What would be the Total Project Value using the revised numbers? I assumed it was the purchase price + capital improvements but I just want to be 100% clear.

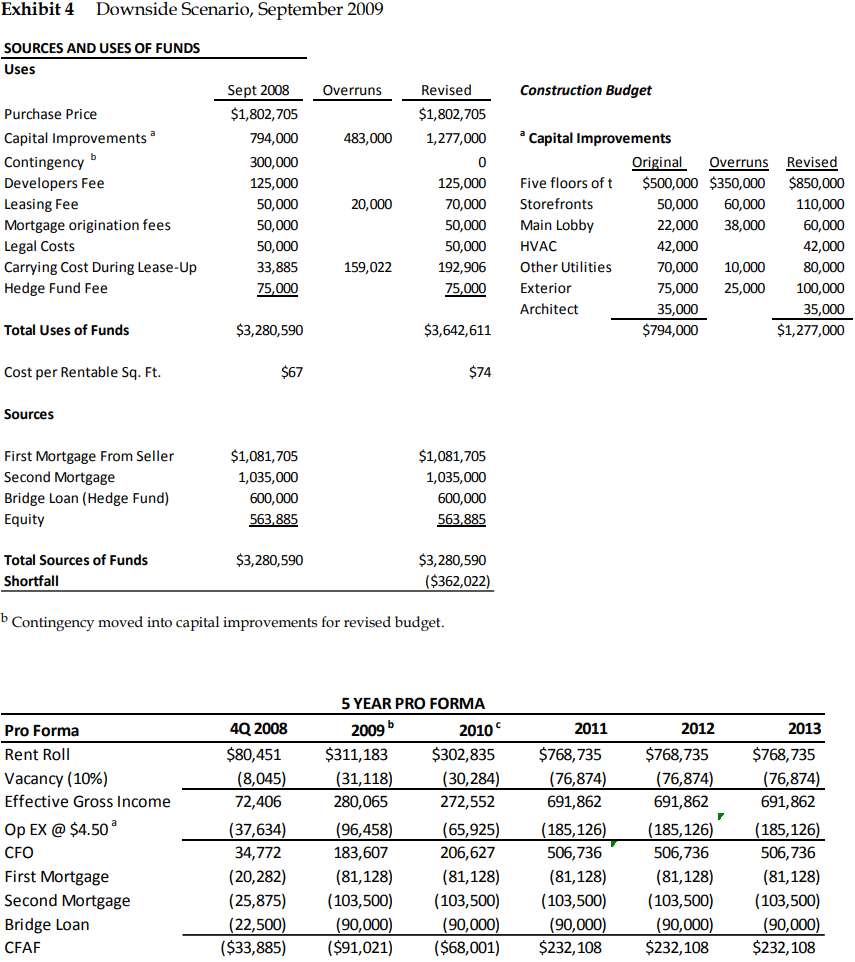

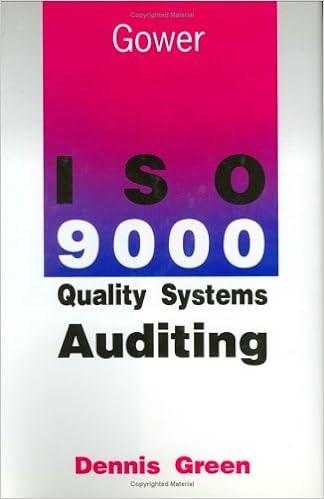

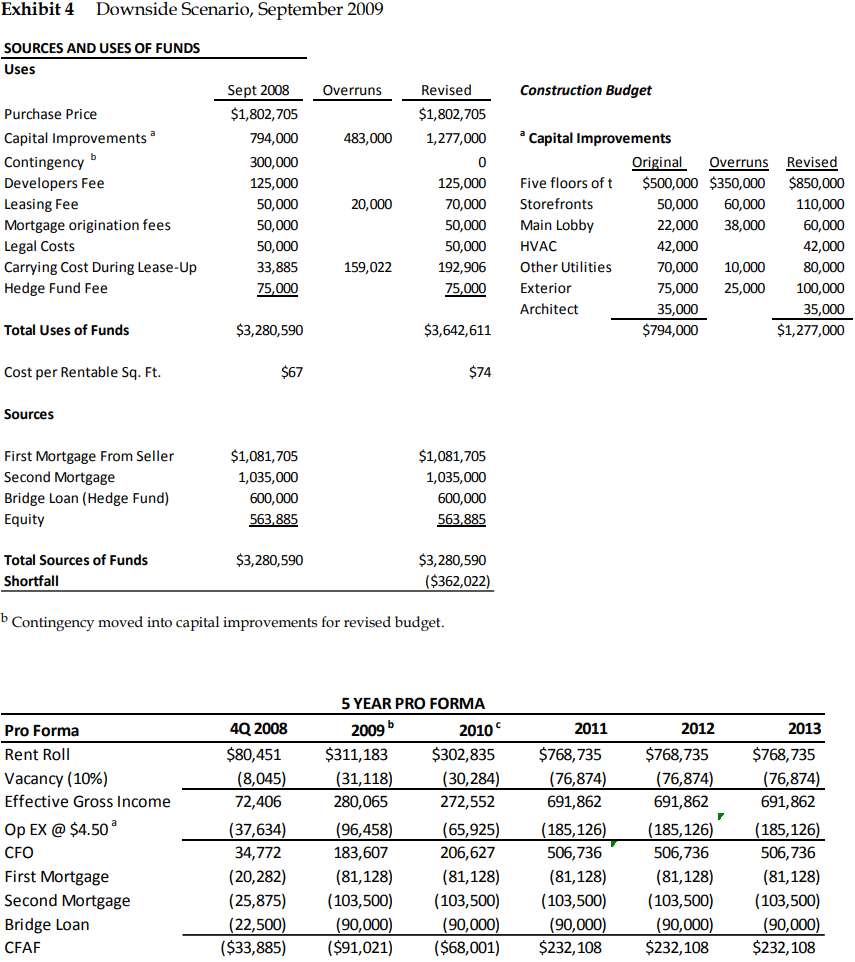

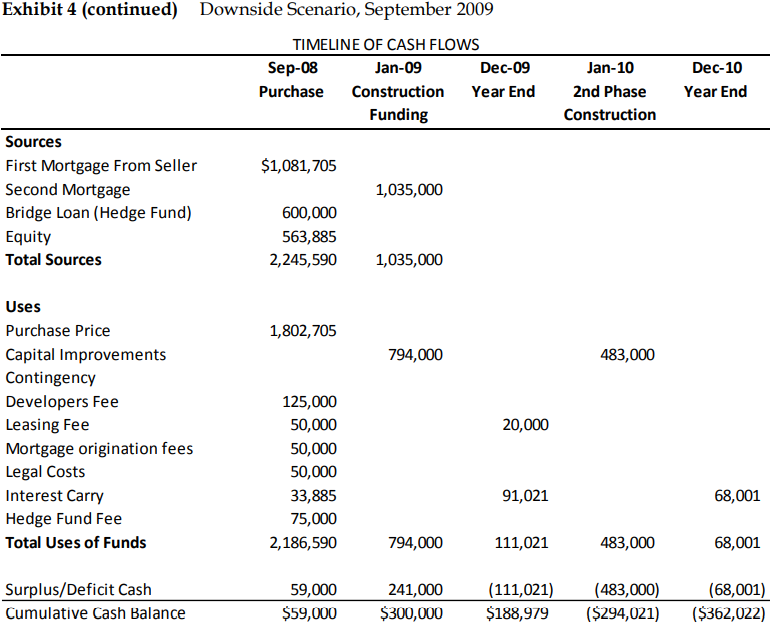

Exhibit 4 Downside Scenario, September 2009 SOURCES AND USES OF FUNDS Uses Overruns Construction Budget Revised $1,802,705 1,277,000 483,000 0 Purchase Price Capital Improvements a Contingency Developers Fee Leasing Fee Mortgage origination fees Legal Costs Carrying Cost During Lease-Up Hedge Fund Fee Sept 2008 $1,802, 705 794,000 300,000 125,000 50,000 50,000 50,000 33,885 75,000 20,000 125,000 70,000 50,000 50,000 192,906 75,000 Capital Improvements Original Overruns Revised Five floors oft $500,000 $350,000 $850,000 Storefronts 50,000 60,000 110,000 Main Lobby 22,000 38,000 60,000 HVAC 42,000 42,000 Other Utilities 70,000 10,000 80,000 Exterior 75,000 25,000 100,000 Architect 35,000 35,000 $794,000 $1,277,000 159,022 Total Uses of Funds $3,280,590 $3,642,611 Cost per Rentable Sq. Ft. $67 $74 Sources First Mortgage From Seller Second Mortgage Bridge Loan (Hedge Fund) Equity $1,081,705 1,035,000 600,000 563.885 $1,081,705 1,035,000 600,000 563.885 $3,280,590 Total Sources of Funds Shortfall $3,280,590 ($362,022) b Contingency moved into capital improvements for revised budget. Pro Forma 2011 2012 Rent Roll Vacancy (10%) Effective Gross Income Op EX @ $4.50 CFO First Mortgage Second Mortgage Bridge Loan CFAF 4Q 2008 $80,451 (8,045) 72,406 (37,634) 34,772 (20,282) (25,875) (22,500) ($33,885) 5 YEAR PRO FORMA 2009 2010 $311,183 $302,835 (31,118) (30,284) 280,065 272,552 (96,458) (65,925) 183,607 206,627 (81,128) (81,128) (103,500) (103,500) (90,000) (90,000) ($91,021) ($68,001) $768,735 (76,874) 691,862 (185, 126) 506,736 (81,128) (103,500) (90,000) $232, 108 $768,735 (76,874) 691,862 (185, 126) 506,736 (81,128) (103,500) (90,000) $232,108 2013 $768,735 (76,874) 691,862 (185,126) 506,736 (81,128) (103,500) (90,000) $232, 108 Jan-10 2nd Phase Construction Dec-10 Year End Exhibit 4 (continued) Downside Scenario, September 2009 TIMELINE OF CASH FLOWS Sep-08 Jan-09 Dec-09 Purchase Construction Year End Funding Sources First Mortgage From Seller $1,081,705 Second Mortgage 1,035,000 Bridge Loan (Hedge Fund) 600,000 Equity 563,885 Total Sources 2,245,590 1,035,000 1,802,705 794,000 483,000 Uses Purchase Price Capital Improvements Contingency Developers Fee Leasing Fee Mortgage origination fees Legal Costs Interest Carry Hedge Fund Fee Total Uses of Funds 20,000 125,000 50,000 50,000 50,000 33,885 75,000 2,186,590 91,021 68,001 794,000 111,021 483,000 68,001 Surplus/Deficit Cash Cumulative Cash Balance 59,000 $59,000 241,000 $300,000 (111,021) $188,979 (483,000) ($294,021) (68,001) ($362,022) Exhibit 4 Downside Scenario, September 2009 SOURCES AND USES OF FUNDS Uses Overruns Construction Budget Revised $1,802,705 1,277,000 483,000 0 Purchase Price Capital Improvements a Contingency Developers Fee Leasing Fee Mortgage origination fees Legal Costs Carrying Cost During Lease-Up Hedge Fund Fee Sept 2008 $1,802, 705 794,000 300,000 125,000 50,000 50,000 50,000 33,885 75,000 20,000 125,000 70,000 50,000 50,000 192,906 75,000 Capital Improvements Original Overruns Revised Five floors oft $500,000 $350,000 $850,000 Storefronts 50,000 60,000 110,000 Main Lobby 22,000 38,000 60,000 HVAC 42,000 42,000 Other Utilities 70,000 10,000 80,000 Exterior 75,000 25,000 100,000 Architect 35,000 35,000 $794,000 $1,277,000 159,022 Total Uses of Funds $3,280,590 $3,642,611 Cost per Rentable Sq. Ft. $67 $74 Sources First Mortgage From Seller Second Mortgage Bridge Loan (Hedge Fund) Equity $1,081,705 1,035,000 600,000 563.885 $1,081,705 1,035,000 600,000 563.885 $3,280,590 Total Sources of Funds Shortfall $3,280,590 ($362,022) b Contingency moved into capital improvements for revised budget. Pro Forma 2011 2012 Rent Roll Vacancy (10%) Effective Gross Income Op EX @ $4.50 CFO First Mortgage Second Mortgage Bridge Loan CFAF 4Q 2008 $80,451 (8,045) 72,406 (37,634) 34,772 (20,282) (25,875) (22,500) ($33,885) 5 YEAR PRO FORMA 2009 2010 $311,183 $302,835 (31,118) (30,284) 280,065 272,552 (96,458) (65,925) 183,607 206,627 (81,128) (81,128) (103,500) (103,500) (90,000) (90,000) ($91,021) ($68,001) $768,735 (76,874) 691,862 (185, 126) 506,736 (81,128) (103,500) (90,000) $232, 108 $768,735 (76,874) 691,862 (185, 126) 506,736 (81,128) (103,500) (90,000) $232,108 2013 $768,735 (76,874) 691,862 (185,126) 506,736 (81,128) (103,500) (90,000) $232, 108 Jan-10 2nd Phase Construction Dec-10 Year End Exhibit 4 (continued) Downside Scenario, September 2009 TIMELINE OF CASH FLOWS Sep-08 Jan-09 Dec-09 Purchase Construction Year End Funding Sources First Mortgage From Seller $1,081,705 Second Mortgage 1,035,000 Bridge Loan (Hedge Fund) 600,000 Equity 563,885 Total Sources 2,245,590 1,035,000 1,802,705 794,000 483,000 Uses Purchase Price Capital Improvements Contingency Developers Fee Leasing Fee Mortgage origination fees Legal Costs Interest Carry Hedge Fund Fee Total Uses of Funds 20,000 125,000 50,000 50,000 50,000 33,885 75,000 2,186,590 91,021 68,001 794,000 111,021 483,000 68,001 Surplus/Deficit Cash Cumulative Cash Balance 59,000 $59,000 241,000 $300,000 (111,021) $188,979 (483,000) ($294,021) (68,001) ($362,022)