Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What would you suggest on this replacement project if the company require 20% cost of capital? Lombard Company is contemplating the purchase of a new

What would you suggest on this replacement project if the company require 20% cost of capital?

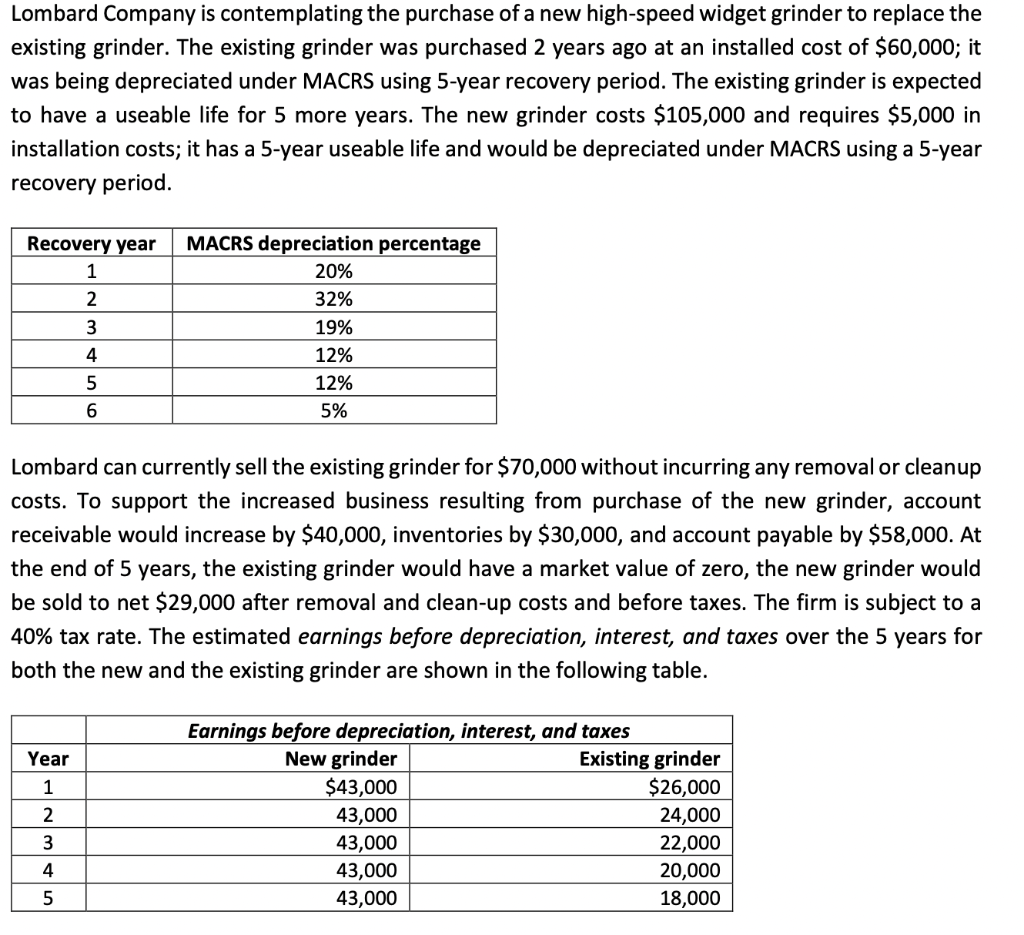

Lombard Company is contemplating the purchase of a new high-speed widget grinder to replace the existing grinder. The existing grinder was purchased 2 years ago at an installed cost of $60,000; it was being depreciated under MACRS using 5-year recovery period. The existing grinder is expected to have a useable life for 5 more years. The new grinder costs $105,000 and requires $5,000 in installation costs; it has a 5-year useable life and would be depreciated under MACRS using a 5-year recovery period. Lombard can currently sell the existing grinder for $70,000 without incurring any removal or cleanup costs. To support the increased business resulting from purchase of the new grinder, account receivable would increase by $40,000, inventories by $30,000, and account payable by $58,000. At the end of 5 years, the existing grinder would have a market value of zero, the new grinder would be sold to net $29,000 after removal and clean-up costs and before taxes. The firm is subject to a 40% tax rate. The estimated earnings before depreciation, interest, and taxes over the 5 years for both the new and the existing grinder are shown in the following tableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started