Answered step by step

Verified Expert Solution

Question

1 Approved Answer

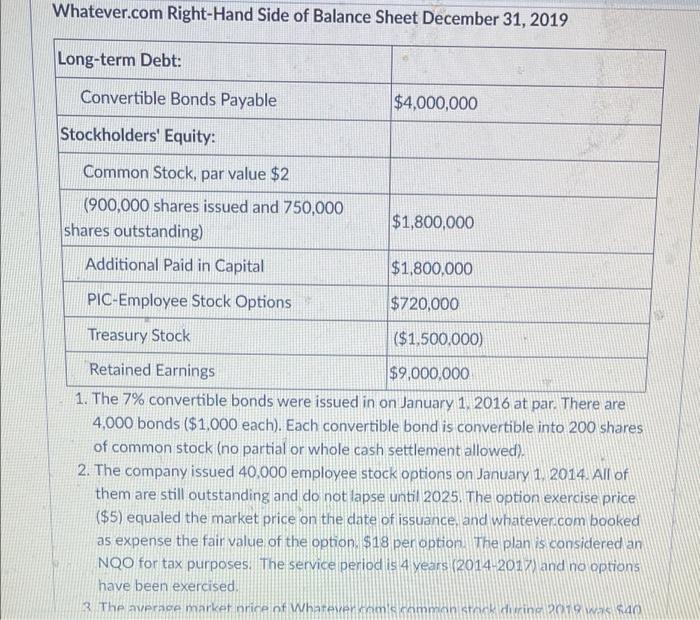

Whatever.com Right-Hand Side of Balance Sheet December 31, 2019 Long-term Debt: Convertible Bonds Payable Stockholders' Equity: Common Stock, par value $2 (900,000 shares issued

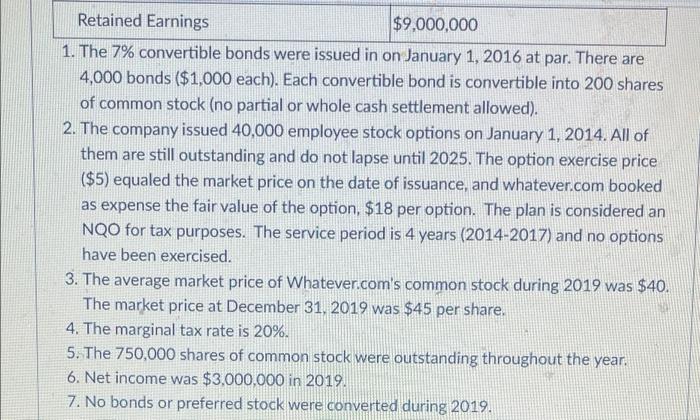

Whatever.com Right-Hand Side of Balance Sheet December 31, 2019 Long-term Debt: Convertible Bonds Payable Stockholders' Equity: Common Stock, par value $2 (900,000 shares issued and 750,000 shares outstanding) Additional Paid in Capital PIC-Employee Stock Options $4,000,000 $1,800,000 $1,800,000 $720,000 Treasury Stock ($1,500,000) Retained Earnings $9,000,000 1. The 7% convertible bonds were issued in on January 1, 2016 at par. There are 4,000 bonds ($1,000 each). Each convertible bond is convertible into 200 shares of common stock (no partial or whole cash settlement allowed). 2. The company issued 40,000 employee stock options on January 1, 2014. All of them are still outstanding and do not lapse until 2025. The option exercise price ($5) equaled the market price on the date of issuance, and whatever.com booked as expense the fair value of the option. $18 per option. The plan is considered an NQO for tax purposes. The service period is 4 years (2014-2017) and no options have been exercised. 3 The average market price of Whatever com's common stock during 2019 was $40 EN Retained Earnings $9,000,000 1. The 7% convertible bonds were issued in on January 1, 2016 at par. There are 4,000 bonds ($1,000 each). Each convertible bond is convertible into 200 shares of common stock (no partial or whole cash settlement allowed). 2. The company issued 40,000 employee stock options on January 1, 2014. All of them are still outstanding and do not lapse until 2025. The option exercise price ($5) equaled the market price on the date of issuance, and whatever.com booked as expense the fair value of the option, $18 per option. The plan is considered an NQO for tax purposes. The service period is 4 years (2014-2017) and no options have been exercised. 3. The average market price of Whatever.com's common stock during 2019 was $40. The market price at December 31, 2019 was $45 per share. 4. The marginal tax rate is 20%. 5. The 750,000 shares of common stock were outstanding throughout the year. 6. Net income was $3,000,000 in 2019. 7. No bonds or preferred stock were converted during 2019. Compute fully-diluted EPS: $1.25) Round to the nearest penny (i.e.

Step by Step Solution

★★★★★

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer Basic EPS is calculated by divid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started