Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When a retailer collects an accounts receivable within its cash discount period, which one of the following accounts is neither debited nor credited by the

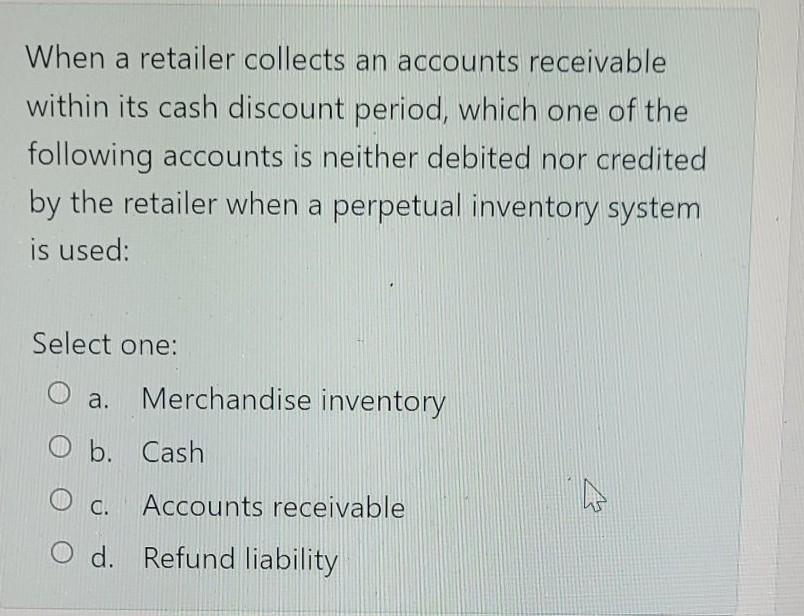

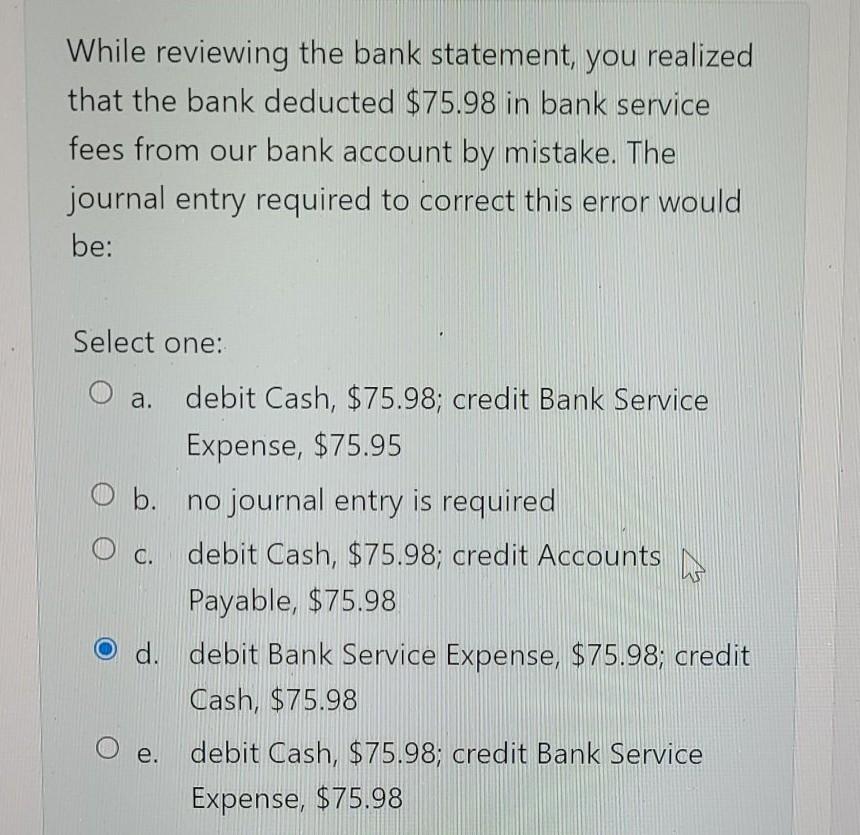

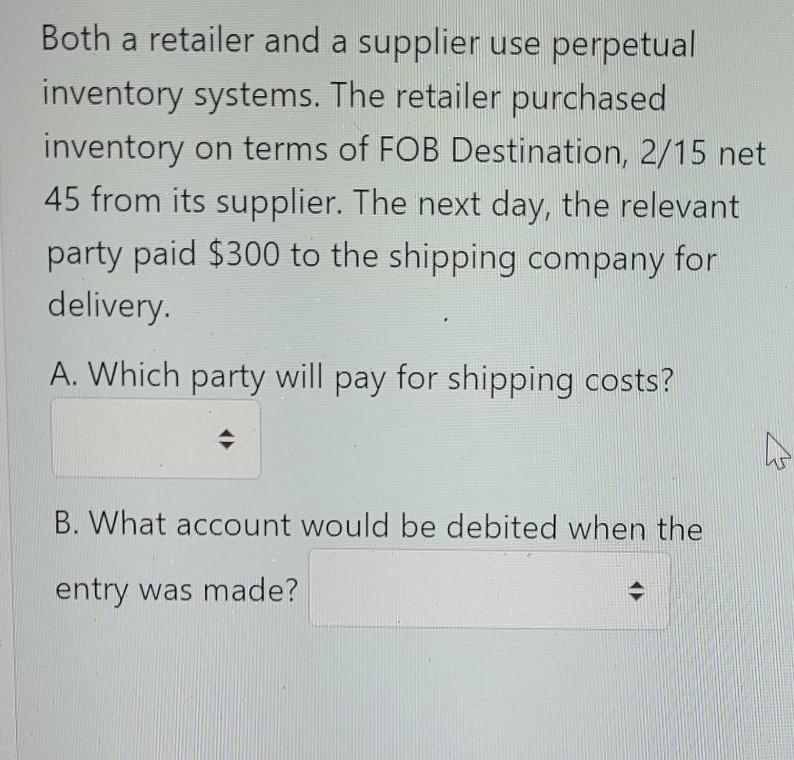

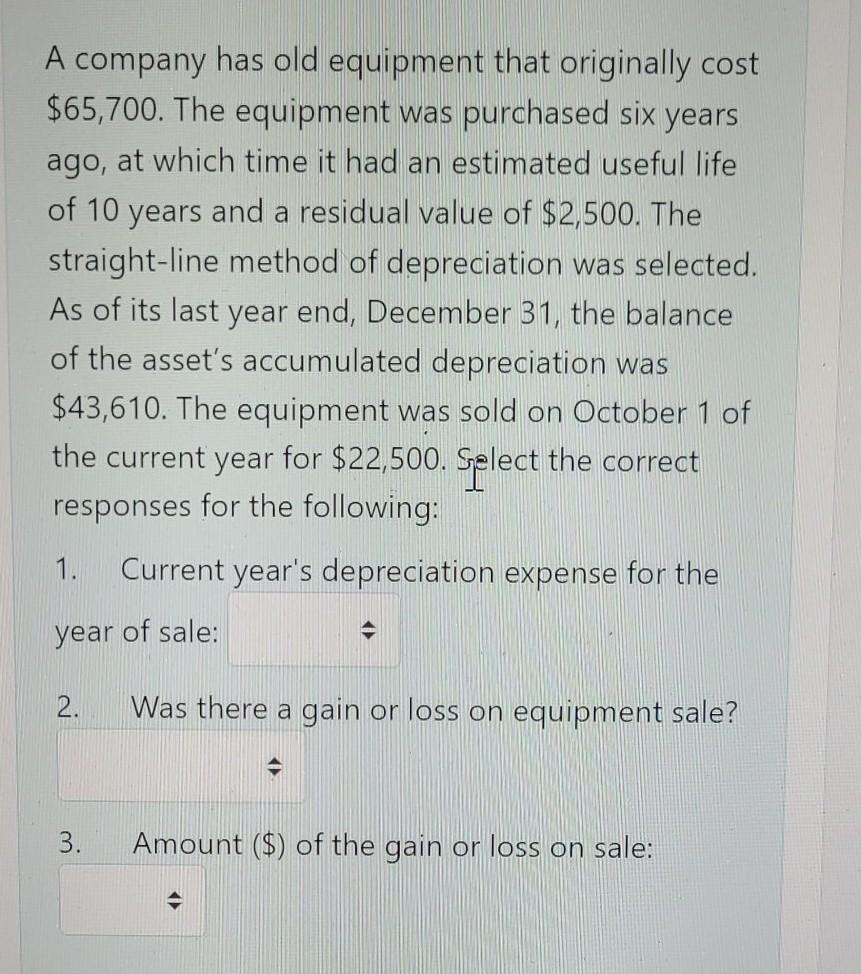

When a retailer collects an accounts receivable within its cash discount period, which one of the following accounts is neither debited nor credited by the retailer when a perpetual inventory system is used: Select one: O a. Merchandise inventory O b. Cash C. Accounts receivable O d. Refund liability While reviewing the bank statement, you realized that the bank deducted $75.98 in bank service fees from our bank account by mistake. The journal entry required to correct this error would be: O c. Select one: O a. debit Cash, $75.98; credit Bank Service Expense, $75.95 O b. no journal entry is required debit Cash, $75.98; credit Accounts Payable, $75.98 d. debit Bank Service Expense, $75.98; credit Cash, $75.98 debit Cash, $75.98; credit Bank Service Expense, $75.98 e. Both a retailer and a supplier use perpetual inventory systems. The retailer purchased inventory on terms of FOB Destination, 2/15 net 45 from its supplier. The next day, the relevant party paid $300 to the shipping company for delivery. A. Which party will pay for shipping costs? B. What account would be debited when the entry was made? A company has old equipment that originally cost $65,700. The equipment was purchased six years ago, at which time it had an estimated useful life of 10 years and a residual value of $2,500. The straight-line method of depreciation was selected. As of its last year end, December 31, the balance of the asset's accumulated depreciation was $43,610. The equipment was sold on October 1 of the current year for $22,500. Select the correct responses for the following: 1. Current year's depreciation expense for the year of sale: 2. Was there a gain or loss on equipment sale? 3. Amount ($) of the gain or loss on sale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started