Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When a bank is expecting to be able to employ the same managers, employees and physical resources to offer multiple products and generate costs savings

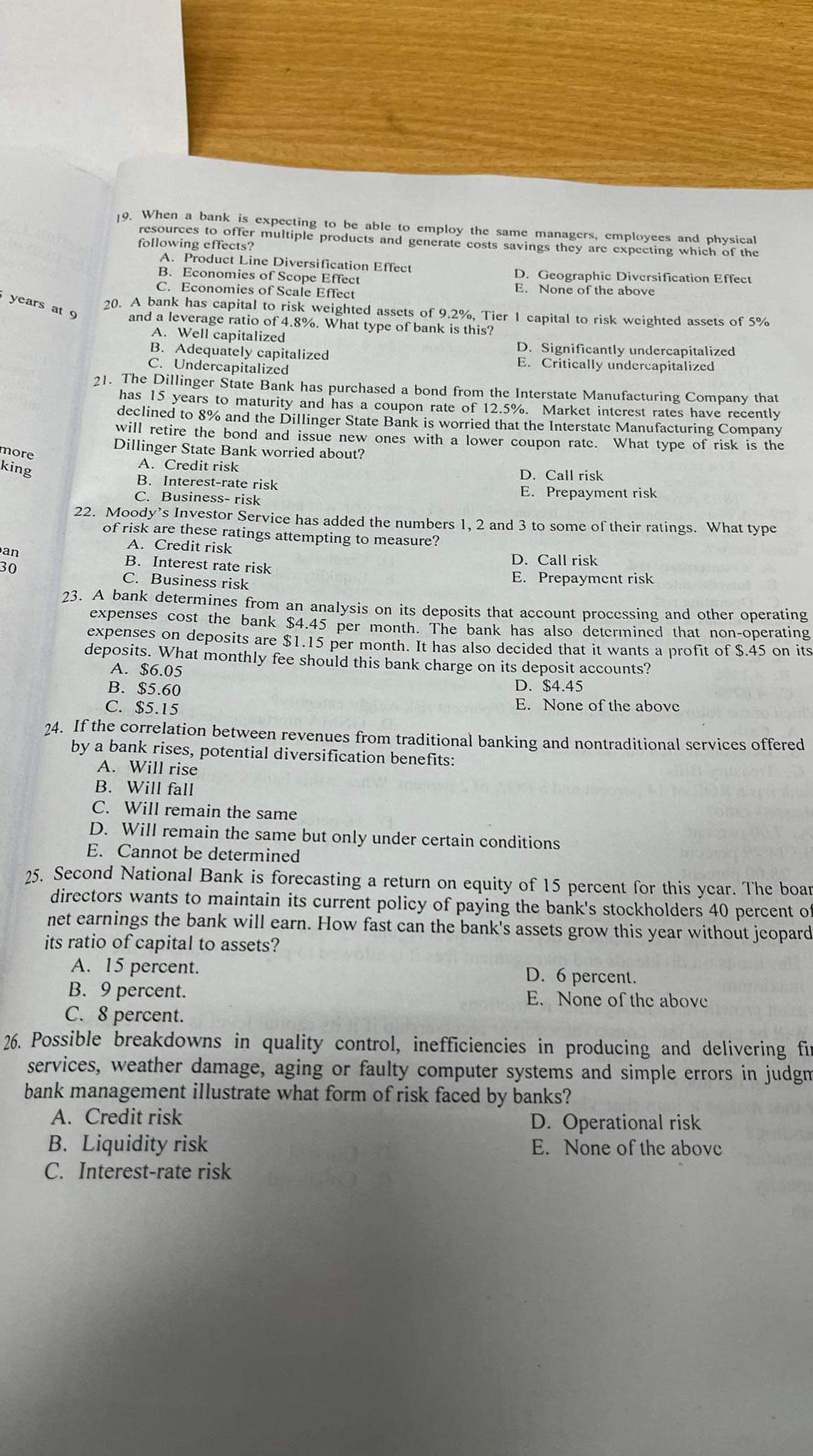

When a bank is expecting to be able to employ the same managers, employees and physical resources to offer multiple products and generate costs savings they are expecting which of the following effects? A Product Line Diversification Effect B Economies of Scope Effect D Geographic Diversification Effect C Economies of Scale Effect E None of the above years at A bank has capital to risk weighted assets of Tier capital to risk weighted assets of and a leverage ratio of What type of bank is this? A Well capitalized D Significantly undercapitalized B Adequately capitalized E Critically undercapitalized C Undercapitalized The Dillinger State Bank has purchased a bond from the Interstate Manufacturing Company that has years to maturity and has a coupon rate of Market interest rates have recently declined to and the Dillinger State Bank is worried that the Interstate Manufacturing Company will retire the bond and issue new ones with a lower coupon ratc. What type of risk is the Dillinger State Bank worried about? A Credit risk D Call risk B Interestrate risk E Prepayment risk C Businessrisk Moody's Investor Service has added the numbers and to some of their ratings. What type of risk are these ratings attempting to measure? A Credit risk D Call risk B Interest rate risk E Prepayment risk C Business risk A bank determines from an analysis on its deposits that account processing and other operating expenses cost the bank $ per month. The bank has also determined that nonoperating expenses on deposits are $ per month. It has also decided that it wants a profit of $ on its deposits. What monthly fee should this bank charge on its deposit accounts? A $ D $ B $ E None of the above C $ If the correlation between revenues from traditional banking and nontraditional services offered by a bank rises, potential diversification benefits: A Will rise B Will fall C Will remain the same D Will remain the same but only under certain conditions E Cannot be determined Second National Bank is forecasting a return on equity of percent for this ycar. The boar directors wants to maintain its current policy of paying the bank's stockholders percent o net earnings the bank will earn. How fast can the bank's assets grow this year without jeopard its ratio of capital to assets? A percent. D percent. B percent. E None of the above C percent. Possible breakdowns in quality control, inefficiencies in producing and delivering fi services, weather damage, aging or faulty computer systems and simple errors in judgn bank management illustrate what form of risk faced by banks? A Credit risk D Operational risk B Liquidity risk E None of the above C Interestrate risk

When a bank is expecting to be able to employ the same managers, employees and physical resources to offer multiple products and generate costs savings they are expecting which of the following effects?

A Product Line Diversification Effect

B Economies of Scope Effect

D Geographic Diversification Effect

C Economies of Scale Effect

E None of the above

years at

A bank has capital to risk weighted assets of Tier capital to risk weighted assets of and a leverage ratio of What type of bank is this?

A Well capitalized

D Significantly undercapitalized

B Adequately capitalized

E Critically undercapitalized

C Undercapitalized

The Dillinger State Bank has purchased a bond from the Interstate Manufacturing Company that has years to maturity and has a coupon rate of Market interest rates have recently declined to and the Dillinger State Bank is worried that the Interstate Manufacturing Company will retire the bond and issue new ones with a lower coupon ratc. What type of risk is the Dillinger State Bank worried about?

A Credit risk

D Call risk

B Interestrate risk

E Prepayment risk

C Businessrisk

Moody's Investor Service has added the numbers and to some of their ratings. What type of risk are these ratings attempting to measure?

A Credit risk

D Call risk

B Interest rate risk

E Prepayment risk

C Business risk

A bank determines from an analysis on its deposits that account processing and other operating expenses cost the bank $ per month. The bank has also determined that nonoperating expenses on deposits are $ per month. It has also decided that it wants a profit of $ on its deposits. What monthly fee should this bank charge on its deposit accounts?

A $

D $

B $

E None of the above

C $

If the correlation between revenues from traditional banking and nontraditional services offered by a bank rises, potential diversification benefits:

A Will rise

B Will fall

C Will remain the same

D Will remain the same but only under certain conditions

E Cannot be determined

Second National Bank is forecasting a return on equity of percent for this ycar. The boar directors wants to maintain its current policy of paying the bank's stockholders percent o net earnings the bank will earn. How fast can the bank's assets grow this year without jeopard its ratio of capital to assets?

A percent.

D percent.

B percent.

E None of the above

C percent.

Possible breakdowns in quality control, inefficiencies in producing and delivering fi services, weather damage, aging or faulty computer systems and simple errors in judgn bank management illustrate what form of risk faced by banks?

A Credit risk

D Operational risk

B Liquidity risk

E None of the above

C Interestrate risk

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started