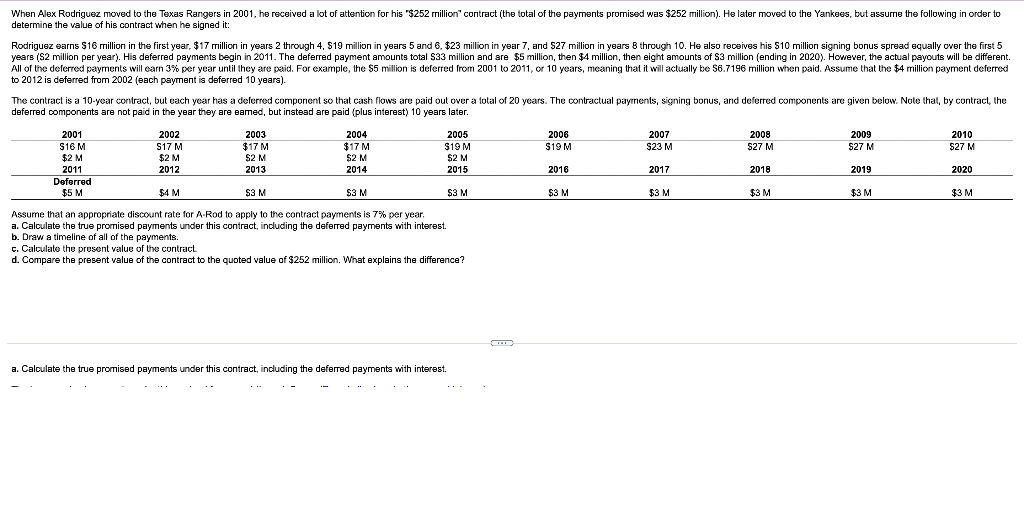

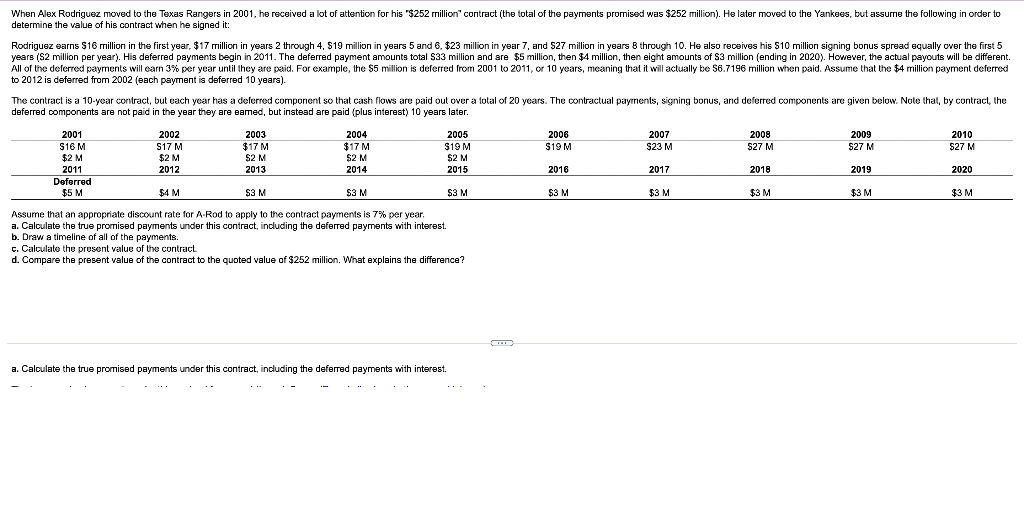

When Alex Rodriguez moved to the Texas Rangers in 2001, he received a lot of attention for his "$252 million contract (the total of the payments promised was $252 million). He later moved to the Yankees, but assume the following in order to determine the value of his contract when he signed it: Rodriguez earns $16 million in the first year, $17 million in years 2 through 4, $19 million in years 5 and 6. $23 million in year 7, and $27 million in years 8 through 10. He also receives his $10 million signing bonus spread equally over the first 5 years ($2 million per year). His deferred payments begin in 2011. The deferred payment amounts total $33 million and are $5 million, then $4 million, then eight amounts of $3 million (ending in 2020). However, the actual payouts will be different. All of the deferred payments will earn 3% per year until they are paid. For example, the $5 million is deferred from 2001 to 2011, or 10 years, meaning that it will actually be $6.7196 million when paid. Assume that the $4 million payment deferred to 2012 is deferred from 2002 (each payment is deferred 10 years). The contract is a 10-year contract, but each year has a deferred component so that cash flows are paid out over a total of 20 years. The contractual payments, signing bonus, and deferred components are given below. Note that, by contract, the deferred components are not paid in the year they are eamed, but instead are paid (plus interest) 10 years later. 2001 2002 2003 2005 2006 2007 2008 2009 2010 $16 M S17 M $17 M 2004 $17 M $2 M $19 M $19 M $2 M $23 M $27 M $27 M $27 M $2 M $2 M $2 M 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Deferred $5 M $4 M $3 M $3 M $3 M $3 M $3 M $3 M $3 M $3 M Assume that an appropriate discount rate for A-Rod to apply to the contract payments is 7% per year. a. Calculate the true promised payments under this contract, including the deferred payments with interest. b. Draw a timeline of all of the payments. c. Calculate the present value of the contract. d. Compare the present value of the contract to the quoted value of $252 million. What explains the difference? a. Calculate the true promised payments under this contract, including the deferred payments with interest. When Alex Rodriguez moved to the Texas Rangers in 2001, he received a lot of attention for his "$252 million contract (the total of the payments promised was $252 million). He later moved to the Yankees, but assume the following in order to determine the value of his contract when he signed it: Rodriguez earns $16 million in the first year, $17 million in years 2 through 4, $19 million in years 5 and 6. $23 million in year 7, and $27 million in years 8 through 10. He also receives his $10 million signing bonus spread equally over the first 5 years ($2 million per year). His deferred payments begin in 2011. The deferred payment amounts total $33 million and are $5 million, then $4 million, then eight amounts of $3 million (ending in 2020). However, the actual payouts will be different. All of the deferred payments will earn 3% per year until they are paid. For example, the $5 million is deferred from 2001 to 2011, or 10 years, meaning that it will actually be $6.7196 million when paid. Assume that the $4 million payment deferred to 2012 is deferred from 2002 (each payment is deferred 10 years). The contract is a 10-year contract, but each year has a deferred component so that cash flows are paid out over a total of 20 years. The contractual payments, signing bonus, and deferred components are given below. Note that, by contract, the deferred components are not paid in the year they are eamed, but instead are paid (plus interest) 10 years later. 2001 2002 2003 2005 2006 2007 2008 2009 2010 $16 M S17 M $17 M 2004 $17 M $2 M $19 M $19 M $2 M $23 M $27 M $27 M $27 M $2 M $2 M $2 M 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Deferred $5 M $4 M $3 M $3 M $3 M $3 M $3 M $3 M $3 M $3 M Assume that an appropriate discount rate for A-Rod to apply to the contract payments is 7% per year. a. Calculate the true promised payments under this contract, including the deferred payments with interest. b. Draw a timeline of all of the payments. c. Calculate the present value of the contract. d. Compare the present value of the contract to the quoted value of $252 million. What explains the difference? a. Calculate the true promised payments under this contract, including the deferred payments with interest