Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What's the IRR? Over the past three years, Canyon Computer has spent $10 million on market research on its Starlite laptop computer. An immediate investment

What's the IRR?

What's the IRR?

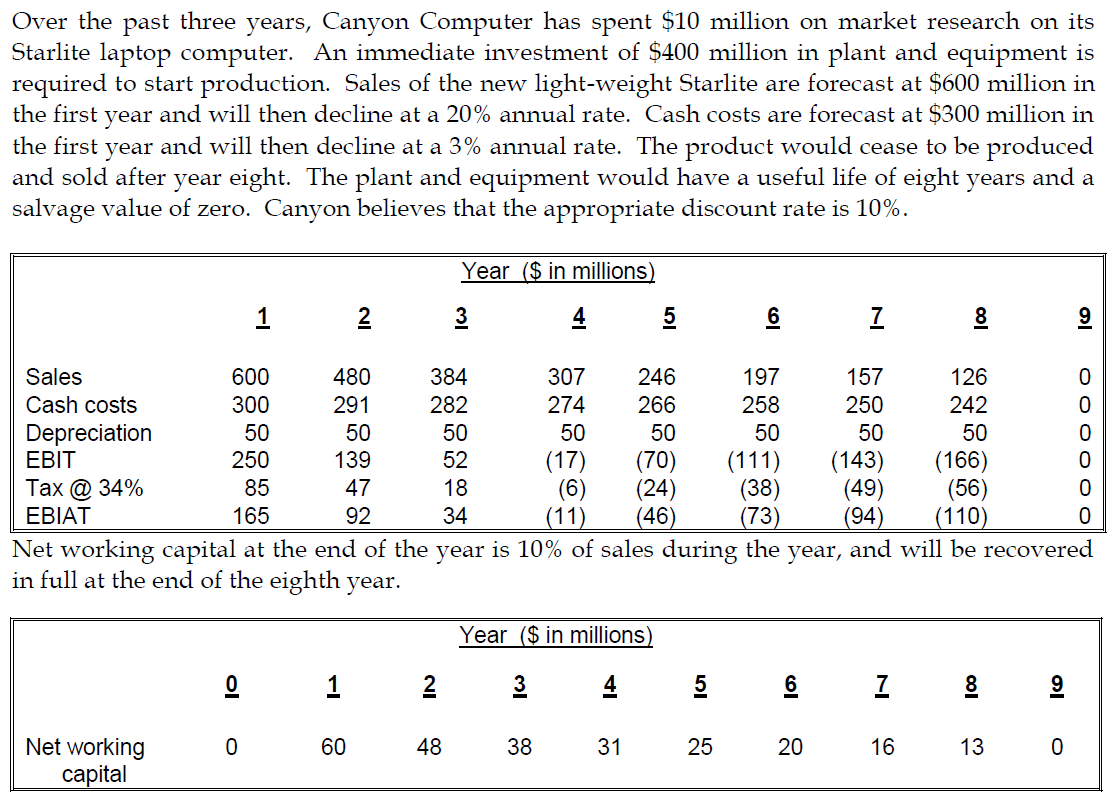

Over the past three years, Canyon Computer has spent $10 million on market research on its Starlite laptop computer. An immediate investment of $400 million in plant and equipment is required to start production. Sales of the new light-weight Starlite are forecast at $600 million in the first year and will then decline at a 20% annual rate. Cash costs are forecast at $300 million in the first year and will then decline at a 3% annual rate. The product would cease to be produced and sold after year eight. The plant and equipment would have a useful life of eight years and a salvage value of zero. Canyon believes that the appropriate discount rate is 10%. Year ($ in millions) 2 3 4 5 6 7 8 126 291 250 ooooooo 50 50 50 Sales 600 480 384 307 246 197 157 300 282 274 266 258 242 Depreciation 50 50 50 EBIT (17) (70) (111) (143) (166) Tax @ 34% 85 (6) (24) (38) (49) (56) EBIAT 165 92 34 (73) (94) (110) Net working capital at the end of the year is 10% of sales during the year, and will be recovered in full at the end of the eighth year. 50 139 47 18 (11) (46) Year ($ in millions) 9 9 0 1 60 2 48 3 38 4 31 5 25 6 20 7 16 8 13 Net working capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started