whats the answer for all

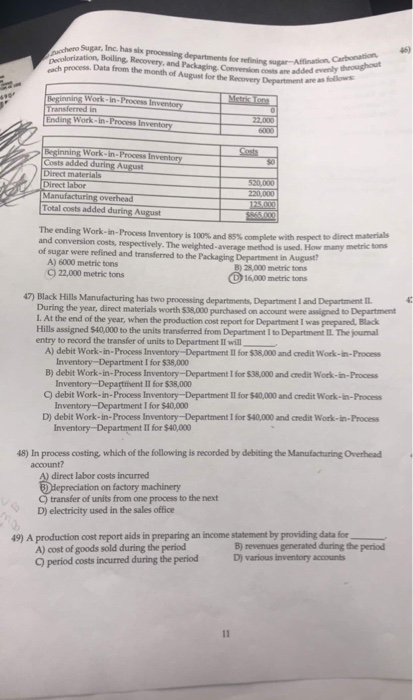

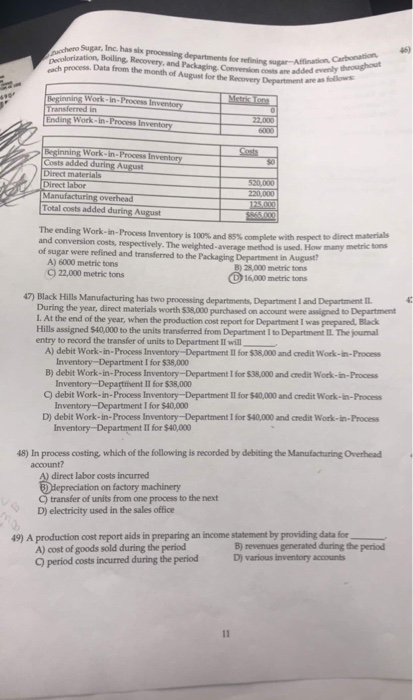

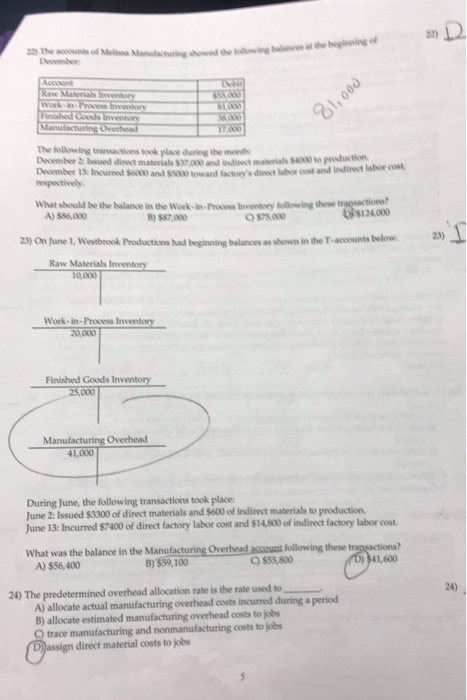

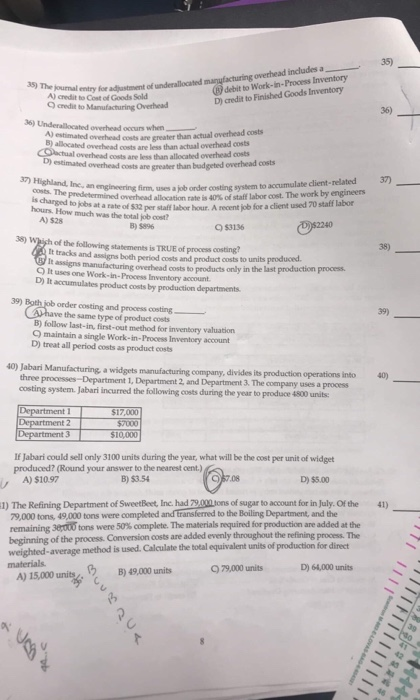

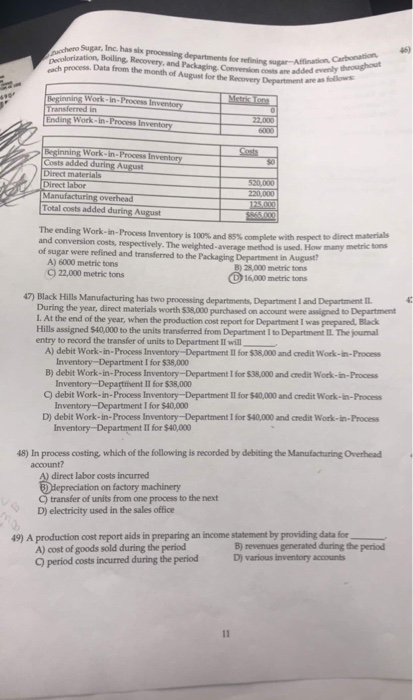

nchero Sugar, Inc. has six processing departments for nefining sugar-Afination Carbonation 46) Decolorization, Boiling, Recovery, and Packaging Conversion costs are added evenly throughout each process. Data from the month of August for the Recovery Department are as follows Beginning Work-in-Process Inventory Transferred in Ending Work-in-Process Inventory Metric Tons 22.000 6000 Beginning Work-in-Process Inventory Costs added during August Direct materials Direct labor Manufacturing overhead Total costs added during August Costs 520,000 220,000 125.000 5865,000 The ending Work-in-Process Inventory is 100% and 85% complete with respect to direct materials and conversion costs, respectively. The weighted-average method is used. How many metric tons of sugar were refined and transferred to the Packaging Department in August? A) 6000 metric tons B) 28,000 metric tons D)16,000 metric tons ) 22,000 metric tons 47) Black Hills Manufacturing has two processing departments, Department I and Department IL During the year, direct materials worth $38,000 purchased on account were assigned to Department I. At the end of the year, when the production cost report for Department I was prepared, Black Hills assigned $40,000 to the units transferred from Department I to Department IL. The joumal entry to record the transfer of units to Department II will A) debit Work-in- Process Inventory-Department II for $38,000 and credit Work-in-Process Inventory-Department I for $38,000 B) debit Work-in-Process Inventory-Department I for $38,000 and credit Work-in-Process Inventory-Department II for $38,000 O debit Work-in-Process Inventory-Department II for $40,,000 and credit Work-in-Process Inventory-Department I for $40,000 D) debit Work-in- Process Inventory-Department I for $40,000 and credit Work-in-Process Inventory-Department II for $40,000 48) In process costing, which of the following is recorded by debiting the Manufacturing Overhead account? A) direct labor costs incurred BHepreciation on factory machinery C) transfer of units from one process to the next D) electricity used in the sales office 49) A production cost report aids in preparing an income statement by providing data for A) cost of goods sold during the period 9 period costs incurred during the period B) revenues generated during the period D) various inventory accounts 11 The accounts of Mesa Manalacturing showed te ollowing balane al the beginning of December Account Raw Malerials nvenory Work-in-Process hvwenory Finished Goods Iventory Manufacturing Overhead Debt 81s000 The following transactions took place during the month December 2 Issued direct materialh S2000 and indirect materials $4000 to production December 13 Incurred Se000 and Ss000 bowand factor's direct labor cost and indirect labor cost respectively. What should be the balance in the Work-in-Process Iventory ollowing these tragsactions? A) $86,000 000 23) On June 1, Westbrook Productions had beginning balances as shown in the T-accounts below. B) $87,000 23) Raw Materials Inventory 10.000 Work-in-Process Inventory 20,000 Finished Goods Inventory 25,000 Manufacturing Overhead 41.000 During June, the following transactions took place June 2: Issued $3300 of direct materials and $600 of indirect materials to production June 13: Incurred $7400 of direct factory labor cost and $14,800 of indirect factory labor cost. What was the balance in the Manufacturing Overhead account following these transactions? A) $56,400 9 $55,800 B) $59,100 D) 341,600 24) The predetermined overhead allocation rate is the rate used to A) allocate actual manufacturing overhead costs incurred during a period B) allocate estimated manufacturing overhead costs to jobs 9 trace manufacturing and nonmanufacturing costs to jobs Dassign direct material costs to jobs 24) 35) 35) The journal entry for adjustment of underallocated manufacturing overhead includes a A) credit to Cost of Goods Sold @debit to Work-in-Process Inventory Dredit to Finished Goods Inventory 9credit to Manufacturing Overhead 36) 36) Underallocated overhead occurs when. A) estimated overhead costs are greater than actual overhead costs B) allocated overhead costs are less than actual overhead costs Cabstual overhead costs ane less than allocated overhead costs D) estimated overhead costs are greater than budgeted overhead costs 37) Highland, Inc, an engineering firm, uses a job order costing system to accumulate client-related 37) costs. The predetermined oerhead allocation rate is 40 % of staff labor cost. The work by engineers is charged to jobs at a rate of $32 per staff labor hour. A recent job for a client used 70 staff labor hours. How much was the total job cost? A) $28 240 B) $896 9 $3136 38) Wigh of the following statements is TRUE of process costing 38) t tracks and assigns both period costs and product costs to units produced. BIt assigns manufacturingg overhead costs to products only in the last production process 9 It uses one Work-in-Process Inventory account D) It accumulates product costs by production departments 39) Both job oreder costing and process costing Ahave the same type of product costs B) follow last-in, first-out method for inventory valuations 9 maintain a single Work-in-Process Inventory account D) treat all period costs as product costs 39) 40) Jabari Manufacturing, a widgets manufacturing company, divides its production operations into three processes-Department 1, Department 2, and Department 3. The company uses a process costing system. Jabari incurred the following costs during the year to produce 4800 units: 40) Department 1 Department 2 Department 3 $17,000 $7000 $10,000 If Jabari could sell only 3100 units during the year, what will be the cost per unit of widget produced? (Round your answer to the nearest cent.) C7.08 B) $3.54 A) $10.97 D) $5.00 1) The Refining Department of SweetBeet, Inc. had 79,000 tons of sugar to account for in July. Of the 79,000 tons, 49,000 tons were completed and transferred to the Boiling Department, and the remaining 3000 tons were 50 % complete. The materials required for production are added at the beginning of the process. Conversion costs are added evenly throughout the refining process. The weighted-average method is used. Calculate the total equivalent units of production for direct 41) materials A) 15,000 units 9 79,000 units D) 64,000 units B) 49,000 units