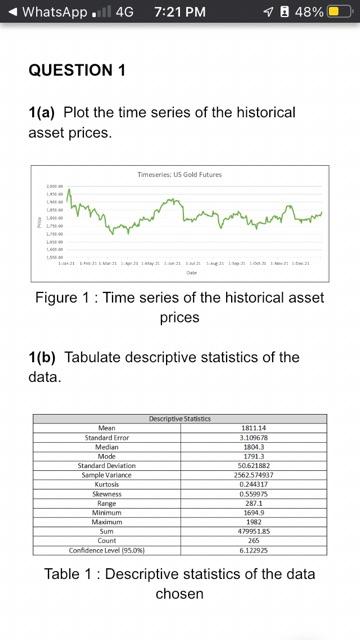

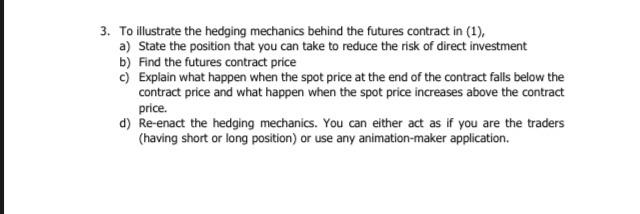

WhatsApp. 4G 7:21 PM B48% QUESTION 1 1(a) Plot the time series of the historical asset prices. Timeseries: US Gold Futures La LAM 201 Figure 1: Time series of the historical asset prices 1(b) Tabulate descriptive statistics of the data. Descriptive Statistics 1811.14 Mean Standard Error 3.109678 Median 1804.3 Mode 1791.3 Standard Deviation 50621882 Sample Variance 2562.574937 Kurtosis 0.244317 Skewness 0.559975 Rarge 287.1 Minimum 1694,9 Maximum 1982 479951.85 Sum Count 265 Confidence Level (95.0%) 6.122925 Table 1 Descriptive statistics of the data chosen 3. To illustrate the hedging mechanics behind the futures contract in (1), a) State the position that you can take to reduce the risk of direct investment b) Find the futures contract price c) Explain what happen when the spot price at the end of the contract falls below the contract price and what happen when the spot price increases above the contract price. d) Re-enact the hedging mechanics. You can either act as if you are the traders (having short or long position) or use any animation-maker application. WhatsApp. 4G 7:21 PM B48% QUESTION 1 1(a) Plot the time series of the historical asset prices. Timeseries: US Gold Futures La LAM 201 Figure 1: Time series of the historical asset prices 1(b) Tabulate descriptive statistics of the data. Descriptive Statistics 1811.14 Mean Standard Error 3.109678 Median 1804.3 Mode 1791.3 Standard Deviation 50621882 Sample Variance 2562.574937 Kurtosis 0.244317 Skewness 0.559975 Rarge 287.1 Minimum 1694,9 Maximum 1982 479951.85 Sum Count 265 Confidence Level (95.0%) 6.122925 Table 1 Descriptive statistics of the data chosen 3. To illustrate the hedging mechanics behind the futures contract in (1), a) State the position that you can take to reduce the risk of direct investment b) Find the futures contract price c) Explain what happen when the spot price at the end of the contract falls below the contract price and what happen when the spot price increases above the contract price. d) Re-enact the hedging mechanics. You can either act as if you are the traders (having short or long position) or use any animation-maker application