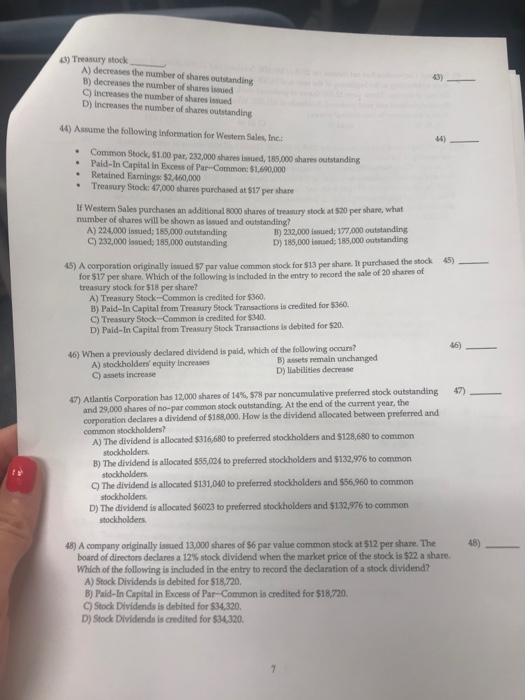

Whats the answers

3) Treasury stock A) decreases the number of shares outstanding B) decreases the number of shares issued C) increases the number of shares issued D) increases the number of shares outstanding 43) 44) Assume the following information for Western Sales, Inc: 44) Common Stock, $1.00 par, 232,000 shares isued, 185,000 shares outstanding Paid-In Capital in Excess of Par-Common: $1,690,000 Retained Earmings: $2,460,000 Treasury Stock: 47,000 shares parchased at $17 per share if Westerm Sales purchases an additional 8000 shares of treasury stock at 520 per share, what number of shares will be shown as issued and outstanding? A) 224,000 issued; 185,000 outstanding C) 232,000 issued; 185,000 outstanding B) 232,000 issued; 177,000 outstanding D) 185,000 issued, 185,000 outstanding 45) A corporation originally issued $7 par value common stock for $13 per share. It purchased the stock 45) record the sale of 20 shares of for $17 per share. Which of the following is included in the entry to treasury stock for $18 per share? A) Treasury Stock-Common is credited for $360. In Capital from Treasury Stock Transactions is credited for $360. C) Treasury Stock-Common is credited for $340 D) Paid-In Capital from Treasury Stock Transactions is debited for $20 46) 46) When a previously declared dividend is paid, which of the following occurs? A) stockholders' equity increases C) assets increase B) assets remain unchanged D) liabilities decrease 47) Atlantis Corporation has i2000 shares of 14%,$78 par noncumulative preferred stock outstanding allocated between preferred and 4) common stock outstanding At the end of the current year, the and 29,000 shares of no-par corporation declares a dividend of $188,000. How is the dividend common stockholders? A) The dividend is allocated $316,680 to preferred stockholders and $128,680 to common B) The dividend is allocated $55,024 to preferred stockholders and $132,976 to common C The dividend is allocated $131,040 to preferred stockholders and $56,960 to common D) The dividend is allocated $6023 to preferred stockholders and $132,976 to common stockholders stockholders 48) A company originally issued 13,000 shares of $6 par value common stock at $12 per share. The 48) board of directors declares a 12% stock dividend when the market price of the stock is$22 a share. Which of the following is included in the entry to record the declaration of a stock dividend? A) Stock Dividends is debited for S18,720. B) Paid-In Capital in Excess of Par-Common is credited for $18,720. C) Stock Dividends is debited for $34,320. D) Stock Dividends is credited for $34,320