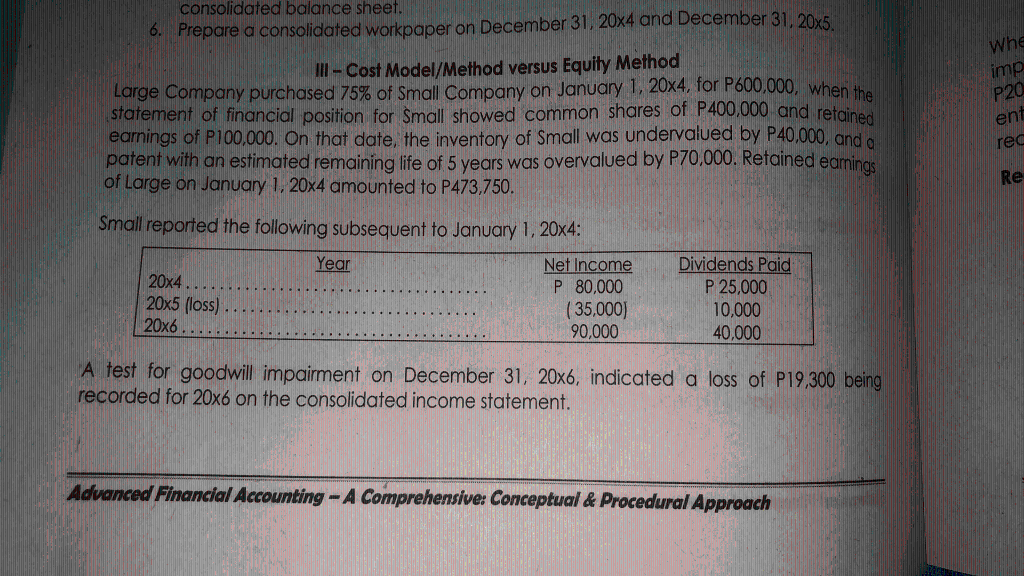

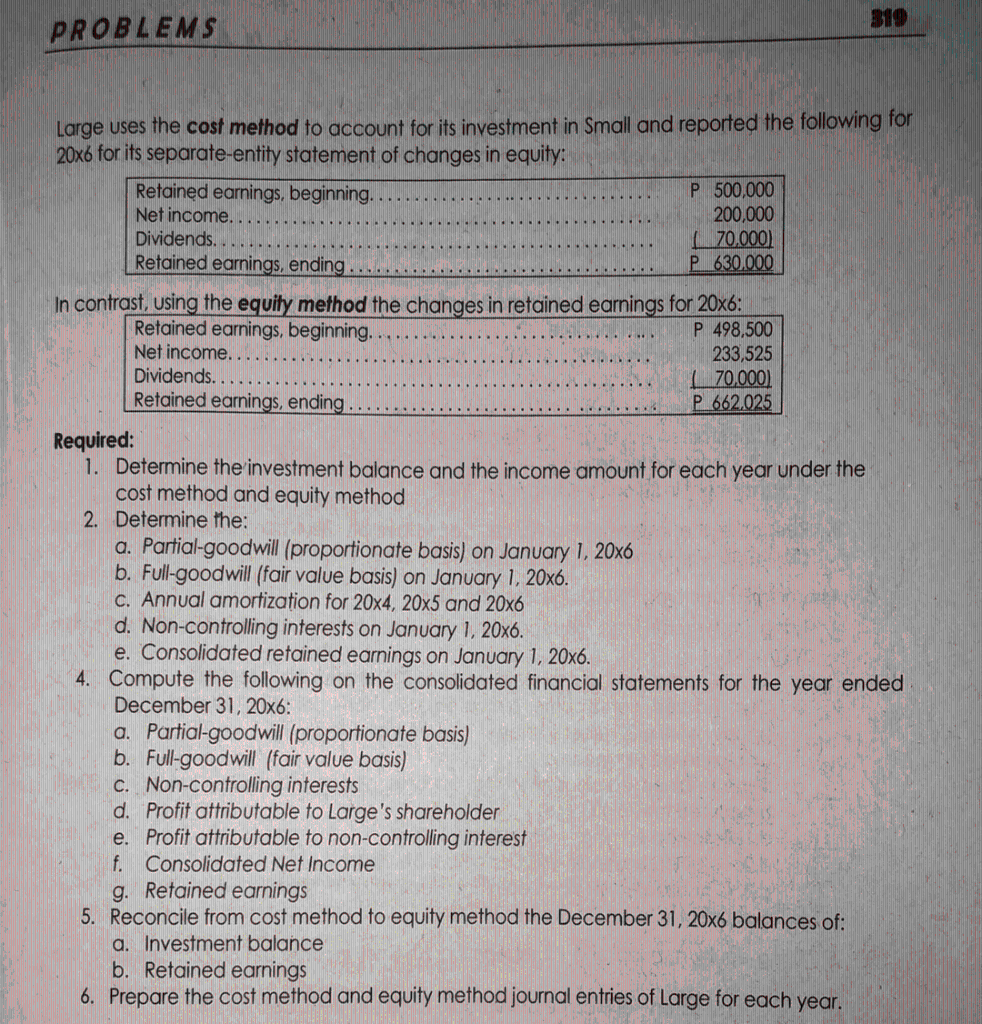

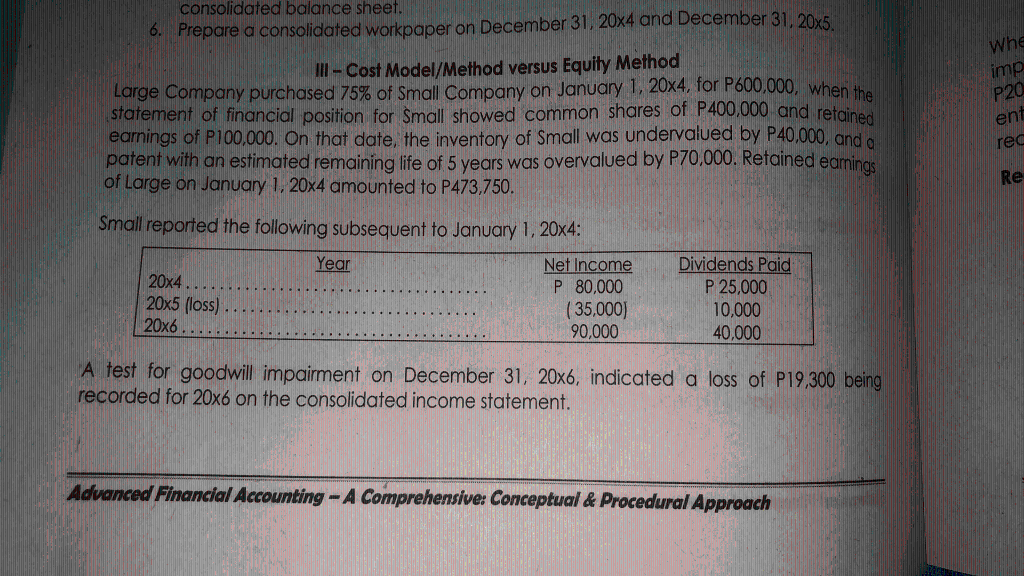

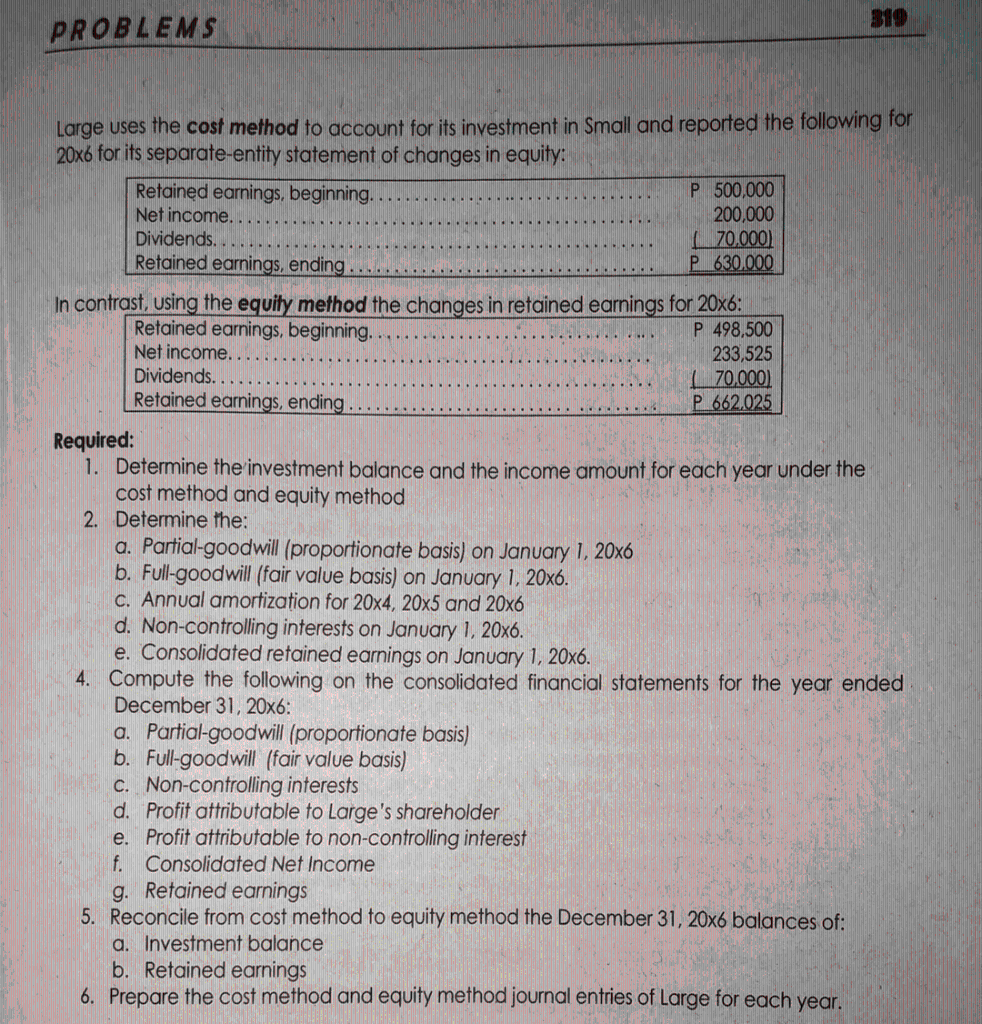

Whe imp P20 ent rec consolidated balance sheet. 6. Prepare a consolidated workpaper on December 31, 20x4 and December 31, 20x5 III - Cost Model/Method versus Equity Method Large Company purchased 75% of Small Company on January 1, 20x4, for P600,000, when the statement of financial position for Small showed common shares of P400.000 and retained earnings of P100,000. On that date, the inventory of Small was undervalued by P40.000, and a patent with an estimated remaining life of 5 years was overvalued by P70,000. Retained earnings of Large on January 1, 20x4 amounted to P473,750. Small reported the following subsequent to January 1, 20x4: Net Income Dividends Paid 20x4 P 80,000 P 25,000 20x5 (loss) (35,000) 10,000 20x6 90,000 40,000 Re Year A test for goodwill impairment on December 31, 20x6, indicated a loss of P19,300 being recorded for 20x6 on the consolidated income statement. Advanced Financial Accounting - A Comprehensive: Conceptual & Procedural Approach 319 PROBLEMS . Large uses the cost method to account for its investment in Small and reported the following for 20x6 for its separate-entity statement of changes in equity: Retained earnings, beginning. P500,000 Net income.. 200,000 Dividends. 70,000) Retained earnings, ending P630.000 In contrast, using the equity method the changes in retained earnings for 20x6: Retained earnings, beginning. P 498,500 Net income. 233,525 Dividends. | 70,000) Retained earnings, ending P.662.025 Required: 1. Determine the investment balance and the income amount for each year under the cost method and equity method 2. Determine the: a. Partial-goodwill (proportionate basis) on January 1, 20x6 b. Full-goodwill (fair value basis) on January 1, 20x6. C. Annual amortization for 20x4, 20x5 and 20x6 d. Non-controlling interests on January 1, 20x6. e. Consolidated retained earnings on January 1, 20x6. 4. Compute the following on the consolidated financial statements for the year ended December 31, 20x6: a. Partial-goodwill (proportionate basis) b. Full-goodwill (fair value basis) C. Non-controlling interests d. Profit attributable to Large's shareholder e. Profit attributable to non-controlling interest f. Consolidated Net Income g. Retained earnings 5. Reconcile from cost method to equity method the December 31, 20x6 balances of: a. Investment balance b. Retained earnings 6. Prepare the cost method and equity method journal entries of Large for each year