what would the differential schedule look like for year 16?

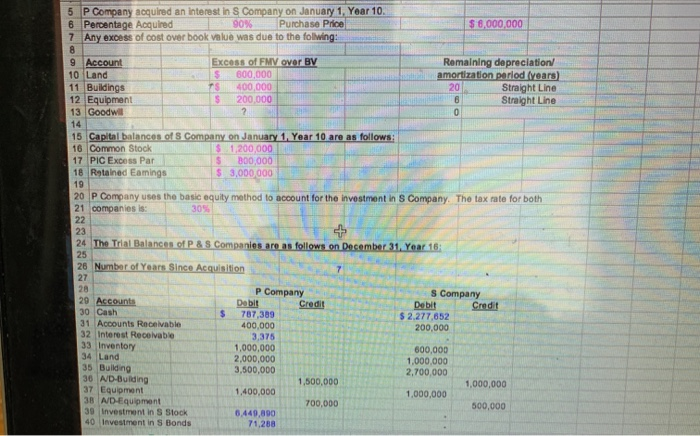

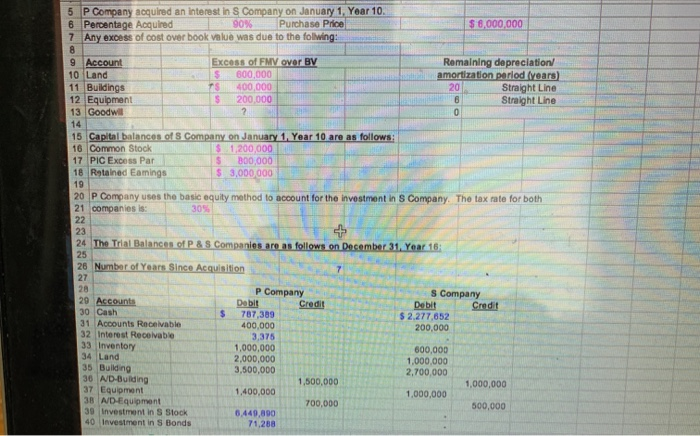

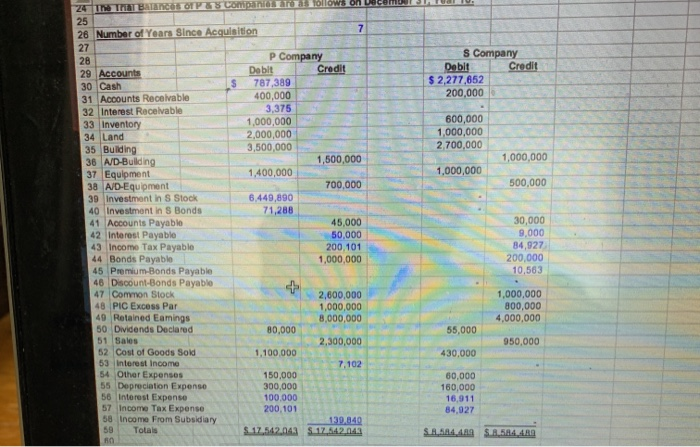

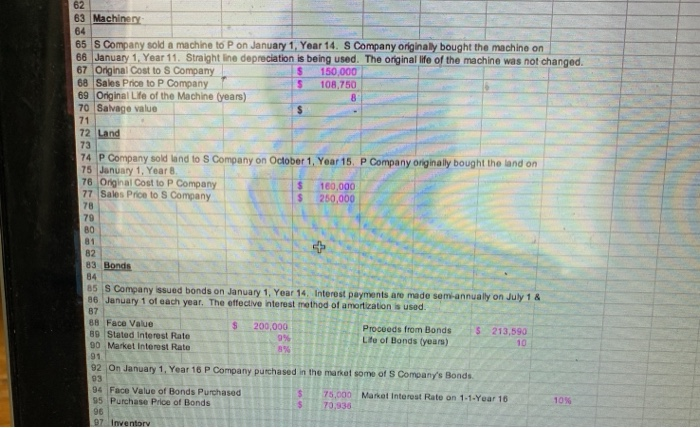

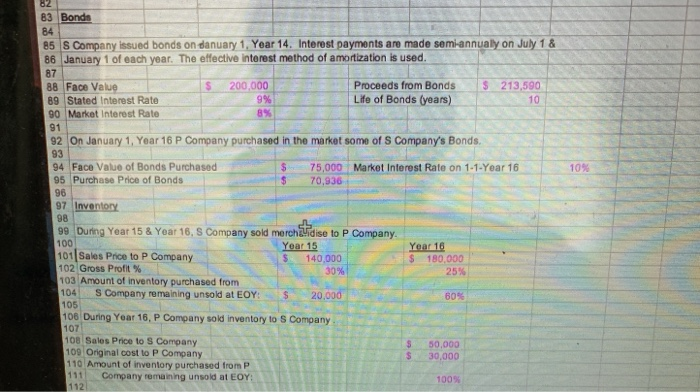

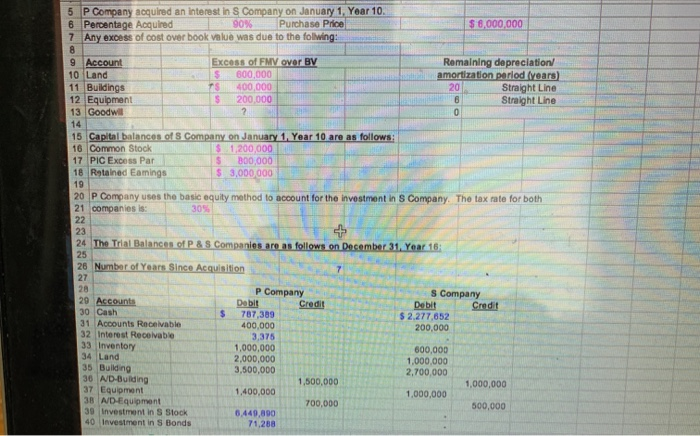

5 P Company acquired an interest in s Company on January 1 Year 10 6 Percentage Acquired 90% Purchase Price $ 6,000,000 7. Any excess of cost over book value was due to the folwing: 8 9 Account Excess of FMV over BV Remaining depreciation/ 10 Land $ 600,000 amortization period (years) 11 Buildings TS 400,000 20 Straight Line 12 Equipment S 200.000 6 Straight Line 13 Goodwill 2 0 14 15 Capital balances of s Company on January 1, Year 10 are as follows: 16 Common Stock $ 1,200,000 17 PIC Excess Par $ 300,000 18 Retained Eamings $ 3,000,000 19 20 P Company uses the basic equity method to account for the investment in S Company. The tax rate for both 21 companies is: 30% 22 23 24 The Trial Balances of P&S Companies are as follows on December 31, Year 16 25 26 Number of Years Since Acquisition 27 28 P Company s Company 29 Accounts Dobit Credit Debit Credit 30 Cash $ 787,389 $ 2.277,652 31 Accounts Receivable 400,000 200,000 32 Interest Receivable 3,376 33 Inventory 1,000,000 600,000 34 Land 2,000,000 1,000,000 35 Building 3,500,000 2,700,000 36 AD-Building 1,500,000 1,000,000 37 Equipment 1,400,000 1,000,000 38 AD-Equipment 700.000 500,000 39 Investment in S Stock 0.449,090 40 Investment in S Bonds 71,288 S Company Debit Credit $ 2,277,652 200,000 600,000 1,000,000 2.700,000 1,000,000 1,000,000 500,000 24 IN THAT BANCOS TOPS Companiollow on 25 7 26 Number of Years Since Acquisition 27 28 P Company 29 Accounts Dobit Credit 30 Cash S 787,389 31 Accounts Receivable 400,000 32 Interest Receivable 3,375 33 Inventory 1,000,000 34 Land 2,000,000 35 Building 3,500,000 36 A/D-Bullding 1,500,000 37 Equipment 1,400,000 38 A/D-Equipment 700,000 39 Investment in S Stock 6,449,890 40 Investment in S Bonds 71,288 41 Accounts Payable 45,000 42 Interest Payable 50,000 43 Income Tax Payable 200,101 44 Bonds Payable 1,000,000 45 Premium-Bonds Payable 46 Discount-Bonds Payable 47 Common Stock 2,600,000 48 PIC Excess Par 1,000,000 49 Retained Eamings 8,000,000 50 Dividends Declared 80,000 51 Sales 2,300,000 52 Cost of Goods Sold 1,100,000 53 Interest Income 7.102 54 Other Expenses 150,000 55 Depreciation Expense 300,000 56 Interest Expense 100,000 57 Income Tax Expense 200.101 58 Income From Subsidiary 139.049 59 Totals $17.542 043 S. 17642.04 30,000 9,000 84,927 200,000 10,563 1,000,000 800,000 4,000,000 55,000 950,000 430,000 60,000 160,000 16,911 84,027 SASA SE5440 62 63 Machinery 64 65 S Company sold a machine to P on January 1, Year 14. S Company originaly bought the machine on 68 January 1 Year 11. Straight line depreciation is being used. The original life of the machine was not changed. 67 Original Cost to S Company 150,000 68 Sales Price to P Company S 108,750 69 Original Life of the Machine (years) 8 70 Salvage value $ 71 72 Land 73 74 P Company sold land to S Company on October 1, Year 15. P Company originally bought the land on 75 January 1, Year 8. 76 Original Cost to P Company $ 180,000 77 Sales Pro to S Company $ 250,000 78 79 0 81 82 83 Bonds 84 85 S Company issued bonds on January 1, Year 14. Interest payments are made semi-annually on July 1 & 86 January 1 of each year. The effective interest method of amortization is used. B7 88 Face Value $ 200,000 Proceeds from Bonds $ 213,590 89 Stated Interest Rate Life of Bonds (years) 10 90 Market Interest Rate 8% 91 92 On January 1, Year 16 P Company purchased in the market some of S Company's Bonds. 93 94 Face Value of Bonds Purchased $ 75,000 Market Interest Rate on 1.1-Year 16 95 Purchase Price of Bonds 10% 5 70,938 9 97 Inventory 10% 82 83 Bonds 84 85 S Company issued bonds on danuary 1, Year 14. Interest payments are made semi-annualy on July 1 & 86 January 1 of each year. The effective interest method of amortization is used. 87 88 Face Value $ 200,000 Proceeds from Bonds $ 213,590 89 Stated Interest Rate 9% Life of Bonds (years) 10 90 Market Interest Rate 8% 91 92 On January 1, Year 16 P Company purchased in the market some of S Company's Bonds. 93 94 Face Value of Bonds Purchased $ 75,000 Market Interest Rate on 1-1-Year 16 95 Purchase price of Bonds $ 70,936 96 97 Inventory 98 99 During Year 15 & Year 16, S Company sold morchilidise to P Company 100 Year 15 Year 16 101 Sales Price to P Company 140,000 $ 180,000 102 Gross Profit % 30% 25% 103 Amount of inventory purchased from 104 S Company remaining unsold at EOY: $ 20.000 60% 105 106 During Year 16, P Company sold Inventory to s Company 107 100 Sales Price to s Company S 50,000 109 Original cost to P Company $ 30,000 110 Amount of inventory purchased from P 111 Company remaining unsold at EOY: 100% 112 5 P Company acquired an interest in s Company on January 1 Year 10 6 Percentage Acquired 90% Purchase Price $ 6,000,000 7. Any excess of cost over book value was due to the folwing: 8 9 Account Excess of FMV over BV Remaining depreciation/ 10 Land $ 600,000 amortization period (years) 11 Buildings TS 400,000 20 Straight Line 12 Equipment S 200.000 6 Straight Line 13 Goodwill 2 0 14 15 Capital balances of s Company on January 1, Year 10 are as follows: 16 Common Stock $ 1,200,000 17 PIC Excess Par $ 300,000 18 Retained Eamings $ 3,000,000 19 20 P Company uses the basic equity method to account for the investment in S Company. The tax rate for both 21 companies is: 30% 22 23 24 The Trial Balances of P&S Companies are as follows on December 31, Year 16 25 26 Number of Years Since Acquisition 27 28 P Company s Company 29 Accounts Dobit Credit Debit Credit 30 Cash $ 787,389 $ 2.277,652 31 Accounts Receivable 400,000 200,000 32 Interest Receivable 3,376 33 Inventory 1,000,000 600,000 34 Land 2,000,000 1,000,000 35 Building 3,500,000 2,700,000 36 AD-Building 1,500,000 1,000,000 37 Equipment 1,400,000 1,000,000 38 AD-Equipment 700.000 500,000 39 Investment in S Stock 0.449,090 40 Investment in S Bonds 71,288 S Company Debit Credit $ 2,277,652 200,000 600,000 1,000,000 2.700,000 1,000,000 1,000,000 500,000 24 IN THAT BANCOS TOPS Companiollow on 25 7 26 Number of Years Since Acquisition 27 28 P Company 29 Accounts Dobit Credit 30 Cash S 787,389 31 Accounts Receivable 400,000 32 Interest Receivable 3,375 33 Inventory 1,000,000 34 Land 2,000,000 35 Building 3,500,000 36 A/D-Bullding 1,500,000 37 Equipment 1,400,000 38 A/D-Equipment 700,000 39 Investment in S Stock 6,449,890 40 Investment in S Bonds 71,288 41 Accounts Payable 45,000 42 Interest Payable 50,000 43 Income Tax Payable 200,101 44 Bonds Payable 1,000,000 45 Premium-Bonds Payable 46 Discount-Bonds Payable 47 Common Stock 2,600,000 48 PIC Excess Par 1,000,000 49 Retained Eamings 8,000,000 50 Dividends Declared 80,000 51 Sales 2,300,000 52 Cost of Goods Sold 1,100,000 53 Interest Income 7.102 54 Other Expenses 150,000 55 Depreciation Expense 300,000 56 Interest Expense 100,000 57 Income Tax Expense 200.101 58 Income From Subsidiary 139.049 59 Totals $17.542 043 S. 17642.04 30,000 9,000 84,927 200,000 10,563 1,000,000 800,000 4,000,000 55,000 950,000 430,000 60,000 160,000 16,911 84,027 SASA SE5440 62 63 Machinery 64 65 S Company sold a machine to P on January 1, Year 14. S Company originaly bought the machine on 68 January 1 Year 11. Straight line depreciation is being used. The original life of the machine was not changed. 67 Original Cost to S Company 150,000 68 Sales Price to P Company S 108,750 69 Original Life of the Machine (years) 8 70 Salvage value $ 71 72 Land 73 74 P Company sold land to S Company on October 1, Year 15. P Company originally bought the land on 75 January 1, Year 8. 76 Original Cost to P Company $ 180,000 77 Sales Pro to S Company $ 250,000 78 79 0 81 82 83 Bonds 84 85 S Company issued bonds on January 1, Year 14. Interest payments are made semi-annually on July 1 & 86 January 1 of each year. The effective interest method of amortization is used. B7 88 Face Value $ 200,000 Proceeds from Bonds $ 213,590 89 Stated Interest Rate Life of Bonds (years) 10 90 Market Interest Rate 8% 91 92 On January 1, Year 16 P Company purchased in the market some of S Company's Bonds. 93 94 Face Value of Bonds Purchased $ 75,000 Market Interest Rate on 1.1-Year 16 95 Purchase Price of Bonds 10% 5 70,938 9 97 Inventory 10% 82 83 Bonds 84 85 S Company issued bonds on danuary 1, Year 14. Interest payments are made semi-annualy on July 1 & 86 January 1 of each year. The effective interest method of amortization is used. 87 88 Face Value $ 200,000 Proceeds from Bonds $ 213,590 89 Stated Interest Rate 9% Life of Bonds (years) 10 90 Market Interest Rate 8% 91 92 On January 1, Year 16 P Company purchased in the market some of S Company's Bonds. 93 94 Face Value of Bonds Purchased $ 75,000 Market Interest Rate on 1-1-Year 16 95 Purchase price of Bonds $ 70,936 96 97 Inventory 98 99 During Year 15 & Year 16, S Company sold morchilidise to P Company 100 Year 15 Year 16 101 Sales Price to P Company 140,000 $ 180,000 102 Gross Profit % 30% 25% 103 Amount of inventory purchased from 104 S Company remaining unsold at EOY: $ 20.000 60% 105 106 During Year 16, P Company sold Inventory to s Company 107 100 Sales Price to s Company S 50,000 109 Original cost to P Company $ 30,000 110 Amount of inventory purchased from P 111 Company remaining unsold at EOY: 100% 112