Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What's the cash beginning balance in this case? NEW PLANT Since moving into the new plant and getting the bugs out of the new operation,

What's the cash beginning balance in this case?

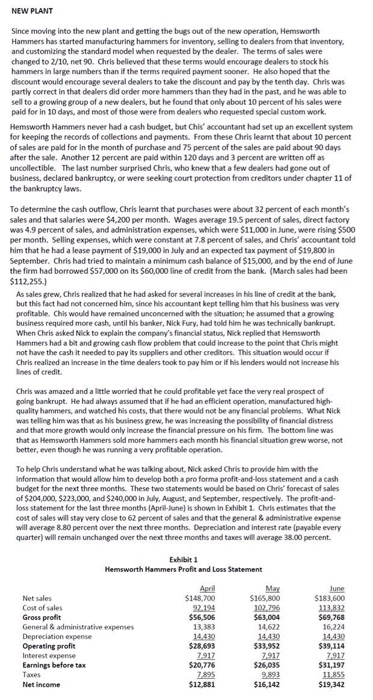

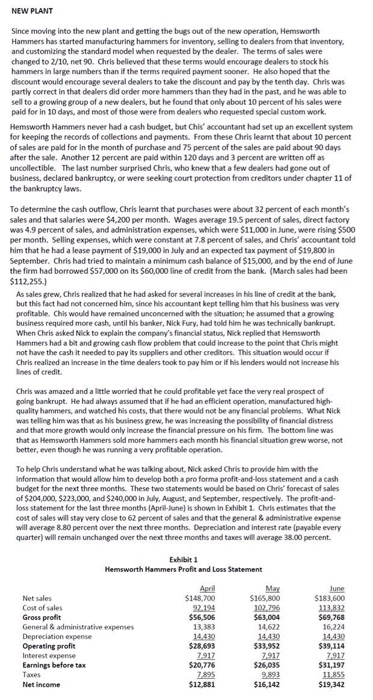

NEW PLANT Since moving into the new plant and getting the bugs out of the new operation, Hemsworth Hammers has started manufacturing hammers for inventory, selling to dealers from that inventory, and customizing the standard model when requested by the dealer. The terms of sales were changed to 2/10, net 90. Chris believed that these terms would encourage dealersto stockhis hammers in large numbers than if the terms required payment sooner. He also hoped that the discount would encourage several dealers to take the discount and paybythe tenth day, Chris was partly correct in that dealers did order more hammers than they had in the past, and he was able to sell to a growing group of a new dealers, but he found that only about 10 percent of his sales were paid for in 10 days, and most of those were from dealers who requested special custom work. Hemsworth Hammers never had a cash budget, but Chis accountant had set up an excellent system for keeping the records of collections and payments. From these Chris learnt that about 10 percent of sales are paid for in the month of purchase and 75 percent of the sales are paid about 90 days after the sale. Another 12 percent are paid within 120 days and 3percent are written off as tible. The last number surprised Chris, who knew that a few dealers had gone out of business declared bankruptcy, or were seeking court protection from creditors underchapter 11 of the bankruptcy la To determine the cash outflow, Chris learnt that purchases were about 32 percent of each month's sales and that salaries were $4.200 per month. Wages average 19.5 percent of sales, direct factory was 4.9 percent of sales, and administration expenses, which were $11.000 in June, were rising $500 per month. Selling expenses, which were constant at 78 percent of sales and Chris accountant told him that he had a lease payment of S19.000 in July and an expected tax payment of S19,800 in September. Chris had tried to maintain a minimum cash balance of $15.000, and by the end of June the firm had borrowed $57,000 on its S60,000line of credit from the bank. (March sales had been $112.255.) As sales grew, Chris realized that he had asked for several increases in his line of credit at the bank, but this fact had not concerned him, since his accountant kept telling him that his business was very profitable. Chi would have remained unconcerned with the situation: heassumed that a growing business required more cash, until his banker, Nick Fury, had told him he was technically bankrupt. When Chris asked Nick to explain the company's financial status, Nick replied that Hemsworth Hammers had a bit and growing cash flow problem that could increase to the point that Chris might not have the cash it needed to pay its suppliers and other creditors. This situation would occur if in the time dealers took to pay him or if his lenders would not increase his Chris realized an increase lines of credit. Chris was amazed and a little worried that he could profitable yet face the veryreal prospect of going bankrupt. He had always assumed that if he had an efficient operation, manufactured high- hammers, and watched his costs, that there would not be any financial problems. What Nick quality was telling him was that as his business grew, he was increasing the possibility of financialdistress and that more would only increase the financial pressure on his firm. The bottom line was that as Hemsworth Hammers sold more hammers each month his financial situation grew worse, not better, even though he was running avery profitable operation. To help Chris understand what he was talking about, Nick asked Christo provide him with the information that would allow him to develop both apro forma profit-and-oss statement and a cash budget for the next three months. These two statements would be based on Chris forecast of sales $204,000 $223,000, and $240,000 in July, August, and September, respectively. The profit and- loss statement for the last three months (Aprillune is shown in Exhibit 1 Chris estimates that the cost of sales will stay very close to 62 percent ofsales and that the general& administrative expense will average 880 percent over the next three months. Depreciation and interest rate (payable every quarter) will remain unchanged over the next three months and taxes wilaverage 3800 percent. Exhibit Hemsworth Hammers Profit and Loss Statement Net sales $148,000 $165800 $183600 Cost of sales Gross profit $$6,506 $69,768 General administrative expenses 13,383 16.224 Depreciation expense 14430 14.430 14,430 $28693 Operating profit $33,952 $39,114 7917 7917 7917 Earnings before tax $20,776 $31,197 $12,881 Net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started