what's the answer for this please?

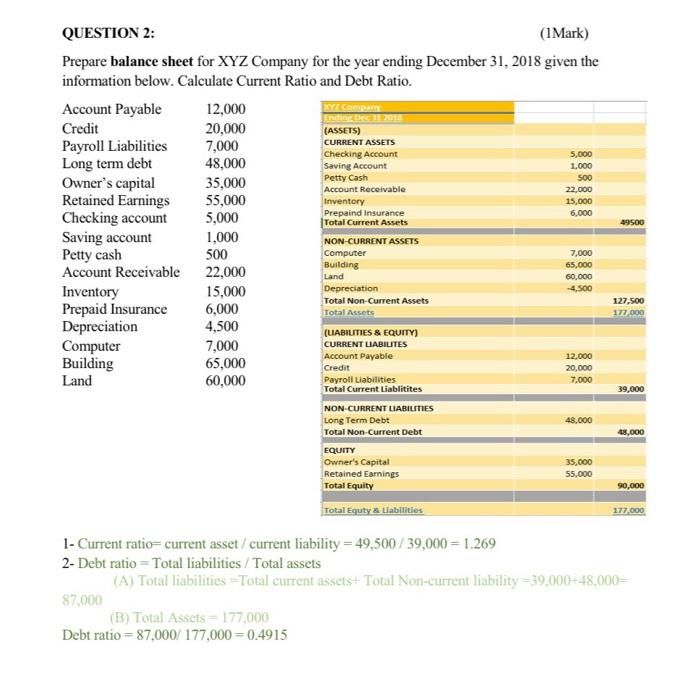

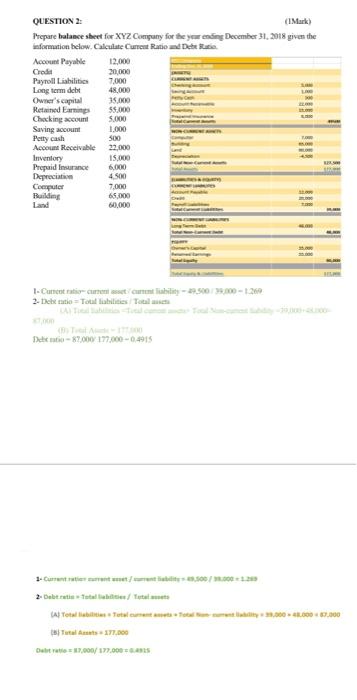

QUESTION 2: (Mark) Prepare balance sheet for XYZ Company for the year ending December 31, 2018 given the information below. Calculate Current Ratio Deate Account Payable 12.000 Credit Payroll Liabilities 7.000 Long term det 48,000 Owner's capital 35.000 Retained 55.000 Checking account 5.000 Saving account Petty cash 500 Account Receivable 32,000 Inventory 15. Prepaid Insurance 6,000 Depreciation 4.500 Computer 7.000 Ruilding 65.000 60,000 1.000 2-Deleratie = Total abilities Total De 87.000 177.00 -0.2015 Totalt 171.000 Dulu 17,000/ 177.000 XYZ Company QUESTION 2: (1Mark) Prepare balance sheet for XYZ Company for the year ending December 31, 2018 given the information below. Calculate Current Ratio and Debt Ratio. Account Payable 12,000 Credit 20,000 Payroll Liabilities 7,000 Long term debt 48,000 Owner's capital 35,000 Retained Earnings 55,000 Checking account 5,000 Saving account 1,000 Petty cash 500 Account Receivable 22,000 Inventory Prepaid Insurance 6,000 Depreciation 4,500 Computer 7,000 Building 65,000 Land 60,000 5,000 1,000 500 22.000 15,000 6.000 (ASSETS) CURRENT ASSETS Checking Account Saving Account Petty Cash Account Receivable Inventory Prepaind Insurance Total Current Assets NON-CURRENT ASSETS Computer Building Land Depreciation Total Non-Current Assets Total Assets 49500 7,000 65,000 60,000 -4,500 15,000 127,500 177.000 (LIABILITIES & EQUITY) CURRENT LIABILITES Account Payable Credit Payroll Liabilities Total Current Liablitites 12.000 20,000 7.000 39,000 48,000 48,000 NON-CURRENT LIABILITIES Long Term Debt Total Non-Current Debt EQUITY Owner's Capital Retained Earnings Total Equity 35,000 55,000 90,000 Total Equty & Labilities 172.000 1- Current ratio=current asset / current liability = 49,500/39,000 = 1.269 2- Debt ratio = Total liabilities / Total assets (A) Total liabilities Total current assets+ Total Non-current liability=39,000+48.000= 87,000 (B) Total Assets = 177,000 Debt ratio = 87,000/ 177,000 = 0.4915 1- Current ratio= current asset / current liability = 49,500 / 39,000 = 1.269 2- Debt ratio = Total liabilities / Total assets (A) Total liabilities = Total current assets + Total Non-current liability = 39,000 + 48,000 = 87,000 (B) Total Assets = 177,000 Debt ratio = 87,000/ 177,000 = 0.4915 QUESTION 2: (Mark) Prepare balance sheet for XYZ Company for the year ending December 31, 2018 given the information below. Calculate Current Ratio Deate Account Payable 12.000 Credit Payroll Liabilities 7.000 Long term det 48,000 Owner's capital 35.000 Retained 55.000 Checking account 5.000 Saving account Petty cash 500 Account Receivable 32,000 Inventory 15. Prepaid Insurance 6,000 Depreciation 4.500 Computer 7.000 Ruilding 65.000 60,000 1.000 2-Deleratie = Total abilities Total De 87.000 177.00 -0.2015 Totalt 171.000 Dulu 17,000/ 177.000 XYZ Company QUESTION 2: (1Mark) Prepare balance sheet for XYZ Company for the year ending December 31, 2018 given the information below. Calculate Current Ratio and Debt Ratio. Account Payable 12,000 Credit 20,000 Payroll Liabilities 7,000 Long term debt 48,000 Owner's capital 35,000 Retained Earnings 55,000 Checking account 5,000 Saving account 1,000 Petty cash 500 Account Receivable 22,000 Inventory Prepaid Insurance 6,000 Depreciation 4,500 Computer 7,000 Building 65,000 Land 60,000 5,000 1,000 500 22.000 15,000 6.000 (ASSETS) CURRENT ASSETS Checking Account Saving Account Petty Cash Account Receivable Inventory Prepaind Insurance Total Current Assets NON-CURRENT ASSETS Computer Building Land Depreciation Total Non-Current Assets Total Assets 49500 7,000 65,000 60,000 -4,500 15,000 127,500 177.000 (LIABILITIES & EQUITY) CURRENT LIABILITES Account Payable Credit Payroll Liabilities Total Current Liablitites 12.000 20,000 7.000 39,000 48,000 48,000 NON-CURRENT LIABILITIES Long Term Debt Total Non-Current Debt EQUITY Owner's Capital Retained Earnings Total Equity 35,000 55,000 90,000 Total Equty & Labilities 172.000 1- Current ratio=current asset / current liability = 49,500/39,000 = 1.269 2- Debt ratio = Total liabilities / Total assets (A) Total liabilities Total current assets+ Total Non-current liability=39,000+48.000= 87,000 (B) Total Assets = 177,000 Debt ratio = 87,000/ 177,000 = 0.4915 1- Current ratio= current asset / current liability = 49,500 / 39,000 = 1.269 2- Debt ratio = Total liabilities / Total assets (A) Total liabilities = Total current assets + Total Non-current liability = 39,000 + 48,000 = 87,000 (B) Total Assets = 177,000 Debt ratio = 87,000/ 177,000 = 0.4915