Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What would be the net income of the Taejon branch as of 2007 and 2008 if the headquarters' overhead costs we allocate by the current

What would be the net income of the Taejon branch as of 2007 and 2008 if the headquarters' overhead costs we allocate by the current method? Calculate the number of revenues and direct and indirect costs of the Taejon branch for these two years.

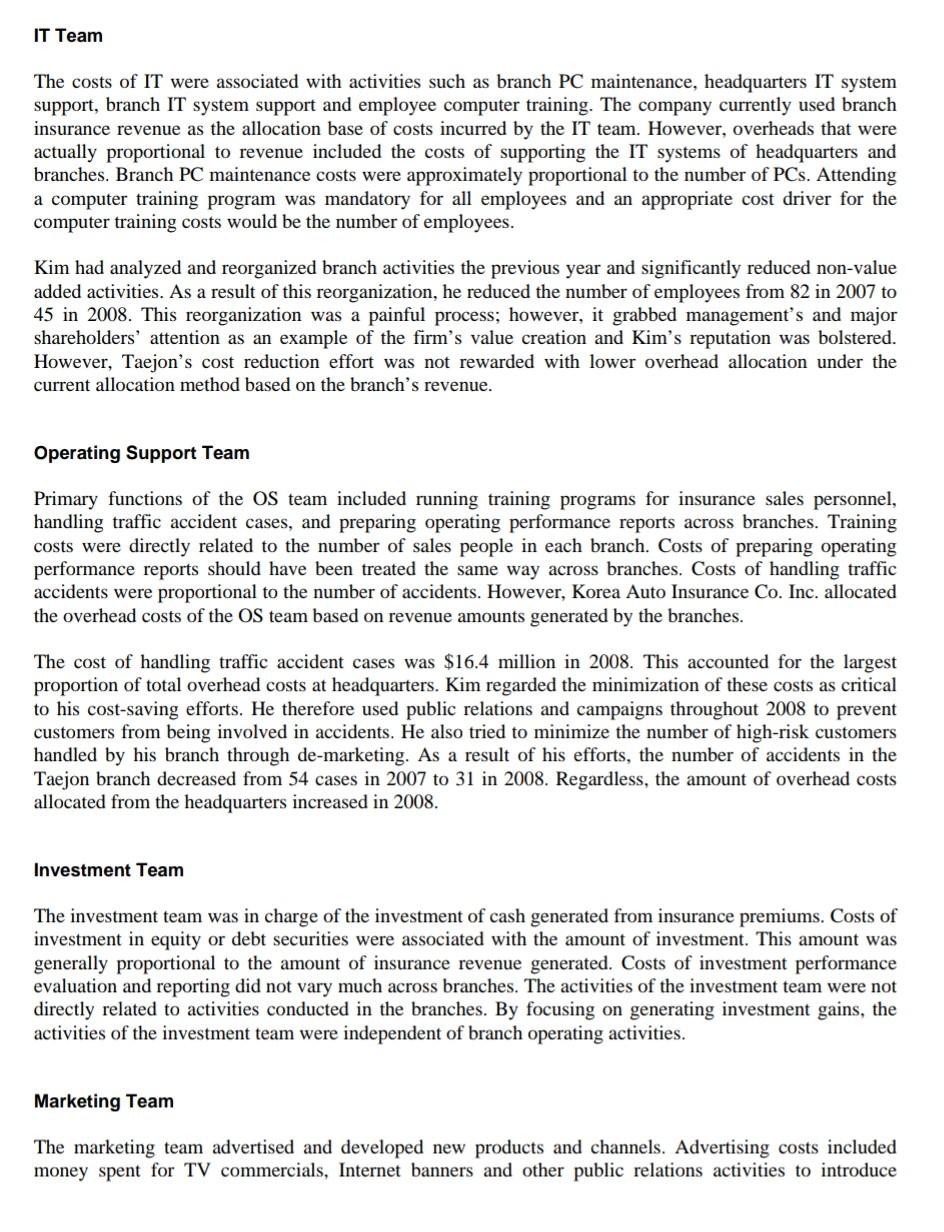

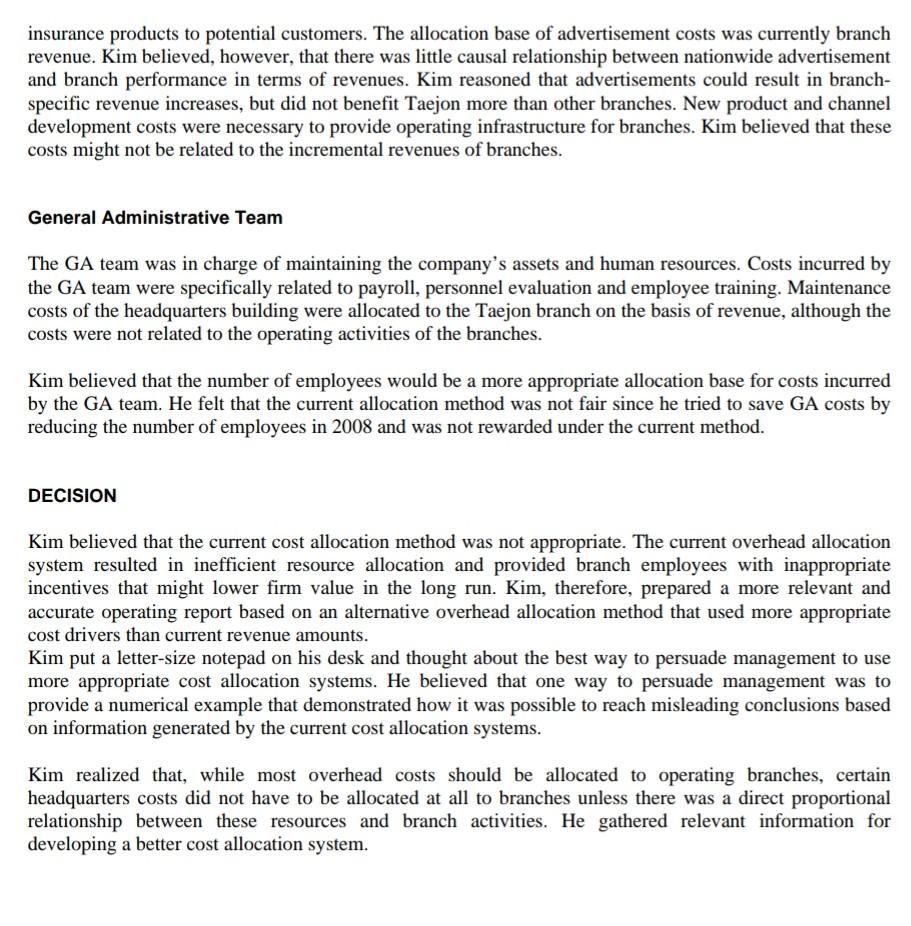

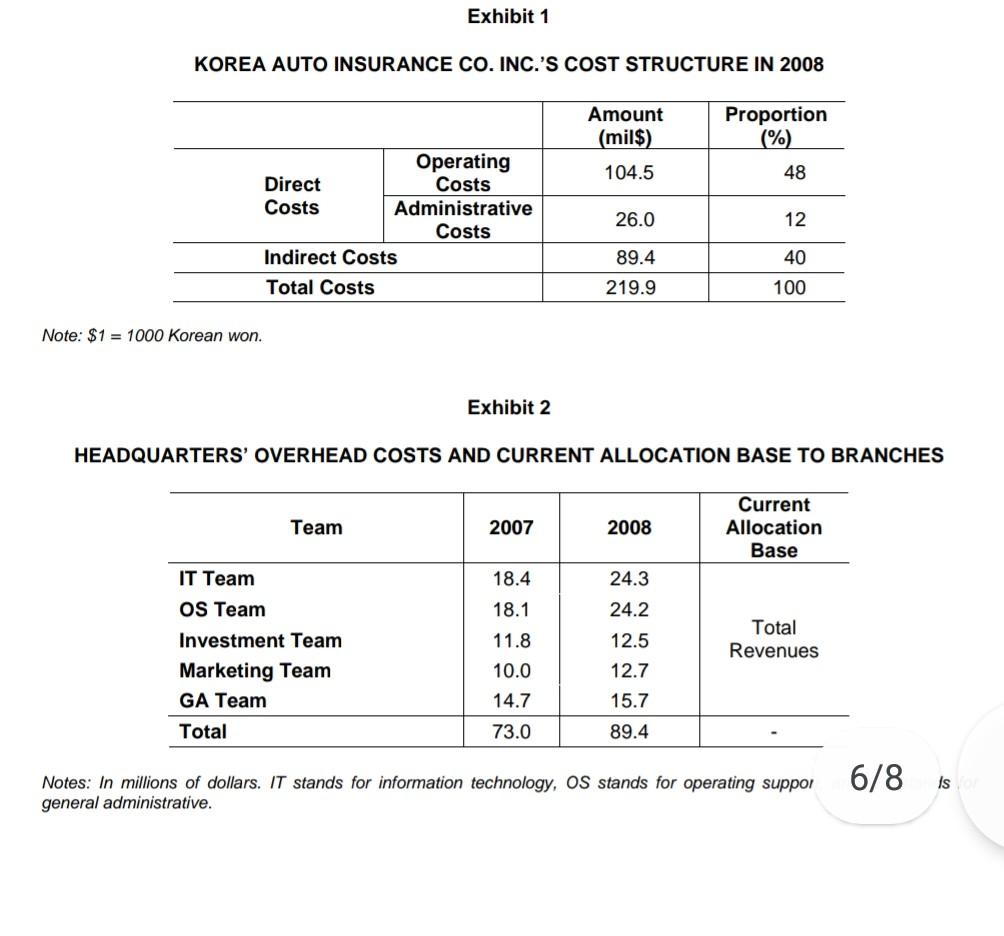

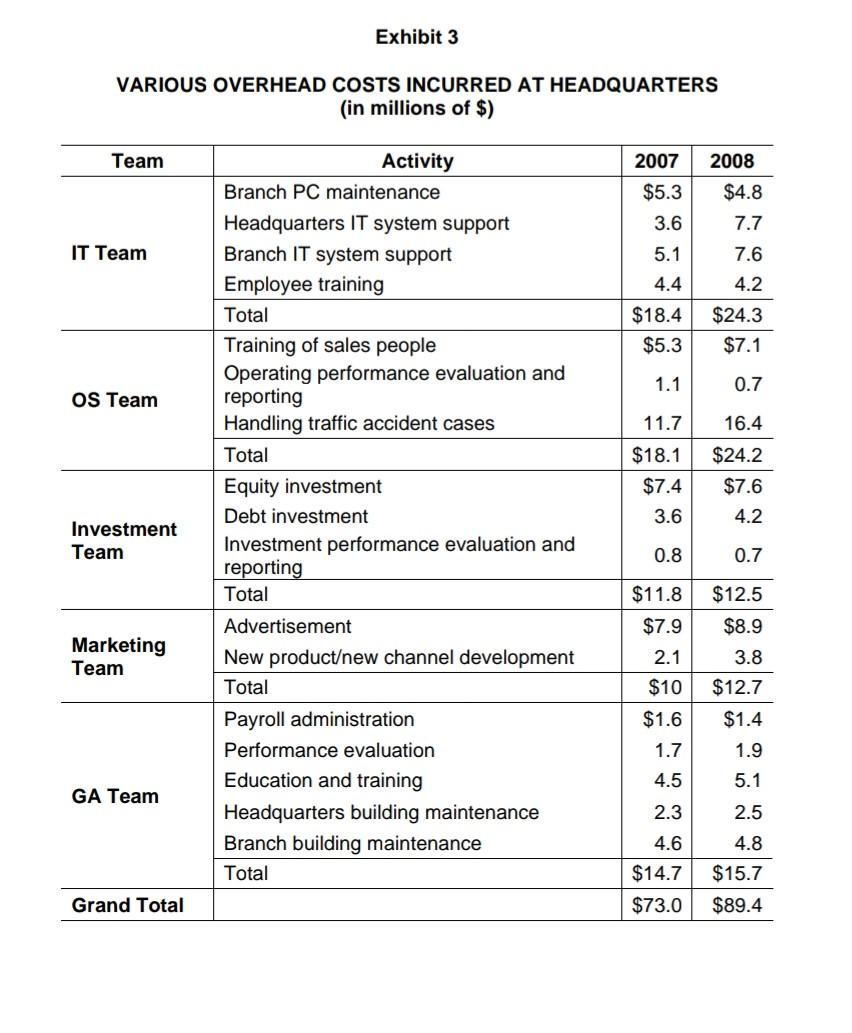

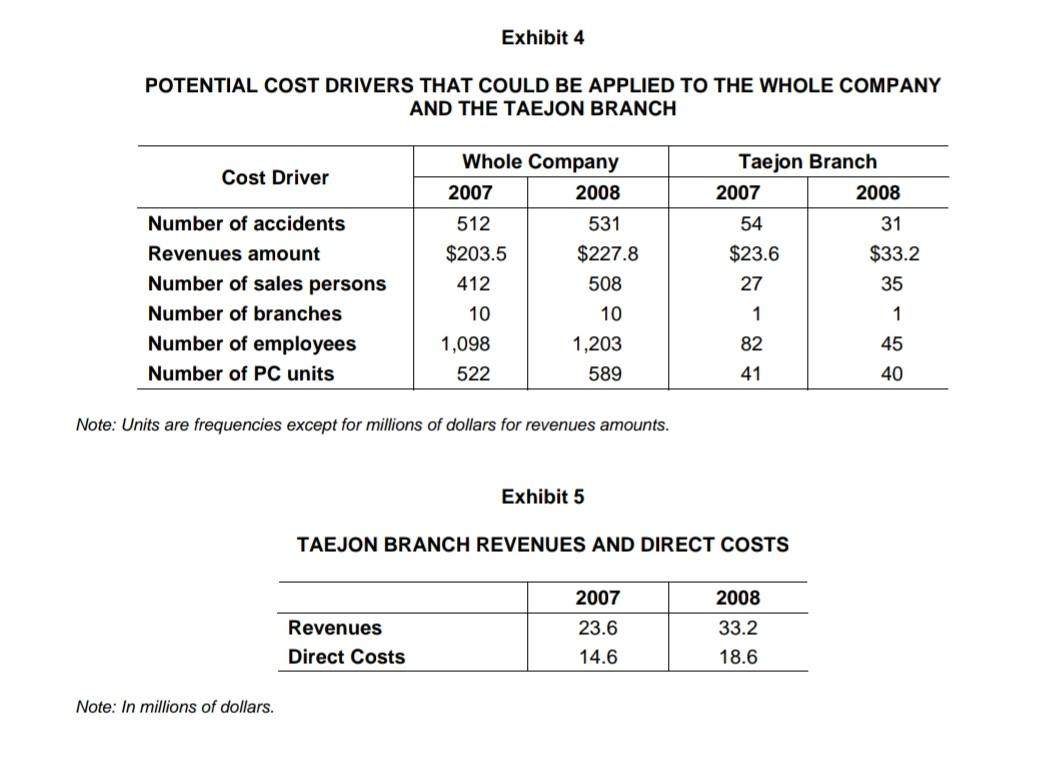

In January 2009, Jin Kim, manager of the Taejon City branch of Korea Auto Insurance in South Korea, was frustrated. Taejon City had grown rapidly since the Korean government started moving key central government offices to the city in 2005 and developing large industrial and residential areas around the city. Many private and public research institutions had built laboratories in a suburb of Taejon City. Auto insurance companies had opened numerous branches to capture new customers. As a result, the Taejon City branch of Korea Auto Insurance Co. Inc. had experienced severe competition and made efforts to capture greater market share in the region. After preparing the operations report for the previous year, Kim realized that his branch's performance was not as good as expected, primarily due to the way cost accounting systems operated within the company. The current cost accounting systems penalized branches that generated more revenue during the fiscal year. Korea Auto Insurance Co. Inc. was one of the three largest liability insurance companies in Korea. Selling auto insurance policies was its primary service. The company had allocated overhead costs incurred at the headquarters across operating branches under a traditional volume-based allocation process. Overhead costs included resources spent by the headquarters for information technology services, general administration and marketing activities. The problem was that the headquarters' overhead costs had been allocated to branches according to the amount of revenue each branch generated. Differences in the cost structure of each branch were not considered in the process. As a result, some branches were allocated a large portion of overhead, but felt they had not benefitted much from headquarters' resources. Some branch managers had complained about the current allocation process of overhead. They argued that their earnings targets were unlikely to be reached, solely because of the inappropriate cost allocation process the company had applied. CONCERNS AS A NEW BRANCH MANAGER Kim was transferred to the Taejon branch in 2008. He was considered a key player in the Strategic Planning Department at the headquarters before being transferred to the branch. He had been involved in major business projects and gained a reputation for his ability to plan and budget. In 2007, he successfully directed a three million dollar project establishing an enterprise resource planning (ERP) system for the entire company. He was expected to be promoted to an executive officer position eventually. Transferring Kim to the Taejon branch was a favor from the top management intended to give him an opportunity to gain field experiences at the branch level, as was commonly expected of future key executive officers. Taejon was a rapidly growing city and a strategically important place for Korea Auto Insurance Co. Inc. to expand its market share. Kim willingly accepted the position. After he took the branch manager position, Kim worked hard to improve the operating results of the branch. Headquarters also provided the Taejon branch with more marketing staff and more office space. As a result of these efforts, the Taejon branch raised insurance revenues from $23.6 million in 2007 to $33.2 million in 2008. However, Kim was frustrated after closing his books while preparing the branch operation report for the fiscal year 2008. He realized that the 2008 net income of the Taejon branch was much lower than for the prior year. The increases in operating costs, including overhead costs allocated from the headquarters, were much higher than the revenues. BACKGROUND: KOREAN INSURANCE MARKET The insurance market of Korea had two characteristics that made it distinct from the markets of other OECD countries. First, automobile insurance was by far the best selling policy in the Korean insurance market. Other property insurance policies against casualties, such as real estate insurance against fire, were sold much less, proportionally, in the Korean market than in the United States. The government mandated auto owners to purchase liability insurance. Government-driven economic growth had pushed gross national income per capita to $20,000 in the 2000s. Korean auto makers, such as Hyundai and Kia, had made progress, technologically and financially, and had been able to meet all the increasing demands from Korean auto buyers. Having more cars on the street meant more revenue for auto insurance companies. Second, the Korean financial industry was heavily regulated by the government. The Financial Supervisory Service, a government organization that ruled all the financial institutions, provided very specific operating guidelines to the market participants. It also monitored whether the financial market was dominated by any chaebols, business conglomerates owned by families. Heavy regulation and over-protection of the industry had weakened the competitive edge of many financial companies. Korea Auto Insurance Co. Inc. was a typical case. An auto insurance company could afford to keep using a potentially unreasonable method of overhead allocation because its management lacked operating autonomy since the auto insurance industry had been tightly regulated by the government. Although the government had not dictated overhead cost allocation methods, the management of insurance companies tended to loosely adopt the simplest or least controversial methods without paying attention to the managerial consequences in detail. CHANGES IN REVENUE/COST STRUCTURE IN THE TAEJON BRANCH Taejon City had, in recent years, dramatically improved its infrastructure by building new freeways and introducing electric railways and a train grande vitesse (TGV) or high-speed train. These changes attracted more people to the city and thus expanded the market for auto insurance. The headquarters of Korea Auto Insurance Co. Inc. tried to capture the Taejon market ahead of potential competitors by providing various supports to the branch. These supports included increasing the branch's marketing staff from 27 to 35. Sending Kim to the Taejon branch was a top-level management decision to make the branch more competitive. Kim, however, realized that expansion of the branch might penalize him and branch employees by not only incurring direct costs at the branch level but also by the branch being allocated a large amount of the headquarters' overhead costs, resulting in lower net income. HEADQUARTERS' OVERHEAD COSTS Exhibit 1 illustrates the cost structure of Korea Auto Insurance Co. Inc. Direct costs accounted for about 60 per cent of total costs while indirect costs accounted for about 40 per cent of total costs. Direct costs consisted of both operating costs (48 per cent) and administrative costs (12 per cent). Exhibit 2 reports headquarters' overhead costs and their allocation bases. There were five teams in the headquarters: information technology (IT), operating support (OS), investment, marketing and general administrative (GA). Costs of the IT team dramatically increased from $18.4 million in 2007 to $24.3 million in 2008. The primary reason for such an increase was the depreciation expense of investment in the ERP system introduced in late 2007. Depreciation was computed based on the straight-line method over a useful life of five years. Ironically, the successful launching of a new IT system in late 2007 by Kim at the headquarters was a major factor in improving the operating performance of the Taejon branch in 2008. The five teams at the headquarters were the cost centers for overhead. They supported the operating activities of the branches and their support was essential in maintaining the business infrastructure of the company. Exhibit 3 lists various costs incurred by these teams during the last two years. Primary activities of the IT team included branch PC maintenance, headquarters IT system support and employee computer training. The OS team provided sales training, operating performance evaluation, evaluation reporting, and traffic accident case handling. Activities and respective costs of the investment, marketing and GA teams, along with those of the IT and OS teams, are provided in Exhibit 3. INDIRECT COSTS DISTRIBUTED TO SALES BRANCHES Kim was frustrated that the current overhead allocation practices of Korea Auto Insurance Co. Inc. did not take into account the importance of overhead costs. Until 2006, the differences in overhead amounts allocated across branches were not significant. However, the differences became significant as the amount of overhead increased and activities became more diversified. Exhibit 4 provides two-year data for potential cost drivers that could be used as a basis to allocate overhead costs to operating branches including Taejon. Exhibit 5 outlines the Taejon branch's revenues and direct costs for the last two years. Exhibit 5 indicates that the proportion of direct costs over total revenues decreased from 61.9 per cent in 2007 to 56.0 per cent in 2008, reflecting Kim's efforts. Primary overhead costs incurred by each team at the headquarters are discussed below. IT Team The costs of IT were associated with activities such as branch PC maintenance, headquarters IT system support, branch IT system support and employee computer training. The company currently used branch insurance revenue as the allocation base of costs incurred by the IT team. However, overheads that were actually proportional to revenue included the costs of supporting the IT systems of headquarters and branches. Branch PC maintenance costs were approximately proportional to the number of PCs. Attending a computer training program was mandatory for all employees and an appropriate cost driver for the computer training costs would be the number of employees. Kim had analyzed and reorganized branch activities the previous year and significantly reduced non-value added activities. As a result of this reorganization, he reduced the number of employees from 82 in 2007 to 45 in 2008. This reorganization was a painful process; however, it grabbed management's and major shareholders' attention as an example of the firm's value creation and Kim's reputation was bolstered. However, Taejon's cost reduction effort was not rewarded with lower overhead allocation under the current allocation method based on the branch's revenue. Operating Support Team Primary functions of the OS team included running training programs for insurance sales personnel, handling traffic accident cases, and preparing operating performance reports across branches. Training costs were directly related to the number of sales people in each branch. Costs of preparing operating performance reports should have been treated the same way across branches. Costs of handling traffic accidents were proportional to the number of accidents. However, Korea Auto Insurance Co. Inc. allocated the overhead costs of the OS team based on revenue amounts generated by the branches. The cost of handling traffic accident cases was $16.4 million in 2008. This accounted for the largest proportion of total overhead costs at headquarters. Kim regarded the minimization of these costs as critical to his cost-saving efforts. He therefore used public relations and campaigns throughout 2008 to prevent customers from being involved in accidents. He also tried to minimize the number of high-risk customers handled by his branch through de-marketing. As a result of his efforts, the number of accidents in the Taejon branch decreased from 54 cases in 2007 to 31 in 2008. Regardless, the amount of overhead costs allocated from the headquarters increased in 2008. Investment Team The investment team was in charge of the investment of cash generated from insurance premiums. Costs of investment in equity or debt securities were associated with the amount of investment. This amount was generally proportional to the amount of insurance revenue generated. Costs of investment performance evaluation and reporting did not vary much across branches. The activities of the investment team were not directly related to activities conducted in the branches. By focusing on generating investment gains, the activities of the investment team were independent of branch operating activities. Marketing Team The marketing team advertised and developed new products and channels. Advertising costs included money spent for TV commercials, Internet banners and other public relations activities to introduce insurance products to potential customers. The allocation base of advertisement costs was currently branch revenue. Kim believed, however, that there was little causal relationship between nationwide advertisement and branch performance in terms of revenues. Kim reasoned that advertisements could result in branch- specific revenue increases, but did not benefit Taejon more than other branches. New product and channel development costs were necessary to provide operating infrastructure for branches. Kim believed that these costs might not be related to the incremental revenues of branches. General Administrative Team The GA team was in charge of maintaining the company's assets and human resources. Costs incurred by the GA team were specifically related to payroll, personnel evaluation and employee training. Maintenance costs of the headquarters building were allocated to the Taejon branch on the basis of revenue, although the costs were not related to the operating activities of the branches. Kim believed that the number of employees would be a more appropriate allocation base for costs incurred by the GA team. He felt that the current allocation method was not fair since he tried to save GA costs by reducing the number of employees in 2008 and was not rewarded under the current method. DECISION Kim believed that the current cost allocation method was not appropriate. The current overhead allocation system resulted in inefficient resource allocation and provided branch employees with inappropriate incentives that might lower firm value in the long run. Kim, therefore, prepared a more relevant and accurate operating report based on an alternative overhead allocation method that used more appropriate cost drivers than current revenue amounts. Kim put a letter-size notepad on his desk and thought about the best way to persuade management to use more appropriate cost allocation systems. He believed that one way to persuade management was to provide a numerical example that demonstrated how it was possible to reach misleading conclusions based on information generated by the current cost allocation systems. Kim realized that, while most overhead costs should be allocated to operating branches, certain headquarters costs did not have to be allocated at all to branches unless there was a direct proportional relationship between these resources and branch activities. He gathered relevant information for developing a better cost allocation system. Exhibit 1 KOREA AUTO INSURANCE CO. INC.'S COST STRUCTURE IN 2008 Amount (mil) Proportion (%) 104.5 48 Operating Direct Costs Costs Administrative Costs Indirect Costs Total Costs 26.0 12 89.4 40 219.9 100 Note: $1 = 1000 Korean won. Exhibit 2 HEADQUARTERS' OVERHEAD COSTS AND CURRENT ALLOCATION BASE TO BRANCHES Team 2007 2008 Current Allocation Base 18.4 24.3 18.1 24.2 11.8 IT Team OS Team Investment Team Marketing Team GA Team Total Total Revenues 10.0 12.5 12.7 15.7 89.4 14.7 73.0 6/8 Is Notes: In millions of dollars. IT stands for information technology, OS stands for operating suppor general administrative. Exhibit 3 VARIOUS OVERHEAD COSTS INCURRED AT HEADQUARTERS (in millions of $) Team 2007 2008 $4.8 7.7 IT Team $5.3 3.6 5.1 4.4 $18.4 $5.3 7.6 4.2 $24.3 $7.1 1.1 0.7 OS Team 11.7 16.4 Activity Branch PC maintenance Headquarters IT system support Branch IT system support Employee training Total Training of sales people Operating performance evaluation and reporting Handling traffic accident cases Total Equity investment Debt investment Investment performance evaluation and reporting Total Advertisement New productew channel development Total Payroll administration Performance evaluation Education and training Headquarters building maintenance Branch building maintenance Total $18.1 $7.4 3.6 $24.2 $7.6 4.2 Investment Team 0.8 0.7 $11.8 $7.9 $12.5 $8.9 Marketing Team 3.8 2.1 $10 O- $12.7 $1.4 1.9 5.1 2.5 $1.6 1.7 4.5 2.3 4.6 $14.7 $73.0 GA Team 4.8 $15.7 $89.4 Grand Total Exhibit 4 POTENTIAL COST DRIVERS THAT COULD BE APPLIED TO THE WHOLE COMPANY AND THE TAEJON BRANCH Cost Driver Whole Company 2007 2008 512 531 $203.5 $227.8 412 508 Number of accidents Revenues amount Number of sales persons Number of branches Number of employees Number of PC units Taejon Branch 2007 2008 54 31 $23.6 $33.2 27 35 1 10 10 82 45 1,098 522 1,203 589 41 40 Note: Units are frequencies except for millions of dollars for revenues amounts. Exhibit 5 TAEJON BRANCH REVENUES AND DIRECT COSTS Revenues Direct Costs 2007 23.6 14.6 2008 33.2 18.6 Note: In millions of dollarsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started