Answered step by step

Verified Expert Solution

Question

1 Approved Answer

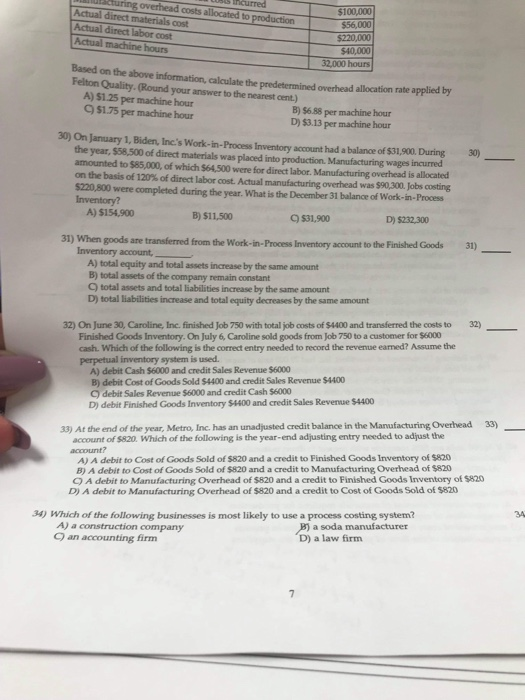

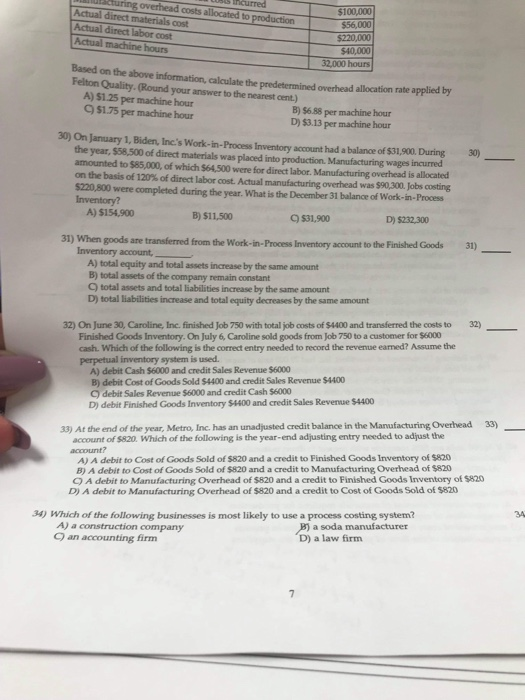

Whats the answers overhead costs allocated to production Actual direct materials cost Actual direct labor cost Actual machine hours $100,000 $56,000 $220,000 $40,000 32,000 hours

Whats the answers

overhead costs allocated to production Actual direct materials cost Actual direct labor cost Actual machine hours $100,000 $56,000 $220,000 $40,000 32,000 hours on the above information, calculate the predetermined overhead allocation rate applied by A) S1.25 per machine hour Felton Quality. (Round your answer to the nearest cent) B) 56.88 per machine hour D) $3.13 per machine hour S1.75 per machine hour 0) On January 1, Biden, Inc's Work-in-Process Inventory account had a balance of $31,900. During 0) the year, $58,500 of direct materials was placed into production. Manufacturing wages incurred amounted to $85,000, of which $64,500 were for direct labor. Manufacturing overhead is allocated on the basis of 120% of direct labor cost. Actual manufacturing overhead was S9000 Jobs axing 220,800 were completed during the year. What is the December 31 balance of Work-in-Process Inventory? A) $154,900 B) $11,500 C) $31,900 D) $232,300 31) When goods are transferred from the Work-in-Process Inventory account to the Finished Goods 31) Inventory account A) total equity and total assets increase by the same amount B) total assets of the company remain constant C) total assets and total liabilities increase by the same amount D) total liabilities increase and total equity decreases by the same amount 32) On June 30, Caroline, Inc. finished Job 750 with total job costs of $4400 and transferred the costs to 3) Finished Goods Inventory. On July 6, Caroline sold goods from Job 750 to a customer for $6000 cash. Which of the following is the correct entry needed to record the revenue earmed? Assume the perpetual inventory system is used. A) debit Cash $6000 and credit Sales Revenue $6000 B) debit Cost of Goods Sold $4400 and credit Sales Revenue $4400 C) debit Sales Revenue $6000 and credit Cash $6000 D) debit Finished Goods Inventory $4400 and credit Sales Revenue $4400 33) 33) At the end of the year, Metro, Inc. has an unadjusted credit balance in the Manufacturing Overhead account of $820. Which of the following is the year-end adjusting entry needed to adjust the account? A) A debit to Cost of Goods Sold of $820 and a credit to Finished Goods Inventory of $820 B) A debit to Cost of Goods Sold of $820 and a credit to Manufacturing Overhead of $820 O A debit to Manufacturing Overhead of $820 and a credit to Finished Goods Inventory of $820 D) A debit to Manufacturing Overhead of $820 and a credit to Cost of Goods Sold of $820 34) Which of the following businesses is most likely to use a process costing system? A) a construction company O an accounting firm B) a soda manufacturer D) a law firm

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started