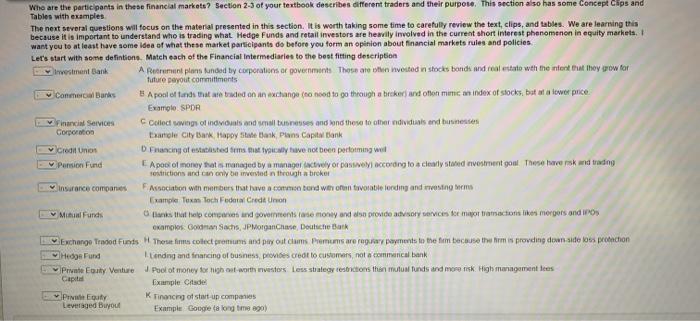

Whe are the particpants in these financial markots? Section 2-3 of your textbook describes different tradors and their purpese. This section also has some Concept Cifps and Tables with examples The next several questions will focus on the material presented in this section. It is worth taking some time to carefully review the text, clips, and tables. We are learsing tis because it is impertant to understand who is trading what. Hedge Funds and retail investers are hewily imvolved in the current short interest phenomence in equily marhets. 1 wast yeu to at least have some idea of what these market participants do before you form an opinion about financial markets rules and policies Lets start with some defintions. Match each of the Financial intermediaries to the best fitting deseription irrestiment Bank fifure serout cormmittments Conmercal Barks I A poal of fands that ate bried on an exchange (co nood to go through a brikerf and oflon menc an index of stocks, bat at a lever price. Example. SPDA Goperotos Eartele City Bank, Hapoy state Elank, Plans Captar Eank Creas uniot D. Fnancing of estatasted fems euat tyaicaly fave no been pertotming wol Pension Fund seestrictions and can only be inversted n ftrough a breker Fxample fuxm locth Fodatai Crede Unon Mitual Funds exampios: Goxdro1 Saths. JPlNorganchase, Doutefie Batk Hedge Fura I. Lending and fraaking of busness, provices creot to cuserrers, not a connmanical bank Promin Equfy: K. rinancing of stat up companies Leveraged Bupou Exampie Gobpe { a long tmes egol Whe are the particpants in these financial markots? Section 2-3 of your textbook describes different tradors and their purpese. This section also has some Concept Cifps and Tables with examples The next several questions will focus on the material presented in this section. It is worth taking some time to carefully review the text, clips, and tables. We are learsing tis because it is impertant to understand who is trading what. Hedge Funds and retail investers are hewily imvolved in the current short interest phenomence in equily marhets. 1 wast yeu to at least have some idea of what these market participants do before you form an opinion about financial markets rules and policies Lets start with some defintions. Match each of the Financial intermediaries to the best fitting deseription irrestiment Bank fifure serout cormmittments Conmercal Barks I A poal of fands that ate bried on an exchange (co nood to go through a brikerf and oflon menc an index of stocks, bat at a lever price. Example. SPDA Goperotos Eartele City Bank, Hapoy state Elank, Plans Captar Eank Creas uniot D. Fnancing of estatasted fems euat tyaicaly fave no been pertotming wol Pension Fund seestrictions and can only be inversted n ftrough a breker Fxample fuxm locth Fodatai Crede Unon Mitual Funds exampios: Goxdro1 Saths. JPlNorganchase, Doutefie Batk Hedge Fura I. Lending and fraaking of busness, provices creot to cuserrers, not a connmanical bank Promin Equfy: K. rinancing of stat up companies Leveraged Bupou Exampie Gobpe { a long tmes egol