for the land, purchased on January 10, 2002, was $28,500. - A personal-use computer acquired on March 2, 2020 for $4,000 was sold for $1,580 on July 10,2021. - A membership card for a prestigious Ames City country club was sold for $10,500 on August 15,2021 . The card was acquired on October 10,2016 , for $6,000. - On August 16, 2021, Spencer sold for $3,700 his 10 shares of York Corporation purchased as an investment on February 16, 2021 for $2,600 - On March 15, 2021, Spencer sold for $6,500 an antique watch fob. The fob was a gift from his grandfather on January 10, 2001, when its FMV was $1,000. The fob was purchased by his grandfather on April 2, 1981 for $1,500. - 10 shares of Texsun Industries, Inc. stock held as an investment were sold for $26,000 on December 5,2021 . The securities were inherited from his uncle, who died on April 10, 2017 when the fair market value of the securities was $19,000. The uncle purchased the securities on January 10,2014 , for $15,700. - Purchased 10 stock options for Krispy Kreme Company common stock on February 14, 2021 which expired on October 1, 2021. Th options cost $850 and were allowed to expire. - He has a short-term capital loss carryover of $550 into 2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started