Answered step by step

Verified Expert Solution

Question

1 Approved Answer

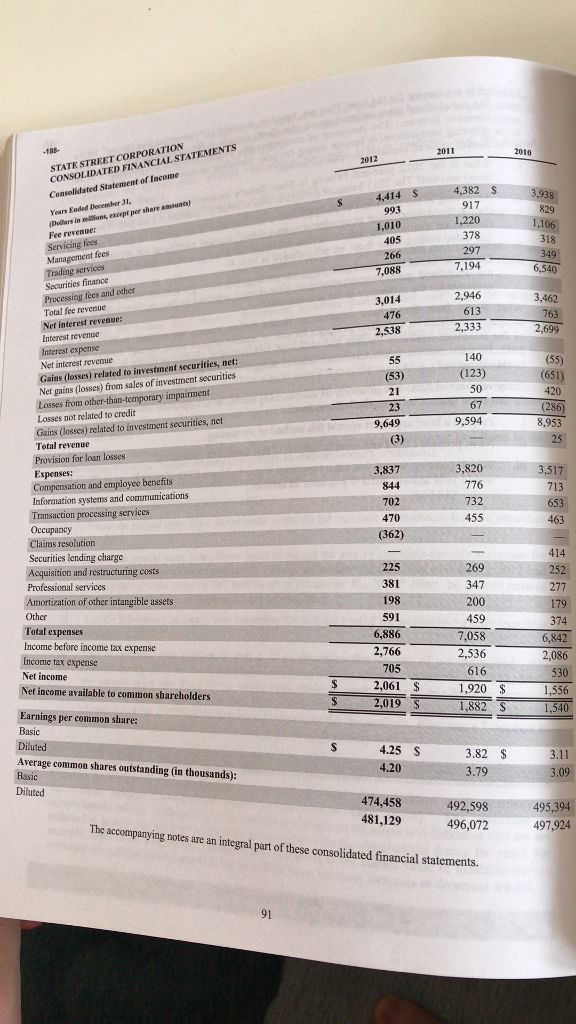

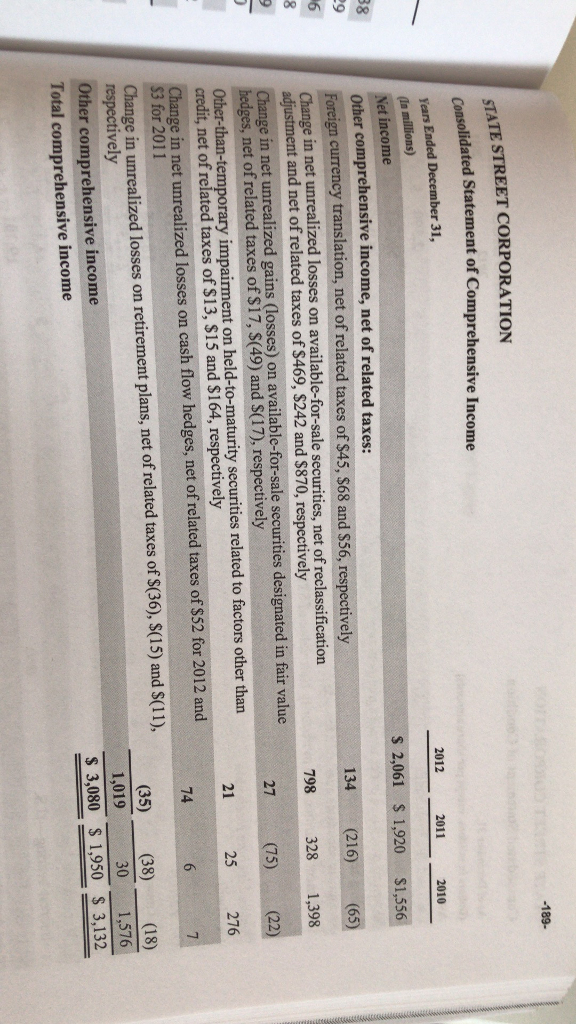

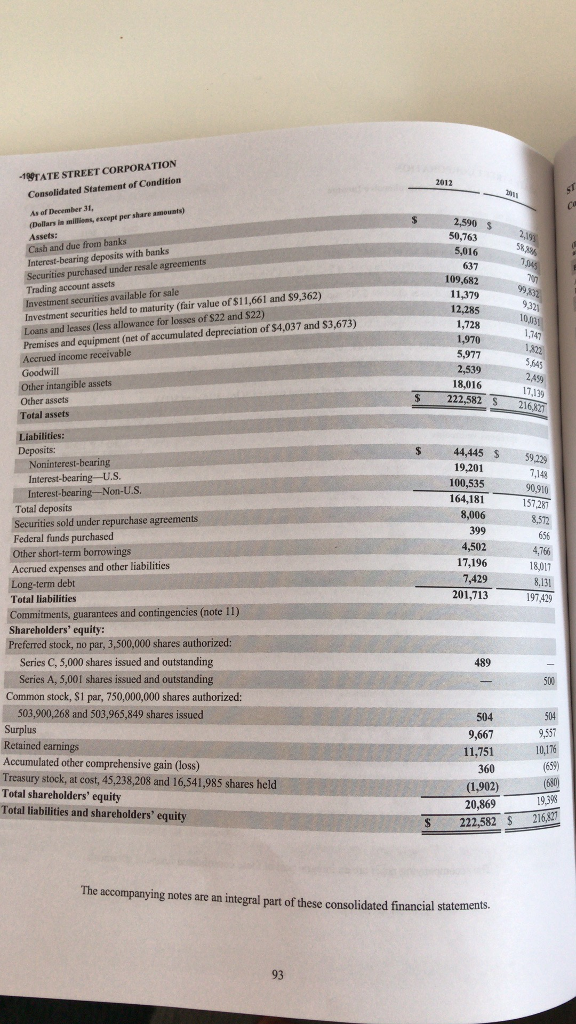

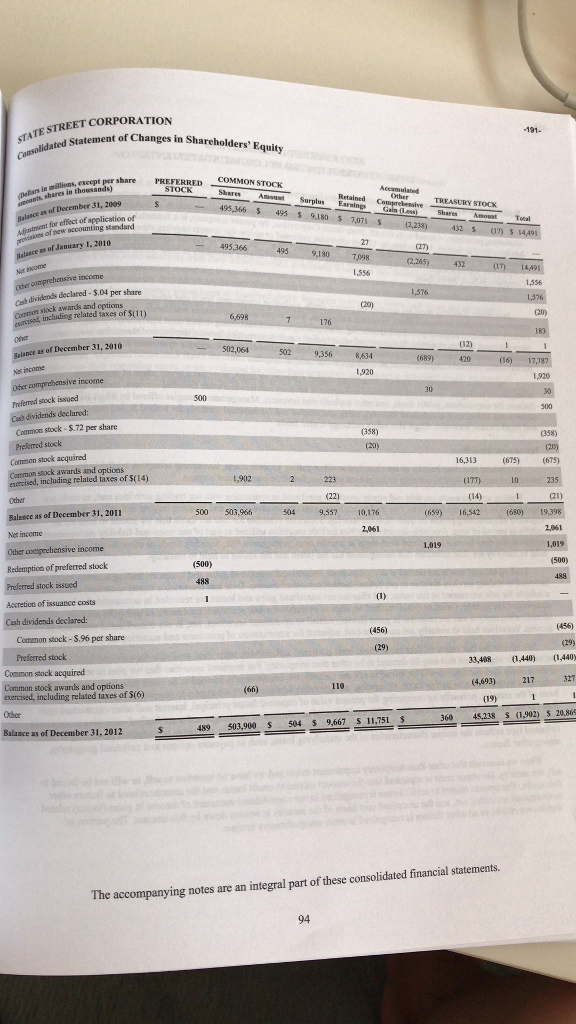

What would State Stree have reported as income before income tax expense in 2012 had the company classified its securities available-for-sale as trading account assets

What would State Stree have reported as income before income tax expense in 2012 had the company classified its securities available-for-sale as trading account assets instead? Assume that all of the securities available-for-sale had also been reclassified as trading securities as of January 1, 2012. By what amount would total shareholders' equity at December 31, 2012, differ with this change in classification?

2011 STNSOLIDATED i STATE STREET CORPORATION CONSOLIDATED FINANCIAL STATEMENTS 4,414 S Ended Devenber 31 Dellars in millians, except per share amauats) Servicing 917 7, 194 2,946 2,333 7,088 3,462 Total fee revenue Interest revenue Interest expense Net interest revenue Gains (losses) related to investment securities, net: (53) Net gains (losses) from sales of investment securities 420 irment Losses not related to credit 8,953 ecurities, n Gains (losses) related to investments Total revenue Provision for loan losses 3,837 Expenses: n and employee benefits Information systems and communications Trinsaction processing services 455 Claims resolution Securities lending charge Acquisition and restructuring costs 198 591 6,886 2,766 705 Amortization of other intangible assets 459 7,058 2,536 374 6,842 Total expenses Income before income tax expense Income tax expease Net income Net income available to common shareholders 2,061 $ 2,019 $ 1,920 $ 1,882 S 1,556 1,540 Earnings per common share: 4.25 S 4.20 3.82 $ 3.11 Average common shares outstanding (in thousands) 3.79 Diluted 474,458 492,598 481,129496,072 495,394 97,924 The accompanying notes are an integral part of these consolidated financial statements 91 2011 STNSOLIDATED i STATE STREET CORPORATION CONSOLIDATED FINANCIAL STATEMENTS 4,414 S Ended Devenber 31 Dellars in millians, except per share amauats) Servicing 917 7, 194 2,946 2,333 7,088 3,462 Total fee revenue Interest revenue Interest expense Net interest revenue Gains (losses) related to investment securities, net: (53) Net gains (losses) from sales of investment securities 420 irment Losses not related to credit 8,953 ecurities, n Gains (losses) related to investments Total revenue Provision for loan losses 3,837 Expenses: n and employee benefits Information systems and communications Trinsaction processing services 455 Claims resolution Securities lending charge Acquisition and restructuring costs 198 591 6,886 2,766 705 Amortization of other intangible assets 459 7,058 2,536 374 6,842 Total expenses Income before income tax expense Income tax expease Net income Net income available to common shareholders 2,061 $ 2,019 $ 1,920 $ 1,882 S 1,556 1,540 Earnings per common share: 4.25 S 4.20 3.82 $ 3.11 Average common shares outstanding (in thousands) 3.79 Diluted 474,458 492,598 481,129496,072 495,394 97,924 The accompanying notes are an integral part of these consolidated financial statements 91Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started